The Bend Oregon Department of Revenue Tax Compliance Certification is a recognition awarded to individuals or businesses in Bend, Oregon, who have successfully demonstrated their compliance with the state's tax laws and regulations. This certification serves as a proof of their commitment to fulfilling their tax obligations and helps build trust with clients, customers, and potential business partners. By obtaining the Bend Oregon Department of Revenue Tax Compliance Certification, individuals and businesses establish themselves as responsible and ethical taxpayers. It showcases their dedication to accurately reporting and paying their taxes promptly, ensuring that they contribute to the local economy and support government operations. This certification plays a vital role in promoting transparency, accountability, and financial stability within the community. To achieve this certification, individuals or businesses must meet specific criteria specified by the Bend Oregon Department of Revenue. These eligibility requirements may include but are not limited to maintaining accurate financial records, filing tax returns on time, paying taxes promptly, and complying with all applicable tax laws. There may be different types or levels of Bend Oregon Department of Revenue Tax Compliance Certification, depending on the nature of the business or individual's tax obligations. These could include: 1. Individual Income Tax Compliance Certification: This certification is designed for individuals who earn income in Bend, Oregon, and have met the requirements outlined by the Bend Oregon Department of Revenue to demonstrate their compliance with state income tax laws. 2. Business Tax Compliance Certification: This certification is intended for businesses operating in Bend, Oregon, and indicates that they have fulfilled their tax obligations, such as collecting and remitting sales tax, employer payroll taxes, and any other applicable business taxes. 3. Property Tax Compliance Certification: This certification focuses on compliance with property tax regulations. It denotes that property owners or real estate businesses have met their obligations related to property assessments, exemptions, and timely payment of property taxes. 4. Specialty Tax Compliance Certification: This category might encompass certifications for specific industries or professions that may have unique tax compliance requirements. Examples may include certifications for licensed professionals like attorneys, accountants, or contractors, each having distinct tax compliance criteria. The Bend Oregon Department of Revenue Tax Compliance Certification not only recognizes individuals or businesses for their adherence to tax laws but can also provide them with a competitive edge. Prospective clients or customers may prefer to work with certified entities, knowing that they prioritize responsible tax practices and contribute to the local economy in a responsible and ethical manner.

Bend Oregon Department of Revenue Tax Compliance Certification

Description

How to fill out Bend Oregon Department Of Revenue Tax Compliance Certification?

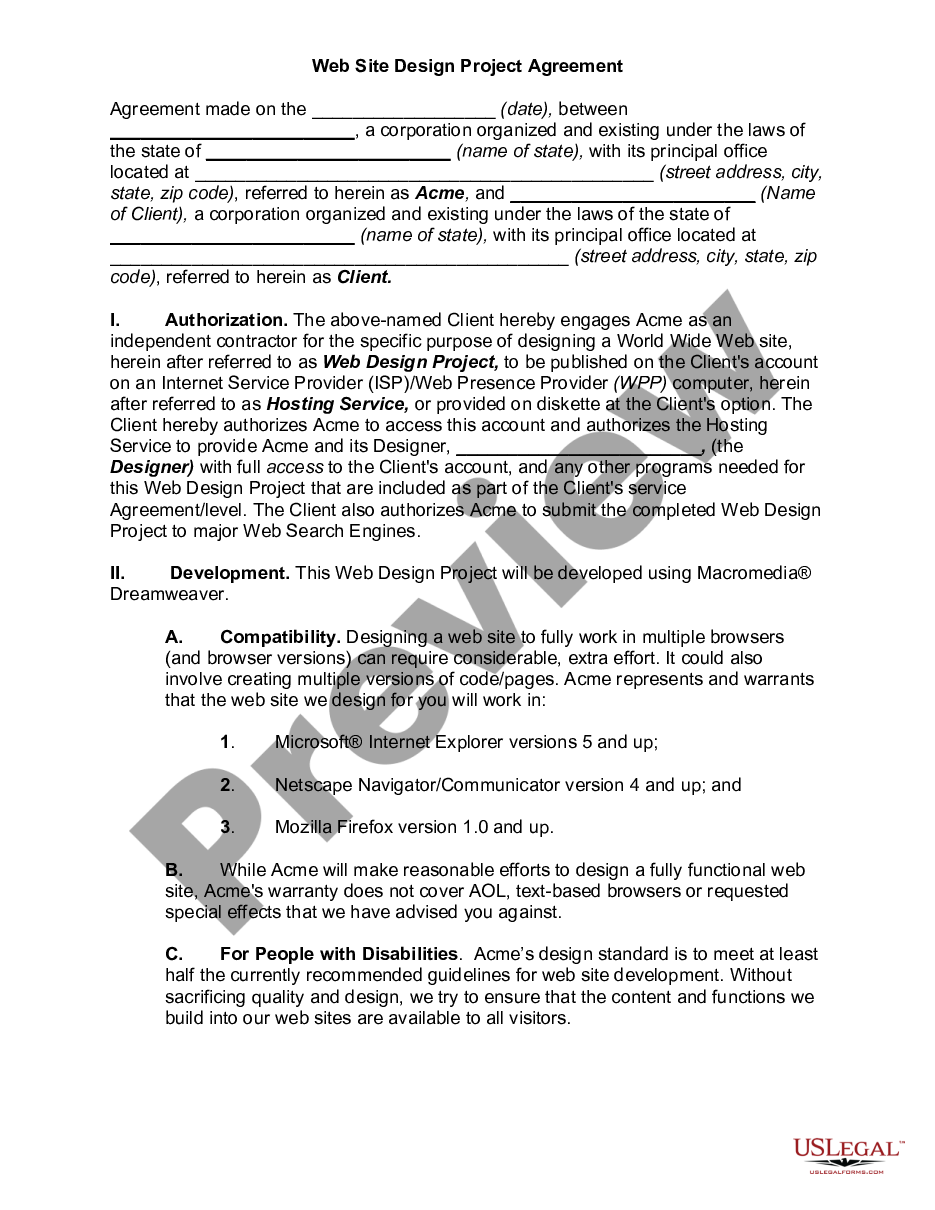

We always want to minimize or avoid legal issues when dealing with nuanced legal or financial matters. To accomplish this, we apply for attorney solutions that, usually, are extremely expensive. However, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to legal counsel. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Bend Oregon Department of Revenue Tax Compliance Certification or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it from within the My Forms tab.

The process is just as effortless if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Bend Oregon Department of Revenue Tax Compliance Certification complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Bend Oregon Department of Revenue Tax Compliance Certification would work for your case, you can pick the subscription option and proceed to payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

How can I check the status of my amended return? You can check the status of your Form 1040-X, Amended U.S. Individual Income Tax Return using the Where's My Amended Return? online tool or by calling the toll-free telephone number 866-464-2050 three weeks after you file your amended return.

How to verify a TCS via SARS eFiling Once you have logged in, setup your user groups and applicable user rights in order to perform TCS verifications. Click on ?Tax Status. Select ?Tax Compliance Status Verification? Complete the activation process.

Visit to download. 1 Logon to eFiling. If you are not yet an eFiler, register at Activate your TCS service. You only need to activate your Tax Compliance Status once, and it will remain active.3 View your ?My Compliance Profile?4 Request PIN on eFiling.

You can prepare a 2021 Oregon Tax Amendment on eFile.com, however you cannot submit it electronically. In comparison, the IRS requires a different Form - Form 1040X - to amend an IRS return (do not use Form 1040 for an IRS Amendment).

You can also check refund status through Oregon's automated phone system at 1-503-378-4988 or toll-free at 1-800-356-4222.

Filers can check the status of a paper or electronically filed Form 1040-X Amended Return using the Where's My Amended Return (WMAR) online tool or the toll-free telephone number 866-464-2050? three weeks after filing the return. Both tools are available in English and Spanish.

You can also request a Tax Clearance Certificate online on the SARS E-Filing website.

How to request your Tax Compliance Status via eFiling Selecting the Tax Compliance Status Request option and the type of TCS for which you would like to apply. You will have the following options: Good standing. Tender.Complete the Tax Compliance Status Request and submit it to SARS.

How to request your Tax Compliance Status via eFiling Selecting the Tax Compliance Status Request option and the type of TCS for which you would like to apply. You will have the following options: Good standing. Tender.Complete the Tax Compliance Status Request and submit it to SARS.

Or, go to oregon.gov/dor/Pages/index.aspx and click on What's My Kicker. Type in your Social Security number and filing status and it will do the math for you.