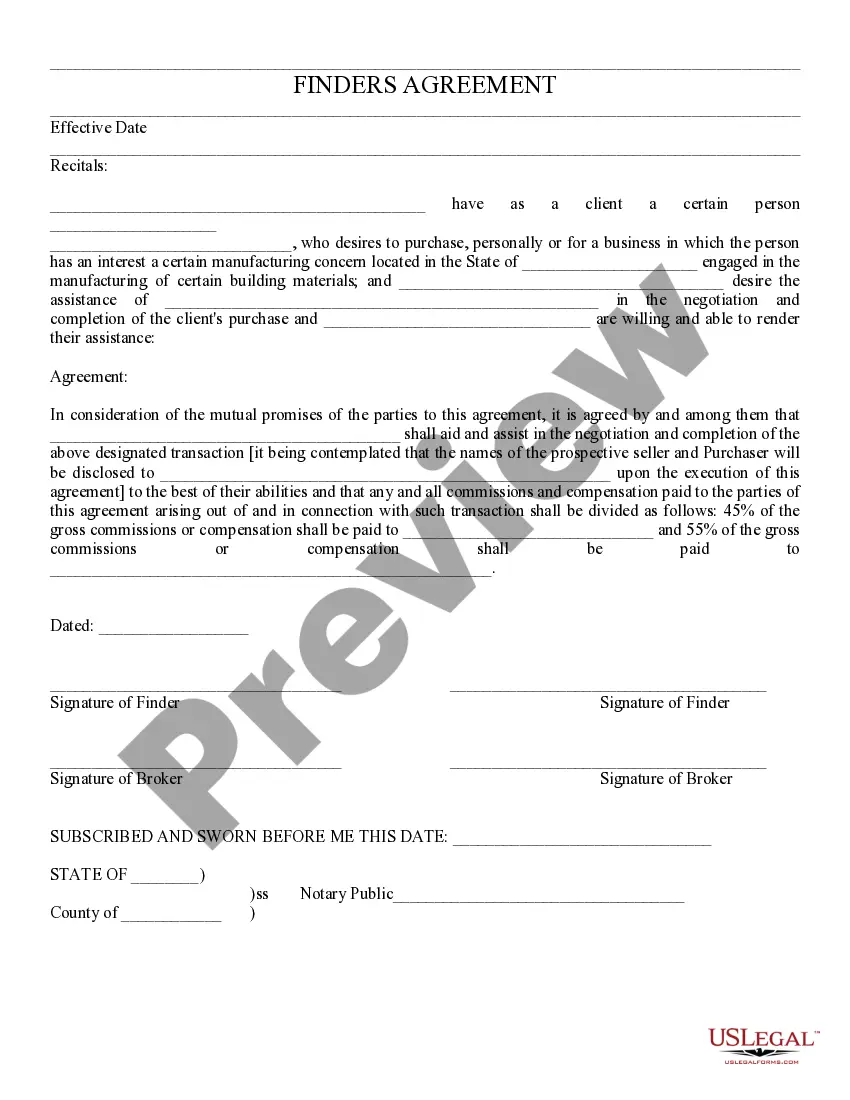

The Hillsboro Oregon Department of Revenue Tax Compliance Certification is a formal recognition issued by the department to individuals or businesses in Hillsboro, Oregon, who demonstrate compliance with the local tax regulations and requirements. It serves as a proof that the certified individual or entity has fulfilled their obligations in terms of reporting and paying taxes accurately and on time. The certification process involves a thorough review of the tax records, financial statements, and other relevant documentation submitted by the applicant. The department ensures that all taxes, including income tax, property tax, and sales tax, have been properly reported and paid according to the applicable regulations. Gaining the Hillsboro Oregon Department of Revenue Tax Compliance Certification is an essential step for individuals and businesses operating in Hillsboro. It demonstrates their commitment to meeting their tax obligations and showcases their credibility and trustworthiness to clients, customers, and stakeholders. The Hillsboro Oregon Department of Revenue offers different types of Tax Compliance Certifications based on the type of applicant: 1. Individual Tax Compliance Certification: This certification is applicable to individuals, including freelancers, professionals, and other self-employed individuals, who need to demonstrate their tax compliance status for personal income tax. 2. Business Tax Compliance Certification: This certification is designed for different types of businesses, such as sole proprietorship, partnerships, corporations, and limited liability companies (LCS). It verifies their compliance with various tax obligations, including business income tax, payroll tax, and sales tax. 3. Property Tax Compliance Certification: This certification focuses on compliance with property tax regulations for property owners and real estate businesses. It ensures that all property taxes have been accurately reported and paid. 4. Sales Tax Compliance Certification: This certification is specific to businesses involved in selling taxable goods or services. It verifies the proper collection, reporting, and remittance of sales taxes to the Hillsboro Oregon Department of Revenue. Individuals or businesses interested in obtaining the Hillsboro Oregon Department of Revenue Tax Compliance Certification should gather all necessary documentation related to their tax filings and consult with the department for detailed guidelines and instructions on the application process. Compliance with tax regulations not only protects individuals and businesses from penalties but also contributes to the overall economic development and stability of Hillsboro, Oregon.

Hillsboro Oregon Department of Revenue Tax Compliance Certification

Description

How to fill out Hillsboro Oregon Department Of Revenue Tax Compliance Certification?

Do you need a trustworthy and affordable legal forms provider to buy the Hillsboro Oregon Department of Revenue Tax Compliance Certification? US Legal Forms is your go-to solution.

No matter if you require a simple agreement to set rules for cohabitating with your partner or a set of documents to move your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed based on the requirements of separate state and area.

To download the form, you need to log in account, locate the required form, and hit the Download button next to it. Please remember that you can download your previously purchased form templates anytime from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Hillsboro Oregon Department of Revenue Tax Compliance Certification conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to find out who and what the form is intended for.

- Restart the search in case the form isn’t good for your specific scenario.

Now you can register your account. Then choose the subscription option and proceed to payment. Once the payment is done, download the Hillsboro Oregon Department of Revenue Tax Compliance Certification in any provided file format. You can return to the website when you need and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending hours learning about legal papers online for good.