Portland Oregon Claim Reserve Worksheet is a crucial document used by insurance companies and professionals involved in the claims' management process in Portland, Oregon. This worksheet aids in estimating and reserving funds for potential insurance claims in a comprehensive and organized manner. It plays a vital role in ensuring that insurance companies allocate sufficient funds to meet their expected claim payment obligations. The Portland Oregon Claim Reserve Worksheet assists insurance companies in maintaining an accurate and up-to-date record of the estimated financial liability associated with different types of insurance claims. It helps them evaluate the potential risks involved in their claims portfolios and make informed decisions on reserve amounts. There are several types of Portland Oregon Claim Reserve Worksheets, each catering to specific insurance lines and claim categories. Some of these include: 1. Auto Insurance Claim Reserve Worksheet: This worksheet focuses on estimating and forecasting potential claim amounts incurred due to auto accidents in Portland, Oregon. It takes into account factors such as property damage, bodily injury, medical expenses, and legal fees. 2. Property Insurance Claim Reserve Worksheet: Designed for property and homeowner's insurance, this worksheet calculates reserves for claims related to damages caused by events like fire, theft, natural disasters, vandalism, and other covered perils. It considers repair costs, replacement values, temporary accommodations, and any additional expenses associated with the property claim. 3. Workers' Compensation Claim Reserve Worksheet: Specifically designed for workers' compensation insurance, this worksheet helps insurance companies calculate reserves for claims related to workplace injuries and illnesses. It factors in medical treatment costs, wage replacement benefits, rehabilitation expenses, and any potential litigation costs. 4. Liability Insurance Claim Reserve Worksheet: This worksheet focuses on estimating and reserving funds for liability claims, including general liability, professional liability, and product liability in Portland, Oregon. It takes into account legal defense costs, settlement or judgment amounts, and potential future medical expenses. 5. Commercial Insurance Claim Reserve Worksheet: This worksheet is applicable to various commercial insurance lines and helps estimate claim reserves for a wide array of potential risks and liabilities faced by businesses in Portland, Oregon. It covers areas such as property damage, general and professional liability, business interruption, and workers' compensation. Overall, the Portland Oregon Claim Reserve Worksheet is an essential tool for insurance companies, claims adjusters, and underwriters to manage the financial aspects of their claims portfolios accurately. It enables them to allocate adequate funds, maintain regulatory compliance, and make informed decisions pertaining to claim settlements, reserves, and risk management strategies.

Portland Oregon Claim Reserve Worksheet

Description

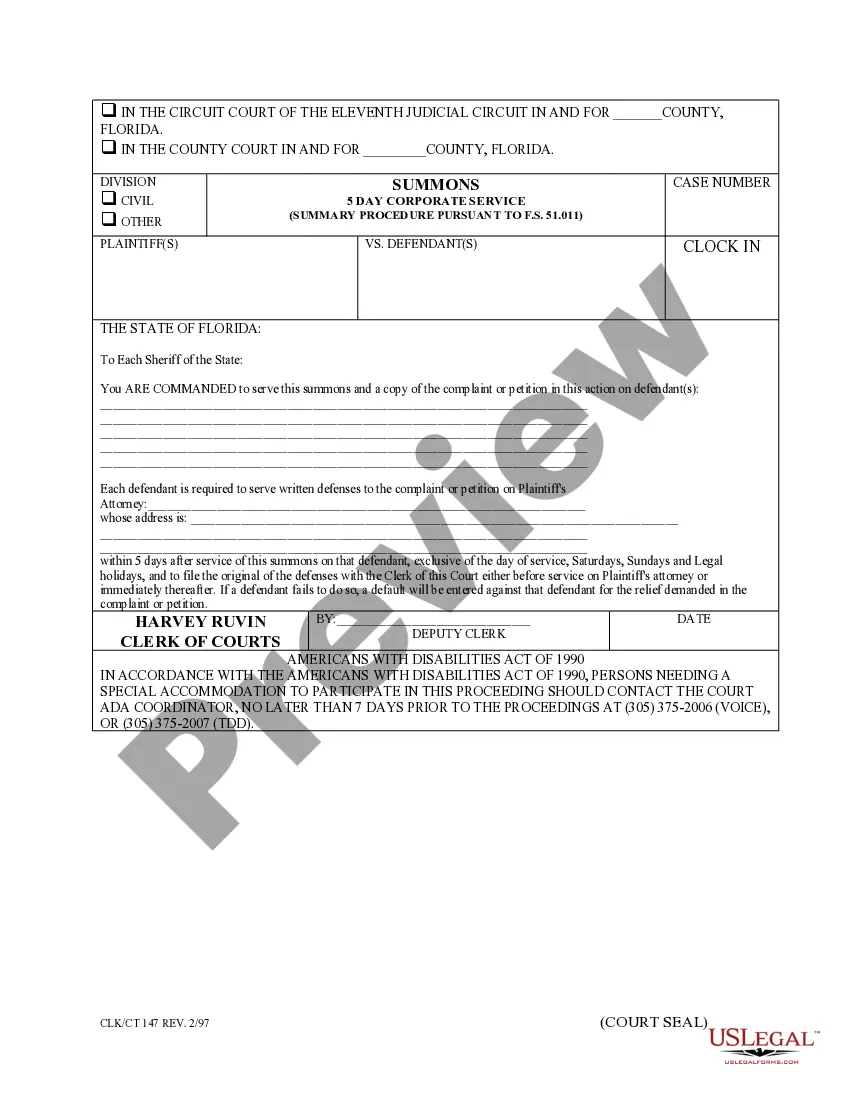

How to fill out Portland Oregon Claim Reserve Worksheet?

Make use of the US Legal Forms and get immediate access to any form sample you require. Our useful website with a large number of templates makes it simple to find and get almost any document sample you will need. You are able to download, complete, and certify the Portland Oregon Claim Reserve Worksheet in a matter of minutes instead of surfing the Net for several hours trying to find the right template.

Using our library is an excellent way to increase the safety of your document filing. Our experienced lawyers on a regular basis check all the records to make sure that the forms are appropriate for a particular region and compliant with new laws and polices.

How do you obtain the Portland Oregon Claim Reserve Worksheet? If you have a profile, just log in to the account. The Download button will appear on all the documents you look at. Moreover, you can find all the earlier saved records in the My Forms menu.

If you don’t have a profile yet, follow the instructions listed below:

- Open the page with the form you require. Ensure that it is the form you were seeking: examine its name and description, and utilize the Preview function if it is available. Otherwise, utilize the Search field to look for the needed one.

- Start the saving procedure. Click Buy Now and choose the pricing plan you like. Then, create an account and pay for your order using a credit card or PayPal.

- Download the document. Select the format to obtain the Portland Oregon Claim Reserve Worksheet and change and complete, or sign it for your needs.

US Legal Forms is probably the most considerable and trustworthy template libraries on the web. We are always ready to assist you in any legal process, even if it is just downloading the Portland Oregon Claim Reserve Worksheet.

Feel free to take advantage of our service and make your document experience as efficient as possible!