The Hillsboro Oregon Self-Insurer Report of Losses — Experience Rating Period serves as a crucial tool for self-insured employers in Hillsboro, Oregon. This report allows employers to assess their workers' compensation claims and calculate their experience modification rate (EMR) accurately. The EMR influences the employer's workers' compensation insurance premiums, making it essential for employers to understand and manage their losses effectively. The self-insurer report of losses is a comprehensive document that includes all the necessary information related to an employer's claim history, losses, and experience rating. It helps employers assess their performance in managing workplace injuries and illnesses, identify trends in claims, and implement effective loss control and safety programs. The report captures various essential elements, such as the employer's identification information, policy details, claim numbers, injury descriptions, medical treatments, and associated costs. Each claim is recorded with detailed information, including the date of loss, employee information, injury type, body part affected, compensation benefits paid, and reserve amounts. By analyzing the self-insurer report of losses, employers gain valuable insights into their workers' compensation claims' frequency and severity. It enables them to identify areas of improvement, uncover potential fraudulent claims, and implement preventive measures to minimize future losses. Furthermore, the self-insurer report helps employers assess their experience rating period, which refers to the timeframe used to calculate the EMR. In Hillsboro, Oregon, different types of experience rating periods may exist, such as the three-year, four-year, or five-year periods. Each period includes a specific timeframe of claim data used for EMR calculation and premium adjustment. The chosen experience rating period significantly impacts an employer's overall EMR. The longer the experience rating period, the more weight is given to historical claim performance, and vice versa. Employers must understand the nuances of each experience rating period and select the most applicable one for their organization to accurately reflect their claims history. In conclusion, the Hillsboro Oregon Self-Insurer Report of Losses — Experience Rating Period is an essential tool for self-insured employers. It provides comprehensive insights into an employer's claim history, facilitating effective analysis and management of losses. By leveraging this report, employers can improve their workers' compensation programs, reduce costs, and enhance workplace safety. Understanding the different experience rating periods available in Hillsboro, Oregon is crucial for accurately determining an employer's EMR and ensuring fair and appropriate insurance premiums.

Hillsboro Oregon Self-Insurer Report of Losses - Experience Rating Period

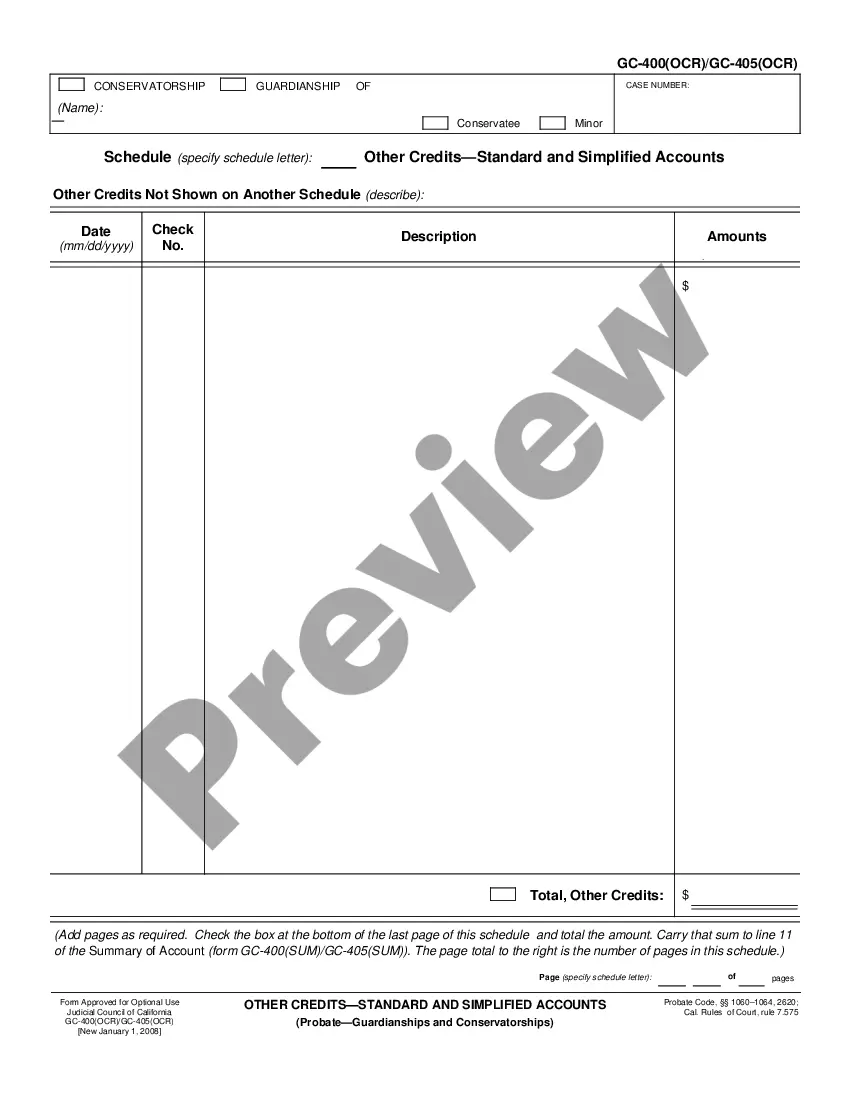

Description

How to fill out Hillsboro Oregon Self-Insurer Report Of Losses - Experience Rating Period?

We always strive to reduce or avoid legal issues when dealing with nuanced legal or financial affairs. To do so, we sign up for legal solutions that, as a rule, are extremely costly. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of using services of legal counsel. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Hillsboro Oregon Self-Insurer Report of Losses - Experience Rating Period or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the website! You can create your account within minutes.

- Make sure to check if the Hillsboro Oregon Self-Insurer Report of Losses - Experience Rating Period complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Hillsboro Oregon Self-Insurer Report of Losses - Experience Rating Period is suitable for your case, you can pick the subscription option and proceed to payment.

- Then you can download the form in any suitable format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

Experience rating is the opposite of community rating. It means that an applicant or group's medical history and claims experience is taken into consideration when premiums are determined. Experience rating can still be used by large group plans.

Since experience rating gives individual employers some influence over the premium they pay, it provides an incentive for employers to develop loss prevention and claims manage- ment programs. In this way, experience rating benefits employers by promoting occupational health and safety.

So, what is a good Experience Modification Rate? Good is anything below a 1.00 if for no other reason than you are receiving a discount on the premiums you pay to your insurance carrier.

The experience rating calculation generally consists of an experience period of three policy years (36 months) of class code, payroll and claim data. The most recent policy year of data used is the policy year that expired one year prior to the rating effective date.

How is EMR Calculated? The EMR is calculated by dividing a company's payroll by classification by 100 and then by a ?class rate? determined by the National Council on Compensation Insurance (NCCI) reflecting the classification's potential risk factor. The NCCI calculations cover businesses in 39 out of 50 states.

An experience rating is the amount of loss that an insured party experiences compared to the amount of loss that similar insured parties have. Experience rating is most commonly associated with workers' compensation insurance. It is used to calculate the experience modification factor.

Experience Rating Definition Experience rating is commonly a factor in worker's compensation. For example, workers' compensation premiums are calculated using an experience rating, based on the employer's claim history and industry classification.