The Eugene Oregon Self-Insurer Report of Losses — Non-Experience Rating Period is a comprehensive and vital document that all self-insurers in Eugene, Oregon must submit. This report provides detailed information about the losses incurred by a self-insured entity during a specific period. It helps regulatory authorities monitor and analyze the effectiveness of self-insurance programs and ensure compliance with state laws and regulations. Keywords: Eugene Oregon, self-insurer report of losses, non-experience rating period, self-insured entity, regulatory authorities, self-insurance programs, state laws, state regulations. The reporting period under this category refers to a specific timeframe during which the self-insured entity gathers data on losses, which is then compiled and submitted to the appropriate authorities. Following are different types of Eugene Oregon Self-Insurer Report of Losses — Non-Experience Rating Period: 1. Workers' Compensation Loss Report: This report focuses on losses arising from workplace injuries and illnesses. It includes details such as the number of claims filed, types of injuries sustained, medical expenses incurred, disability benefits paid, and any settlements made during the reporting period. 2. Liability Loss Report: This report mainly pertains to losses resulting from third-party liability claims against the self-insured entity. It provides information on the number and type of claims filed, legal expenses, settlements, and judgments during the specified reporting period. 3. Property Loss Report: This report focuses on losses related to damage or destruction of the self-insured entity's property. It includes details such as the cause of loss, estimated property value, repair costs, and any indemnity payments made during the reporting period. 4. Auto Loss Report: This report specifically addresses losses arising from auto accidents involving vehicles owned or operated by the self-insured entity. It includes information on the number of accidents, injuries, damages, repair costs, and any settlements or payments related to the accidents during the reporting period. 5. Medical Loss Report: This report is relevant for self-insured entities that provide healthcare services. It focuses on losses incurred due to medical malpractice claims or other medical-related liabilities. It includes details such as the number and type of claims filed, associated medical expenses, settlements, and judgments during the specified reporting period. These Eugene Oregon Self-Insurer Reports of Losses — Non-Experience Rating Period play a crucial role in assessing the financial stability of self-insured entities and evaluating the effectiveness of risk management strategies. By monitoring and analyzing this data, regulatory authorities can ensure that self-insured entities are adequately protecting themselves against potential losses and maintaining the necessary funds to cover any liabilities that may arise.

Eugene Oregon Self-Insurer Report of Losses - Non-Experience Rating Period

Description

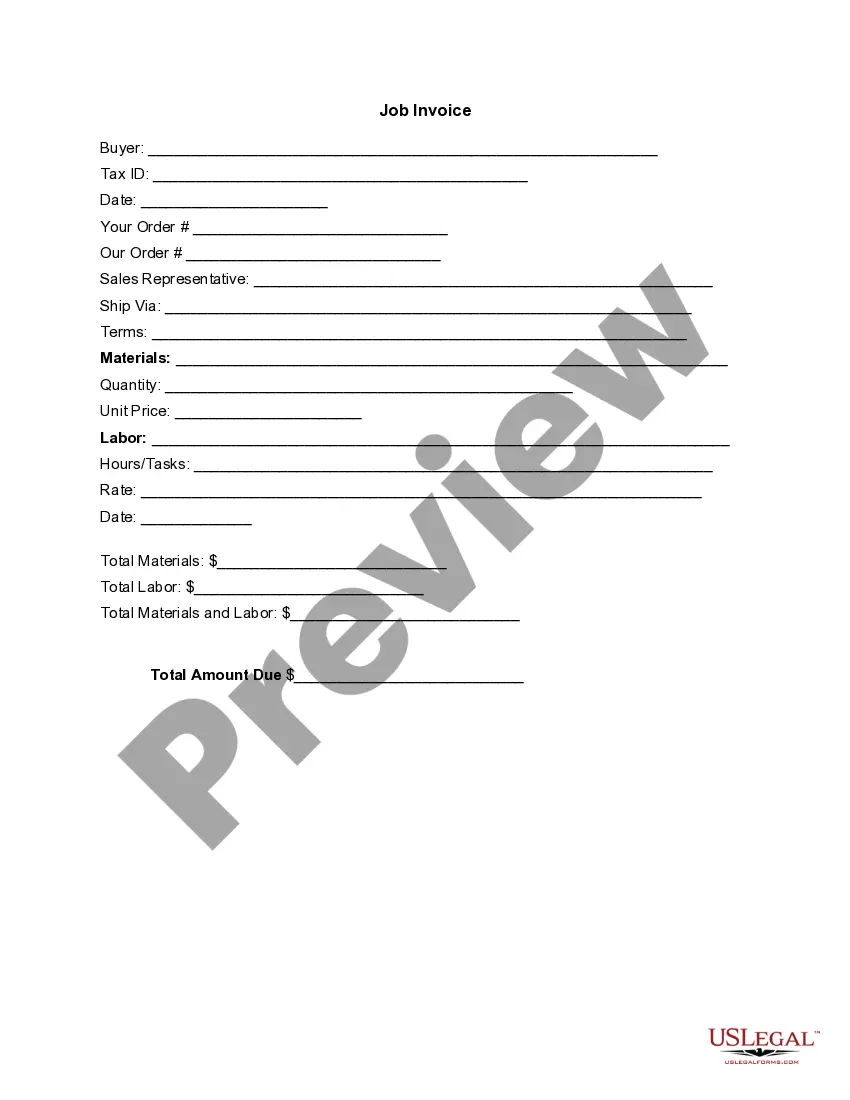

How to fill out Eugene Oregon Self-Insurer Report Of Losses - Non-Experience Rating Period?

We always strive to reduce or avoid legal issues when dealing with nuanced legal or financial matters. To accomplish this, we apply for legal solutions that, usually, are very expensive. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of legal counsel. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Eugene Oregon Self-Insurer Report of Losses - Non-Experience Rating Period or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is equally effortless if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the Eugene Oregon Self-Insurer Report of Losses - Non-Experience Rating Period complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Eugene Oregon Self-Insurer Report of Losses - Non-Experience Rating Period is suitable for you, you can choose the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!