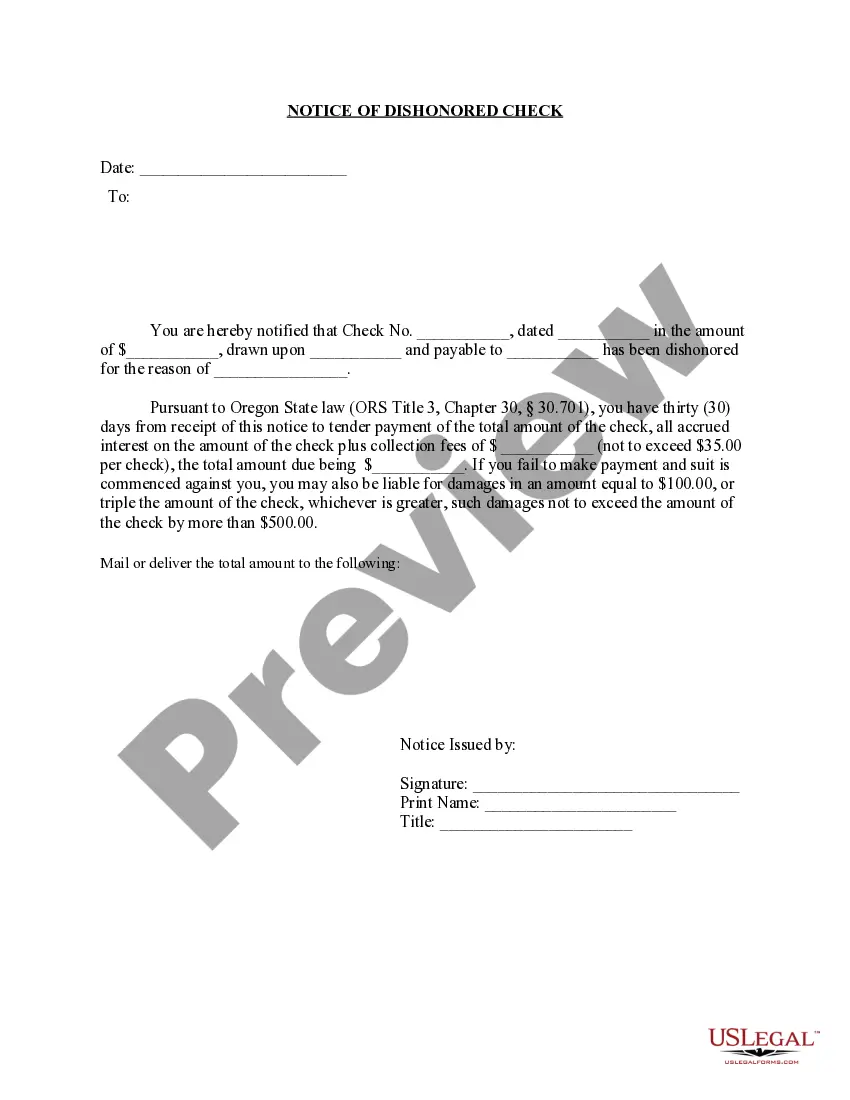

This is a Notice of Dishonored Check (Civil). A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

The Bend Oregon Notice of Dishonored Check — Civil serves as a legal communication issued to notify individuals or businesses when a check they have received has been dishonored or bounced due to insufficient funds in the issuer's account. This official document holds significant importance in cases involving bad or bounced checks, providing the affected party with the necessary information and legal recourse. A bad check is defined as a check that is returned unpaid by the bank due to various reasons such as insufficient funds, account closure, or a mismatched signature. This can bring inconvenience, financial loss, and potential legal disputes to the recipient. The Bend Oregon Notice of Dishonored Check — Civil contains several crucial elements, including the name and contact information of the person or entity issuing the notice, the recipient's details, and the specific details of the dishonored check. This comprehensive description ensures that all parties involved are aware of the situation and can address it accordingly. Multiple types of bad checks might be encountered, each with distinct circumstances and consequences: 1. Insufficient Funds Check: This type of bad check is the most common, occurring when the issuer's account lacks the necessary funds to cover the amount stated on the check. It often results from unintentional oversights or financial instability. 2. Account Closed Check: When a check bounces due to an account closure, it signifies that the issuer has closed their account before the check was encased. This can lead to difficulties in recovering the payment, as the issuer may be unreachable or non-cooperative. 3. Post-Dated Check: A post-dated check specifies a future date on which it should be cashed. If the check is presented for payment before the indicated date, it will be considered a bad check. This usually occurs unintentionally, when the recipient overlooks the date. 4. Non-Existent Account Check: This type of bad check is issued with an invalid or non-existent account number. The transfer cannot be completed as there is no account associated with the provided details. This might occur due to typographical errors or fraudulent activities. In the event of receiving a Bend Oregon Notice of Dishonored Check — Civil, it is crucial to comply with the instructions provided within. The notice often includes a deadline for the issuer to rectify the situation, urging them to compensate for the dishonored check amount promptly. Failure to comply with the notice may lead to legal actions, penalties, or even criminal charges, as the intentional issuance of bad checks is considered a criminal offense. Ultimately, the Bend Oregon Notice of Dishonored Check — Civil plays a vital role in addressing instances of bad or bounced checks, protecting the rights of recipients who have suffered financial loss. By initiating timely communication and legal procedures, this notice ensures that appropriate actions are taken to rectify the situation and prevent similar instances in the future.The Bend Oregon Notice of Dishonored Check — Civil serves as a legal communication issued to notify individuals or businesses when a check they have received has been dishonored or bounced due to insufficient funds in the issuer's account. This official document holds significant importance in cases involving bad or bounced checks, providing the affected party with the necessary information and legal recourse. A bad check is defined as a check that is returned unpaid by the bank due to various reasons such as insufficient funds, account closure, or a mismatched signature. This can bring inconvenience, financial loss, and potential legal disputes to the recipient. The Bend Oregon Notice of Dishonored Check — Civil contains several crucial elements, including the name and contact information of the person or entity issuing the notice, the recipient's details, and the specific details of the dishonored check. This comprehensive description ensures that all parties involved are aware of the situation and can address it accordingly. Multiple types of bad checks might be encountered, each with distinct circumstances and consequences: 1. Insufficient Funds Check: This type of bad check is the most common, occurring when the issuer's account lacks the necessary funds to cover the amount stated on the check. It often results from unintentional oversights or financial instability. 2. Account Closed Check: When a check bounces due to an account closure, it signifies that the issuer has closed their account before the check was encased. This can lead to difficulties in recovering the payment, as the issuer may be unreachable or non-cooperative. 3. Post-Dated Check: A post-dated check specifies a future date on which it should be cashed. If the check is presented for payment before the indicated date, it will be considered a bad check. This usually occurs unintentionally, when the recipient overlooks the date. 4. Non-Existent Account Check: This type of bad check is issued with an invalid or non-existent account number. The transfer cannot be completed as there is no account associated with the provided details. This might occur due to typographical errors or fraudulent activities. In the event of receiving a Bend Oregon Notice of Dishonored Check — Civil, it is crucial to comply with the instructions provided within. The notice often includes a deadline for the issuer to rectify the situation, urging them to compensate for the dishonored check amount promptly. Failure to comply with the notice may lead to legal actions, penalties, or even criminal charges, as the intentional issuance of bad checks is considered a criminal offense. Ultimately, the Bend Oregon Notice of Dishonored Check — Civil plays a vital role in addressing instances of bad or bounced checks, protecting the rights of recipients who have suffered financial loss. By initiating timely communication and legal procedures, this notice ensures that appropriate actions are taken to rectify the situation and prevent similar instances in the future.