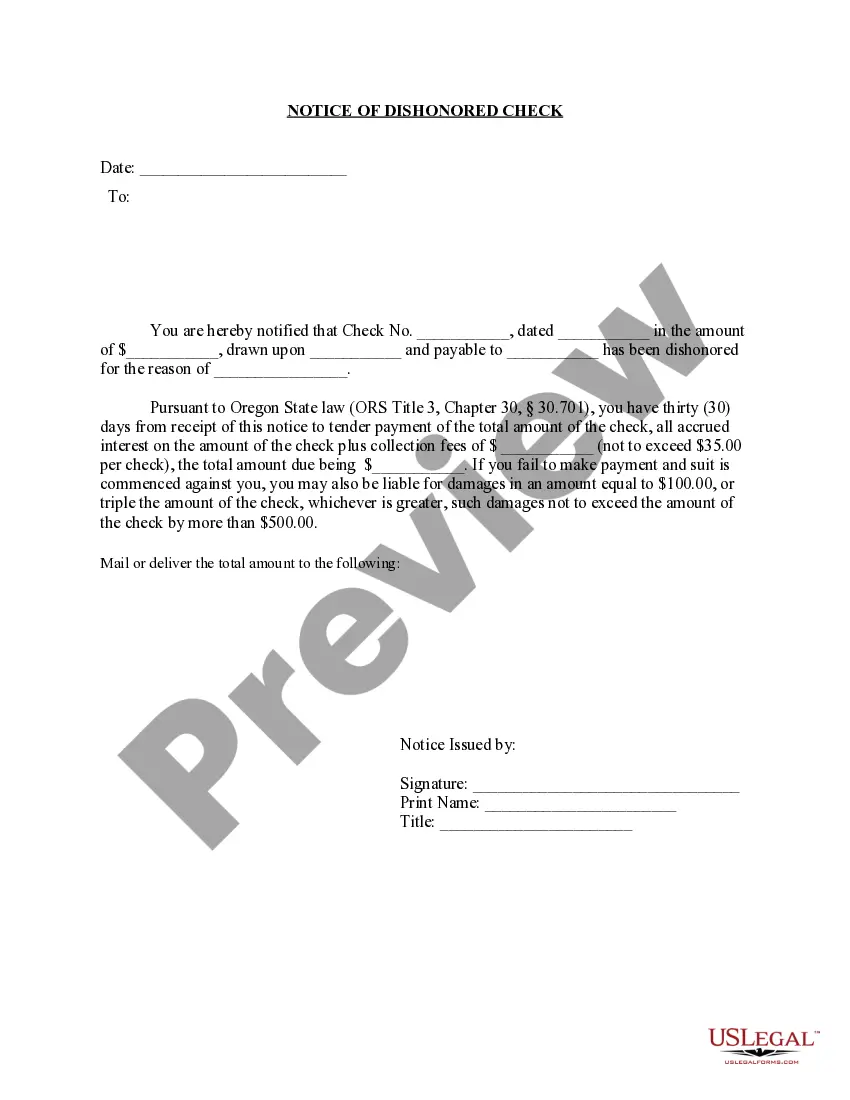

This is a Notice of Dishonored Check (Civil). A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Title: Understanding Gresham Oregon's Notice of Dishonored Check — Civil Introduction: In Gresham, Oregon, individuals and businesses need to be aware of the legal consequences associated with issuing a bad check or a bounced check. To facilitate the resolution of such cases, Gresham employs a Notice of Dishonored Check — Civil, a legal document used to inform the check writer about the situation. This article will provide a comprehensive overview of the notice, explaining what it entails, its implications, and the different types of bad checks Gresham recognizes. 1. What is a Gresham Oregon Notice of Dishonored Check — Civil? A Gresham Oregon Notice of Dishonored Check — Civil is a formal communication sent to the person who wrote a bad or bounced check within the city limits of Gresham. It serves as a legal notice, informing the check writer that their check has been dishonored or returned unpaid by the bank due to insufficient funds, account closures, or other account-related issues. 2. Implications of a Gresham Oregon Notice of Dishonored Check — Civil: Receiving a Gresham Oregon Notice of Dishonored Check — Civil can have serious consequences for the check writer. Some common implications may include: a) Legal Obligations: The notice serves as evidence that the check writer has failed to fulfill their financial obligations, which may lead to potential legal action. b) Financial Penalties: The check writer may be required to pay additional fees, such as the amount of the dishonored check, service charges, and possibly compensation for the recipient's losses. c) Damaged Reputation: A dishonored check can negatively impact a person's reputation, potentially affecting future financial transactions and creditworthiness. 3. Types of Bad Checks Recognized by Gresham Oregon: Gresham, Oregon recognizes various categories of bad checks, and the Notice of Dishonored Check — Civil can be issued for any of the following reasons: a) Insufficient Funds: When the check writer does not have enough money in their account to cover the amount stated on the check. b) Closed Account: If the check writer's account has been closed before the recipient attempts to deposit or cash the check. c) Account Restrictions: If the account is subject to restrictions or limitations, preventing the bank from honoring the check. d) Forgery or Alteration: When a check is knowingly forged or altered, including changing the payee's name or the check amount. e) Stop Payment Request: If the check writer requests a stop payment order on a check after issuing it, rendering it invalid. Conclusion: A Gresham Oregon Notice of Dishonored Check — Civil is an essential legal document used to notify individuals who have issued bad or bounced checks within Gresham's jurisdiction. Understanding the implications of receiving such a notice can help individuals and businesses take appropriate actions to resolve the matter, such as reimbursing the amount owed and avoiding legal consequences. This knowledge empowers individuals to act responsibly in their financial transactions and cultivate positive financial reputations.Title: Understanding Gresham Oregon's Notice of Dishonored Check — Civil Introduction: In Gresham, Oregon, individuals and businesses need to be aware of the legal consequences associated with issuing a bad check or a bounced check. To facilitate the resolution of such cases, Gresham employs a Notice of Dishonored Check — Civil, a legal document used to inform the check writer about the situation. This article will provide a comprehensive overview of the notice, explaining what it entails, its implications, and the different types of bad checks Gresham recognizes. 1. What is a Gresham Oregon Notice of Dishonored Check — Civil? A Gresham Oregon Notice of Dishonored Check — Civil is a formal communication sent to the person who wrote a bad or bounced check within the city limits of Gresham. It serves as a legal notice, informing the check writer that their check has been dishonored or returned unpaid by the bank due to insufficient funds, account closures, or other account-related issues. 2. Implications of a Gresham Oregon Notice of Dishonored Check — Civil: Receiving a Gresham Oregon Notice of Dishonored Check — Civil can have serious consequences for the check writer. Some common implications may include: a) Legal Obligations: The notice serves as evidence that the check writer has failed to fulfill their financial obligations, which may lead to potential legal action. b) Financial Penalties: The check writer may be required to pay additional fees, such as the amount of the dishonored check, service charges, and possibly compensation for the recipient's losses. c) Damaged Reputation: A dishonored check can negatively impact a person's reputation, potentially affecting future financial transactions and creditworthiness. 3. Types of Bad Checks Recognized by Gresham Oregon: Gresham, Oregon recognizes various categories of bad checks, and the Notice of Dishonored Check — Civil can be issued for any of the following reasons: a) Insufficient Funds: When the check writer does not have enough money in their account to cover the amount stated on the check. b) Closed Account: If the check writer's account has been closed before the recipient attempts to deposit or cash the check. c) Account Restrictions: If the account is subject to restrictions or limitations, preventing the bank from honoring the check. d) Forgery or Alteration: When a check is knowingly forged or altered, including changing the payee's name or the check amount. e) Stop Payment Request: If the check writer requests a stop payment order on a check after issuing it, rendering it invalid. Conclusion: A Gresham Oregon Notice of Dishonored Check — Civil is an essential legal document used to notify individuals who have issued bad or bounced checks within Gresham's jurisdiction. Understanding the implications of receiving such a notice can help individuals and businesses take appropriate actions to resolve the matter, such as reimbursing the amount owed and avoiding legal consequences. This knowledge empowers individuals to act responsibly in their financial transactions and cultivate positive financial reputations.