This is a Notice of Dishonored Check (Civil). A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

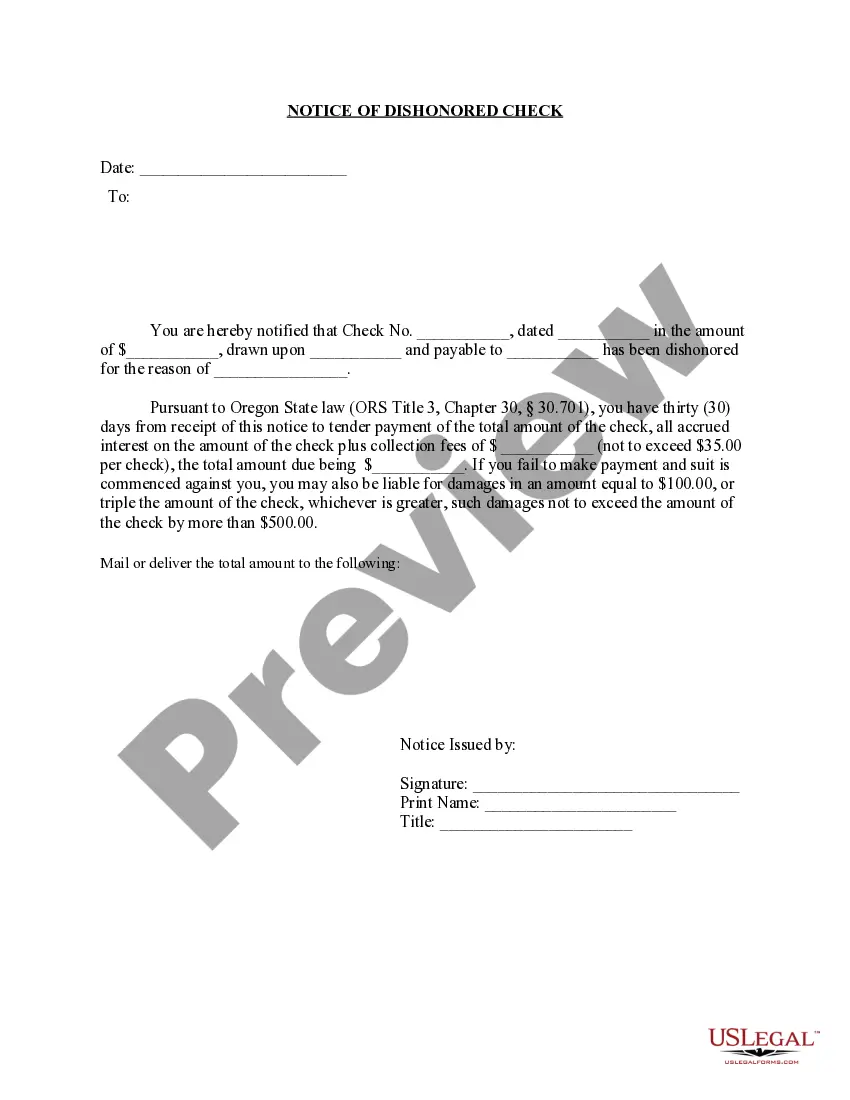

Title: Understanding the Portland Oregon Notice of Dishonored Check — Civil Introduction: In Portland, Oregon, when a check is bounced or deemed as a bad check, the recipient can file a Notice of Dishonored Check — Civil to hold the issuer legally accountable. This comprehensive guide aims to explain the process, consequences, and relevant information related to bad checks, bounced checks, and the Notice of Dishonored Check in Portland, Oregon. 1. What is a Bad Check or Bounced Check? A bad check or bounced check refers to a check that is returned by a bank due to insufficient funds or other issues, making it unable to be processed for payment. It can also include checks that have been altered, forged, or otherwise invalid. 2. Different Types of Bad Checks: a. Insufficient Funds Check: This type of bad check occurs when the issuer does not have enough funds in their bank account to cover the check amount. b. Closed Account Check: When the bank account of the check issuer is closed at the time the check is presented for payment, it is known as a closed account check. c. Alteration or Forgery Check: Checks that have been illegally altered or forged are considered invalid and fall under this category. 3. Portland Oregon Notice of Dishonored Check — Civil: In Portland, Oregon, recipients of bad checks or bounced checks can file a Notice of Dishonored Check — Civil to initiate legal action against the issuer. This notice serves as an official notification to the check writer regarding the dishonored check, providing an opportunity for them to rectify the situation promptly. 4. Process of Filing a Notice of Dishonored Check — Civil: a. Gather Essential Information: Collect all necessary information related to the check, including the check number, date, issuer's name, bank details, and recipient's details. b. Contact the Writer: Attempt to contact the check writer and inform them about the dishonored check, allowing them to resolve the matter before initiating legal actions. c. Draft the Notice: Create a formal Notice of Dishonored Check using a template or seek legal advice to ensure accuracy and compliance with the legal requirements. d. Serve the Notice: Legal service should be made to the check writer within a specified time frame. e. Legal Consequences: Upon receiving the Notice of Dishonored Check, the check writer has a certain period to make restitution. If not resolved, the recipient can pursue legal action, potentially resulting in monetary penalties, payment of legal fees, or even criminal charges. 5. Seeking Legal Assistance: Given the complexities involved in dealing with bad checks, it is highly recommended consulting with an attorney experienced in civil law or specifically check disputes in Portland, Oregon. They can provide guidance throughout the process, ensuring compliance with legal requirements and maximizing the chances of a favorable outcome. Conclusion: Understanding the Portland Oregon Notice of Dishonored Check — Civil is crucial for individuals and businesses dealing with bad checks or bounced checks. Complying with the legal procedures while resolving dishonored checks can minimize financial losses and protect the rights of recipients seeking restitution.Title: Understanding the Portland Oregon Notice of Dishonored Check — Civil Introduction: In Portland, Oregon, when a check is bounced or deemed as a bad check, the recipient can file a Notice of Dishonored Check — Civil to hold the issuer legally accountable. This comprehensive guide aims to explain the process, consequences, and relevant information related to bad checks, bounced checks, and the Notice of Dishonored Check in Portland, Oregon. 1. What is a Bad Check or Bounced Check? A bad check or bounced check refers to a check that is returned by a bank due to insufficient funds or other issues, making it unable to be processed for payment. It can also include checks that have been altered, forged, or otherwise invalid. 2. Different Types of Bad Checks: a. Insufficient Funds Check: This type of bad check occurs when the issuer does not have enough funds in their bank account to cover the check amount. b. Closed Account Check: When the bank account of the check issuer is closed at the time the check is presented for payment, it is known as a closed account check. c. Alteration or Forgery Check: Checks that have been illegally altered or forged are considered invalid and fall under this category. 3. Portland Oregon Notice of Dishonored Check — Civil: In Portland, Oregon, recipients of bad checks or bounced checks can file a Notice of Dishonored Check — Civil to initiate legal action against the issuer. This notice serves as an official notification to the check writer regarding the dishonored check, providing an opportunity for them to rectify the situation promptly. 4. Process of Filing a Notice of Dishonored Check — Civil: a. Gather Essential Information: Collect all necessary information related to the check, including the check number, date, issuer's name, bank details, and recipient's details. b. Contact the Writer: Attempt to contact the check writer and inform them about the dishonored check, allowing them to resolve the matter before initiating legal actions. c. Draft the Notice: Create a formal Notice of Dishonored Check using a template or seek legal advice to ensure accuracy and compliance with the legal requirements. d. Serve the Notice: Legal service should be made to the check writer within a specified time frame. e. Legal Consequences: Upon receiving the Notice of Dishonored Check, the check writer has a certain period to make restitution. If not resolved, the recipient can pursue legal action, potentially resulting in monetary penalties, payment of legal fees, or even criminal charges. 5. Seeking Legal Assistance: Given the complexities involved in dealing with bad checks, it is highly recommended consulting with an attorney experienced in civil law or specifically check disputes in Portland, Oregon. They can provide guidance throughout the process, ensuring compliance with legal requirements and maximizing the chances of a favorable outcome. Conclusion: Understanding the Portland Oregon Notice of Dishonored Check — Civil is crucial for individuals and businesses dealing with bad checks or bounced checks. Complying with the legal procedures while resolving dishonored checks can minimize financial losses and protect the rights of recipients seeking restitution.