A Eugene Oregon Workers Compensation Surety Bond is a type of surety bond that serves as a financial guarantee between an employer and the state of Oregon. It ensures that the employer will comply with the state's workers' compensation laws and regulations. This bond acts as protection for employees who may need to file a claim for injuries or illnesses that occur in the workplace. Workers compensation insurance is mandatory for most employers in the state of Oregon. However, in some cases, employers may be granted an exemption if they obtain a surety bond instead. The purpose of this bond is to provide a financial safety net for employees, in case the employer fails to pay the necessary compensation for work-related injuries or illness. There are two main types of Eugene Oregon Workers Compensation Surety Bonds: 1. Individual Employer Bond: This type of bond is specific to a particular employer and ensures that they will comply with the workers' compensation laws and provide proper coverage for their employees. The bond amount is determined based on the employer's payroll and the number of employees. 2. Pooled Employer Bond: This type of bond is designed for multiple employers who are part of a group or association. The bond functions similarly to an individual employer bond, but it covers all employers within the group. The bond amount is calculated based on the total payroll and employee count of all the employers in the group. Both types of bonds are intended to protect employees and ensure they receive the necessary compensation in case of work-related injuries or illnesses. By obtaining a Eugene Oregon Workers Compensation Surety Bond, employers demonstrate their commitment to providing a safe working environment and complying with the state's workers' compensation laws. In conclusion, a Eugene Oregon Workers Compensation Surety Bond is a crucial financial instrument that guarantees employees' compensation in case of work-related injuries or illnesses. It provides a safety net for employees and ensures employers' compliance with the state's workers' compensation laws. Whether it's an individual employer bond or a pooled employer bond, these bonds play a vital role in protecting employees and promoting workplace safety in Eugene, Oregon.

Eugene Oregon Workers Compensation Surety Bond

Description

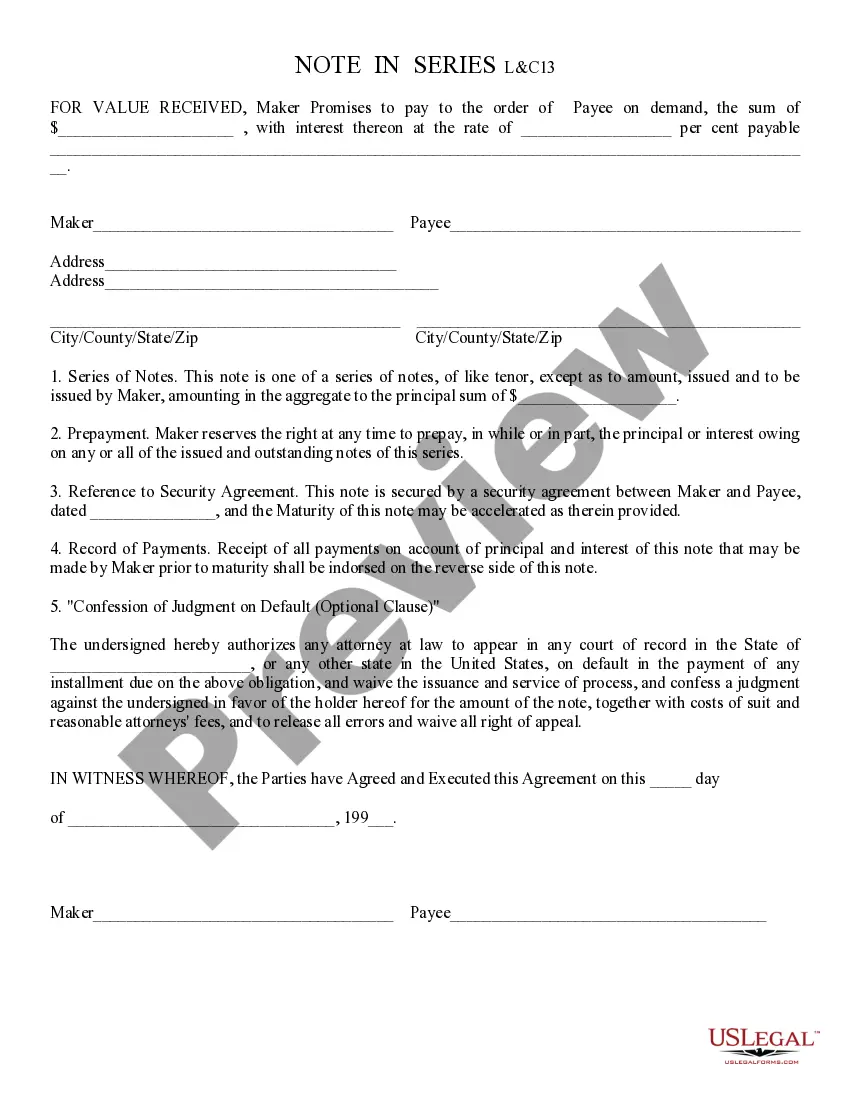

How to fill out Eugene Oregon Workers Compensation Surety Bond?

No matter the social or professional standing, completing law-related documents is a regrettable necessity in the current professional landscape.

Often, it’s nearly impossible for someone without any legal expertise to draft such documents from scratch, primarily due to the intricate jargon and legal nuances they involve.

This is where US Legal Forms can come to the rescue.

Confirm that the template you have located is tailored to your area, as the regulations of one state or county do not apply to another.

Preview the document and review a brief description (if available) of the scenarios for which the document may be applicable.

- Our service provides an extensive collection of over 85,000 ready-to-use forms specific to each state that address nearly any legal circumstance.

- US Legal Forms also acts as a valuable resource for associates or legal advisors seeking to save time with our DIY documents.

- Whether you need the Eugene Oregon Workers Compensation Surety Bond or other official paperwork valid in your area, with US Legal Forms, everything is easily accessible.

- Here’s how to obtain the Eugene Oregon Workers Compensation Surety Bond in minutes using our reliable service.

- If you are currently an existing client, you can proceed to Log In to your account to retrieve the required form.

- However, if you are new to our platform, make sure to follow these steps before downloading the Eugene Oregon Workers Compensation Surety Bond.

Form popularity

FAQ

A $5000 bond, particularly in the context of Eugene Oregon Workers Compensation Surety Bond, serves as a financial guarantee that protects against potential claims. The worth of the bond refers to its backing in terms of coverage for workers' compensation obligations. Essentially, this bond assures that the specified amount is available to cover benefits for employees in case of workplace injuries. It's important to understand that the bond itself provides significant peace of mind, ensuring compliance with local regulations while protecting your workforce.

Getting a surety bond in Oregon involves a few steps. First, determine the type and amount of bond you need, such as the Eugene Oregon Workers Compensation Surety Bond. Next, apply with a bonding company, providing necessary documentation and information about your business. Platforms like uslegalforms can assist you with the entire application process, making it easier to obtain your bond efficiently.

To calculate a surety bond, consider the bond amount required by the state for your specific industry. Usually, the premium is a percentage of this bond amount, ranging from 1% to 15%. For the Eugene Oregon Workers Compensation Surety Bond, you may need to provide documentation such as your credit score and financial history, which can affect your premium. Using a reliable service like uslegalforms can simplify this process by offering clear guidelines and resources.

To get a surety bond in Oregon, particularly a Eugene Oregon Workers Compensation Surety Bond, you need to find a licensed surety company. Begin by researching various providers and choose one that offers competitive rates and excellent service. USLegalForms can help streamline your search and assist with the application process, ensuring you meet all requirements. Once approved, you will receive your bond, which helps protect your clients and comply with legal obligations.

Applying for a Eugene Oregon Workers Compensation Surety Bond is a straightforward process. You can start by gathering the required documents and information, such as your business details and any financial records. Once you have your documents ready, visit a trusted surety bond provider or platform like USLegalForms, which simplifies the application process. After submitting your application, the provider will assess your information and determine the bond amount you need.

The fact is that surety bonds are good for business. They instill trust in your company, make it even more reputable and, in most situations, keep it compliant under the law or the governing body of your industry.

What is the Cost of the Oregon Contractor License Bond? Residential ContractorsBond TypeSurety Bond AmountBetween 600-649Residential General Contractor's Limited Contractors and Developers$20,000$500-$1,000Residential Specialty Contractors$15,000$375-$7505 more rows

A surety bond is a promise to be liable for the debt, default, or failure of another. It is a three-party contract by which one party (the surety) guarantees the performance or obligations of a second party (the principal) to a third party (the obligee).

Some construction license bonds such as the $10,000 Residential Limited Contractor Bond can cost as low as $100 per year. Others like the Commercial General Contractor Level 1 can cost $750 per year. The cost of these bonds can increase as the personal credit score of the company's owners decreases.