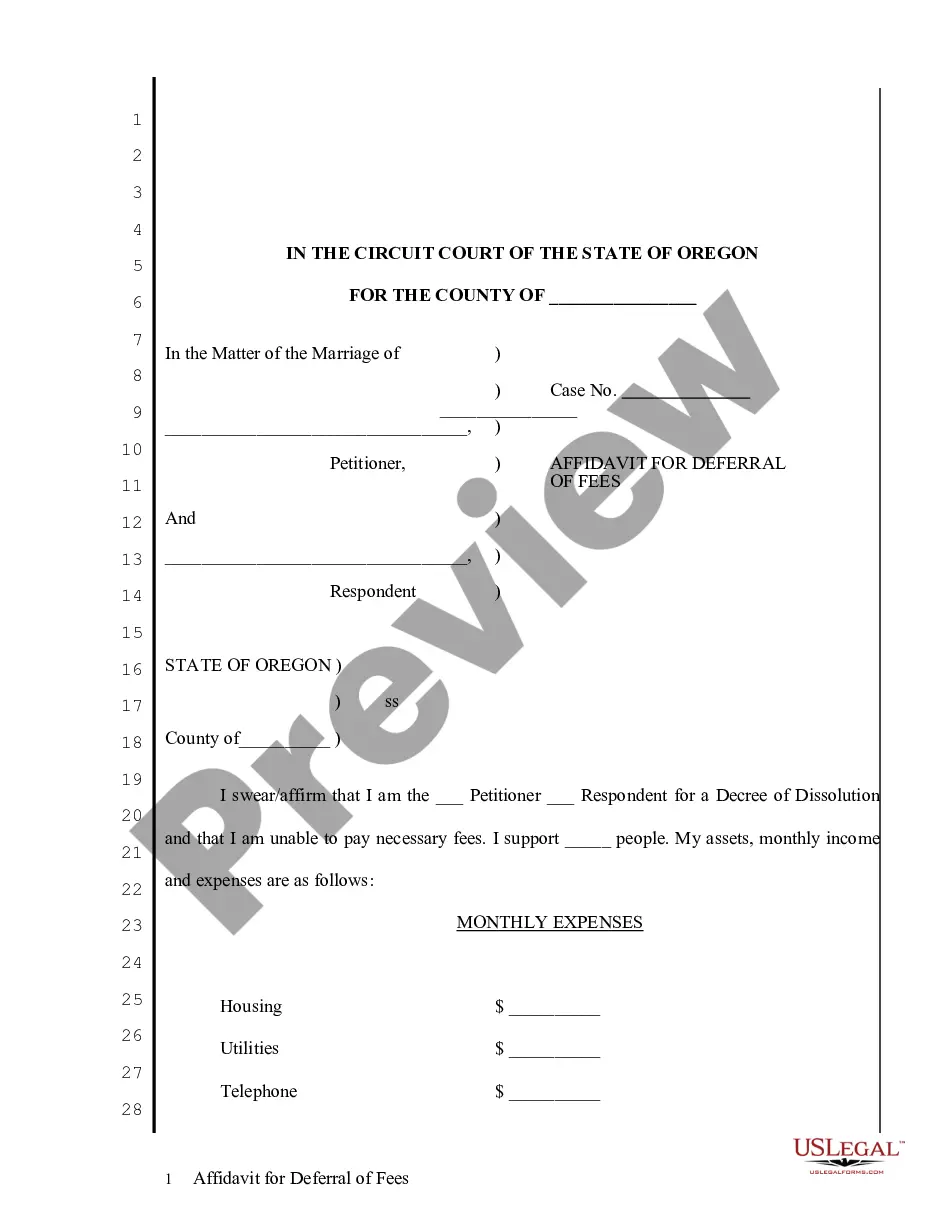

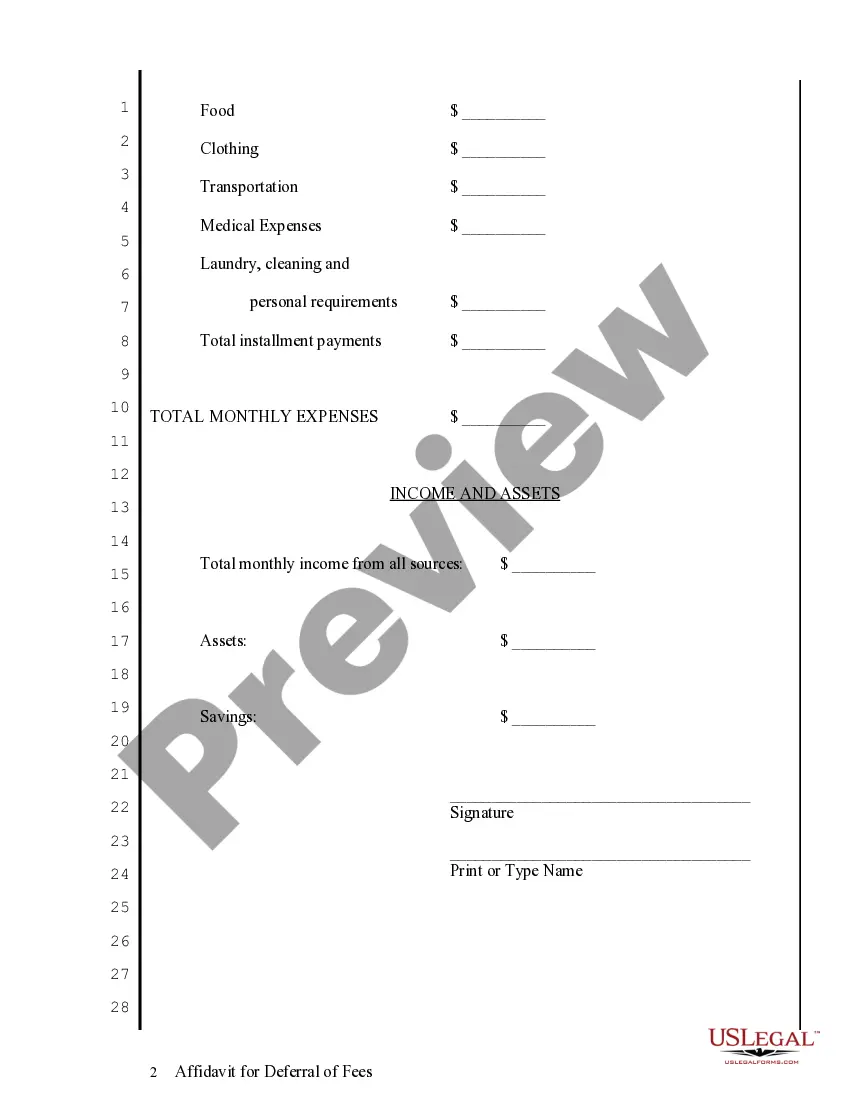

Title: Understanding the Gresham Oregon Affidavit for Deferral of Fees: A Comprehensive Guide on Managing Expenses vs. Income Introduction: In Gresham, Oregon, residents facing financial constraints may find relief through the Affidavit for Deferral of Fees programs. This initiative provides individuals with the opportunity to defer certain fees, allowing them to manage their expenses more effectively in relation to their income. This article aims to provide a detailed description of this program, shedding light on its purpose, eligibility criteria, and different types available. 1. What is the Gresham Oregon Affidavit for Deferral of Fees? The Gresham Oregon Affidavit for Deferral of Fees is a program designed to help eligible individuals manage their financial hardships by postponing various fees associated with essential services, such as utility bills, property taxes, sewer charges, and transportation fees. By opting for deferral, individuals can allocate their limited income towards other immediate expenses, aiming to alleviate their financial burden. 2. Eligibility Criteria: To qualify for the Affidavit for Deferral of Fees, individuals must meet specific requirements set by the city of Gresham. These criteria typically include: — Residency: Applicants must be residents of Gresham, Oregon, providing proof of address. — Income Limitation: There is usually an income threshold that applicants must meet or fall below to be considered eligible for fee deferral. — Financial Hardship: Applicants must demonstrate a genuine financial need, substantiating their inability to pay the fees within the designated timeframe. 3. Comparison of Different Types of Affidavit for Deferral of Fees: a) Utility Fee Deferral: This type of affidavit allows eligible individuals to defer payments related to essential utilities such as water, electricity, and gas bills. By postponing these fees, individuals can prioritize other pressing expenses without the risk of service interruptions. b) Property Tax Deferral: Under this type, eligible homeowners can temporarily defer payment of their property taxes to alleviate financial strain. However, it is important to note that deferred property taxes accumulate interest, which must be repaid at a later date. c) Sewer Charge Deferral: This option enables individuals to defer sewer charges, providing temporary relief for those facing financial constraints. By deferring sewer fees, individuals can allocate their income towards other essential needs until their financial situation improves. d) Transportation Fee Deferral: This type of affidavit allows qualifying individuals to defer transportation-related fees, such as public transportation passes or vehicle registration fees. By opting for deferral, individuals can reserve their limited income for more immediate expenses. 4. How to Apply: To apply for the Gresham Oregon Affidavit for Deferral of Fees, interested individuals must complete a formal application, providing requested documents, including proof of residency, income verification, and proof of financial hardship. It is advisable to contact the Gresham city administration or visit their official website for specific application procedures, requirements, and deadlines. Conclusion: The Gresham Oregon Affidavit for Deferral of Fees assists individuals facing financial constraints by allowing them to defer certain fees temporarily. By understanding the different types of fee deferral available, eligible residents can prioritize their limited income effectively, mitigating financial burdens while ensuring essential expenses are met. It is crucial to consult the city's administration to obtain accurate and up-to-date information regarding eligibility, application procedures, and program specifics.

Gresham Oregon Affidavit for Deferral of Fees with emphasis on expenses versus income

Description

How to fill out Gresham Oregon Affidavit For Deferral Of Fees With Emphasis On Expenses Versus Income?

No matter what social or professional status, completing law-related documents is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for someone with no legal background to draft such papers from scratch, mainly because of the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes in handy. Our platform offers a massive collection with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also is an excellent resource for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you need the Gresham Oregon Affidavit for Deferral of Fees with emphasis on expenses versus income or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Gresham Oregon Affidavit for Deferral of Fees with emphasis on expenses versus income quickly employing our trusted platform. In case you are presently an existing customer, you can go on and log in to your account to get the appropriate form.

However, if you are new to our platform, ensure that you follow these steps before obtaining the Gresham Oregon Affidavit for Deferral of Fees with emphasis on expenses versus income:

- Be sure the form you have found is suitable for your area because the regulations of one state or area do not work for another state or area.

- Preview the form and read a quick description (if provided) of scenarios the paper can be used for.

- If the form you picked doesn’t suit your needs, you can start again and look for the necessary form.

- Click Buy now and pick the subscription option that suits you the best.

- Access an account {using your login information or register for one from scratch.

- Select the payment gateway and proceed to download the Gresham Oregon Affidavit for Deferral of Fees with emphasis on expenses versus income once the payment is done.

You’re all set! Now you can go on and print the form or complete it online. Should you have any problems locating your purchased documents, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.

Form popularity

FAQ

Divorce in Oregon can take on average between 6 and 12 months from the date your divorce case is filed until your divorce is final. There is no waiting period in Oregon, so your divorce can even be completed within a few weeks if both parties agree on the terms and a Judge signs off on your petition.

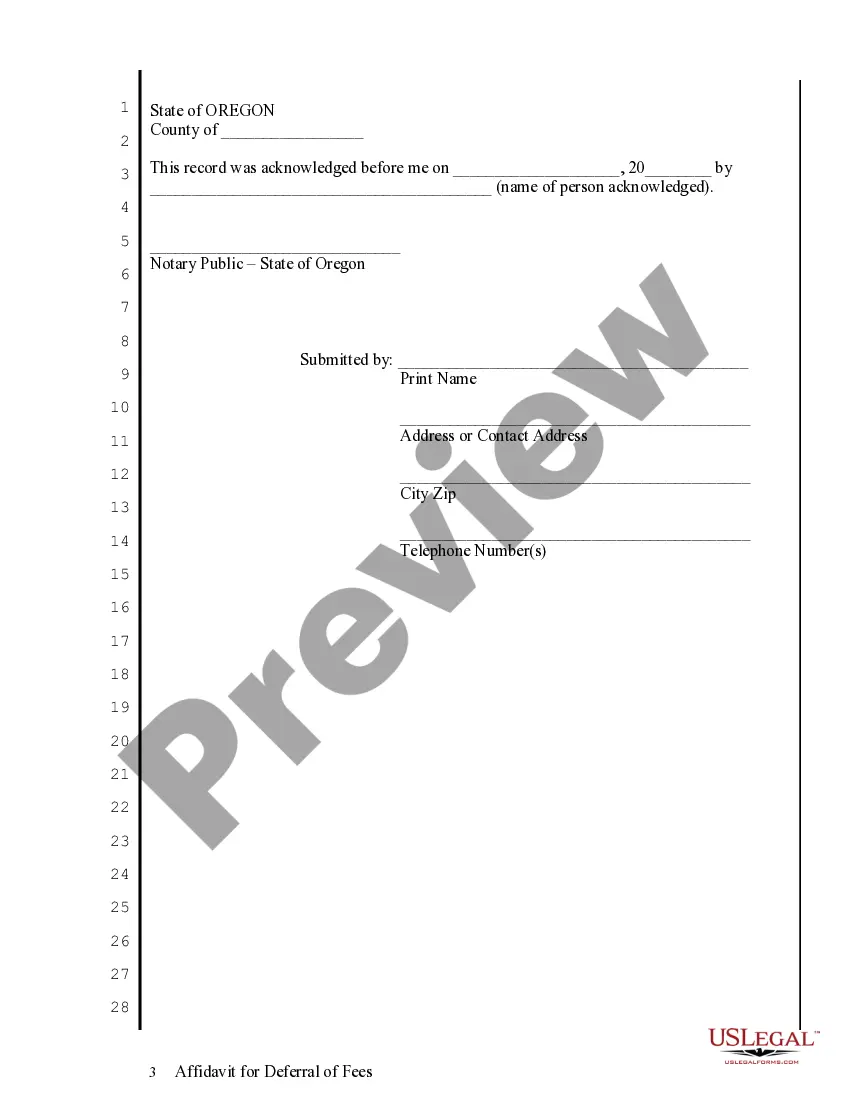

The fee waiver and deferral process is a two-step process and requires that you file a Supplemental Application (Form No. AOCDFGF9F) when there is a final order, decree, or judgment in your case. The court may waive your fees if your financial situation does not change.

If you are low income and cannot afford to pay the fee to file your court papers or other court fees, you can ask for a fee waiver.

The filing fee is $252.00. If you cannot afford to pay the filing fee, ask the court clerk for information about filing an application for a fee waiver.

When you file for divorce in Texas, you are required to pay a filing fee that typically ranges between $250 and $300, though the exact cost differs from county to county. Additionally, you will need to pay a service fee and an issuance fee if you need to have your spouse served with divorce papers.

These fees vary from county to county. If you cannot afford the fees, you can ask to have them waived....You will get a full (100%) waiver if: You receive an income-based public benefit, Your income is 125% of the federal poverty levels or less; or. The judge decides having to pay would be a substantial hardship for you.

A Tuition Fee Deferral protects course enrollment and delays the payment of tuition fees. However, a tuition fee deferral will not delay university housing charges.

Divorce Filing Fees in Oregon As of 2021, Oregon courts charge $301 to file a dissolution of marriage. Because filing fees change often, you'll want to get the current fee schedule from the clerk of the court where you'll be filing your petition.

It costs $301 to file a dissolution of marriage in Oregon. Filing fees do change, though, so you'll want to confirm the fee with the clerk of the court where you'll be filing your petition.

When negotiating a fee waiver, it's important to be specific and straightforward. Call the bank, mention the fee you incurred and say you would like to have it waived by the bank. If the bank isn't immediately open to helping you, try to show you're a valuable customer.