Eugene Oregon Probate Checklist

Description

How to fill out Oregon Probate Checklist?

Utilize the US Legal Forms and gain immediate access to any template you desire.

Our user-friendly website, featuring a vast array of templates, streamlines the process of locating and acquiring nearly any document sample you need.

You can download, fill out, and authenticate the Eugene Oregon Probate Checklist in merely a few minutes instead of spending hours online searching for the appropriate template.

Using our collection is an excellent approach to enhance the security of your document submissions. Our experienced legal experts routinely assess all documents to ensure that the forms are suitable for a specific state and conform to the latest laws and regulations.

Locate the template you need. Ensure it is the form you were looking for: check its name and details, and utilize the Preview feature if it’s offered. Otherwise, use the Search field to find the required one.

Initiate the downloading process. Click Buy Now and select the pricing plan that suits you best. Then, set up an account and complete your purchase using a credit card or PayPal.

- How can you obtain the Eugene Oregon Probate Checklist.

- If you already have an account, simply Log In to your account. The Download button will be visible on all the documents you view. Additionally, you can access all previously saved documents in the My documents section.

- If you haven’t yet created an account, follow the steps below.

Form popularity

FAQ

You can find a probate list by visiting the website of your local probate court, which typically maintains records of all pending probate cases. Some counties also publish probate lists in local newspapers or online legal databases. Accessing the Eugene Oregon Probate Checklist can provide guidance on how to locate these resources efficiently.

While it is not legally required to have an attorney for probate in Oregon, it is highly recommended, especially for complex estates. An experienced attorney can navigate the legal procedures, help with paperwork, and represent your interests in court. If you prefer a guided approach, leveraging the Eugene Oregon Probate Checklist along with an attorney's expertise can ensure you meet all necessary requirements.

To check probate status in Oregon, visit the local probate court’s website or call their office directly. Many courts offer online databases where you can search for case information by the deceased’s name or case number. Regularly checking these resources will keep you updated on any filings or hearings. Using the Eugene Oregon Probate Checklist can guide you on what information to look for.

To begin probate in Oregon, you must file a petition with the probate court in the county where the deceased person lived. It’s essential to gather necessary documents, like the original will and death certificate, ahead of time. Once filed, the court will schedule a hearing to validate the will and appoint a personal representative. Following the Eugene Oregon Probate Checklist can help streamline this process.

Non-probate assets refer to those that can transfer directly to beneficiaries without going through probate court. Common examples are joint tenancy properties, retirement accounts with designated beneficiaries, and assets in a living trust. Understanding the distinction between probate and non-probate assets is key to efficient estate planning, making the Eugene Oregon Probate Checklist a great resource for ensuring all aspects of your estate are addressed correctly.

Assets that typically pass through probate include those solely owned by the deceased without named beneficiaries, such as personal property, bank accounts, and real estate. If no designated beneficiary exists, these assets must go through the probate court for distribution according to state law. Utilizing the Eugene Oregon Probate Checklist can help you determine which of your assets require probate, simplifying the process during a difficult time.

When overseeing a probate case, a judge typically asks about the validity of the will, the deceased's assets, and any debts owed by the estate. They also inquire about the appointed executor to ensure they can manage the estate properly. Understanding these questions can prepare you for the probate process, making resources like the Eugene Oregon Probate Checklist essential for navigating these requirements smoothly.

Non-probate property includes assets that do not require court approval to transfer upon death. For example, life insurance policies with named beneficiaries and assets held in a living trust are classified as non-probate. Knowing what qualifies as non-probate can simplify the estate planning process, making tools like the Eugene Oregon Probate Checklist extremely valuable. This checklist can guide you in identifying these assets, ensuring efficient handling of your estate.

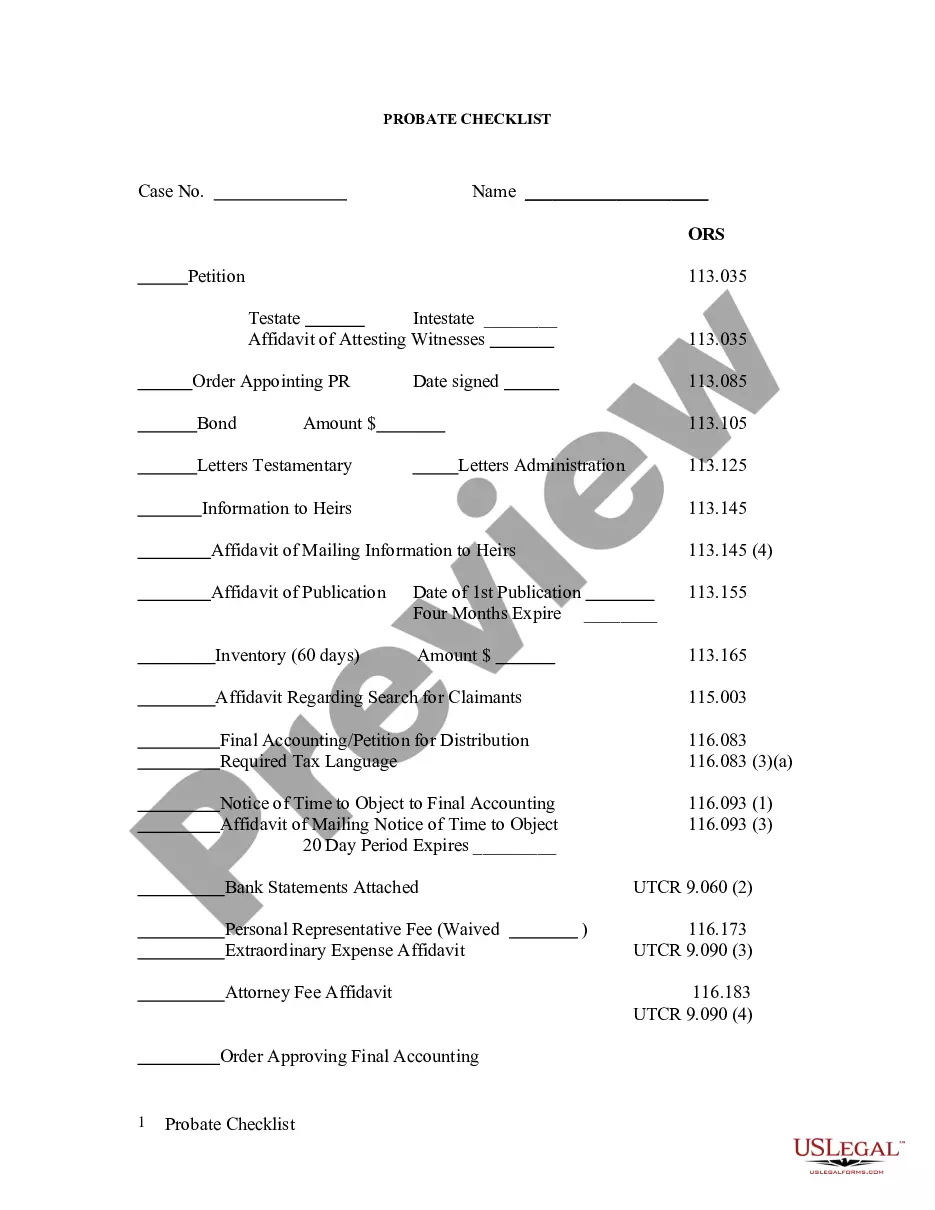

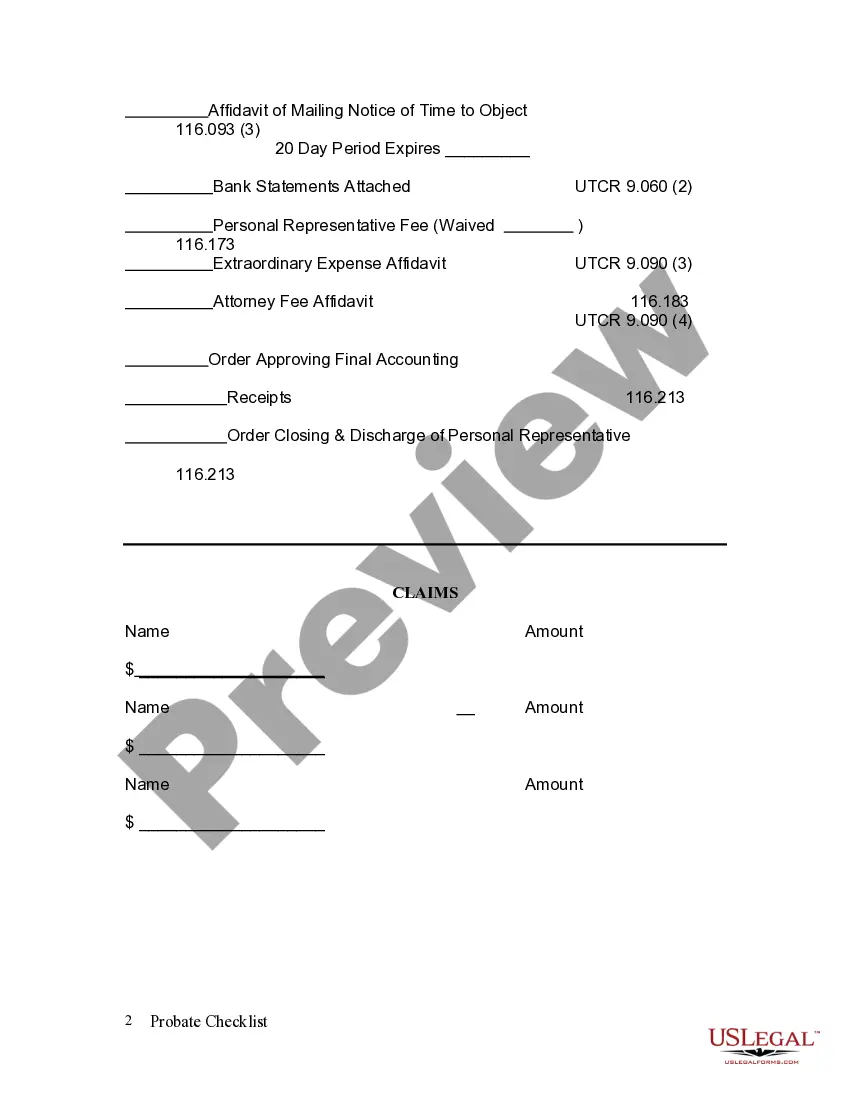

The major steps in probate include filing the will with the court, appointing a personal representative, notifying heirs and creditors, managing the estate’s assets, and distributing the remaining assets. Each of these steps is crucial for ensuring a smooth probate process. To keep track of these tasks and understand what to expect, the Eugene Oregon Probate Checklist serves as an invaluable tool. It provides clarity and structure to every phase of the probate journey.

While it's not mandatory to hire a lawyer for probate in Oregon, doing so can simplify the process significantly. A lawyer can provide guidance on legal requirements, paperwork, and navigating court procedures, which can be complex. If you choose to proceed without a lawyer, ensure you are well-informed by utilizing resources like the Eugene Oregon Probate Checklist. This checklist can assist you in identifying critical legal steps.