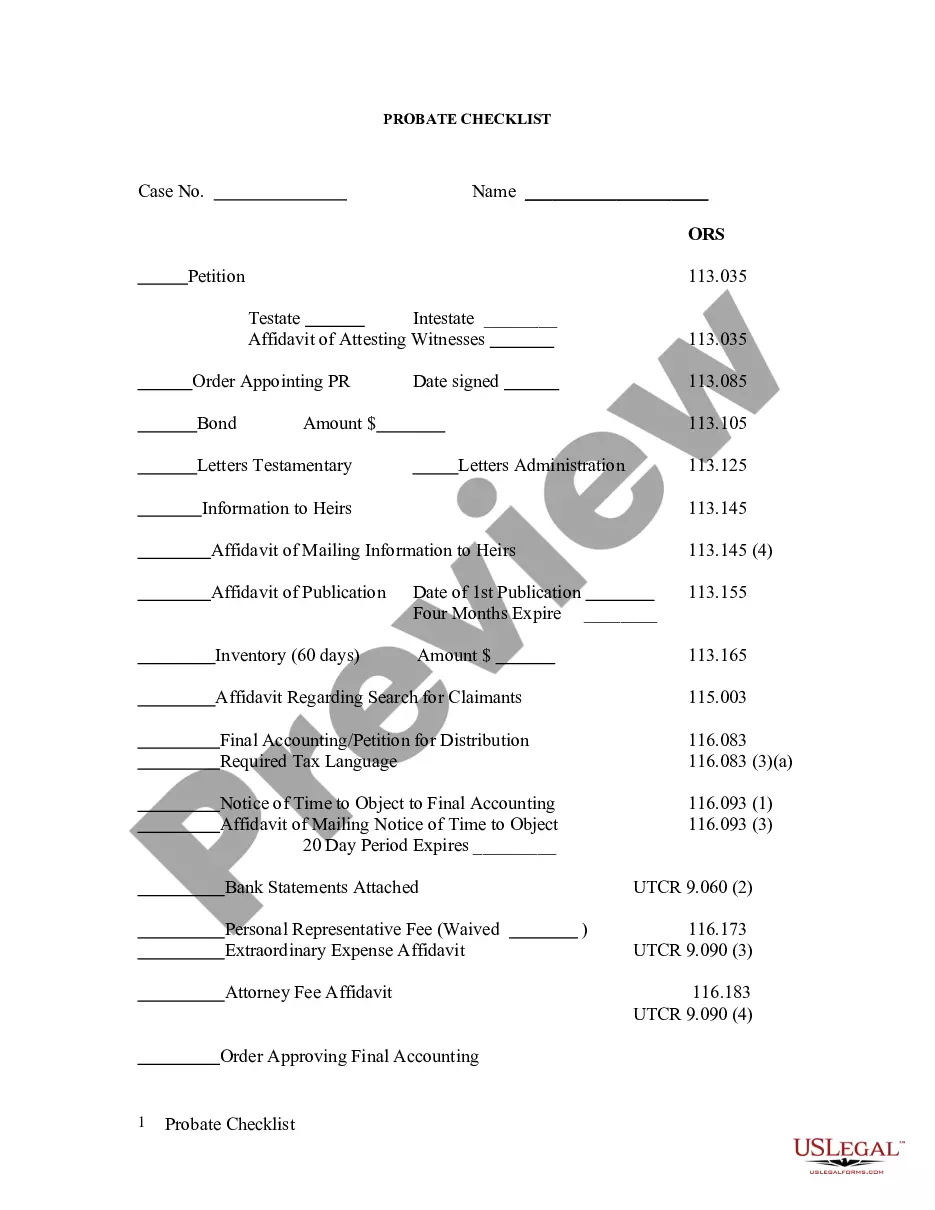

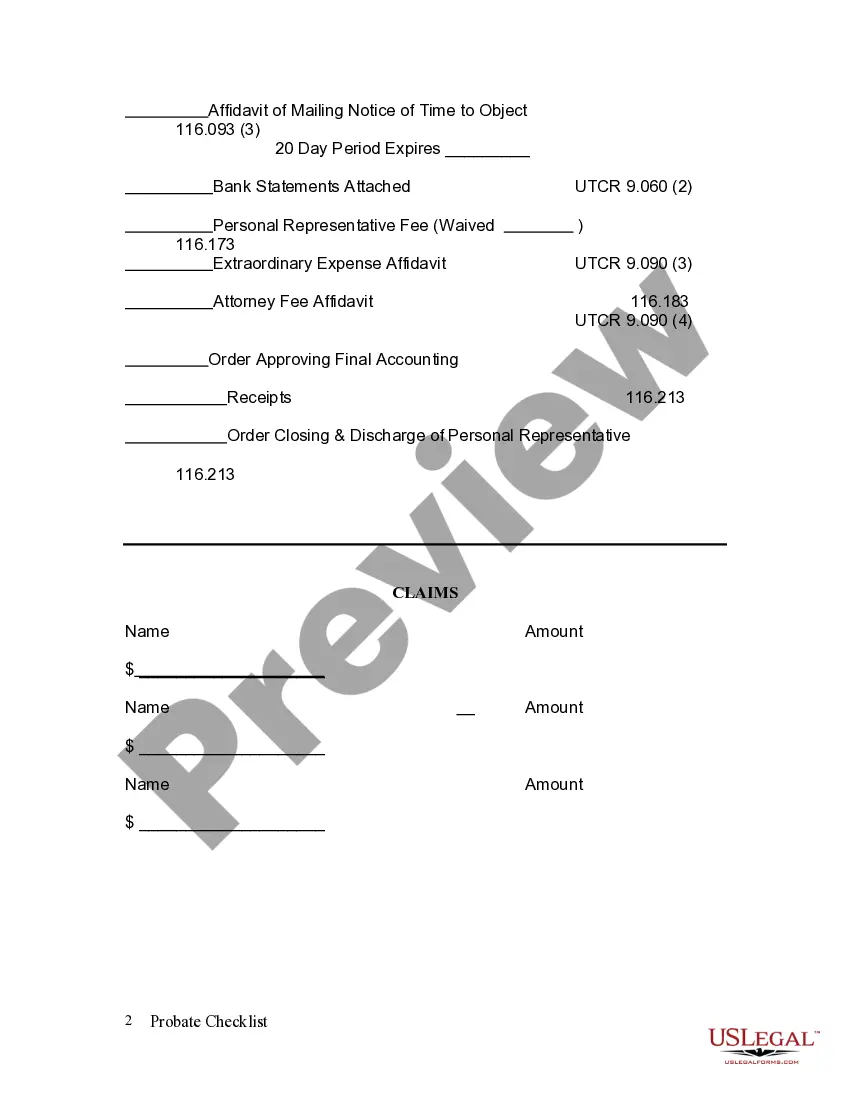

Portland Oregon Probate Checklist is a comprehensive document that outlines the necessary steps and requirements for administering a deceased individual's estate in Portland, Oregon. This checklist serves as a vital tool for executors, administrators, and personal representatives to ensure that they fulfill their legal obligations and efficiently navigate the probate process. By adhering to this checklist, individuals can avoid potential delays, errors, and complications that may arise during the administration of an estate in Portland, Oregon. The Portland Oregon Probate Checklist covers various key aspects and includes relevant keywords such as: 1. Gathering essential documents: The checklist emphasizes the importance of collecting important documents related to the deceased individual's assets, liabilities, and personal information. This may include but is not limited to the will, death certificate, deeds, bank statements, insurance policies, and outstanding bills. 2. Identifying and notifying beneficiaries: Executors or administrators are responsible for identifying and notifying all beneficiaries named in the will or those entitled by law. This step involves conducting a thorough search to locate individuals who may be difficult to find or were previously unknown. 3. Filing the necessary legal documents: This checklist outlines the specific legal forms and documents that must be filed with the appropriate court to initiate the probate process. These may include the Petition for Probate, Letters Testamentary, and Inventory and Appraisal statements. 4. Managing estate assets: Executors must secure and manage the deceased individual's assets during the probate process. This may involve tasks such as gathering and valuing assets, managing investments, paying bills, and filing tax returns. 5. Notifying creditors and resolving debts: Executors are responsible for notifying potential creditors of the deceased's passing and settling outstanding debts or claims against the estate. This may involve publishing a Notice to Creditors, reviewing claims, and negotiating settlements. 6. Distributing assets to beneficiaries: Once all debts, taxes, and expenses have been paid, executors must distribute the remaining assets to the beneficiaries according to the terms of the will or intestate succession laws. While different types of Portland Oregon Probate Checklists may not exist, individuals may find customized versions based on their specific circumstances or the complexity of the estate being administered. However, it is essential to consult with legal professionals or the local court for any updated probate forms or guidelines specific to Portland, Oregon.

Portland Oregon Probate Checklist

Description

How to fill out Portland Oregon Probate Checklist?

We always strive to reduce or avoid legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we apply for legal services that, usually, are very expensive. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to an attorney. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Portland Oregon Probate Checklist or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Portland Oregon Probate Checklist complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Portland Oregon Probate Checklist is proper for you, you can pick the subscription plan and proceed to payment.

- Then you can download the form in any available format.

For more than 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!