The Bend Oregon Chapter 13 Plan is a legal program offered under the United States Bankruptcy Code specifically designed for individuals or small business owners residing in Bend, Oregon, who are facing financial challenges. This plan allows eligible individuals to reorganize their debts and create a feasible repayment schedule within a specific timeframe, typically spanning three to five years. The primary purpose of a Chapter 13 Plan is to provide debtors with an opportunity to repay their creditors, while still being able to retain their assets and avoid liquidation. Unlike Chapter 7 bankruptcy, where non-exempt assets may be sold to repay outstanding debts, Chapter 13 allows individuals to maintain ownership of their property while adhering to a structured repayment plan. Under this plan, debtors work with their bankruptcy attorney to submit a detailed proposal to the bankruptcy court, outlining their income, expenses, and a comprehensive repayment plan to address priority debts, secured debts, and unsecured debts. Priority debts, such as child support or tax obligations, usually receive full or specified payments, while secured debts, such as mortgages or car loans, are restructured to accommodate the debtor's repayment capacity. Additionally, unsecured debts, such as credit card or medical bills, may be subject to partial repayment or even complete discharge, depending on the debtor's disposable income and the value of non-exempt assets. The repayment plan is often structured in a way that debtors can meet their daily living expenses while dedicating a portion of their income towards repaying their outstanding debts. One noteworthy aspect of the Bend Oregon Chapter 13 Plan is the possibility of including a provision to strip off second mortgages or home equity lines of credit (Helots) if the home's value is less than the first mortgage balance. This particular provision allows debtors to potentially eliminate these liens, thereby reducing the overall debt burden. It is important to note that Chapter 13 Plan requirements and guidelines may differ between jurisdictions and may have specific nuances within the Bend, Oregon area. Different types or variations of Chapter 13 Plan typically do not exist, as the plan itself serves as a standardized way to arrange debt repayment for individuals within the specified region. Overall, the Bend Oregon Chapter 13 Plan serves as a valuable tool for individuals residing in Bend who are struggling financially, offering them an opportunity to restructure their debts, regain control over their financial situation, and potentially achieve a fresh start towards a more secure financial future.

Bend Oregon Chapter 13 Plan

Description

How to fill out Bend Oregon Chapter 13 Plan?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Bend Oregon Chapter 13 Plan gets as quick and easy as ABC.

For everyone already familiar with our library and has used it before, obtaining the Bend Oregon Chapter 13 Plan takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a couple of additional steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

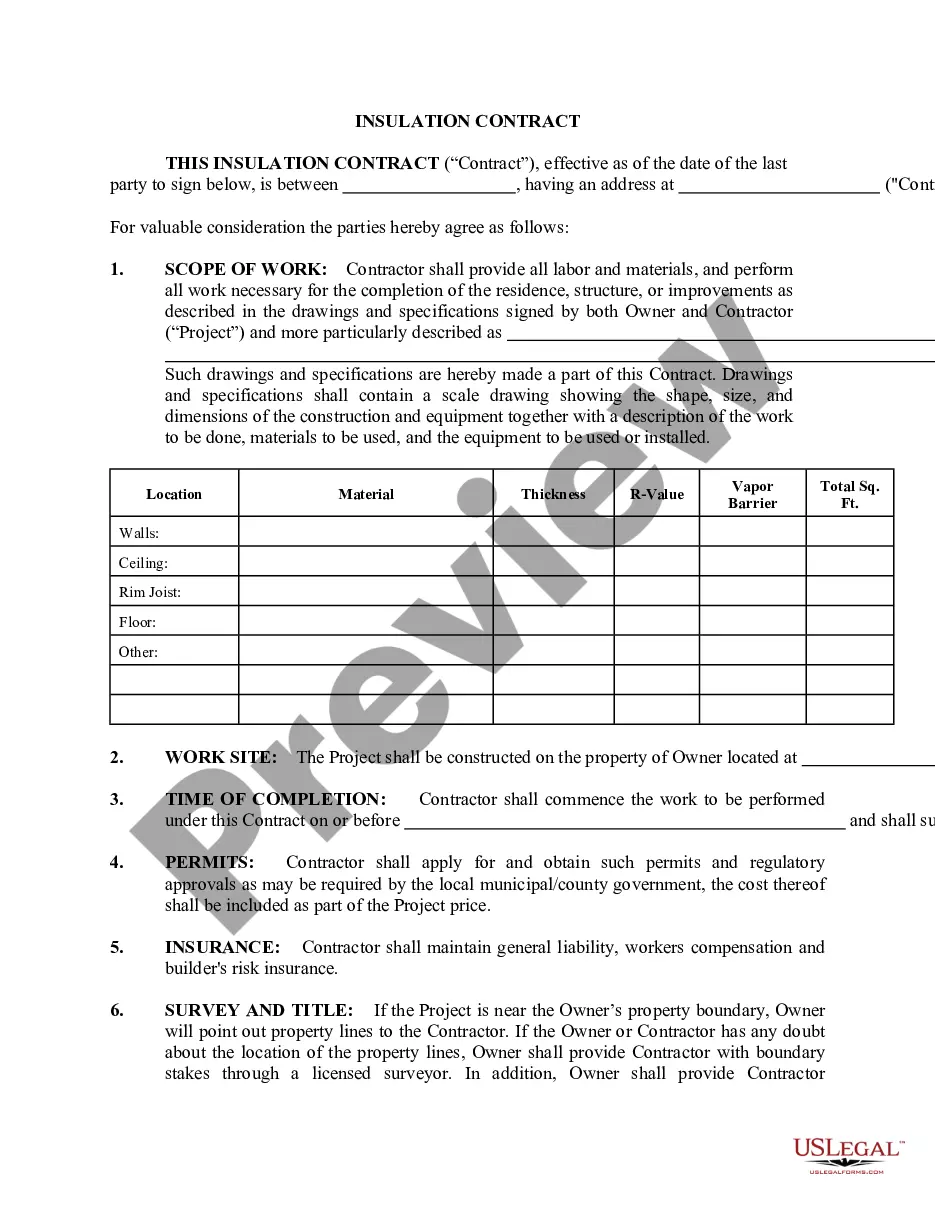

- Check the Preview mode and form description. Make certain you’ve picked the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Bend Oregon Chapter 13 Plan. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!