Chapter 13 Plan in Gresham, Oregon, is a legally structured repayment plan designed for individuals who are facing financial challenges while still wanting to retain their assets. This plan falls under the United States Bankruptcy Code and provides individuals with a realistic approach to tackling their debt by creating a manageable payment schedule over a period of three to five years. Gresham, Oregon Chapter 13 Plan allows individuals to reorganize their debts and establish a repayment plan approved by the court. This plan is particularly suitable for those who have a regular source of income and wish to prevent foreclosure or repossession of their property, while still repaying their debts in a structured manner. In Gresham, Oregon, there are various types of Chapter 13 Plans that may be applicable based on an individual's specific circumstances: 1. Standard Chapter 13 Plan: This is the most common type of Chapter 13 Plan, where individuals propose to use their disposable income to repay secured and unsecured creditors over the specified duration of the plan. 2. Zero Percent Plan: In some cases, individuals may be eligible for a Zero Percent Plan, where they propose a plan that repays all priority and secured debts in full, with no repayment towards unsecured debts. 3. Cram down Plan: A Cram down Plan allows individuals to reduce the principal balance of secured debts to the current market value of the asset securing the debt. This option is particularly helpful for individuals who owe more on their property than its current value, enabling them to lower their overall debt burden. 4. Equal Monthly Payment Plan: Under this type, individuals propose to pay a fixed monthly amount over the plan's duration. This plan is beneficial for individuals with consistent income, as it simplifies budgeting and ensures the repayment obligations. 5. Step Plan: A Step Plan is designed for individuals who expect their income to increase over the life of the plan. With this approach, individuals initially pay a fixed amount, which gradually increases at predetermined intervals. By filing for Chapter 13 bankruptcy under Gresham, Oregon laws, individuals can protect their assets while repaying their debts over time. The specific type of Chapter 13 Plan selected will depend on individual circumstances and the guidance of an experienced bankruptcy attorney. It is essential to consult a legal professional to determine eligibility, evaluate available options, and create a customized plan that best suits the individual's unique financial situation.

Gresham Oregon Chapter 13 Plan

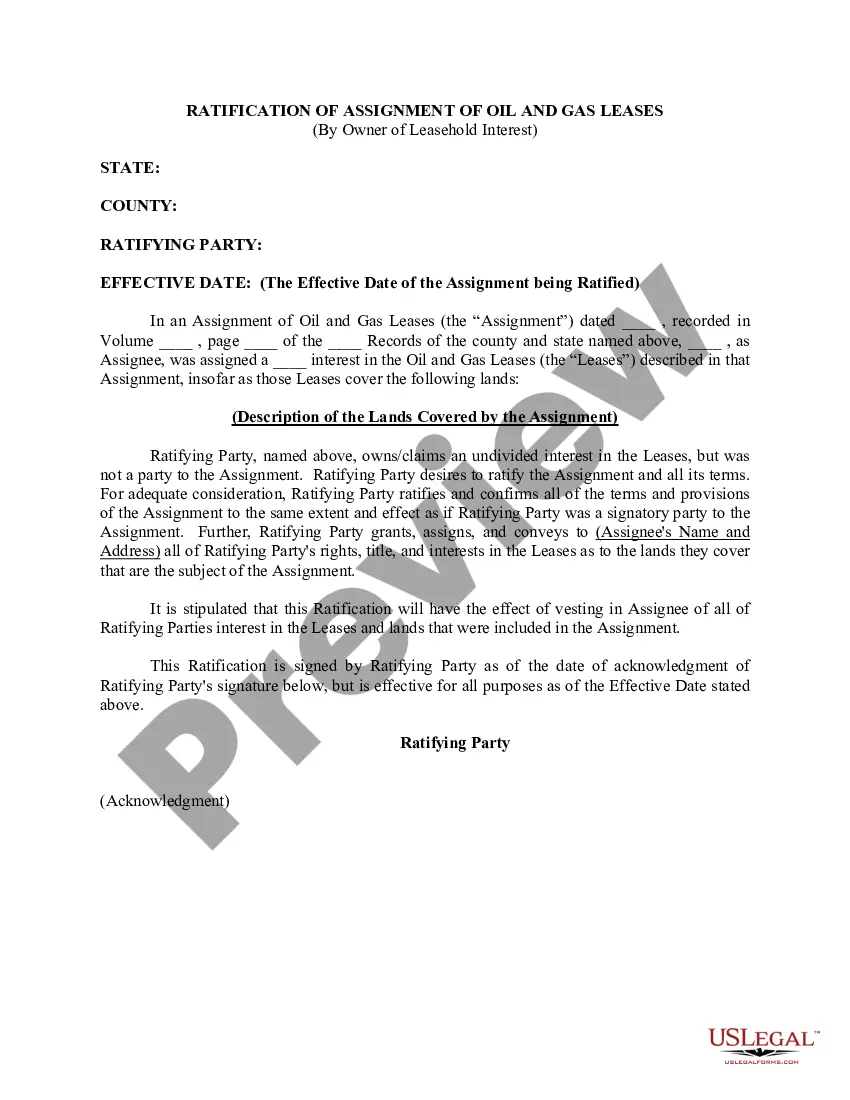

Description

How to fill out Gresham Oregon Chapter 13 Plan?

Regardless of social or professional status, filling out legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone with no law education to draft this sort of paperwork cfrom the ground up, mostly because of the convoluted jargon and legal subtleties they entail. This is where US Legal Forms can save the day. Our platform offers a massive library with over 85,000 ready-to-use state-specific documents that work for almost any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time using our DYI forms.

Whether you require the Gresham Oregon Chapter 13 Plan or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Gresham Oregon Chapter 13 Plan quickly employing our reliable platform. In case you are presently an existing customer, you can go ahead and log in to your account to get the appropriate form.

Nevertheless, if you are new to our library, ensure that you follow these steps prior to obtaining the Gresham Oregon Chapter 13 Plan:

- Ensure the form you have found is suitable for your area because the regulations of one state or county do not work for another state or county.

- Preview the form and go through a quick outline (if available) of cases the document can be used for.

- If the form you selected doesn’t meet your needs, you can start again and search for the needed document.

- Click Buy now and choose the subscription option that suits you the best.

- with your login information or register for one from scratch.

- Pick the payment gateway and proceed to download the Gresham Oregon Chapter 13 Plan once the payment is done.

You’re all set! Now you can go ahead and print the form or fill it out online. Should you have any issues getting your purchased documents, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.