Portland Oregon Reaffirmation Cover sheet is an essential document used in bankruptcy cases within the jurisdiction of Portland, Oregon. It encompasses critical information and acts as a formal acknowledgement of the debtor's intention to reaffirm a particular debt during bankruptcy proceedings. This cover sheet ensures that the debtor and creditor comply with the necessary legal obligations and reaffirmation requirements set forth by the Bankruptcy Code. The Portland Oregon Reaffirmation Cover sheet serves as a formal communication tool between the debtor, their legal representative, and the creditor involved in the reaffirmation process. It contains various key details that aid in identifying the bankruptcy case and the reaffirmed debts. These include the case number, debtor's name, creditor's name, mailing address, and contact information. Furthermore, the Portland Oregon Reaffirmation Cover sheet signifies the type of reaffirmation agreement being filed. There are several types of reaffirmation agreements that can be associated with this cover sheet, each specifically tailored to cater to different forms of debts. Commonly encountered types of Portland Oregon Reaffirmation Cover sheets may include: 1. Mortgage Reaffirmation Cover sheet: This form focuses on reaffirming mortgage loans, allowing debtors to retain their homes and continue mortgage payments under specific agreed-upon terms. 2. Auto Loan Reaffirmation Cover sheet: Employed when reaffirming automobile loans, this type ensures that debtors can keep their vehicles and maintain regular payments as agreed upon. 3. Personal Property Reaffirmation Cover sheet: Pertaining to reaffirmation of personal property or other tangible items, this cover sheet specifies details regarding the reaffirmed property, such as its description and the creditor's interest in it. 4. Secured Debt Reaffirmation Cover sheet: Used for reaffirming secured debts other than mortgages or auto loans, this cover sheet primarily focuses on outlining the nature of the collateral and the involved creditor's rights. In summary, the Portland Oregon Reaffirmation Cover sheet is a fundamental document enabling debtors to formally reaffirm specific debts during bankruptcy proceedings in Portland, Oregon. It ensures compliance with legal requirements and facilitates effective communication between debtors, their legal representatives, and creditors. With different types of cover sheets associated with various reaffirmation agreements (such as mortgage, auto loan, personal property, and secured debt), this document plays a crucial role in the appropriate resolution of bankruptcy cases.

Portland Oregon Reaffirmation Coversheet

Description

How to fill out Portland Oregon Reaffirmation Coversheet?

Finding authenticated templates tailored to your regional rules can be difficult unless you utilize the US Legal Forms library.

It’s an online repository of over 85,000 legal documents for personal and professional requirements and various real-life situations.

All the files are suitably categorized by usage area and jurisdiction, making it as straightforward as pie to find the Portland Oregon Reaffirmation Coversheet.

Maintaining organized paperwork that complies with legal standards is crucial. Take advantage of the US Legal Forms library to always have necessary document templates accessible at your fingertips!

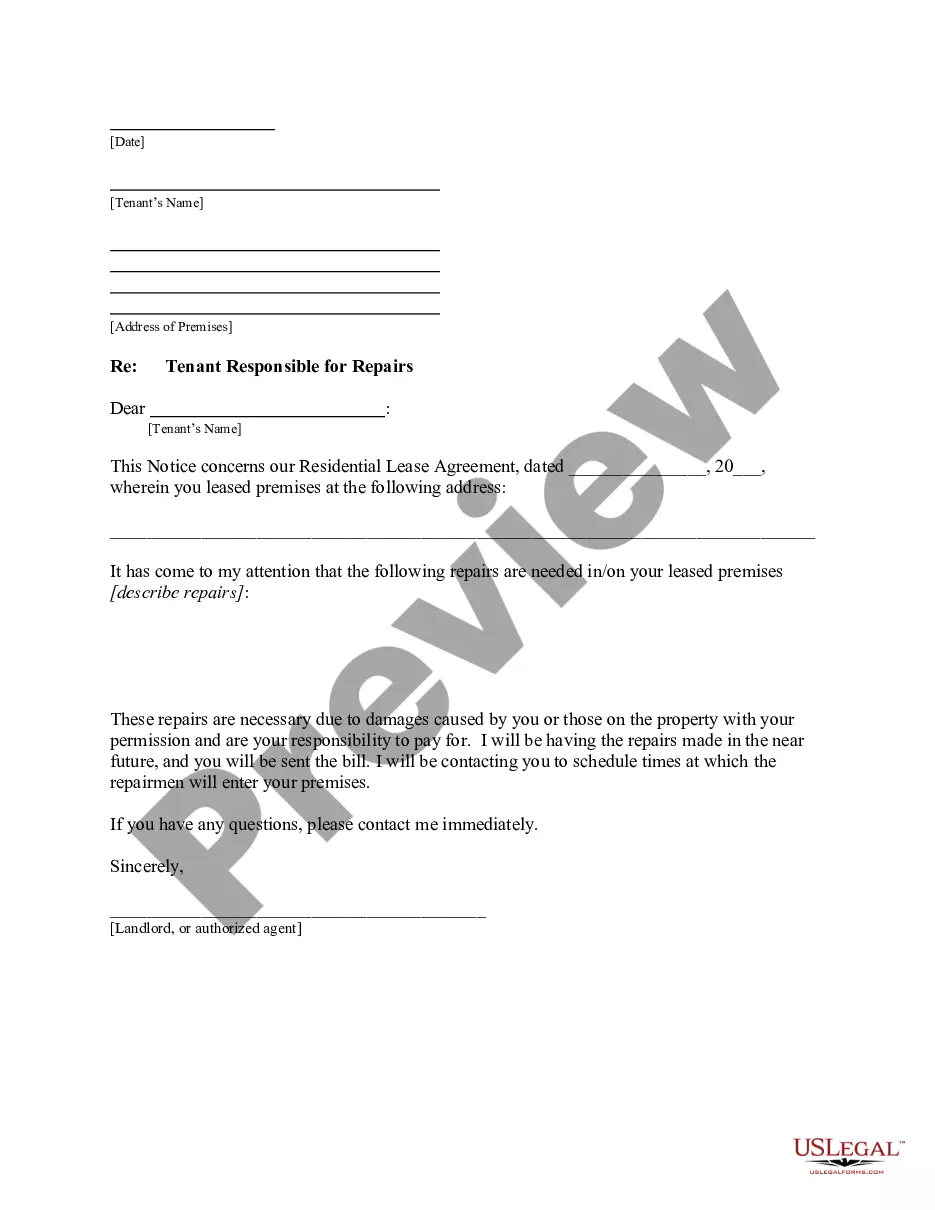

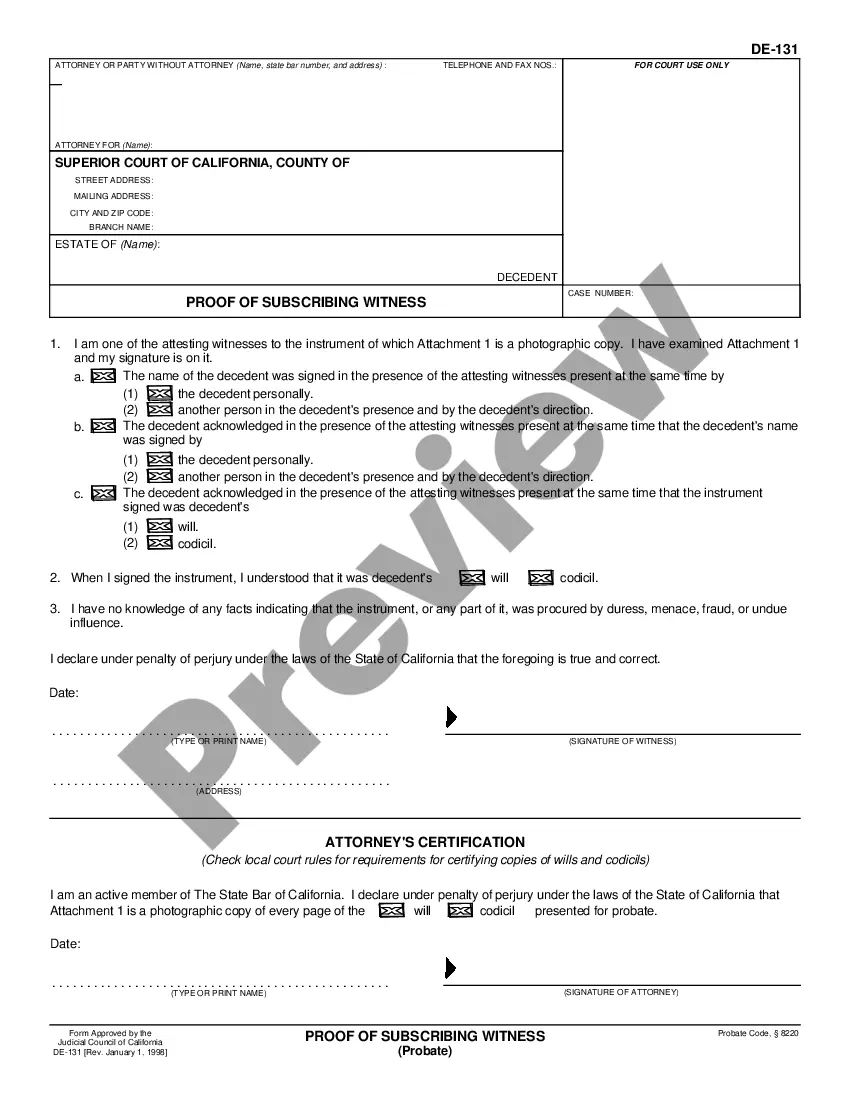

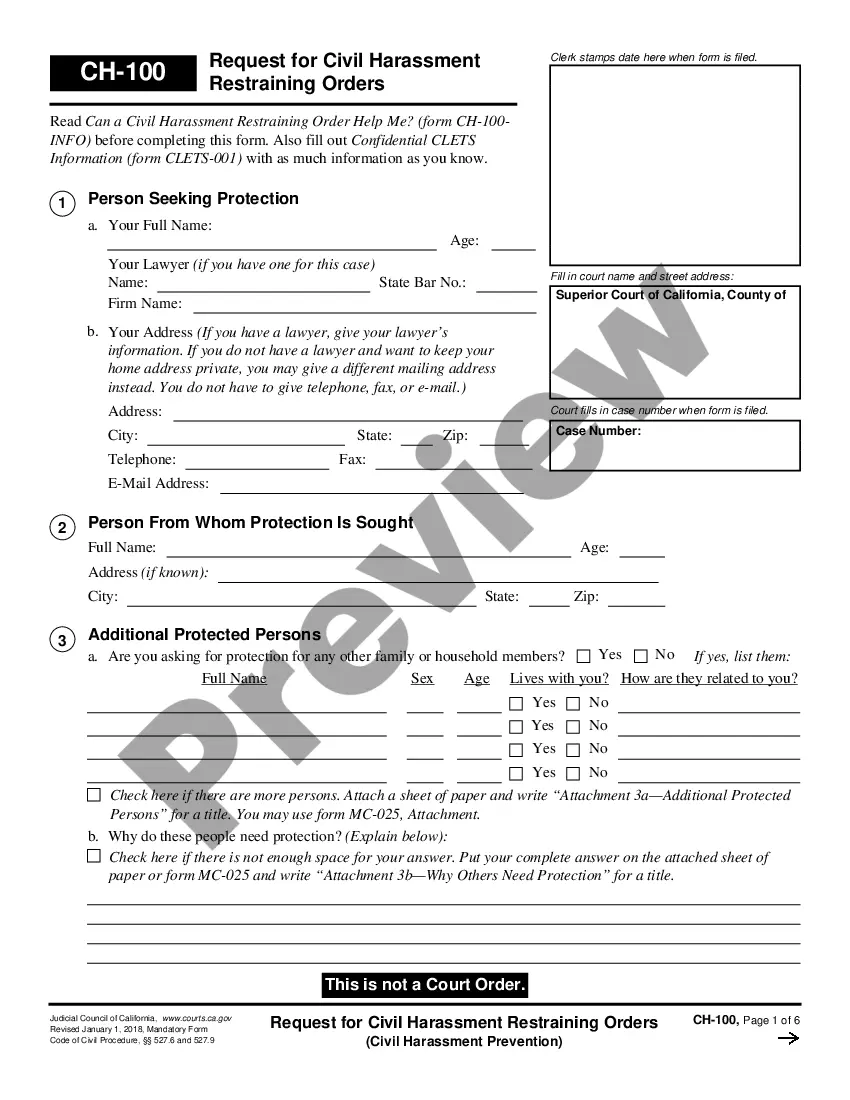

- Review the Preview mode and document description.

- Ensure you’ve selected the correct one that fulfills your needs and fully aligns with your local jurisdiction guidelines.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, use the Search tab above to locate the correct one. If it meets your requirements, proceed to the next step.

- Click on the Buy Now button and choose your desired subscription plan to purchase the document.

Form popularity

FAQ

A reaffirmation agreement shall be filed no later than 60 days after the first date set for the meeting of creditors under §341(a) of the Code.

Without a reaffirmation agreement, you are not personally liable for the debt. So, while the mortgage company can still foreclose on their lien if you don't pay, you are free to walk away with no penalty or further damage to your credit. The bankruptcy has removed your personal liability.

Can you file a reaffirmation agreement after discharge? Once a discharge order has been entered in your bankruptcy case, you can no longer reaffirm any of the debts included in the discharge agreement. The same goes for if your case has been closed by the court.

Reaffirming a mortgage debt requires a comprehensive multi-page reaffirmation agreement that must be filed with the court. The reaffirmation agreement also requires the debtor's bankruptcy attorney to indicate that he or she has read the agreement and that it does not impose any undue hardship on the client.

The purpose of a bankruptcy reaffirmation agreement is to protect all parties with a financial and legal interest in the Chapter 7 bankruptcy proceedings. It establishes the terms and conditions of reaffirming an asset and can be negotiated to benefit both the creditor and debtor.

Not reaffirming doesn't prevent someone from refinancing, but it may prevent you from refinancing with your current lender. All mortgage companies are more picky than they used to be about qualifying someone for a mortgage loan. Check with your local credit union for more information on the requirements to refinance.

If the Court denies the reaffirmation agreement, you are in technical default again. This is part of the trade?off between Chapters 7 and 13. In exchange for a quick, efficient, inexpensive discharge of your debts, you give up control over the actions of creditors.

No creditor can make you reaffirm a debt. This is because a reaffirmation goes against the most basic upside of filing bankruptcy: the fresh start. You cannot be sent to collections, sued, or garnished on a debt that was discharged in bankruptcy.

If you change your mind on the reaffirmation agreement after signing it, you also have 60 days to revoke it. The agreement also has to be approved by the court in most cases. At Southern California Law Advocates, P.C., we represent clients throughout Southern California who are struggling with crippling debt.

If you want to request a reaffirmation agreement, you must agree after filing for bankruptcy but before any collateral is discharged to the lender. An agreement is filed by submitting a Statement of Intent to the court. Then, you must also send the Statement of Intent to the lender.