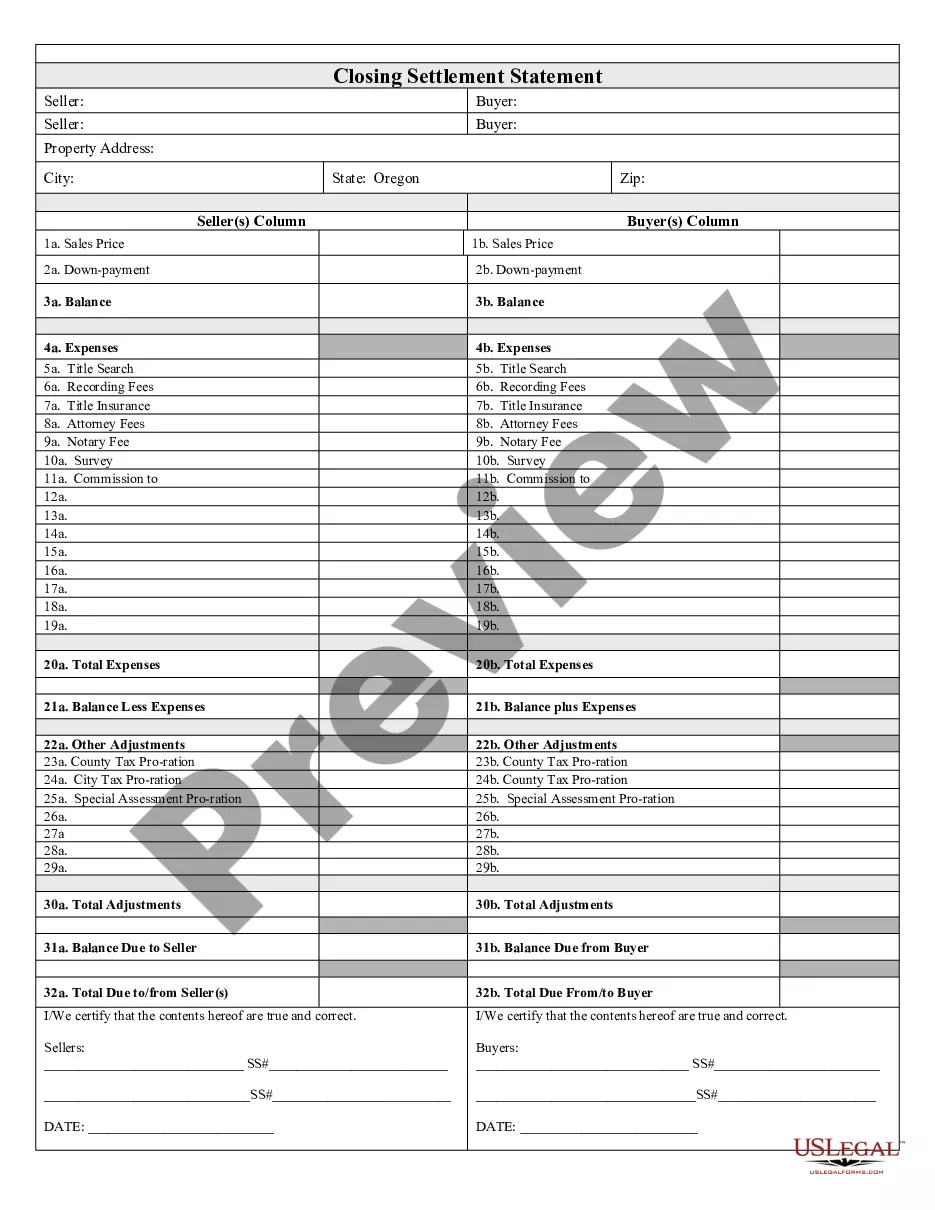

Eugene, Oregon Closing Statement: A Comprehensive Overview In the world of real estate, the term "closing statement" refers to a crucial financial document that summarizes the financial transactions associated with a real estate transaction in Eugene, Oregon. It serves as a conclusive record of all the costs, credits, and fees involved in the property transfer process or the closure of a mortgage loan. These closing statements are typically prepared by real estate agents, attorneys, or closing agents, and they help ensure transparency and accuracy throughout the transaction. The information contained within the statement is critical for both buyers and sellers, as it highlights the financial aspects of the property transfer. The Eugene Oregon Closing Statement typically includes a wide range of details relating to the transaction, such as the purchase price, down payment, loan amount, prorated taxes, insurance costs, fees for lawyers or agents, and any adjustments for items like prepaid property taxes or utility bills. It essentially itemizes all the monetary exchanges between the parties involved in the deal and outlines who are responsible for each expense. By carefully examining the closing statement, both buyers and sellers can gain an accurate understanding of the financial implications associated with the transaction. Different Types of Eugene Oregon Closing Statements: 1. Buyer's Closing Statement: This type of closing statement focuses on the financial obligations of the buyer. It outlines the costs associated with purchasing the property, including the down payment, loan fees, and any additional expenses the buyer might be responsible for. 2. Seller's Closing Statement: The seller's closing statement highlights the financial aspects of the transaction from the seller's perspective. It outlines the proceeds the seller will receive after deducting various costs, such as real estate commissions, taxes, and any unpaid bills associated with the property. 3. Refinance Closing Statement: When homeowners in Eugene, Oregon opt to refinance their mortgages, this type of closing statement comes into play. It details the new loan terms, any fees or upfront costs involved in the refinancing process, and the lender's instructions on how to disburse any remaining proceeds. In conclusion, the Eugene, Oregon Closing Statement plays a vital role in the real estate industry. Whether you are a buyer, seller, or participating in a refinancing, understanding the information contained within the closing statement is crucial. It provides a clear picture of the financial aspects of the transaction, ensuring transparency and accuracy throughout the process. By examining this document meticulously, all parties involved can make informed decisions and proceed with their real estate endeavors confidently.

Eugene Oregon Closing Statement

Description

How to fill out Eugene Oregon Closing Statement?

If you are searching for a relevant form, it’s impossible to find a more convenient service than the US Legal Forms website – one of the most extensive online libraries. With this library, you can find a huge number of form samples for organization and personal purposes by types and regions, or key phrases. With our advanced search option, discovering the most up-to-date Eugene Oregon Closing Statement is as easy as 1-2-3. Furthermore, the relevance of each and every document is verified by a team of skilled attorneys that on a regular basis review the templates on our platform and update them in accordance with the latest state and county regulations.

If you already know about our platform and have a registered account, all you should do to get the Eugene Oregon Closing Statement is to log in to your profile and click the Download button.

If you utilize US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have chosen the form you need. Check its explanation and use the Preview feature to check its content. If it doesn’t meet your needs, utilize the Search field near the top of the screen to find the proper record.

- Confirm your choice. Select the Buy now button. Following that, select your preferred pricing plan and provide credentials to register an account.

- Make the financial transaction. Make use of your bank card or PayPal account to finish the registration procedure.

- Receive the template. Pick the file format and save it to your system.

- Make modifications. Fill out, edit, print, and sign the received Eugene Oregon Closing Statement.

Every template you save in your profile has no expiration date and is yours permanently. You can easily access them using the My Forms menu, so if you need to get an additional copy for editing or printing, you can return and export it once again whenever you want.

Make use of the US Legal Forms extensive collection to get access to the Eugene Oregon Closing Statement you were seeking and a huge number of other professional and state-specific samples on one platform!