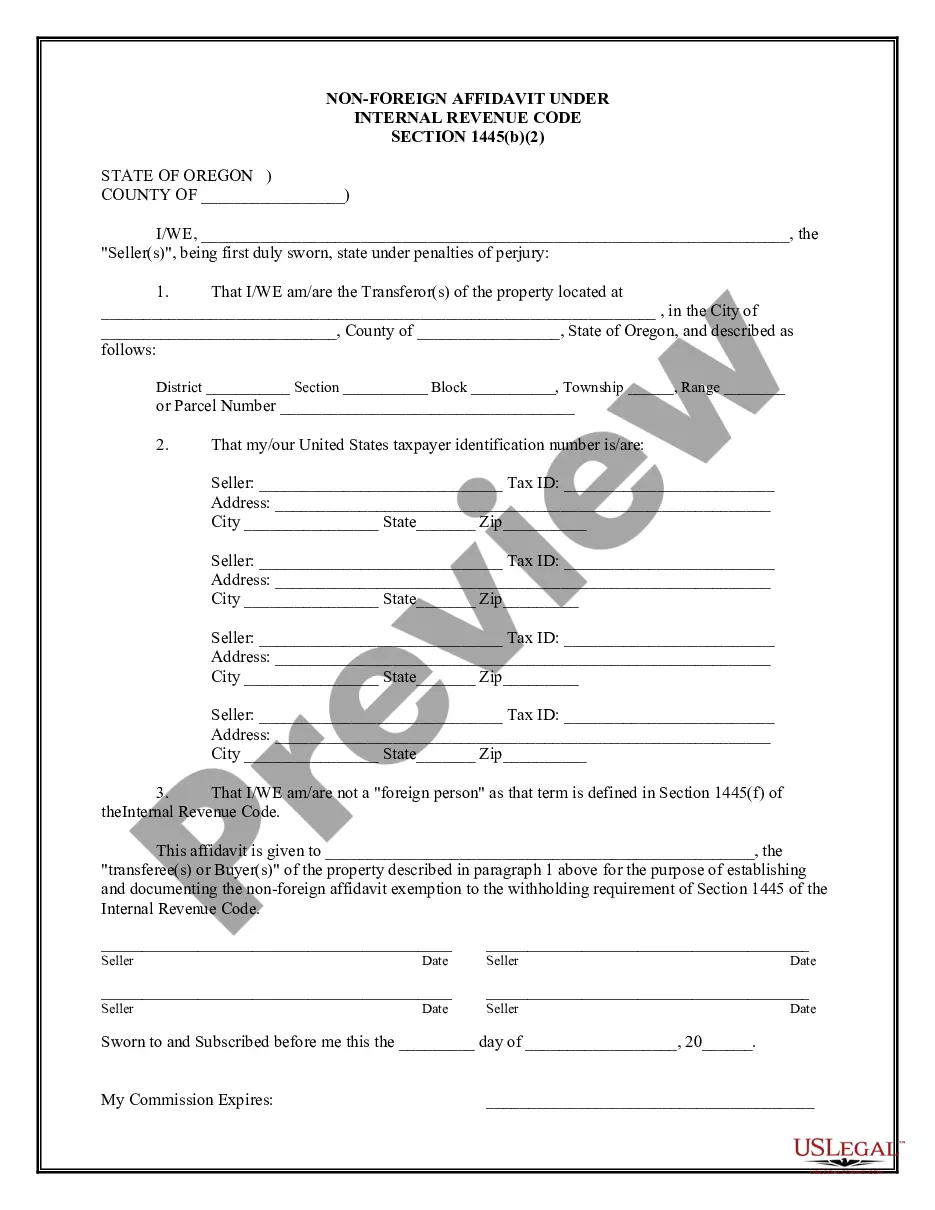

Description: A Gresham Oregon Non-Foreign Affidavit under IRC 1445 is a legal document that certifies a person's non-foreign status for tax purposes. This affidavit is required by the Internal Revenue Code (IRC) section 1445, which deals with the withholding of tax on dispositions of the United States real property interests by foreign persons. The purpose of this affidavit is to ensure compliance with tax laws and to determine whether the seller of a US property is a US citizen or resident alien. The Gresham Oregon Non-Foreign Affidavit under IRC 1445 is particularly relevant when a non-US individual sells a property located in Gresham, Oregon. By filing this affidavit, the seller declares their non-foreign status, indicating that they are not a foreign person for tax purposes. This document allows the buyer or agent responsible for withholding to properly comply with the tax regulations. Different types of Gresham Oregon Non-Foreign Affidavit under IRC 1445: 1. Individual Non-Foreign Affidavit: This type of affidavit is used when an individual who is not a foreign person for tax purposes sells a property in Gresham, Oregon. The affidavit includes personal details of the seller such as name, address, and taxpayer identification number. 2. Corporate Non-Foreign Affidavit: In the case where a corporation, partnership, or other similar entity is selling a property in Gresham, Oregon, a corporate non-foreign affidavit is required. This affidavit certifies that the entity is not a foreign person under the IRC 1445. 3. Trust Non-Foreign Affidavit: When a trust is the seller of a property in Gresham, Oregon, a trust non-foreign affidavit is necessary. This affidavit verifies that the trust is not considered a foreign person and is compliant with the tax laws as per IRC 1445. 4. Estate Non-Foreign Affidavit: In situations where an estate is selling a property in Gresham, Oregon, an estate non-foreign affidavit is used. This affidavit confirms the non-foreign status of the estate and ensures adherence to the IRC 1445 regulations. In conclusion, the Gresham Oregon Non-Foreign Affidavit under IRC 1445 is a crucial document for ensuring tax compliance when selling a property in Gresham, Oregon. It certifies the seller's non-foreign status, allowing the buyer or withholding agent to handle tax obligations correctly. Different types of affidavits, including individual, corporate, trust, and estate, can be used depending on the nature of the seller.

Gresham Oregon Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Gresham Oregon Non-Foreign Affidavit Under IRC 1445?

Make use of the US Legal Forms and get instant access to any form sample you require. Our beneficial platform with a large number of templates allows you to find and obtain virtually any document sample you want. You are able to download, complete, and sign the Gresham Oregon Non-Foreign Affidavit Under IRC 1445 in a few minutes instead of browsing the web for several hours looking for a proper template.

Utilizing our collection is a superb way to improve the safety of your form submissions. Our experienced legal professionals on a regular basis review all the documents to ensure that the forms are appropriate for a particular region and compliant with new acts and polices.

How do you get the Gresham Oregon Non-Foreign Affidavit Under IRC 1445? If you have a subscription, just log in to the account. The Download button will be enabled on all the documents you view. Moreover, you can get all the previously saved records in the My Forms menu.

If you haven’t registered an account yet, stick to the instructions listed below:

- Find the form you need. Make certain that it is the template you were hoping to find: examine its headline and description, and utilize the Preview option when it is available. Otherwise, make use of the Search field to look for the needed one.

- Launch the saving procedure. Click Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and process your order using a credit card or PayPal.

- Download the file. Choose the format to obtain the Gresham Oregon Non-Foreign Affidavit Under IRC 1445 and revise and complete, or sign it for your needs.

US Legal Forms is probably the most significant and trustworthy template libraries on the internet. We are always happy to help you in virtually any legal case, even if it is just downloading the Gresham Oregon Non-Foreign Affidavit Under IRC 1445.

Feel free to make the most of our platform and make your document experience as straightforward as possible!