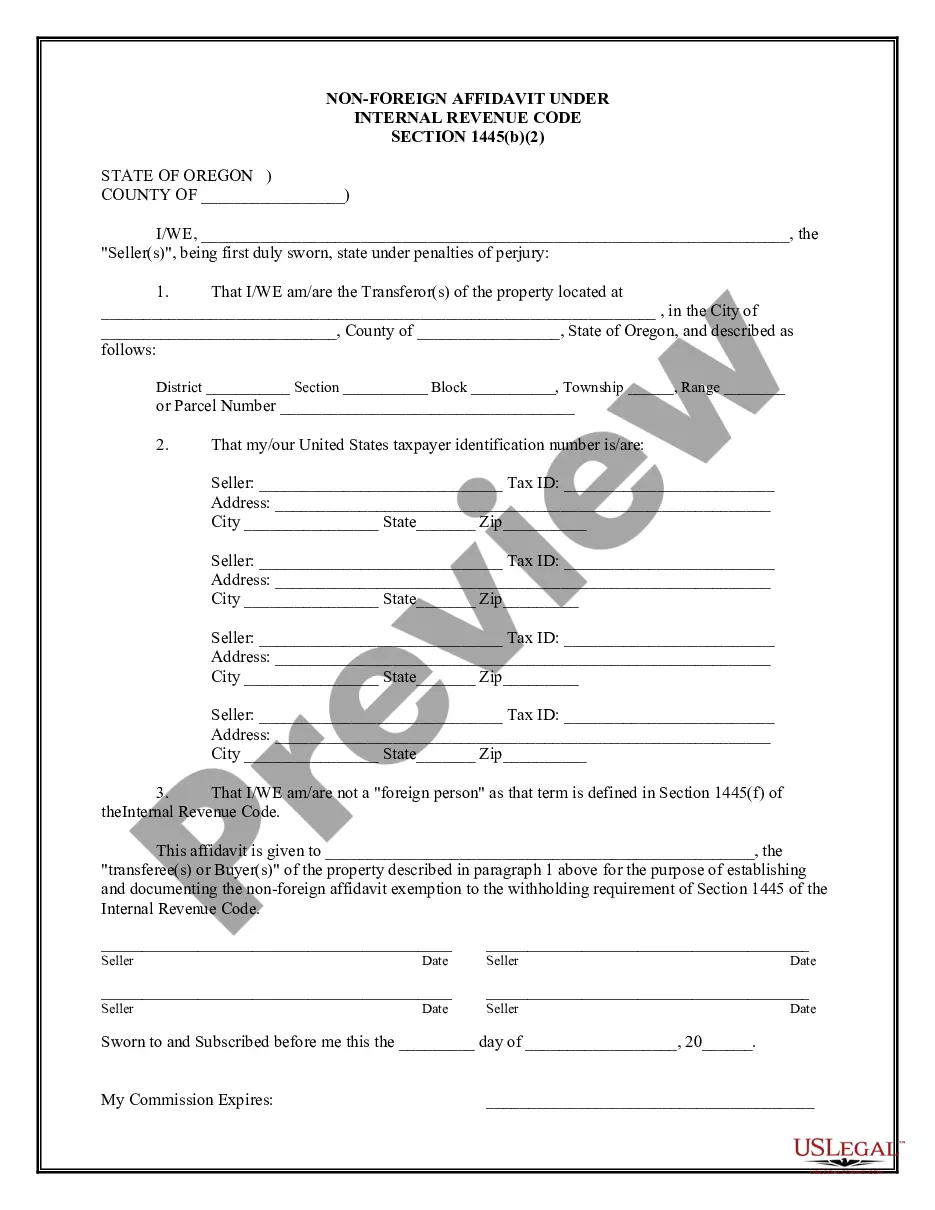

Portland Oregon Non-Foreign Affidavit Under IRC 1445: A Detailed Description In Portland, Oregon, when it comes to real estate transactions involving the sale or transfer of property by a nonresident alien or foreign entity, the Internal Revenue Code (IRC) 1445 requires the completion of a Non-Foreign Affidavit. This document serves as a declaration by the seller or transferor, affirming their non-foreign status and providing certain information required by the IRS. The Portland Oregon Non-Foreign Affidavit Under IRC 1445 is primarily administered by the Internal Revenue Service (IRS) to ensure compliance with tax obligations and regulations. The affidavit gathers critical details about the seller or transferor, the property being sold or transferred, and the transaction itself. Key information required in the Non-Foreign Affidavit may include: 1. Seller or Transferor Information: This section seeks personal details such as name, address, taxpayer identification number (TIN), and contact information. It is crucial for establishing the identity and tax residency status of the individual or entity involved. 2. Property Information: This section entails detailed information about the property subject to the sale or transfer, including its physical address, legal description, and other relevant identification details. Accurate property information is essential for proper identification and taxation purposes. 3. Transaction Details: Here, the affidavit captures specific information about the sale or transfer transaction, such as the date of the transaction, purchase price, and terms of the agreement. These details aid the IRS in determining tax liabilities and verifying compliance. Types of Portland Oregon Non-Foreign Affidavit Under IRC 1445: 1. Portland Oregon Non-Foreign Affidavit for Individual Sellers: This type of affidavit is utilized when the property is being sold or transferred by an individual who is classified as a nonresident alien for tax purposes. It gathers relevant personal information and ensures the seller's compliance with IRS regulations. 2. Portland Oregon Non-Foreign Affidavit for Entity/Corporate Sellers: When the sale or transfer involves a nonresident alien entity or corporation, this variant of the affidavit is used. It collects essential details about the entity's legal structure, identification numbers, and contact information, confirming its non-foreign status. Completing the Portland Oregon Non-Foreign Affidavit Under IRC 1445 accurately and providing the required information is crucial to avoid any potential penalties or delays in the real estate transaction process. It is wise to consult with a qualified tax professional or attorney experienced in dealing with international real estate transactions to ensure compliance with the IRS regulations and to navigate any complexities that may arise.

Portland Oregon Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Portland Oregon Non-Foreign Affidavit Under IRC 1445?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Portland Oregon Non-Foreign Affidavit Under IRC 1445 gets as quick and easy as ABC.

For everyone already familiar with our service and has used it before, getting the Portland Oregon Non-Foreign Affidavit Under IRC 1445 takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few more actions to make for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve selected the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Portland Oregon Non-Foreign Affidavit Under IRC 1445. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!