A Hillsboro Oregon Complex Will with Credit Shelter Marital Trust for Large Estates is a legal instrument designed specifically for individuals with considerable assets and complex estate planning needs in the city of Hillsboro, Oregon. This estate planning tool allows individuals to protect and manage their wealth while ensuring the financial wellbeing of their spouse and family. The Hillsboro Oregon Complex Will with Credit Shelter Marital Trust for Large Estates is designed to address the complexities and unique concerns associated with large estates, providing comprehensive protection and minimizing potential tax liabilities. This legal document incorporates both a credit shelter trust and a marital trust, each serving distinct purposes. The credit shelter trust, also known as a bypass or exemption trust, is established to take full advantage of the estate tax exemption amount available to individuals. By placing assets into this trust, individuals can reduce or eliminate estate taxes upon their death, ensuring the preservation of wealth for future generations. The marital trust, also known as a TIP (Qualified Terminable Interest Property) trust, provides financial security and support for the surviving spouse. Under this trust, the surviving spouse receives income generated by the trust assets during their lifetime. Upon the surviving spouse's death, the remaining assets are distributed according to the original granter's wishes, typically to the beneficiaries named, such as children or other family members. This type of Hillsboro Oregon Complex Will with Credit Shelter Marital Trust for Large Estates can also be customized based on unique needs and preferences. There may be variations or specific provisions added to the trust agreement based on the individual's circumstances, such as considerations for blended families, charitable giving, or specific asset management requirements. It is crucial to consult with an experienced estate planning attorney in Hillsboro, Oregon, to create a tailored Hillsboro Oregon Complex Will with Credit Shelter Marital Trust for Large Estates that aligns with your specific goals. This legal professional will guide you through the process, ensuring that all legal requirements are met and your estate plan is properly executed. In summary, the Hillsboro Oregon Complex Will with Credit Shelter Marital Trust for Large Estates is an advanced estate planning tool designed for individuals with significant assets. Its purpose is to protect and preserve wealth, minimize estate taxes, and provide financial security for surviving spouses. By consulting with an experienced attorney, individuals can tailor this legal instrument to suit their specific estate planning needs effectively.

Hillsboro Oregon Complex Will with Credit Shelter Marital Trust for Large Estates

Description

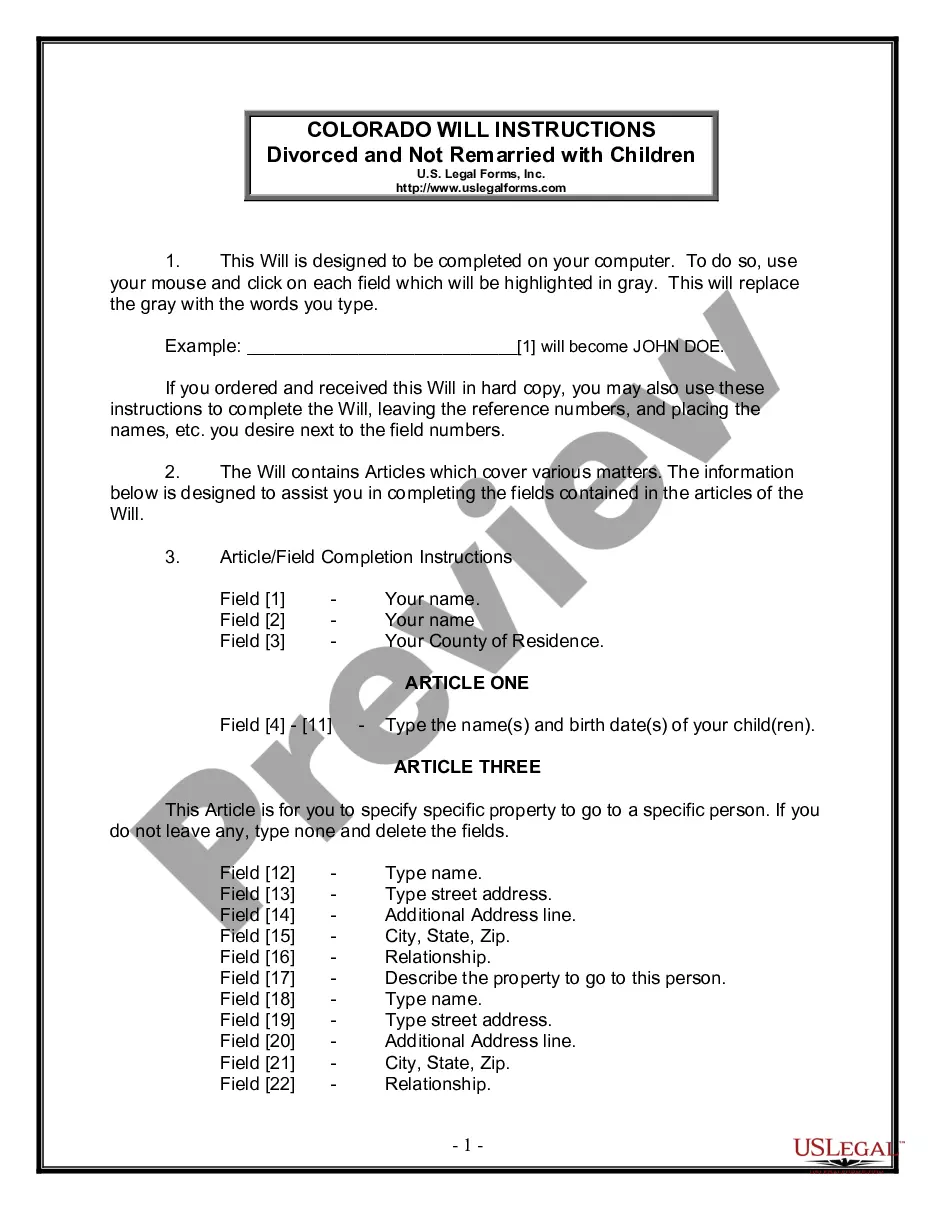

How to fill out Hillsboro Oregon Complex Will With Credit Shelter Marital Trust For Large Estates?

If you are searching for a relevant form template, it’s impossible to find a more convenient place than the US Legal Forms website – probably the most extensive online libraries. Here you can get thousands of document samples for organization and personal purposes by categories and states, or keywords. With the advanced search feature, finding the latest Hillsboro Oregon Complex Will with Credit Shelter Marital Trust for Large Estates is as elementary as 1-2-3. Furthermore, the relevance of each and every record is proved by a group of expert attorneys that on a regular basis review the templates on our platform and revise them based on the most recent state and county laws.

If you already know about our platform and have a registered account, all you need to get the Hillsboro Oregon Complex Will with Credit Shelter Marital Trust for Large Estates is to log in to your profile and click the Download button.

If you use US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have chosen the form you want. Read its information and utilize the Preview feature to see its content. If it doesn’t meet your needs, use the Search field near the top of the screen to discover the needed document.

- Confirm your selection. Select the Buy now button. Next, select your preferred subscription plan and provide credentials to register an account.

- Make the purchase. Utilize your credit card or PayPal account to complete the registration procedure.

- Obtain the form. Choose the file format and download it on your device.

- Make adjustments. Fill out, edit, print, and sign the obtained Hillsboro Oregon Complex Will with Credit Shelter Marital Trust for Large Estates.

Every single form you save in your profile does not have an expiration date and is yours permanently. You can easily gain access to them via the My Forms menu, so if you want to get an extra duplicate for enhancing or printing, you may come back and export it once again whenever you want.

Take advantage of the US Legal Forms professional library to gain access to the Hillsboro Oregon Complex Will with Credit Shelter Marital Trust for Large Estates you were looking for and thousands of other professional and state-specific samples in one place!