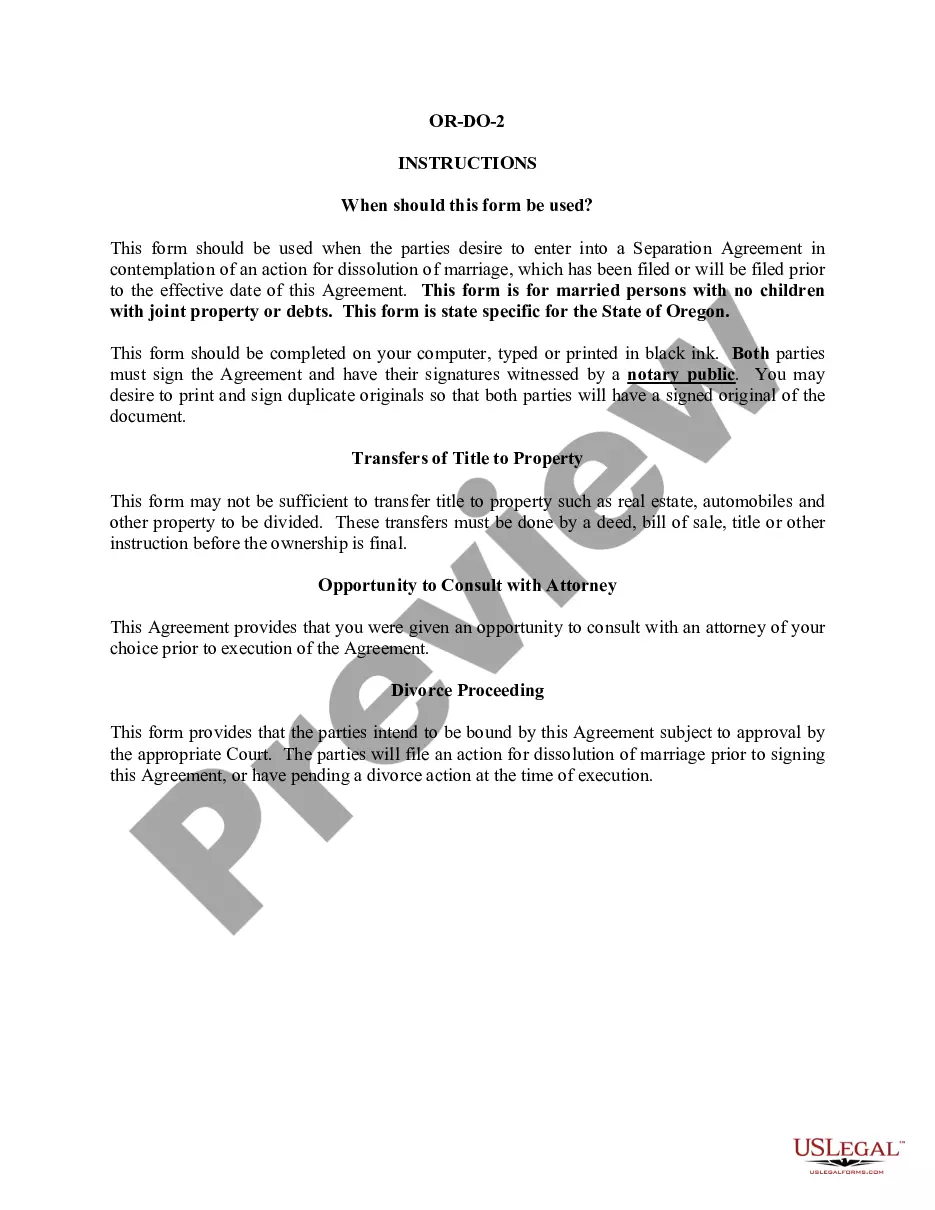

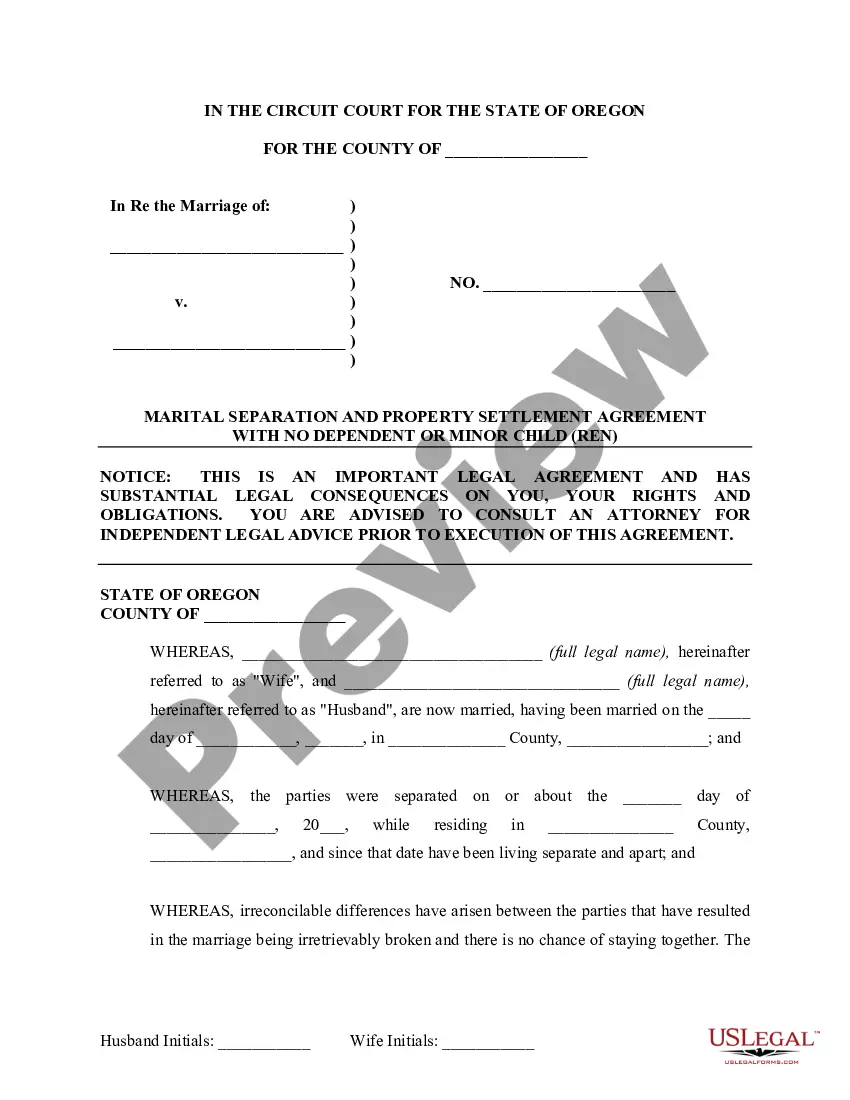

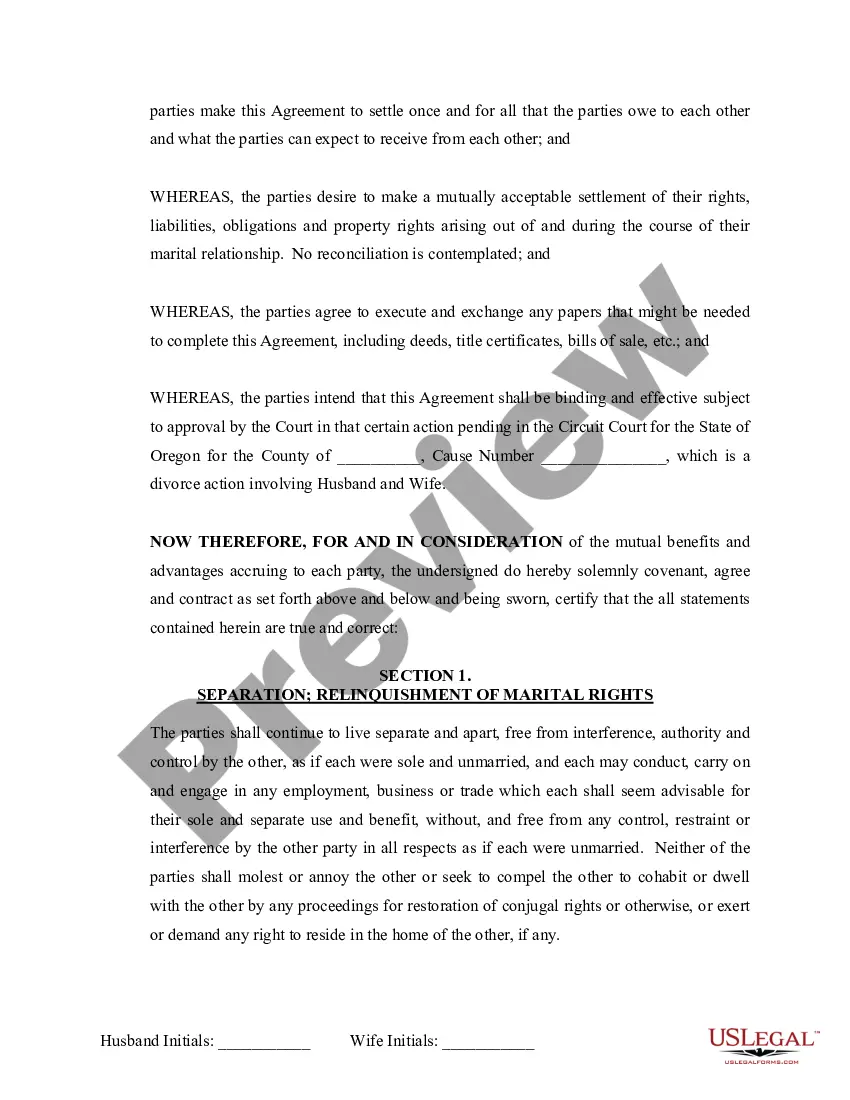

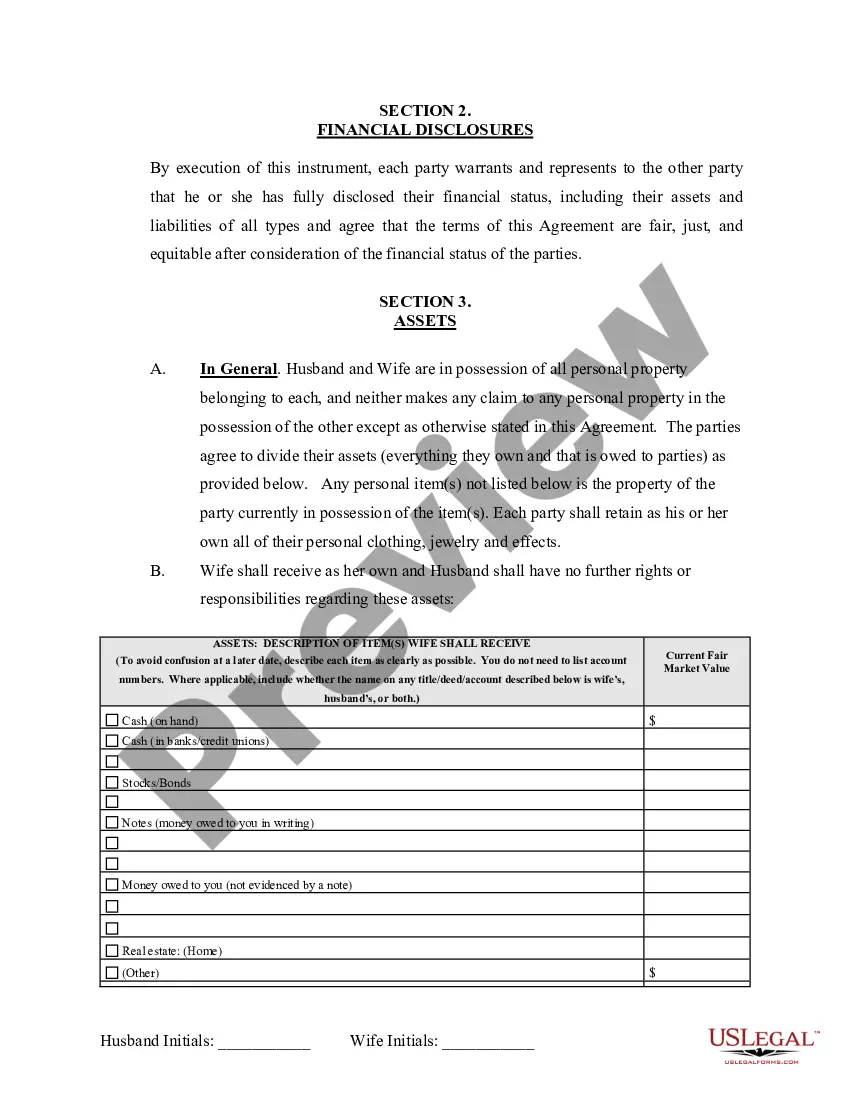

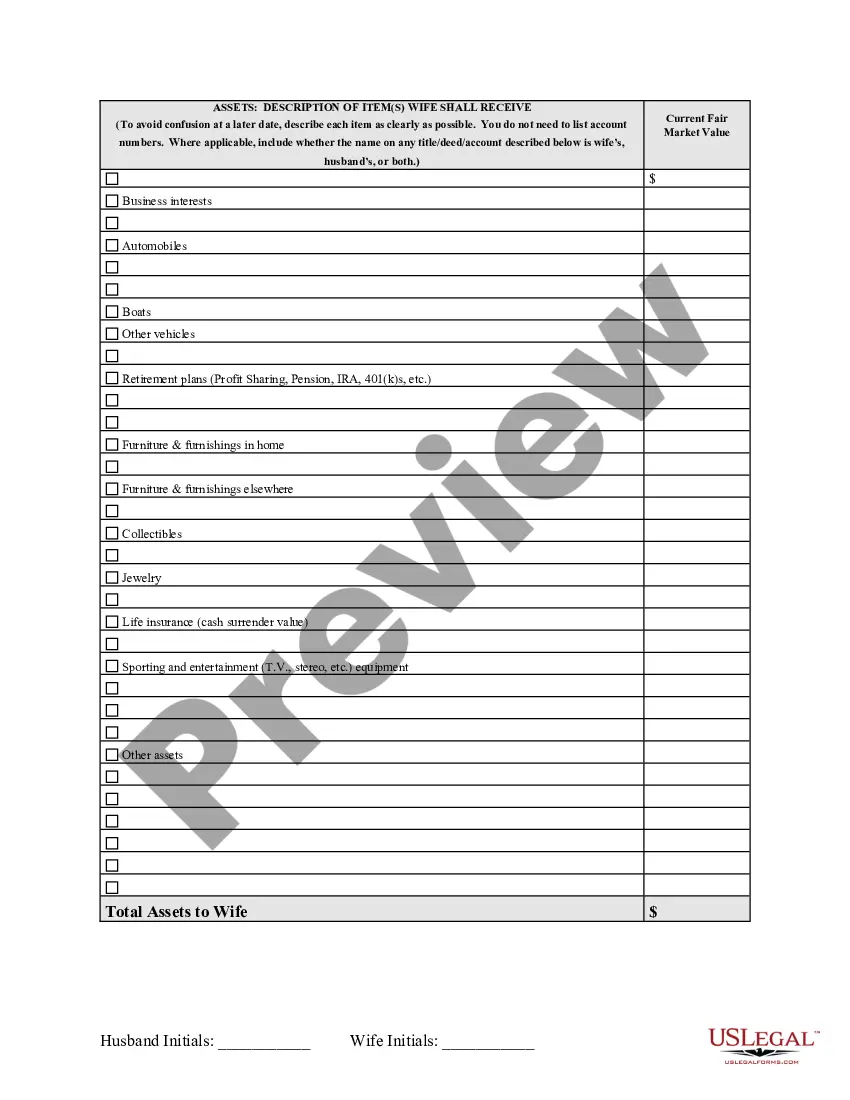

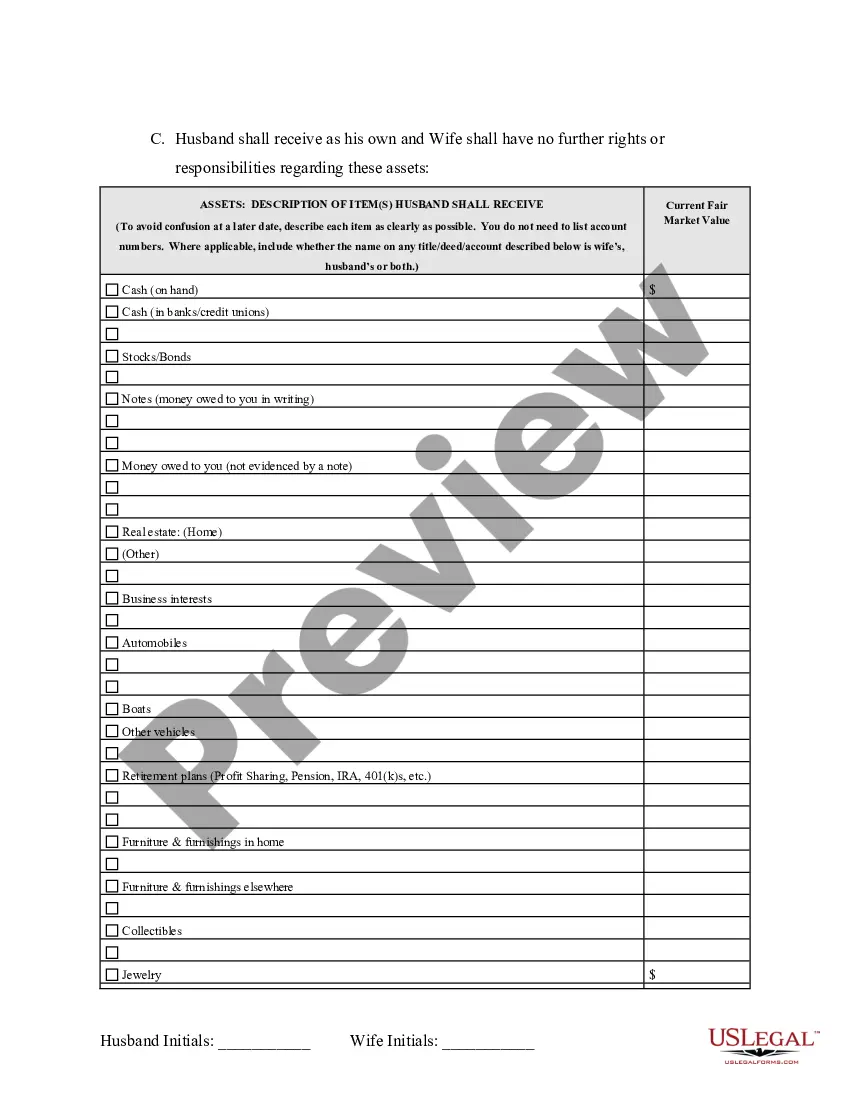

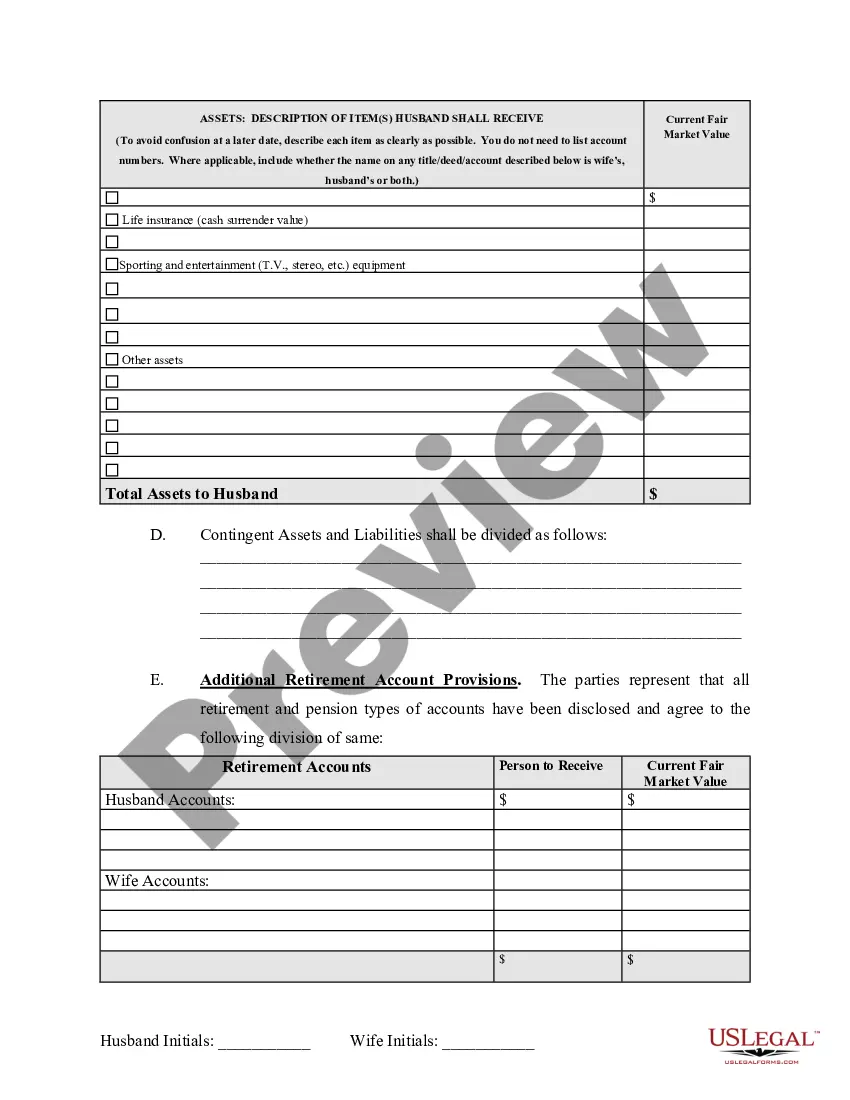

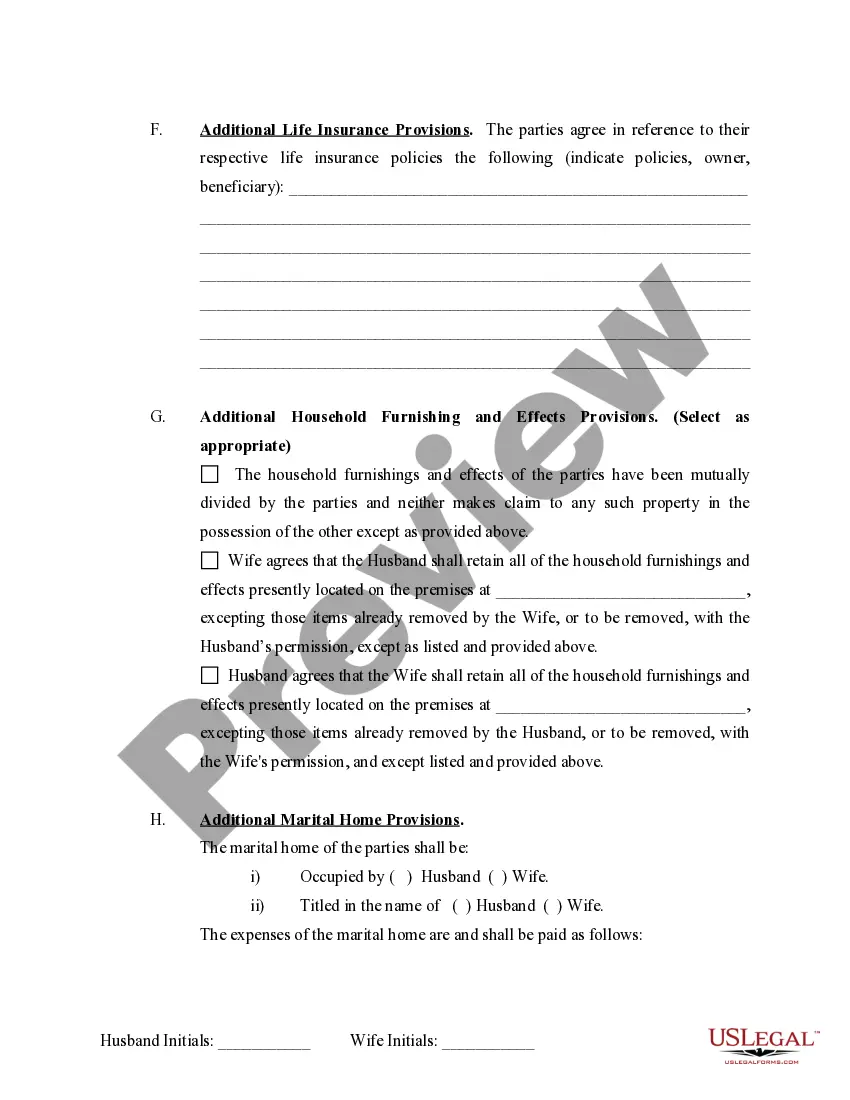

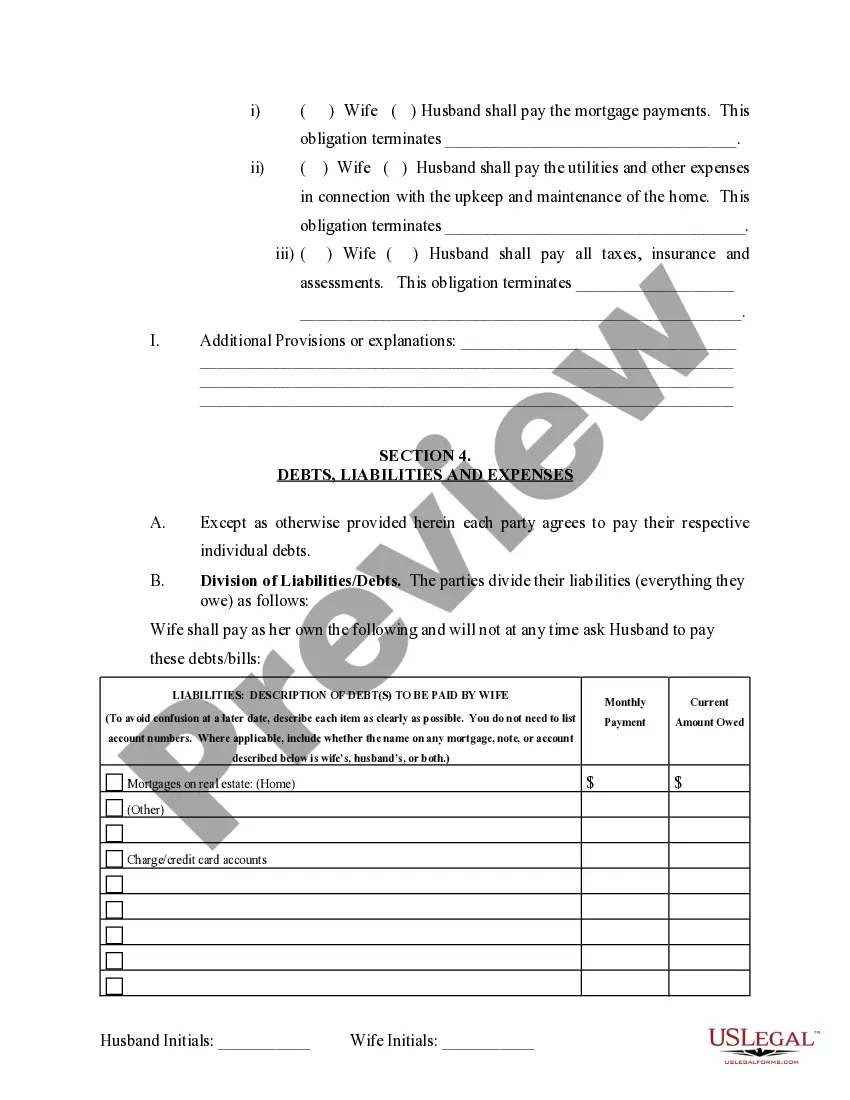

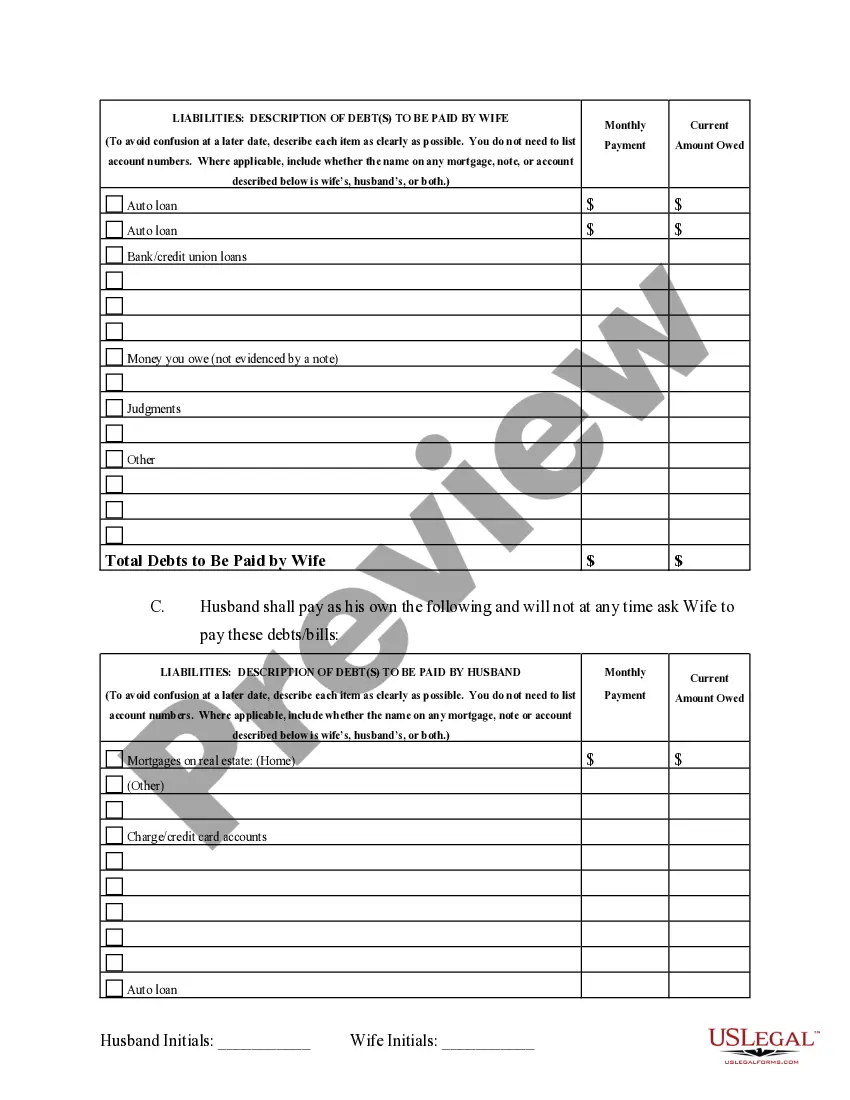

The Eugene Oregon Marital Domestic Separation and Property Settlement Agreement is a legal document that outlines the terms and conditions for the separation and division of assets between married couples residing in Eugene, Oregon. This agreement is specifically designed for couples who do not have any children and have joint property or debts that need to be divided. When a divorce action is filed, parties often find it necessary to establish a comprehensive agreement that ensures a fair distribution of their joint assets and liabilities. The Eugene Oregon Marital Domestic Separation and Property Settlement Agreement provides a framework for the equitable division of property and debts between the parties involved. This agreement addresses various aspects of the couple's marital estate, including tangible assets such as real property, vehicles, bank accounts, investments, and personal belongings. It also covers intangible assets like pension plans, retirement accounts, and other financial assets. The goal is to allocate these assets in a way that reasonably reflects each party's contributions and interests. In addition to property division, this agreement addresses the settlement of debts acquired during the marriage. It outlines the responsibility of each party in repaying joint debts, such as mortgages, loans, credit cards, and other liabilities. To ensure a fair and transparent process, the Eugene Oregon Marital Domestic Separation and Property Settlement Agreement may include provisions for asset valuation, appraisals, and professional evaluations if necessary. This helps determine the accurate market value of the couple's assets and ensures an equitable distribution. It is important to note that there may be different types or variations of the Eugene Oregon Marital Domestic Separation and Property Settlement Agreement, depending on the specific circumstances of the couple. For instance, if there are children involved, there may be additional provisions related to child custody, visitation, and child support. In such cases, a separate agreement or parenting plan may be needed to address these matters. Overall, the Eugene Oregon Marital Domestic Separation and Property Settlement Agreement provides a clear and legally binding document that allows parties to formalize their separation and ensure a fair distribution of their joint property and debts. Consulting with an experienced family law attorney is highly recommended ensuring the agreement accurately reflects the couple's intentions and complies with the applicable laws in Eugene, Oregon.

- US Legal Forms

- Localized Forms

- Oregon

- Eugene

-

Oregon Marital Domestic Separation and Property Settlement Agreement...

Eugene Oregon Marital Domestic Separation and Property Settlement Agreement no Children parties may have Joint Property or Debts where Divorce Action Filed

Description

Related forms

Related legal definitions

How to fill out Eugene Oregon Marital Domestic Separation And Property Settlement Agreement No Children Parties May Have Joint Property Or Debts Where Divorce Action Filed?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Eugene Oregon Marital Domestic Separation and Property Settlement Agreement no Children parties may have Joint Property or Debts where Divorce Action Filed becomes as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Eugene Oregon Marital Domestic Separation and Property Settlement Agreement no Children parties may have Joint Property or Debts where Divorce Action Filed takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a couple of additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve chosen the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Eugene Oregon Marital Domestic Separation and Property Settlement Agreement no Children parties may have Joint Property or Debts where Divorce Action Filed. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form Rating

Form popularity

FAQ

Let's go over some basic steps you can take for protecting assets in a divorce. Know What You Own and What Your Spouse Owns.Know the Value of Your Assets.Act Early: Try a Trust or Pre/Postnuptial Agreement.Don't Comingle Assets.Don't Sell, Transfer, or Change Your Property.Hire a Good Attorney.

5 Mistakes To Avoid During Your Separation Keep it private. The second you announce you're getting a divorce, everyone will have an opinion.Don't leave the house.Don't pay more than your share.Don't jump into a rebound relationship.Don't put off the inevitable.

How to Financially Protect Yourself in a Divorce Legally establish the separation/divorce. Get a copy of your credit report and monitor activity. Separate debt to financially protect your assets. Move half of joint bank balances to a separate account. Comb through your assets. Conduct a cash flow analysis.

How to Financially Protect Yourself in a Divorce Legally establish the separation/divorce. Get a copy of your credit report and monitor activity. Separate debt to financially protect your assets. Move half of joint bank balances to a separate account. Comb through your assets. Conduct a cash flow analysis.

The Factors Considered in Oregon Spousal Support The main factors that are relevant to all three types of support (transitional, compensatory, and maintenance) include: the length of the marriage. both spouses' financial needs and resources. the requesting spouse's work experience, employment skills, and income

No there is no provision as such which provides for fifty percent of the property or assets to be given to the wife automatically upon divorce. The alimony or the maintenance amount has to be decided by the parties themselves or the same is decided by the court accordingly.

In Oregon, the court will presume that the spouses contributed equally to the acquisition of most property during marriage, regardless of what title says. Property acquired equally will be split equally. The only assets left out of this presumption are gifts to one spouse that are always kept separate.

Coping With Separation And Divorce Recognize that it's OK to have different feelings.Give yourself a break.Don't go through this alone.Take care of yourself emotionally and physically.Avoid power struggles and arguments with your spouse or former spouse.Take time to explore your interests.Think positively.

To give yourselves the best chance of emerging from a separation period on amicable terms, you both need to commit to open and honest communications. Effective communication can help prevent the types of misunderstandings, wrongful accusations, and the ?blame game? that often occurs during separations.

7 Things to Do Before You Separate Know where you're going.Know why you're going.Get legal advice.Decide what you want your partner to understand most about your leaving.Talk to your kids.Decide on the rules of engagement with your partner.Line up support.

Eugene Oregon Marital Domestic Separation and Property Settlement Agreement no Children parties may have Joint Property or Debts where Divorce Action Filed Related Searches

-

divorce property division

-

is property owned before marriage

-

oregon spousal abandonment laws

-

presumption of equal contribution

-

oregon divorce law inheritance

-

premarital assets in divorce

-

if my husband owns a business do i own it too

-

how do i know when my divorce is final

-

oregon divorce laws property division

-

do i qualify for an annulment of marriage

More info

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Oregon

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Pennsylvania

-

Rhode Island

-

South Dakota

-

Tennessee

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

Note: This summary is not intended to be an all inclusive discussion of the law of separation agreements in Oregon, but does include basic and other provisions.

General Summary:

Parties to a dissolution of marriage may enter into separate agreements regarding the terms of the dissolution. Generally, if the parties asks, the trial court will review and incorporate all or part of their agreement into the judgment. The trial court is not required to incorporate into the judgment agreements that are "unfair" to one or the other of the parties.

Statutes:

Oregon Revised Statutes

VOLUME 3

Title 11. DOMESTIC RELATIONS

Chapter 107.

Dissolution, Annulment; Separation; Mediation and Conciliation Services

Provisions of decree:

(1) Whenever the court grants a decree of marital annulment, dissolution or separation, it may further decree as follows:

(a) For the future care and custody, by one party or jointly, of all minor children of the parties born, adopted or conceived during the marriage, and for minor children born to the parties prior to the marriage, as the court may deem just and proper under ORS 107.137. The court may hold a hearing to decide the custody issue prior to any other issues. When appropriate, the court shall recognize the value of close contact with both parents and encourage joint parental custody and joint responsibility for the welfare of the children.

(b) For parenting time rights of the parent not having custody of such children, and for visitation rights of grandparents pursuant to a petition filed under ORS 109.121. When a parenting plan has been developed as required by ORS 107.102, the court shall review the parenting plan and, if approved, incorporate the parenting plan into the court's final order. When incorporated into a final order, the parenting plan is determinative of parenting time rights. If the parents have been unable to develop a parenting plan or if either of the parents requests the court to develop a detailed parenting plan, the court shall develop the parenting plan in the best interest of the child, ensuring the noncustodial parent sufficient access to the child to provide for appropriate quality parenting time and assuring the safety of the parties, if implicated. The court may deny parenting time to the noncustodial parent under this subsection only if the court finds that parenting time would endanger the health or safety of the child. The court shall recognize the value of close contact with both parents and encourage, when practicable, joint responsibility for the welfare of such children and extensive contact between the minor children of the divided marriage and the parties. If the court awards parenting time to a noncustodial parent who has committed abuse, the court shall make adequate provision for the safety of the child and the other parent in accordance with the provisions of ORS 107.718 (4).

(c) For the support of the children of the marriage by the parties. In ordering child support, the formula established by ORS 25.270 to 25.287 shall apply. The court may at any time require an accounting from the custodial parent with reference to the use of the money received as child support. The court is not required to order support for any minor child who has become self-supporting, emancipated or married, or who has ceased to attend school after becoming 18 years of age.

(d) For spousal support, an amount of money for a period of time as may be just and equitable for one party to contribute to the other, in gross or in installments or both. The court may approve an agreement for the entry of an order for the support of a party. In making the spousal support order, the court shall designate one or more categories of spousal support and shall make findings of the relevant factors in the decision. The court may order:

(A) Transitional spousal support as needed for a party to attain education and training necessary to allow the party to prepare for reentry into the job market or for advancement therein. The factors to be considered by the court in awarding transitional spousal support include but are not limited to:

(i) The duration of the marriage;

(ii) A party's training and employment skills;

(iii) A party's work experience;

(iv) The financial needs and resources of each party;

(v) The tax consequences to each party;

(vi) A party's custodial and child support responsibilities; and

(vii) Any other factors the court deems just and equitable.

(B) Compensatory spousal support when there has been a significant financial or other contribution by one party to the education, training, vocational skills, career or earning capacity of the other party and when an order for compensatory spousal support is otherwise just and equitable in all of the circumstances. The factors to be considered by the court in awarding compensatory spousal support include but are not limited to:

(i) The amount, duration and nature of the contribution;

(ii) The duration of the marriage;

(iii) The relative earning capacity of the parties;

(iv) The extent to which the marital estate has already benefited from the contribution;

(v) The tax consequences to each party; and

(vi) Any other factors the court deems just and equitable.

(C) Spousal maintenance as a contribution by one spouse to the support of the other for either a specified or an indefinite period. The factors to be considered by the court in awarding spousal maintenance include but are not limited to:

(i) The duration of the marriage;

(ii) The age of the parties;

(iii) The health of the parties, including their physical, mental and emotional condition;

(iv) The standard of living established during the marriage;

(v) The relative income and earning capacity of the parties, recognizing that the wage earner's continuing income may be a basis for support distinct from the income that the supported spouse may receive from the distribution of marital property;

(vi) A party's training and employment skills;

(vii) A party's work experience;

(viii) The financial needs and resources of each party;

(ix) The tax consequences to each party;

(x) A party's custodial and child support responsibilities; and

(xi) Any other factors the court deems just and equitable.

(e) For the delivery to one party of such party's personal property in the possession or control of the other at the time of the giving of the decree.

(f) For the division or other disposition between the parties of the real or personal property, or both, of either or both of the parties as may be just and proper in all the circumstances. A retirement plan or pension or an interest therein shall be considered as property. The court shall consider the contribution of a spouse as a homemaker as a contribution to the acquisition of marital assets. There is a rebuttable presumption that both spouses have contributed equally to the acquisition of property during the marriage, whether such property is jointly or separately held. Subsequent to the filing of a petition for annulment or dissolution of marriage or separation, the rights of the parties in the marital assets shall be considered a species of coownership, and a transfer of marital assets under a decree of annulment or dissolution of marriage or of separation entered on or after October 4, 1977, shall be considered a partitioning of jointly owned property. The court shall require full disclosure of all assets by the parties in arriving at a just property division. In arriving at a just and proper division of property, the court shall consider reasonable costs of sale of assets, taxes and any other costs reasonably anticipated by the parties. If a spouse has been awarded spousal support in lieu of a share of property, the court shall so state on the record, and shall order the obligor to provide for and maintain life insurance in an amount commensurate with the obligation and designating the obligee as beneficiary for the duration of the obligation. If the obligor dies prior to the termination of such support and such insurance is not in force, the court may modify the method of payment of spousal support under the decree or order of support from installments to a lump sum payment to the obligee from the estate of the obligor in an amount commensurate with the present value of the spousal support at the time of death. The obligee or attorney of the obligee shall cause a certified copy of the decree to be delivered to the life insurance company or companies. If the obligee or the attorney of the obligee delivers a true copy of the decree to the life insurance company or companies, identifying the policies involved and requesting such notification under this section, the company or companies shall notify the obligee, as beneficiary of the insurance policy, whenever the policyholder takes any action that will change the beneficiary or reduce the benefits of the policy. Either party may request notification by the insurer when premium payments have not been made. If the obligor is ordered to provide for and maintain life insurance, the obligor shall provide to the obligee a true copy of the policy. The obligor shall also provide to the obligee written notice of any action that will reduce the benefits or change the designation of the beneficiaries under the policy.

(g) For the creation of trusts as follows:

(A) For the appointment of one or more trustees to hold, control and manage for the benefit of the children of the parties, of the marriage or otherwise, such of the real or personal property of either or both of the parties, as the court may order to be allocated or appropriated to their support and welfare; and to collect, receive, expend, manage or invest any sum of money decreed for the support and welfare of minor children of the parties.

(B) For the appointment of one or more trustees to hold, manage and control such amount of money or such real or personal property of either or both of the parties, as may be set aside, allocated or appropriated for the support of a party.

(C) For the establishment of the terms of the trust and provisions for the disposition or distribution of such money or property to or between the parties, their successors, heirs and assigns after the purpose of the trust has been accomplished. Upon petition of a party or a person having an interest in the trust showing a change of circumstances warranting a change in the terms of the trust, the court may make and direct reasonable modifications in its terms.

(h) To change the name of either spouse to a name the spouse held before the marriage. The court shall decree a change if it is requested by the affected party.

(i) For a judgment against one party in favor of the other for any sums of money found to be then remaining unpaid upon any enforceable order or orders theretofore duly made and entered in the proceedings under any of the provisions of ORS 107.095, and for a judgment against one party in favor of the other or in favor of the other's attorney for any further sums as additional attorney fees or additional costs and expenses of suit or defense as the court finds reasonably and necessarily incurred by such party; or, in the absence of any such order or orders pendente lite, a like judgment for such amount of money as the court finds was reasonably necessary to enable such party to prosecute or defend the suit. The decree may include a judgment for any arrearage in any sum ordered while litigation was pending, but if such a judgment is not included in the decree, such arrearages shall not be deemed satisfied.

(2) In determining the proper amount of support and the proper division of property under subsection (1)(c), (d) and (f) of this section, the court may consider evidence of the tax consequences on the parties of its proposed decree.

(3) Upon the filing of the decree, the property division ordered shall be deemed effective for all purposes. This transfer by decree, which shall effect solely owned property transferred to the other spouse as well as commonly owned property in the same manner as would a declaration of a resulting trust in favor of the spouse to whom the property is awarded, shall not be deemed a taxable sale or exchange.

(4) If an appeal is taken from a decree of annulment or dissolution of marriage or of separation or from any part of a decree rendered in pursuance of the provisions of ORS 107.005 to 107.085, 107.095, 107.105, 107.115 to 107.174, 107.405, 107.425, 107.445 to 107.520, 107.540 and 107.610, the court making such decree may provide in a separate order for any relief provided for in ORS 107.095 and shall provide that the order is to be in effect only during the pendency of the appeal. A temporary order under this subsection may be enforced as provided in ORS 33.015 to 33.155. On motion of a party the Court of Appeals may review the trial court's disposition of a request for a temporary order. A motion under this subsection must be filed with the Court of Appeals within 14 days after the entry of the temporary order. The Court of Appeals may modify the trial court's order only if the Court of Appeals finds an abuse of discretion by the trial court. Upon such finding, the Court of Appeals may enter a temporary order, affirm, modify or vacate the trial court's order, remand the order to the trial court for reconsideration or impose terms and conditions on the order.

(5) If an appeal is taken from the decree or other appealable order in a suit for annulment or dissolution of a marriage or for separation, and the appellate court awards costs and disbursements to a party, it may also award to that party, as part of the costs, the appeal.

(6) If, as a result of a suit for the annulment or dissolution of a marriage or for separation, the parties to such suit become owners of an undivided interest in any real or personal property, or both, either party may maintain supplemental proceedings by filing a petition in such suit for the partition of such real or personal property, or both, within two years from the entry of said decree, showing among other things that the original parties to such decree and their joint or several creditors having a lien upon any such real or personal property, if any there be, constitute the sole and only necessary parties to such supplemental proceedings. The procedure in the supplemental proceedings, so far as applicable, shall be the procedure provided in ORS 105.405, for the partition of real property, and the court granting such decree shall have in the first instance and retain jurisdiction in equity therefor. Section 107.105

Vacation or modification of decree:

(1) The court may at any time after a decree of annulment or dissolution of marriage or of separation is granted, upon the motion of either party and after service of notice on the other party in the manner provided by ORCP 7, and after notice to the Division of Child Support when required pursuant to subsection (8) of this section:

(a) Set aside, alter or modify so much of the decree as may provide for the appointment and duties of trustees, for the custody, parenting time, visitation, support and welfare of the minor children and the children attending school, as defined in ORS 107.108, including any provisions for health or life insurance, or for the support of a party or for life insurance under ORS 107.820 or 107.830;

(b) Make an order, after service of notice to the other party, providing for the future custody, support and welfare of minor children residing in the state, who, at the time the decree was given, were not residents of the state, or were unknown to the court or were erroneously omitted from the decree;

(c) Terminate a duty of support toward any minor child who has become self-supporting, emancipated or married;

(d) Notwithstanding section 84 (2), chapter 827, Oregon Laws 1973, and after service of notice on the child in the manner provided by law for service of a summons, suspend future support for any child who has ceased to be a child attending school as defined in ORS 107.108; and

(e) Set aside, alter or modify so much of the decree as may provide for a property award based on the enhanced earning capacity of a party that was awarded before October 23, 1999. A property award may be set aside, altered or modified under this paragraph:

(A) When the person with the enhanced earning capacity makes a good faith career change that results in less income;

(B) When the income of the person with the enhanced earning capacity decreases due to circumstances beyond the person's control; or

(C) Under such other circumstances as the court deems just and proper.

(2) In a proceeding under this section to reconsider the spousal or child support provisions of the decree, the following provisions apply:

(a) A substantial change in economic circumstances of a party, which may include, but is not limited to, a substantial change in the cost of reasonable and necessary expenses to either party, is sufficient for the court to reconsider its order of support, except that an order of compensatory spousal support may only be modified upon a showing of an involuntary, extraordinary and unanticipated change in circumstances that reduces the earning capacity of the paying spouse.

(b) If the decree provided for a termination or reduction of spousal support at a designated age in anticipation of the commencement of pension, social security or other entitlement payments, and if the obligee is unable to obtain the anticipated entitlement payments, that inability is sufficient change in circumstances for the court to reconsider its order of support.

(c) If social security is considered in lieu of spousal support or partial spousal support, the court shall determine the amount of social security the party is eligible to collect. The court shall take into consideration any pension, retirement or other funds available to either party to effect an equitable distribution between the parties and shall also take into consideration any reduction of entitlement caused by taking early retirement.

(3) In considering under this section whether a change in circumstances exists sufficient for the court to reconsider spousal or child support provisions of a decree, the following provisions apply:

(a) The court or administrator, as defined in ORS 25.010, shall consider income opportunities and benefits of the respective parties from all sources, including but not limited to:

(A) The reasonable opportunity of each party, the obligor and obligee respectively, to acquire future income and assets.

(B) Retirement benefits available to the obligor and to the obligee.

(C) Other benefits to which the obligor is entitled, such as travel benefits, recreational benefits and medical benefits, contrasted with benefits to which the obligee is similarly entitled.

(D) Social Security benefits received on behalf of a child due to a parent's disability or retirement if the benefits:

(i) Were not previously considered in the child support order; or

(ii) Were considered in an action initiated before March 1, 1999.

(E) Veterans' benefits received on behalf of a child due to a parent's disability or retirement if the benefits:

(i) Were not previously considered in the child support order; or

(ii) Were considered in an action initiated before October 23, 1999.

(b) If the motion for modification is one made by the obligor to reduce or terminate support, and if the obligee opposes the motion, the court shall not find a change in circumstances sufficient for reconsideration of support provisions, if the motion is based upon a reduction of the obligor's financial status resulting from the obligor's taking voluntary retirement, partial voluntary retirement or any other voluntary reduction of income or self-imposed curtailment of earning capacity, if it is shown that such action of the obligor was not taken in good faith but was for the primary purpose of avoiding the support obligation. In any subsequent motion for modification, the court shall deny the motion if the sole basis of the motion for modification is the termination of voluntarily taken retirement benefits and the obligor previously has been found not to have acted in good faith.

(c) The court shall consider the following factors in deciding whether the actions of the obligor were not in "good faith":

(A) Timing of the voluntary retirement or other reduction in financial status to coincide with court action in which the obligee seeks or is granted an increase in spousal support.

(B) Whether all or most of the income producing assets and property were awarded to the obligor, and spousal support in lieu of such property was awarded to the obligee.

(C) Extent of the obligor's dissipation of funds and assets prior to the voluntary retirement or soon after filing for the change of circumstances based on retirement.

(D) If earned income is reduced and absent dissipation of funds or large gifts, whether the obligor has funds and assets from which the spousal support could have been paid.

(E) Whether the obligor has given gifts of substantial value to others, including a current spouse, to the detriment of the obligor's ability to meet the preexisting obligation of spousal support.

(4) Upon terminating a duty of spousal support, a court shall make specific findings of the basis for the termination and shall include the findings in the judgment order.

(5) Any modification of spousal support granted because of a change of circumstances may be ordered effective retroactive to the date the motion for modification was filed or to any date thereafter.

(6) The decree is a final judgment as to any installment or payment of money that has accrued up to the time either party makes a motion to set aside, alter or modify the decree, and the court does not have the power to set aside, alter or modify such decree, or any portion thereof, that provides for any payment of money, either for minor children or the support of a party, that has accrued prior to the filing of such motion. However:

(a) The court may allow a credit against child support arrearages for periods of time, excluding reasonable parenting time unless otherwise provided by order or decree, during which the obligated parent has physical custody of the child with the knowledge and consent of the custodial parent; and

(b) The court or the administrator, as defined in ORS 25.010, may allow, as provided in the rules of the Child Support Program, a credit against child support arrearages for any Social Security or Veterans' benefits paid retroactively to the child, or to a representative payee administering the funds for the child's use and benefit, as a result of a parent's disability or retirement.

(7) In a proceeding under subsection (1) of this section, the court may assess against either party a reasonable attorney fee and costs for the benefit of the other party. If a party is found to have acted in bad faith, the court shall order that party to pay a reasonable attorney fee and costs of the defending party.

(8) Whenever a motion to establish, modify or terminate child support or satisfy or alter support arrearages is filed and public assistance, as defined in ORS 416.400, is being granted to or on behalf of a dependent child or children, natural or adopted, of the parties, a true copy of the motion shall be served by mail or personal delivery on the Administrator of the Division of Child Support of the Department of Justice, or on the branch office of the division providing service to the county in which the motion is filed.

(9) (a) Except as provided in ORS 109.700 to 109.930, the courts of Oregon, having once acquired personal and subject matter jurisdiction in a domestic relations action, retain such jurisdiction regardless of any change of domicile.

(b) The courts of Oregon, in a proceeding to establish, enforce or modify a child support order, shall recognize the provisions of the federal Full Faith and Credit for Child Support Orders Act (28 U.S.C. 1738B).

(10) In a proceeding under this section to reconsider provisions in a decree relating to custody or parenting time, the court may consider repeated and unreasonable denial of, or interference with, parenting time to be a substantial change of circumstances.

(11) Within 30 days after service of notice under subsection (1) of this section, the party served shall file a written response with the court. Section 107.135.

Case Law:

Parties to a dissolution of marriage may enter into separate agreements regarding the terms of the dissolution. Generally, if the parties ask, the trial court will review and incorporate all or part of their agreement into the judgment. Rigdon v. Rigdon, 219 Or. 271, 276, 347 P.2d 43 (1959). The trial court is not required to incorporate into the judgment agreements that are "unfair to one or the other of the parties." McDonnal and McDonnal, 293 Or. 772, 778, 652 P.2d 1247 (1982).

The parties may enter into a property settlement agreement providing for spousal support which the court may approve and ratify by incorporating it into the decree, or the court may itself determine the appropriate amount and duration of spousal support based on the evidence presented. In the second case, the court shall apply the factors set out in the statute. A court is not required to accept an agreement between the parties, Unander v. Unander, 265 Or. 102, 107, 506 P.2d 719 (1973); Frey and Frey, 23 Or. App. 25, 541 P.2d 145 (1975). It may, upon consideration, reject an agreement as unfair to one or the other of the parties. Bach and Bach, 27 Or. App. 411, 555 P.2d 1264 (1976). However, agreements made in anticipation of a dissolution are generally enforceable and accepted by the court when they are equitable given the circumstances of the case. The court is not required to apply an analysis of the statutory factors to the circumstances of each case when confronted with a proposed agreement. Jensen v. Jensen, 249 Or. 423, 438 P.2d 1013 (1968); Prime v. Prime, 172 Or. 34, 139 P.2d 550 (1943).

In Oregon, public policy requires that persons of full age and competent understanding shall have the utmost liberty of contracting, and that their contracts, when entered into freely and voluntarily, shall be held sacred and shall be enforced by courts of justice; and it is only when some other overpowering rule of public policy intervenes, rendering such agreements unfair or illegal, that they will not be enforced. Eldridge v. Johnson, 195 Or. 379, 245 P.2d 239, 251; Feves v. Feves, 198 Or. 151, 159-160, 254 P.2d 694 (1953). Short of conflict with the statutory powers of the court, it is the court's responsibility to discover and give effect to the intent of the parties as reflected in the incorporated settlement agreement. McDonnal and McDonnal, 293 Or. 772 (1982) 652 P.2d 1247.

Note: This summary is not intended to be an all inclusive discussion of the law of separation agreements in Oregon, but does include basic and other provisions.

General Summary:

Parties to a dissolution of marriage may enter into separate agreements regarding the terms of the dissolution. Generally, if the parties asks, the trial court will review and incorporate all or part of their agreement into the judgment. The trial court is not required to incorporate into the judgment agreements that are "unfair" to one or the other of the parties.

Statutes:

Oregon Revised Statutes

VOLUME 3

Title 11. DOMESTIC RELATIONS

Chapter 107.

Dissolution, Annulment; Separation; Mediation and Conciliation Services

Provisions of decree:

(1) Whenever the court grants a decree of marital annulment, dissolution or separation, it may further decree as follows:

(a) For the future care and custody, by one party or jointly, of all minor children of the parties born, adopted or conceived during the marriage, and for minor children born to the parties prior to the marriage, as the court may deem just and proper under ORS 107.137. The court may hold a hearing to decide the custody issue prior to any other issues. When appropriate, the court shall recognize the value of close contact with both parents and encourage joint parental custody and joint responsibility for the welfare of the children.

(b) For parenting time rights of the parent not having custody of such children, and for visitation rights of grandparents pursuant to a petition filed under ORS 109.121. When a parenting plan has been developed as required by ORS 107.102, the court shall review the parenting plan and, if approved, incorporate the parenting plan into the court's final order. When incorporated into a final order, the parenting plan is determinative of parenting time rights. If the parents have been unable to develop a parenting plan or if either of the parents requests the court to develop a detailed parenting plan, the court shall develop the parenting plan in the best interest of the child, ensuring the noncustodial parent sufficient access to the child to provide for appropriate quality parenting time and assuring the safety of the parties, if implicated. The court may deny parenting time to the noncustodial parent under this subsection only if the court finds that parenting time would endanger the health or safety of the child. The court shall recognize the value of close contact with both parents and encourage, when practicable, joint responsibility for the welfare of such children and extensive contact between the minor children of the divided marriage and the parties. If the court awards parenting time to a noncustodial parent who has committed abuse, the court shall make adequate provision for the safety of the child and the other parent in accordance with the provisions of ORS 107.718 (4).

(c) For the support of the children of the marriage by the parties. In ordering child support, the formula established by ORS 25.270 to 25.287 shall apply. The court may at any time require an accounting from the custodial parent with reference to the use of the money received as child support. The court is not required to order support for any minor child who has become self-supporting, emancipated or married, or who has ceased to attend school after becoming 18 years of age.

(d) For spousal support, an amount of money for a period of time as may be just and equitable for one party to contribute to the other, in gross or in installments or both. The court may approve an agreement for the entry of an order for the support of a party. In making the spousal support order, the court shall designate one or more categories of spousal support and shall make findings of the relevant factors in the decision. The court may order:

(A) Transitional spousal support as needed for a party to attain education and training necessary to allow the party to prepare for reentry into the job market or for advancement therein. The factors to be considered by the court in awarding transitional spousal support include but are not limited to:

(i) The duration of the marriage;

(ii) A party's training and employment skills;

(iii) A party's work experience;

(iv) The financial needs and resources of each party;

(v) The tax consequences to each party;

(vi) A party's custodial and child support responsibilities; and

(vii) Any other factors the court deems just and equitable.

(B) Compensatory spousal support when there has been a significant financial or other contribution by one party to the education, training, vocational skills, career or earning capacity of the other party and when an order for compensatory spousal support is otherwise just and equitable in all of the circumstances. The factors to be considered by the court in awarding compensatory spousal support include but are not limited to:

(i) The amount, duration and nature of the contribution;

(ii) The duration of the marriage;

(iii) The relative earning capacity of the parties;

(iv) The extent to which the marital estate has already benefited from the contribution;

(v) The tax consequences to each party; and

(vi) Any other factors the court deems just and equitable.

(C) Spousal maintenance as a contribution by one spouse to the support of the other for either a specified or an indefinite period. The factors to be considered by the court in awarding spousal maintenance include but are not limited to:

(i) The duration of the marriage;

(ii) The age of the parties;

(iii) The health of the parties, including their physical, mental and emotional condition;

(iv) The standard of living established during the marriage;

(v) The relative income and earning capacity of the parties, recognizing that the wage earner's continuing income may be a basis for support distinct from the income that the supported spouse may receive from the distribution of marital property;

(vi) A party's training and employment skills;

(vii) A party's work experience;

(viii) The financial needs and resources of each party;

(ix) The tax consequences to each party;

(x) A party's custodial and child support responsibilities; and

(xi) Any other factors the court deems just and equitable.

(e) For the delivery to one party of such party's personal property in the possession or control of the other at the time of the giving of the decree.

(f) For the division or other disposition between the parties of the real or personal property, or both, of either or both of the parties as may be just and proper in all the circumstances. A retirement plan or pension or an interest therein shall be considered as property. The court shall consider the contribution of a spouse as a homemaker as a contribution to the acquisition of marital assets. There is a rebuttable presumption that both spouses have contributed equally to the acquisition of property during the marriage, whether such property is jointly or separately held. Subsequent to the filing of a petition for annulment or dissolution of marriage or separation, the rights of the parties in the marital assets shall be considered a species of coownership, and a transfer of marital assets under a decree of annulment or dissolution of marriage or of separation entered on or after October 4, 1977, shall be considered a partitioning of jointly owned property. The court shall require full disclosure of all assets by the parties in arriving at a just property division. In arriving at a just and proper division of property, the court shall consider reasonable costs of sale of assets, taxes and any other costs reasonably anticipated by the parties. If a spouse has been awarded spousal support in lieu of a share of property, the court shall so state on the record, and shall order the obligor to provide for and maintain life insurance in an amount commensurate with the obligation and designating the obligee as beneficiary for the duration of the obligation. If the obligor dies prior to the termination of such support and such insurance is not in force, the court may modify the method of payment of spousal support under the decree or order of support from installments to a lump sum payment to the obligee from the estate of the obligor in an amount commensurate with the present value of the spousal support at the time of death. The obligee or attorney of the obligee shall cause a certified copy of the decree to be delivered to the life insurance company or companies. If the obligee or the attorney of the obligee delivers a true copy of the decree to the life insurance company or companies, identifying the policies involved and requesting such notification under this section, the company or companies shall notify the obligee, as beneficiary of the insurance policy, whenever the policyholder takes any action that will change the beneficiary or reduce the benefits of the policy. Either party may request notification by the insurer when premium payments have not been made. If the obligor is ordered to provide for and maintain life insurance, the obligor shall provide to the obligee a true copy of the policy. The obligor shall also provide to the obligee written notice of any action that will reduce the benefits or change the designation of the beneficiaries under the policy.

(g) For the creation of trusts as follows:

(A) For the appointment of one or more trustees to hold, control and manage for the benefit of the children of the parties, of the marriage or otherwise, such of the real or personal property of either or both of the parties, as the court may order to be allocated or appropriated to their support and welfare; and to collect, receive, expend, manage or invest any sum of money decreed for the support and welfare of minor children of the parties.

(B) For the appointment of one or more trustees to hold, manage and control such amount of money or such real or personal property of either or both of the parties, as may be set aside, allocated or appropriated for the support of a party.

(C) For the establishment of the terms of the trust and provisions for the disposition or distribution of such money or property to or between the parties, their successors, heirs and assigns after the purpose of the trust has been accomplished. Upon petition of a party or a person having an interest in the trust showing a change of circumstances warranting a change in the terms of the trust, the court may make and direct reasonable modifications in its terms.

(h) To change the name of either spouse to a name the spouse held before the marriage. The court shall decree a change if it is requested by the affected party.

(i) For a judgment against one party in favor of the other for any sums of money found to be then remaining unpaid upon any enforceable order or orders theretofore duly made and entered in the proceedings under any of the provisions of ORS 107.095, and for a judgment against one party in favor of the other or in favor of the other's attorney for any further sums as additional attorney fees or additional costs and expenses of suit or defense as the court finds reasonably and necessarily incurred by such party; or, in the absence of any such order or orders pendente lite, a like judgment for such amount of money as the court finds was reasonably necessary to enable such party to prosecute or defend the suit. The decree may include a judgment for any arrearage in any sum ordered while litigation was pending, but if such a judgment is not included in the decree, such arrearages shall not be deemed satisfied.

(2) In determining the proper amount of support and the proper division of property under subsection (1)(c), (d) and (f) of this section, the court may consider evidence of the tax consequences on the parties of its proposed decree.

(3) Upon the filing of the decree, the property division ordered shall be deemed effective for all purposes. This transfer by decree, which shall effect solely owned property transferred to the other spouse as well as commonly owned property in the same manner as would a declaration of a resulting trust in favor of the spouse to whom the property is awarded, shall not be deemed a taxable sale or exchange.

(4) If an appeal is taken from a decree of annulment or dissolution of marriage or of separation or from any part of a decree rendered in pursuance of the provisions of ORS 107.005 to 107.085, 107.095, 107.105, 107.115 to 107.174, 107.405, 107.425, 107.445 to 107.520, 107.540 and 107.610, the court making such decree may provide in a separate order for any relief provided for in ORS 107.095 and shall provide that the order is to be in effect only during the pendency of the appeal. A temporary order under this subsection may be enforced as provided in ORS 33.015 to 33.155. On motion of a party the Court of Appeals may review the trial court's disposition of a request for a temporary order. A motion under this subsection must be filed with the Court of Appeals within 14 days after the entry of the temporary order. The Court of Appeals may modify the trial court's order only if the Court of Appeals finds an abuse of discretion by the trial court. Upon such finding, the Court of Appeals may enter a temporary order, affirm, modify or vacate the trial court's order, remand the order to the trial court for reconsideration or impose terms and conditions on the order.

(5) If an appeal is taken from the decree or other appealable order in a suit for annulment or dissolution of a marriage or for separation, and the appellate court awards costs and disbursements to a party, it may also award to that party, as part of the costs, the appeal.

(6) If, as a result of a suit for the annulment or dissolution of a marriage or for separation, the parties to such suit become owners of an undivided interest in any real or personal property, or both, either party may maintain supplemental proceedings by filing a petition in such suit for the partition of such real or personal property, or both, within two years from the entry of said decree, showing among other things that the original parties to such decree and their joint or several creditors having a lien upon any such real or personal property, if any there be, constitute the sole and only necessary parties to such supplemental proceedings. The procedure in the supplemental proceedings, so far as applicable, shall be the procedure provided in ORS 105.405, for the partition of real property, and the court granting such decree shall have in the first instance and retain jurisdiction in equity therefor. Section 107.105

Vacation or modification of decree:

(1) The court may at any time after a decree of annulment or dissolution of marriage or of separation is granted, upon the motion of either party and after service of notice on the other party in the manner provided by ORCP 7, and after notice to the Division of Child Support when required pursuant to subsection (8) of this section:

(a) Set aside, alter or modify so much of the decree as may provide for the appointment and duties of trustees, for the custody, parenting time, visitation, support and welfare of the minor children and the children attending school, as defined in ORS 107.108, including any provisions for health or life insurance, or for the support of a party or for life insurance under ORS 107.820 or 107.830;

(b) Make an order, after service of notice to the other party, providing for the future custody, support and welfare of minor children residing in the state, who, at the time the decree was given, were not residents of the state, or were unknown to the court or were erroneously omitted from the decree;

(c) Terminate a duty of support toward any minor child who has become self-supporting, emancipated or married;

(d) Notwithstanding section 84 (2), chapter 827, Oregon Laws 1973, and after service of notice on the child in the manner provided by law for service of a summons, suspend future support for any child who has ceased to be a child attending school as defined in ORS 107.108; and

(e) Set aside, alter or modify so much of the decree as may provide for a property award based on the enhanced earning capacity of a party that was awarded before October 23, 1999. A property award may be set aside, altered or modified under this paragraph:

(A) When the person with the enhanced earning capacity makes a good faith career change that results in less income;

(B) When the income of the person with the enhanced earning capacity decreases due to circumstances beyond the person's control; or

(C) Under such other circumstances as the court deems just and proper.

(2) In a proceeding under this section to reconsider the spousal or child support provisions of the decree, the following provisions apply:

(a) A substantial change in economic circumstances of a party, which may include, but is not limited to, a substantial change in the cost of reasonable and necessary expenses to either party, is sufficient for the court to reconsider its order of support, except that an order of compensatory spousal support may only be modified upon a showing of an involuntary, extraordinary and unanticipated change in circumstances that reduces the earning capacity of the paying spouse.

(b) If the decree provided for a termination or reduction of spousal support at a designated age in anticipation of the commencement of pension, social security or other entitlement payments, and if the obligee is unable to obtain the anticipated entitlement payments, that inability is sufficient change in circumstances for the court to reconsider its order of support.

(c) If social security is considered in lieu of spousal support or partial spousal support, the court shall determine the amount of social security the party is eligible to collect. The court shall take into consideration any pension, retirement or other funds available to either party to effect an equitable distribution between the parties and shall also take into consideration any reduction of entitlement caused by taking early retirement.

(3) In considering under this section whether a change in circumstances exists sufficient for the court to reconsider spousal or child support provisions of a decree, the following provisions apply:

(a) The court or administrator, as defined in ORS 25.010, shall consider income opportunities and benefits of the respective parties from all sources, including but not limited to:

(A) The reasonable opportunity of each party, the obligor and obligee respectively, to acquire future income and assets.

(B) Retirement benefits available to the obligor and to the obligee.

(C) Other benefits to which the obligor is entitled, such as travel benefits, recreational benefits and medical benefits, contrasted with benefits to which the obligee is similarly entitled.

(D) Social Security benefits received on behalf of a child due to a parent's disability or retirement if the benefits:

(i) Were not previously considered in the child support order; or

(ii) Were considered in an action initiated before March 1, 1999.

(E) Veterans' benefits received on behalf of a child due to a parent's disability or retirement if the benefits:

(i) Were not previously considered in the child support order; or

(ii) Were considered in an action initiated before October 23, 1999.

(b) If the motion for modification is one made by the obligor to reduce or terminate support, and if the obligee opposes the motion, the court shall not find a change in circumstances sufficient for reconsideration of support provisions, if the motion is based upon a reduction of the obligor's financial status resulting from the obligor's taking voluntary retirement, partial voluntary retirement or any other voluntary reduction of income or self-imposed curtailment of earning capacity, if it is shown that such action of the obligor was not taken in good faith but was for the primary purpose of avoiding the support obligation. In any subsequent motion for modification, the court shall deny the motion if the sole basis of the motion for modification is the termination of voluntarily taken retirement benefits and the obligor previously has been found not to have acted in good faith.

(c) The court shall consider the following factors in deciding whether the actions of the obligor were not in "good faith":

(A) Timing of the voluntary retirement or other reduction in financial status to coincide with court action in which the obligee seeks or is granted an increase in spousal support.

(B) Whether all or most of the income producing assets and property were awarded to the obligor, and spousal support in lieu of such property was awarded to the obligee.

(C) Extent of the obligor's dissipation of funds and assets prior to the voluntary retirement or soon after filing for the change of circumstances based on retirement.

(D) If earned income is reduced and absent dissipation of funds or large gifts, whether the obligor has funds and assets from which the spousal support could have been paid.

(E) Whether the obligor has given gifts of substantial value to others, including a current spouse, to the detriment of the obligor's ability to meet the preexisting obligation of spousal support.

(4) Upon terminating a duty of spousal support, a court shall make specific findings of the basis for the termination and shall include the findings in the judgment order.

(5) Any modification of spousal support granted because of a change of circumstances may be ordered effective retroactive to the date the motion for modification was filed or to any date thereafter.

(6) The decree is a final judgment as to any installment or payment of money that has accrued up to the time either party makes a motion to set aside, alter or modify the decree, and the court does not have the power to set aside, alter or modify such decree, or any portion thereof, that provides for any payment of money, either for minor children or the support of a party, that has accrued prior to the filing of such motion. However:

(a) The court may allow a credit against child support arrearages for periods of time, excluding reasonable parenting time unless otherwise provided by order or decree, during which the obligated parent has physical custody of the child with the knowledge and consent of the custodial parent; and

(b) The court or the administrator, as defined in ORS 25.010, may allow, as provided in the rules of the Child Support Program, a credit against child support arrearages for any Social Security or Veterans' benefits paid retroactively to the child, or to a representative payee administering the funds for the child's use and benefit, as a result of a parent's disability or retirement.

(7) In a proceeding under subsection (1) of this section, the court may assess against either party a reasonable attorney fee and costs for the benefit of the other party. If a party is found to have acted in bad faith, the court shall order that party to pay a reasonable attorney fee and costs of the defending party.

(8) Whenever a motion to establish, modify or terminate child support or satisfy or alter support arrearages is filed and public assistance, as defined in ORS 416.400, is being granted to or on behalf of a dependent child or children, natural or adopted, of the parties, a true copy of the motion shall be served by mail or personal delivery on the Administrator of the Division of Child Support of the Department of Justice, or on the branch office of the division providing service to the county in which the motion is filed.

(9) (a) Except as provided in ORS 109.700 to 109.930, the courts of Oregon, having once acquired personal and subject matter jurisdiction in a domestic relations action, retain such jurisdiction regardless of any change of domicile.

(b) The courts of Oregon, in a proceeding to establish, enforce or modify a child support order, shall recognize the provisions of the federal Full Faith and Credit for Child Support Orders Act (28 U.S.C. 1738B).

(10) In a proceeding under this section to reconsider provisions in a decree relating to custody or parenting time, the court may consider repeated and unreasonable denial of, or interference with, parenting time to be a substantial change of circumstances.

(11) Within 30 days after service of notice under subsection (1) of this section, the party served shall file a written response with the court. Section 107.135.

Case Law:

Parties to a dissolution of marriage may enter into separate agreements regarding the terms of the dissolution. Generally, if the parties ask, the trial court will review and incorporate all or part of their agreement into the judgment. Rigdon v. Rigdon, 219 Or. 271, 276, 347 P.2d 43 (1959). The trial court is not required to incorporate into the judgment agreements that are "unfair to one or the other of the parties." McDonnal and McDonnal, 293 Or. 772, 778, 652 P.2d 1247 (1982).

The parties may enter into a property settlement agreement providing for spousal support which the court may approve and ratify by incorporating it into the decree, or the court may itself determine the appropriate amount and duration of spousal support based on the evidence presented. In the second case, the court shall apply the factors set out in the statute. A court is not required to accept an agreement between the parties, Unander v. Unander, 265 Or. 102, 107, 506 P.2d 719 (1973); Frey and Frey, 23 Or. App. 25, 541 P.2d 145 (1975). It may, upon consideration, reject an agreement as unfair to one or the other of the parties. Bach and Bach, 27 Or. App. 411, 555 P.2d 1264 (1976). However, agreements made in anticipation of a dissolution are generally enforceable and accepted by the court when they are equitable given the circumstances of the case. The court is not required to apply an analysis of the statutory factors to the circumstances of each case when confronted with a proposed agreement. Jensen v. Jensen, 249 Or. 423, 438 P.2d 1013 (1968); Prime v. Prime, 172 Or. 34, 139 P.2d 550 (1943).

In Oregon, public policy requires that persons of full age and competent understanding shall have the utmost liberty of contracting, and that their contracts, when entered into freely and voluntarily, shall be held sacred and shall be enforced by courts of justice; and it is only when some other overpowering rule of public policy intervenes, rendering such agreements unfair or illegal, that they will not be enforced. Eldridge v. Johnson, 195 Or. 379, 245 P.2d 239, 251; Feves v. Feves, 198 Or. 151, 159-160, 254 P.2d 694 (1953). Short of conflict with the statutory powers of the court, it is the court's responsibility to discover and give effect to the intent of the parties as reflected in the incorporated settlement agreement. McDonnal and McDonnal, 293 Or. 772 (1982) 652 P.2d 1247.