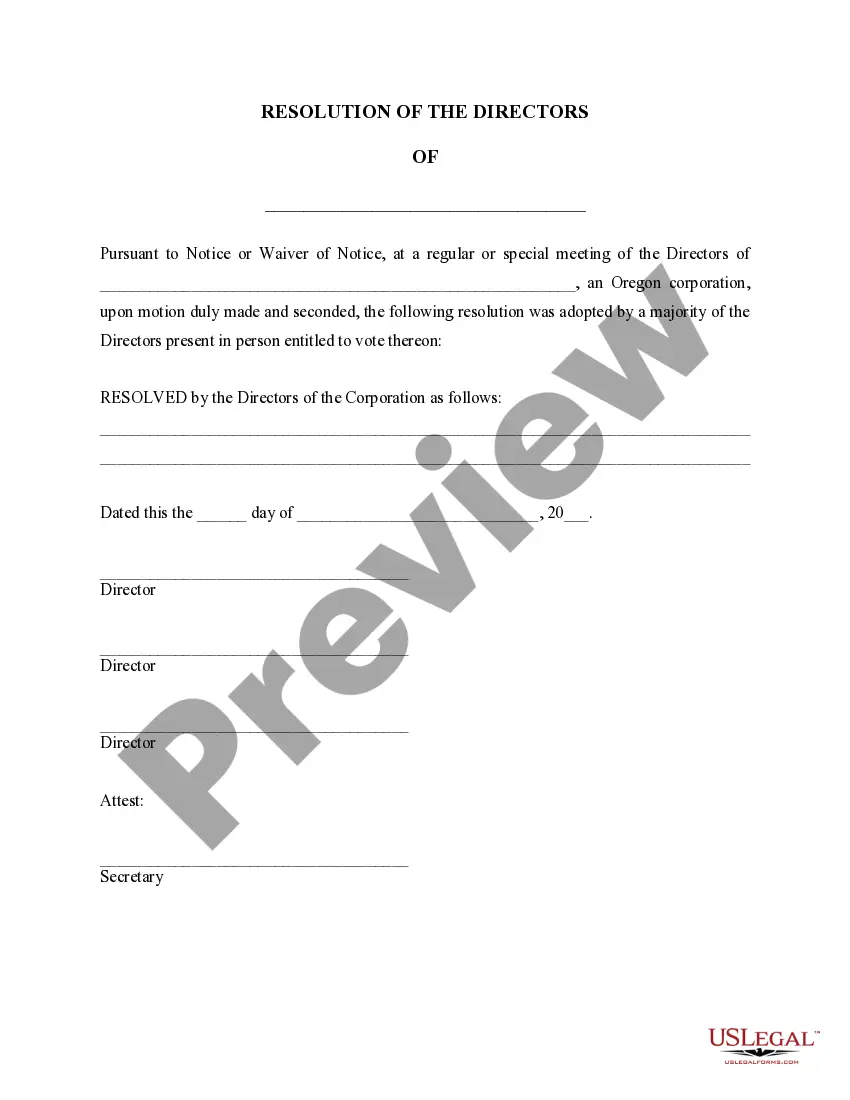

Title: Hillsboro Oregon Dissolution Package to Dissolve Corporation — A Comprehensive Guide for Business Owners Introduction: Dissolving a corporation in Hillsboro, Oregon requires careful consideration and adherence to legal procedures. To simplify the dissolution process and ensure compliance, Hillsboro offers a variety of dissolution packages tailored to meet the unique needs of each corporation. In this article, we will provide a detailed description of the Hillsboro Oregon Dissolution Package to Dissolve Corporation and explore the different types available. 1. Basic Dissolution Package: The Basic Dissolution Package offered by Hillsboro, Oregon provides essential services for corporations looking to dissolve. It includes assistance with completing necessary dissolution forms, guidance on filing requirements, and access to resources for businesses in the dissolution phase. This package is ideal for corporations with straightforward dissolution requirements. 2. Expedited Dissolution Package: For corporations seeking a faster dissolution process, the Expedited Dissolution Package offers an accelerated timeline. This package includes expedited processing of dissolution documents and priority handling of paperwork, significantly reducing the overall dissolution time. It suits corporations with time-sensitive dissolution needs, such as those facing financial challenges or bankruptcy. 3. Dissolution Package with Legal Consultation: Business owners who require legal guidance throughout the dissolution process can opt for the Dissolution Package with Legal Consultation. This comprehensive package includes all the services from the Basic Dissolution Package while adding personalized legal consultation. A qualified attorney will review all dissolution documents, provide legal advice on liabilities, assist in resolving outstanding legal matters, and ensure compliance with local laws. 4. Dissolution Package with Tax Consultation: Corporations concerned about potential tax implications during the dissolution can benefit from the Dissolution Package with Tax Consultation. This package not only covers the standard dissolution services but also offers guidance from certified tax professionals. They will help navigate tax-related matters, ensure proper filing and reporting, identify potential tax savings, and minimize any liabilities arising from the dissolution process. Conclusion: Hillsboro, Oregon provides various dissolution packages to dissolve corporations efficiently and accurately. Whether a corporation requires the Basic Dissolution Package, Expedited Dissolution Package, Dissolution Package with Legal Consultation, or Dissolution Package with Tax Consultation, there is a package to suit every business's unique needs. Consulting with a professional familiar with Hillsboro's dissolution requirements can ensure a smooth and compliant dissolution process. Remember that selecting the appropriate package is crucial for a hassle-free corporation dissolution experience.

Hillsboro Oregon Dissolution Package to Dissolve Corporation

Description

How to fill out Hillsboro Oregon Dissolution Package To Dissolve Corporation?

Benefit from the US Legal Forms and get instant access to any form sample you need. Our beneficial platform with thousands of documents makes it simple to find and obtain virtually any document sample you require. It is possible to download, complete, and certify the Hillsboro Oregon Dissolution Package to Dissolve Corporation in just a matter of minutes instead of browsing the web for hours seeking the right template.

Using our library is a great strategy to improve the safety of your record submissions. Our experienced attorneys on a regular basis check all the documents to make sure that the templates are appropriate for a particular state and compliant with new laws and regulations.

How do you obtain the Hillsboro Oregon Dissolution Package to Dissolve Corporation? If you already have a subscription, just log in to the account. The Download button will appear on all the samples you look at. In addition, you can get all the earlier saved files in the My Forms menu.

If you haven’t registered a profile yet, follow the instructions listed below:

- Open the page with the form you require. Ensure that it is the template you were hoping to find: check its name and description, and use the Preview function if it is available. Otherwise, utilize the Search field to find the needed one.

- Launch the saving process. Click Buy Now and select the pricing plan that suits you best. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Save the document. Select the format to get the Hillsboro Oregon Dissolution Package to Dissolve Corporation and edit and complete, or sign it for your needs.

US Legal Forms is probably the most considerable and reliable template libraries on the web. We are always happy to assist you in any legal process, even if it is just downloading the Hillsboro Oregon Dissolution Package to Dissolve Corporation.

Feel free to take advantage of our platform and make your document experience as efficient as possible!