Eugene Oregon Living Trust for Husband and Wife with No Children

Description

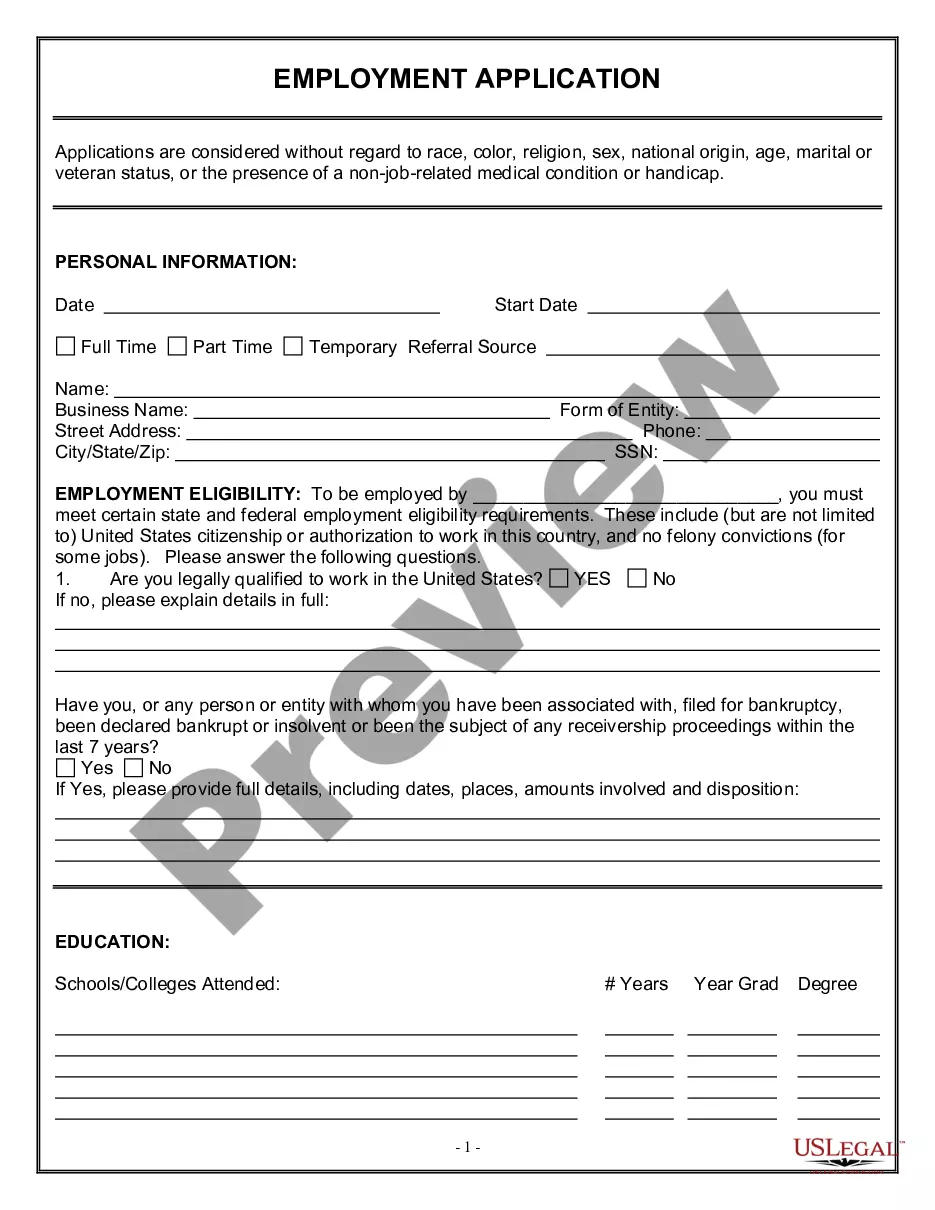

How to fill out Oregon Living Trust For Husband And Wife With No Children?

Regardless of social or professional standing, completing legal documents is a regrettable requirement in the modern world.

Often, it is nearly unattainable for an individual without legal training to create such documents from the beginning, primarily due to the intricate terminology and legal nuances they involve.

This is where US Legal Forms steps in to assist.

Verify that the template you located is tailored to your region, as the laws of one state or area do not apply in another.

Examine the form and read a brief description (if available) of the situations for which the document can be utilized.

- Our platform offers an extensive library with over 85,000 state-specific forms that accommodate nearly every legal situation.

- US Legal Forms is also an excellent resource for associates or legal advisors looking to save time by utilizing our DYI templates.

- Whether you are in need of the Eugene Oregon Living Trust for Husband and Wife with No Children or any other document valid in your location, US Legal Forms puts everything within your reach.

- This is how you can swiftly obtain the Eugene Oregon Living Trust for Husband and Wife with No Children using our reliable service.

- If you are currently a member, you may proceed to Log In to your account to access the required form.

- However, if you are not acquainted with our platform, be sure to follow these steps prior to downloading the Eugene Oregon Living Trust for Husband and Wife with No Children.

Form popularity

FAQ

There's no specific age that fits everyone, but setting up a trust can be beneficial once you start accumulating assets. Many people begin thinking about a Eugene Oregon Living Trust for Husband and Wife with No Children in their 30s or 40s, especially as life circumstances change. Early planning helps you secure your financial future and provides peace of mind knowing your wishes are well established. Consider using platforms like uslegalforms to navigate the process smoothly.

Yes, a single person with no children should consider establishing a trust. A Eugene Oregon Living Trust for Husband and Wife with No Children can still serve as an excellent option for individuals by protecting their assets and avoiding probate. Trusts provide flexibility in managing your estate and can help in financial and tax planning. Additionally, it allows you to designate beneficiaries or even support charitable causes.

For a single person, a simple will often suffices. This type of will clearly outlines how you want your assets distributed upon your passing. While considering a Eugene Oregon Living Trust for Husband and Wife with No Children is valuable for couples, singles should focus on straightforward solutions like a will. Such planning ensures your wishes are respected and can simplify the probate process.

You can write your own trust in Oregon, but be cautious about the details. An effective Eugene Oregon Living Trust for Husband and Wife with No Children requires clarity in your wishes and compliance with state laws. You might face challenges if the trust document lacks necessary provisions or is ambiguous. To avoid complications, consider using uslegalforms, which offers easy-to-use resources to help you draft a comprehensive and legally sound trust.

Even without children, a married couple should have a will to outline their wishes regarding asset transfer and final arrangements. A will complements a Eugene Oregon Living Trust for Husband and Wife with No Children by covering aspects that a trust may not, such as guardianship for pets or specific bequests. It ensures your desires are respected and reduces potential conflicts among surviving family members. Having both a will and a trust provides a comprehensive estate planning strategy.

Yes, a childless couple should consider a trust to manage their assets, such as a Eugene Oregon Living Trust for Husband and Wife with No Children. This type of trust can safeguard your estate and clarify intentions for asset distribution, particularly when there are no children involved. Additionally, it allows couples to choose alternate beneficiaries, ensuring their legacy continues as they wish. Establishing a trust simplifies the process for your surviving partner.

Married couples benefit significantly from establishing a trust, particularly a Eugene Oregon Living Trust for Husband and Wife with No Children. A trust helps manage assets efficiently, avoiding the lengthy probate process. It also ensures that your loved one has access to resources during life and makes your wishes clear after you’re gone. Ultimately, a trust can provide peace of mind for both partners.

Having separate living trusts for each partner can offer flexibility and control. However, a shared Eugene Oregon Living Trust for Husband and Wife with No Children can simplify asset management and ensure both partners' wishes are respected. This shared trust allows for streamlined decision-making during either partner's lifetime. It also provides clear directions for asset distribution after both partners pass.

While having children often prompts the creation of a trust, couples without children can also benefit significantly from one. A trust can provide clarity and direction for asset distribution, ensuring that your wishes are honored. Furthermore, it helps manage your estate during life and after death, preventing potential disputes. An Eugene Oregon Living Trust for Husband and Wife with No Children offers a straightforward way to organize your affairs, securing peace of mind for both partners.

For a single person, a revocable living trust is often the most suitable choice. This type of trust allows individuals to maintain control over their assets while simplifying the estate transfer process. It is essential to ensure that the trust is funded properly to achieve its intended benefits. If you are considering this option, an Eugene Oregon Living Trust for Husband and Wife with No Children can be tailored to fit your specific needs even if children are not part of the equation.