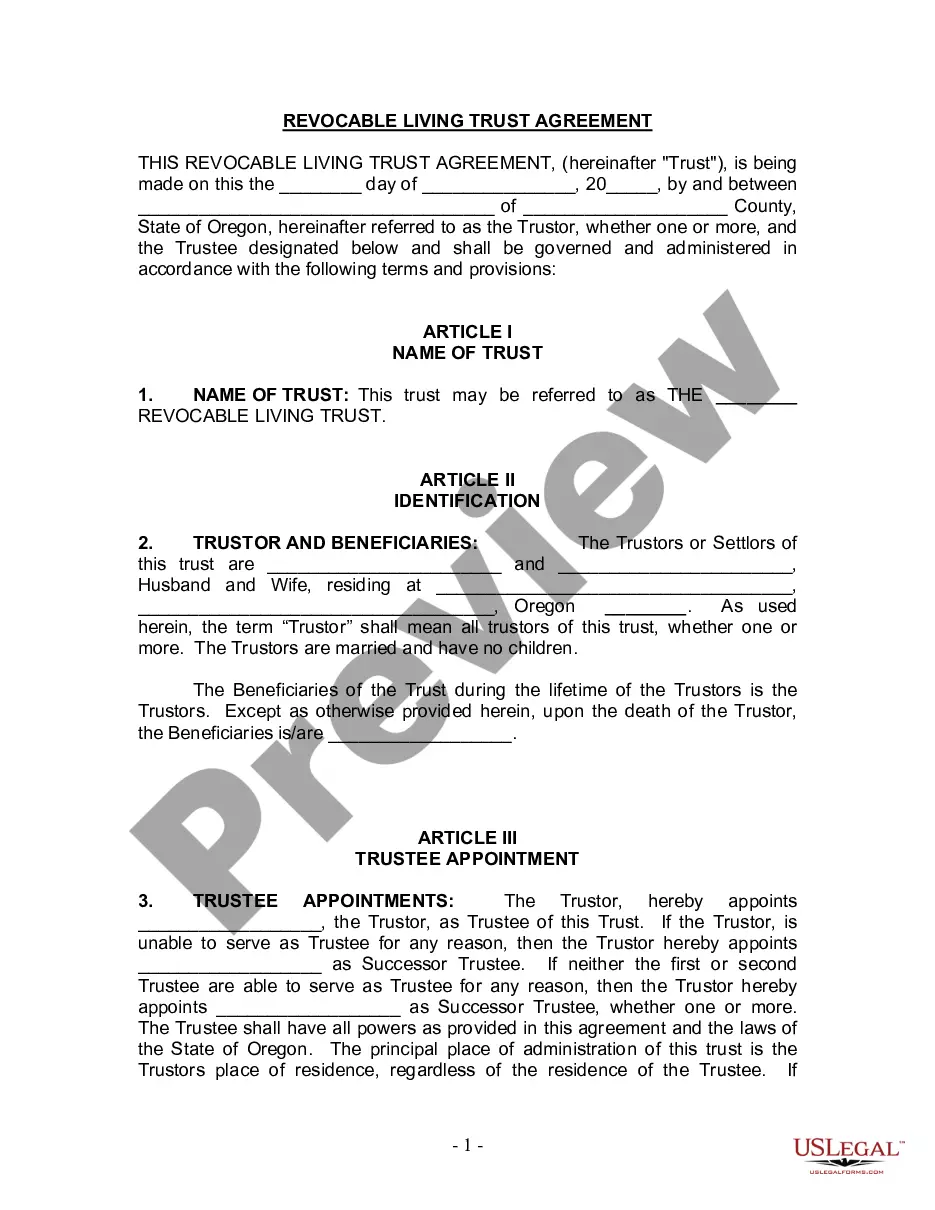

Gresham Oregon Living Trust for Husband and Wife with No Children, also known as a joint living trust, is a legal tool designed to safeguard and manage a couple's assets during their lifetime and efficiently distribute them after their passing. This type of trust is specifically tailored for couples who do not have children or heirs to pass their assets to. It provides flexibility, privacy, and control over the couple's estate planning. One of the main objectives of establishing a Gresham Oregon Living Trust for Husband and Wife with No Children is to avoid probate, the legal process of validating a will. By avoiding probate, the trust allows for a quicker and more cost-effective transfer of assets to the beneficiaries. Additionally, this type of trust offers protection against potential disputes, creditor claims, and conservatorship proceedings. There are different variations of Gresham Oregon Living Trust for Husband and Wife with No Children, depending on the specific needs and preferences of the couple. These variations may include: 1. Revocable Living Trust: This type of trust allows the couple to make changes, revoke, or amend the trust during their lifetime. It provides flexibility in managing assets and can address changes in circumstances or beneficiaries' needs. 2. Irrevocable Living Trust: In contrast to a revocable trust, an irrevocable living trust cannot be altered or revoked without the consent of the beneficiaries. This type of trust offers potential advantages such as estate tax reduction, creditor protection, and Medicaid planning. 3. AB Living Trust: An AB Living Trust, also known as a Survivor's Trust, is designed to minimize estate taxes. It divides the trust into two parts upon the first spouse's death: the A trust, also called the Marital or Survivor's Trust, and the B trust, also known as the Bypass or Family Trust. The assets in the B trust are not subject to estate tax when the surviving spouse passes away. 4. TIP Trust: A Qualified Terminable Interest Property (TIP) Trust is commonly used when one spouse wants to provide financial security for the surviving spouse while ensuring that the remaining assets pass to specific beneficiaries. This trust allows the granter to provide for the surviving spouse while having control over the ultimate distribution of the assets. In summary, a Gresham Oregon Living Trust for Husband and Wife with No Children is a comprehensive estate planning tool that empowers couples to manage their assets efficiently during their lifetime and distribute them according to their wishes. With several variations available, couples can tailor their trust to their specific goals and needs, ensuring both their financial security and that of their chosen beneficiaries.

Gresham Oregon Living Trust for Husband and Wife with No Children

Description

How to fill out Gresham Oregon Living Trust For Husband And Wife With No Children?

No matter the social or professional status, filling out legal forms is an unfortunate necessity in today’s world. Very often, it’s practically impossible for a person without any legal education to draft such papers from scratch, mainly because of the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes in handy. Our service offers a huge collection with more than 85,000 ready-to-use state-specific forms that work for practically any legal case. US Legal Forms also is a great resource for associates or legal counsels who want to save time using our DYI tpapers.

Whether you require the Gresham Oregon Living Trust for Husband and Wife with No Children or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Gresham Oregon Living Trust for Husband and Wife with No Children quickly employing our trusted service. If you are already an existing customer, you can proceed to log in to your account to download the appropriate form.

Nevertheless, in case you are a novice to our platform, make sure to follow these steps prior to downloading the Gresham Oregon Living Trust for Husband and Wife with No Children:

- Be sure the template you have chosen is suitable for your location because the regulations of one state or county do not work for another state or county.

- Preview the document and go through a short outline (if provided) of cases the document can be used for.

- If the one you chosen doesn’t suit your needs, you can start over and look for the necessary document.

- Click Buy now and choose the subscription option that suits you the best.

- utilizing your credentials or create one from scratch.

- Choose the payment method and proceed to download the Gresham Oregon Living Trust for Husband and Wife with No Children as soon as the payment is through.

You’re all set! Now you can proceed to print the document or fill it out online. Should you have any problems locating your purchased forms, you can easily access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.