Hillsboro Oregon Living Trust for Husband and Wife with No Children — Overview and Types A Hillsboro Oregon Living Trust for Husband and Wife with No Children is a legally binding document that allows a married couple residing in Hillsboro, Oregon, to safeguard their assets and ensure their wishes are carried out during and after their lifetimes. This trust empowers them to dictate how their assets will be managed, distributed, and protected for their own benefit during their lifetime, and to determine the distribution plan after their passing. There are primarily two types of Hillsboro Oregon Living Trusts for Husband and Wife with No Children: 1. Revocable Living Trust: The revocable living trust grants married couples the flexibility to retain control over their assets during their lifetimes. It enables them to modify, amend, or revoke the trust at any time if their circumstances or wishes change. Assets placed in this trust are managed by the trustees (usually the couple themselves), who can enjoy full usage and access to them. In case of incapacity, the trust can designate alternate trustees who can manage the assets on behalf of the couple. Upon the death of the last surviving spouse, the trust assets are distributed according to the couple's predetermined instructions. 2. Irrevocable Living Trust: Unlike the revocable living trust, the irrevocable living trust cannot be altered or revoked once it has been created. Once assets are transferred into this trust, they are considered owned by the trust itself, rather than the individuals. This trust type offers certain tax benefits and enables couples to protect their assets from potential creditors or legal claims. An irrevocable trust may also include additional clauses for charitable contributions or other philanthropic endeavors that reflect the couple's values and beliefs. Regardless of the specific type of trust chosen, a Hillsboro Oregon Living Trust for Husband and Wife with No Children typically encompasses the following key features: 1. Granters: The couple who establishes the trust is referred to as the granters. They initiate the trust, transfer their assets into it, and define its terms and conditions. 2. Trustees: The trustees are responsible for managing the trust assets and ensuring that the granters' wishes are carried out. Initially, the couple typically acts as trustees, with alternates designated for situations like incapacity or death. 3. Successor Trustees: Successor trustees are nominated to step in and manage the trust assets upon the incapacity or death of the initial trustees. These individuals should be trustworthy, capable of handling the responsibilities, and versed in the legal requirements of trust administration. 4. Beneficiaries: The beneficiaries of the trust are those who will receive the assets upon the passing of the last surviving spouse. These could be other family members, close friends, or charitable organizations. In summary, a Hillsboro Oregon Living Trust for Husband and Wife with No Children allows couples to have control and flexibility over their assets during their lifetime while providing for distribution after their passing. Whether choosing a revocable or irrevocable trust, the couple can ensure their assets are managed, preserved, and distributed according to their wishes. Consulting a qualified estate planning attorney is recommended to create a tailored trust that best aligns with the couple's financial goals, values, and family situation.

Hillsboro Oregon Living Trust for Husband and Wife with No Children

Description

How to fill out Hillsboro Oregon Living Trust For Husband And Wife With No Children?

Make use of the US Legal Forms and have instant access to any form you need. Our beneficial platform with a large number of documents makes it simple to find and obtain almost any document sample you want. You can save, fill, and sign the Hillsboro Oregon Living Trust for Husband and Wife with No Children in a matter of minutes instead of surfing the Net for many hours looking for a proper template.

Utilizing our catalog is a superb strategy to increase the safety of your form filing. Our professional legal professionals on a regular basis check all the documents to make sure that the templates are appropriate for a particular region and compliant with new acts and polices.

How can you get the Hillsboro Oregon Living Trust for Husband and Wife with No Children? If you already have a subscription, just log in to the account. The Download option will appear on all the documents you view. Additionally, you can find all the previously saved documents in the My Forms menu.

If you don’t have a profile yet, follow the instruction below:

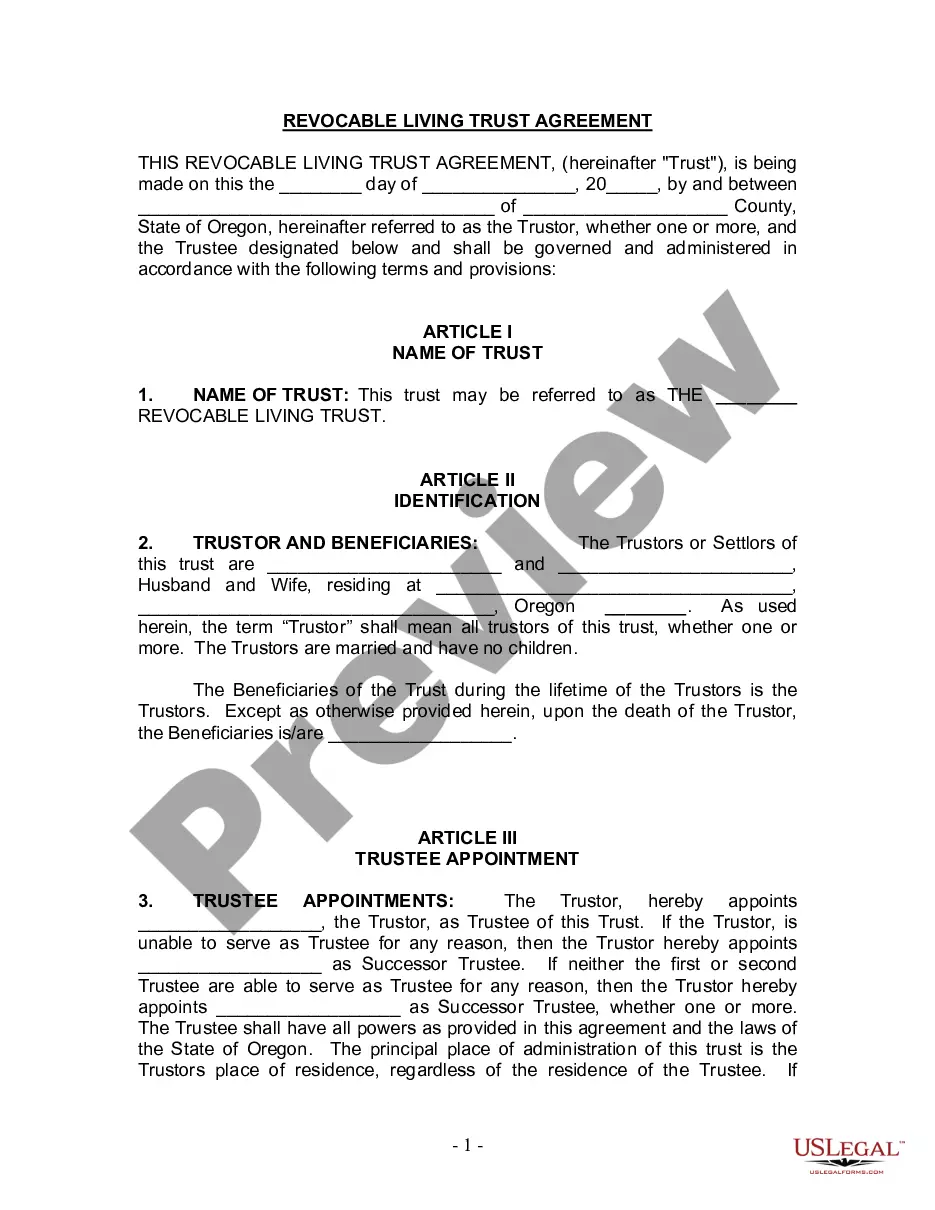

- Open the page with the form you need. Make sure that it is the form you were hoping to find: verify its name and description, and take take advantage of the Preview function when it is available. Otherwise, use the Search field to look for the needed one.

- Launch the downloading procedure. Click Buy Now and select the pricing plan that suits you best. Then, sign up for an account and process your order using a credit card or PayPal.

- Save the document. Indicate the format to obtain the Hillsboro Oregon Living Trust for Husband and Wife with No Children and revise and fill, or sign it according to your requirements.

US Legal Forms is probably the most significant and trustworthy template libraries on the internet. We are always ready to help you in any legal case, even if it is just downloading the Hillsboro Oregon Living Trust for Husband and Wife with No Children.

Feel free to make the most of our form catalog and make your document experience as straightforward as possible!