Eugene Oregon Living Trust for Husband and Wife with One Child

Description

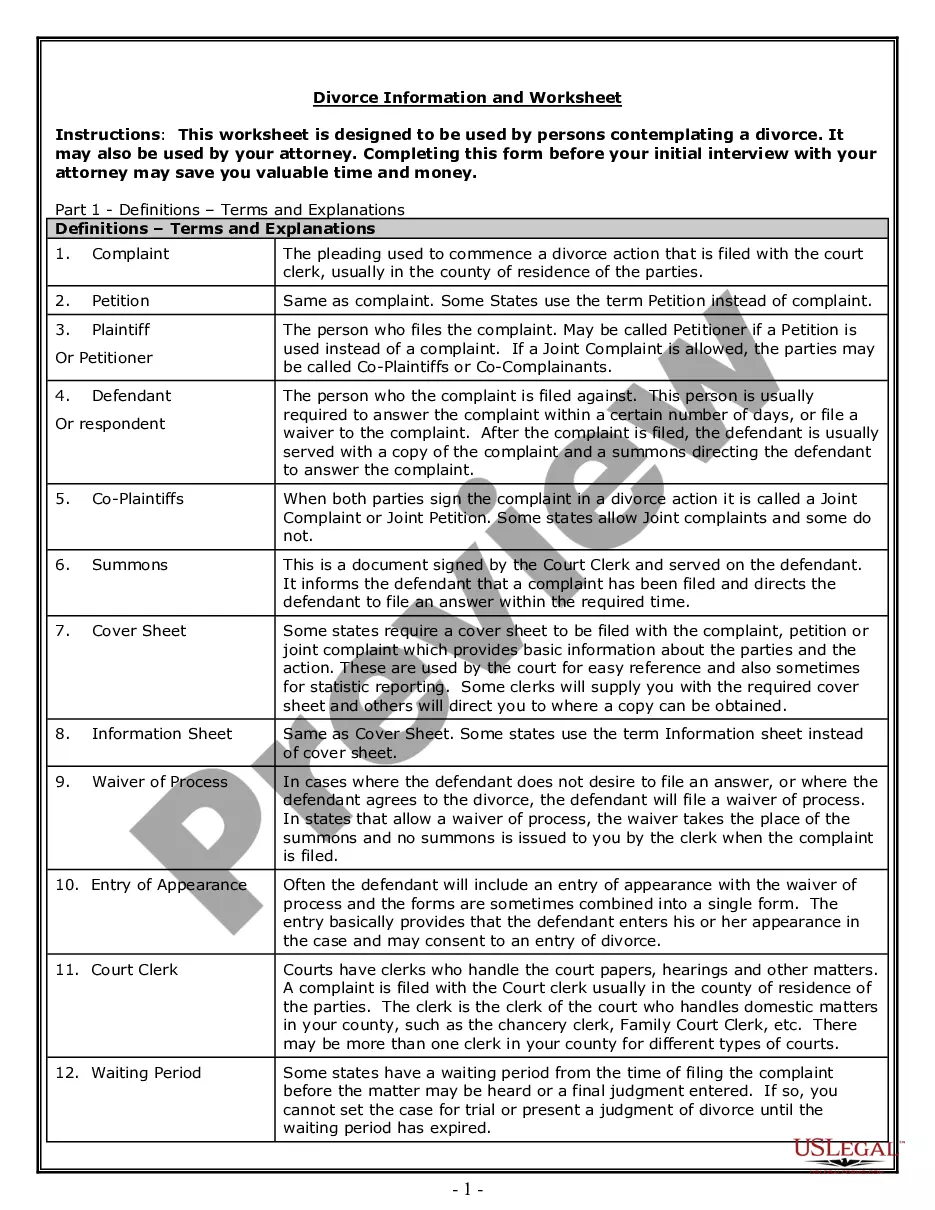

How to fill out Oregon Living Trust For Husband And Wife With One Child?

Finding validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It’s a digital compilation of over 85,000 legal documents for personal and business purposes as well as any practical scenarios.

All the files are systematically categorized by usage area and jurisdiction, making it simple and straightforward to find the Eugene Oregon Living Trust for Husband and Wife with One Child.

Maintaining documents organized and compliant with legal requirements is critically important. Take advantage of the US Legal Forms library to always have vital document templates for any needs right at your fingertips!

- Examine the Preview mode and form details.

- Ensure you’ve selected the correct one that fulfills your requirements and fully aligns with your local jurisdiction standards.

- Search for an alternative template, if necessary.

- If you encounter any discrepancies, use the Search tab above to find the accurate one. If it fits your needs, proceed to the next stage.

- Complete the purchase.

Form popularity

FAQ

Even if you have only one child, establishing a living trust can be beneficial. A Eugene Oregon Living Trust for Husband and Wife with One Child helps avoid probate, simplifies asset transfer, and protects your child's inheritance. It's a smart way to ensure that your child's needs are prioritized and that your estate plan aligns with your specific family situation.

Yes, you can write your own trust in Oregon, but it is essential to ensure that it meets all legal requirements. A properly drafted Eugene Oregon Living Trust for Husband and Wife with One Child allows you to control your assets and specify your wishes. While DIY options exist, using a reliable platform like uslegalforms can guide you in creating a trust that complies with state laws and secures your family's future.

Yes, a married couple can create a single Eugene Oregon Living Trust for Husband and Wife with One Child. This type of trust allows both spouses to combine their assets and plan for their child's future together. By establishing one cohesive trust, they can simplify management and distribution of assets while ensuring that their wishes are honored. Using a reliable platform like US Legal Forms can help couples create a customized living trust that meets their unique needs.

Yes, you can create your own living trust in Oregon, though it is advisable to proceed cautiously. Using templates and resources can be helpful, but a DIY approach may lead to errors that could affect a Eugene Oregon Living Trust for Husband and Wife with One Child. Consider utilizing a platform like uslegalforms to access reliable templates and guidelines, ensuring that your trust meets all legal requirements and serves your family's needs effectively.

The biggest mistake parents often make when setting up a trust fund is not clearly defining the terms and conditions that govern the trust. A vague Eugene Oregon Living Trust for Husband and Wife with One Child may lead to misunderstandings and disputes among heirs later on. Additionally, failing to adequately fund the trust can render it ineffective. Parents should carefully consider their wishes and seek professional guidance to ensure their trust functions as intended.

In most cases, a husband and wife may benefit from a joint living trust, particularly when creating a Eugene Oregon Living Trust for Husband and Wife with One Child. This unified approach simplifies asset management and provides a clear plan for distributing wealth to your child. However, there are instances where separate trusts can offer more tailored protections and address specific financial situations. It’s essential to consult with a legal expert to determine the best option for your family.

A marital trust is a legal entity established to pass assets to a surviving spouse or children/grandchildren. When a spouse dies, their assets are moved into the trust. A general power of appointment, an estate trust, and a QTIP trust are three types of marital trusts.

Simple Living Trusts for Married Couples Simple living trusts are often considered the easiest kinds of trusts to set up and keep. In a simple living trust, a couple can share the control and benefits of the trust while they are living. Once one spouse dies, the other spouse will have total control over the trust.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

Pricing depends on the size of the Estate. $3,200 for Estates under $2 million. $4,200 for Estates between $2 million and $5 million, and Estates over $5 million are subject to a special fee agreement based on the complexity of the Estate. Pricing for a Two Trust Plan.