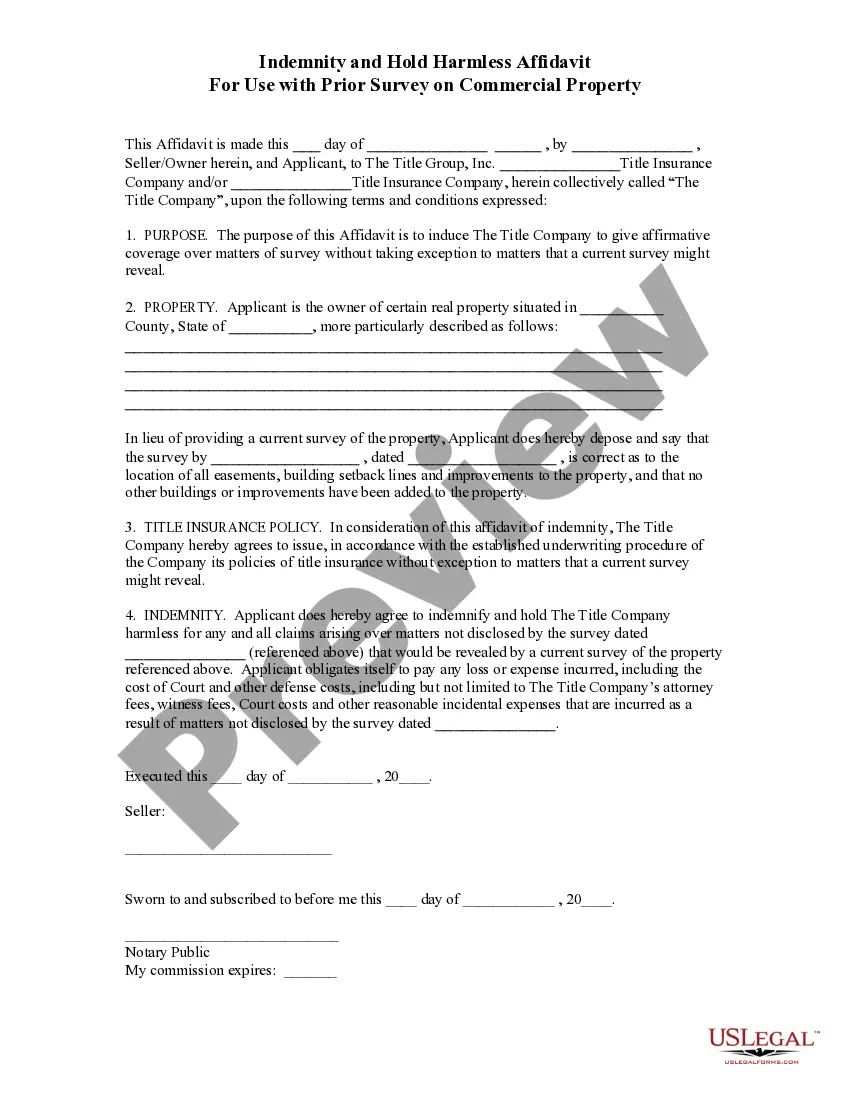

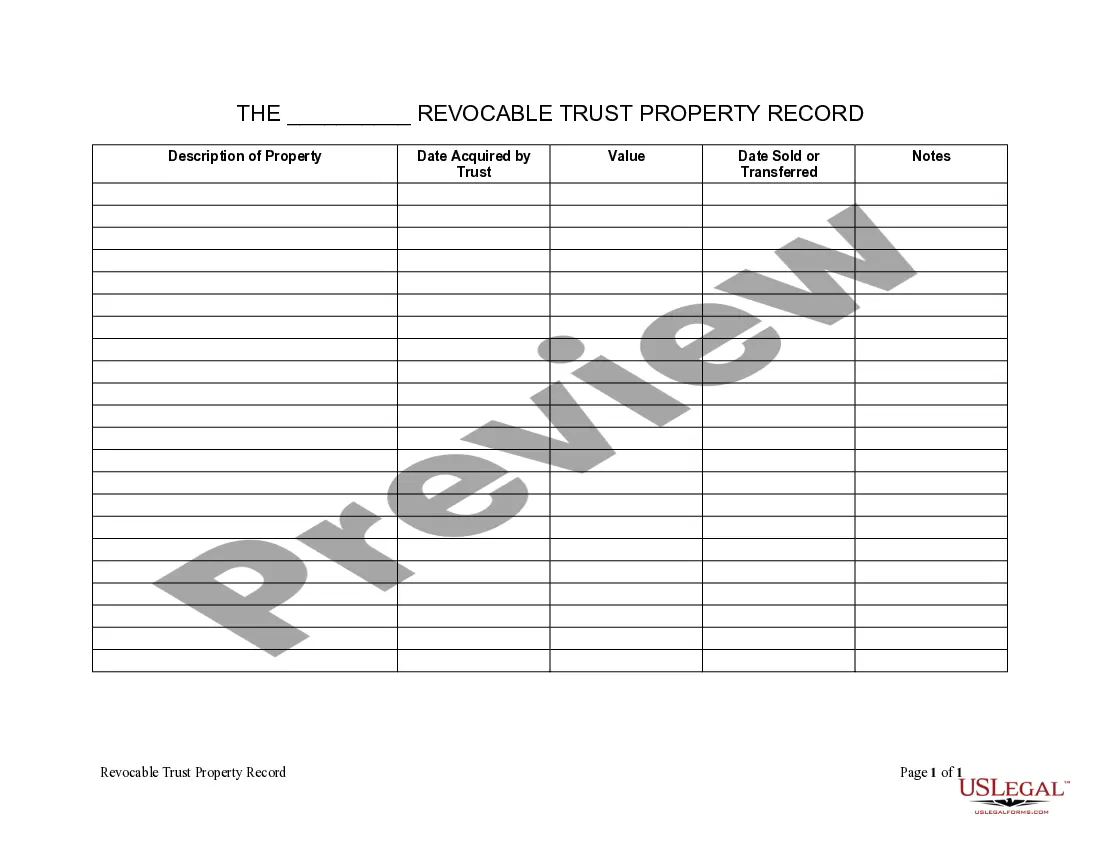

Bend Oregon Living Trust Property Record

Description

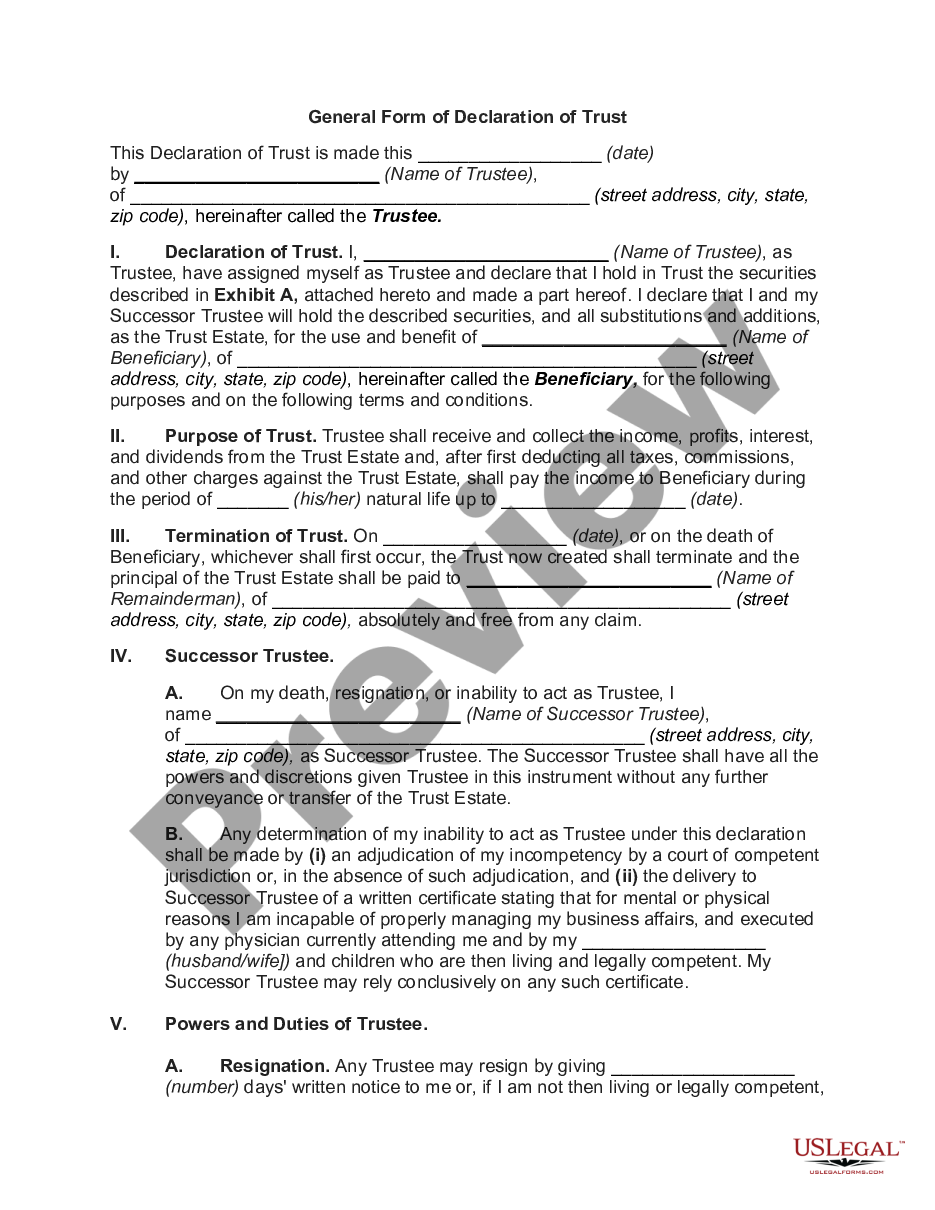

How to fill out Oregon Living Trust Property Record?

If you are looking for a legitimate form, it’s impossible to discover a superior service than the US Legal Forms site – likely the most extensive libraries online.

With this collection, you can find thousands of templates for corporate and personal uses categorized by types and regions, or keywords.

With the enhanced search feature, locating the latest Bend Oregon Living Trust Property Record is as straightforward as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Select the format and download it to your device. Edit the document. Fill out, modify, print, and sign the acquired Bend Oregon Living Trust Property Record.

- Additionally, the validity of each document is verified by a group of experienced attorneys who routinely evaluate the templates on our website and refresh them in line with the latest state and county regulations.

- If you are already familiar with our platform and possess an active account, all you need to do to obtain the Bend Oregon Living Trust Property Record is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the very first time, just follow the instructions below.

- Ensure you have accessed the sample you wish to use. Review its details and use the Preview feature to check its contents. If it does not meet your requirements, utilize the Search option at the top of the page to find the suitable document.

- Confirm your choice. Click the Buy now button. After that, choose your desired subscription plan and provide your details to create an account.

Form popularity

FAQ

Typically, a trust does not have to go through probate in Oregon when it is fully funded and consists of assets like your Bend Oregon Living Trust Property Record. Unlike wills, which are subject to probate, trusts allow for direct transfers to beneficiaries. This feature expedites the distribution process and offers greater privacy. Engaging with resources such as uslegalforms can help ensure that all aspects of your trust are properly managed.

In Oregon, a living trust works by allowing you to place your assets into the trust while you're still alive, retaining control over them. Once you pass away, the assets in your Bend Oregon Living Trust Property Record are distributed to your beneficiaries according to your wishes, without court interference. This arrangement not only simplifies the transfer process but also can provide a clear plan for your estate. Making use of platforms like uslegalforms can streamline the trust creation process.

Yes, a living trust can help you avoid probate in Oregon. Since assets held in a living trust at the time of your passing do not go through probate, your beneficiaries can access them more quickly. This feature is particularly beneficial for those who want to simplify the transfer of their Bend Oregon Living Trust Property Record. It allows for privacy and reduces the time and expenses associated with the probate process.

Bend, Oregon, has seen significant growth in wealth, with many residents enjoying comfortable lifestyles. This prosperity stems from a combination of a strong local economy, real estate growth, and tourism. As a result, many individuals consider establishing a Bend Oregon living trust property record to secure their financial legacy. Understanding the wealth dynamics in Bend can help inform your estate planning strategies.

Bend, Oregon, enjoys popularity due to its vibrant outdoor lifestyle, stunning natural beauty, and thriving arts scene. People are drawn to its recreational activities like hiking, skiing, and mountain biking, all set against a backdrop of breathtaking mountains and rivers. Furthermore, the city's friendly atmosphere fosters a strong sense of community. All these features make understanding your Bend Oregon living trust property record crucial if you decide to make this captivating city your home.

As of recent data, the property tax rate in Bend, Oregon, typically hovers around 1.1% of the assessed property value. However, this rate can vary based on factors such as property exemptions and local tax measures. If you own property in Bend, knowing the tax rate is important for effective estate planning and maintaining a clear Bend Oregon living trust property record. Planning ahead can help ensure you meet your financial responsibilities.

Bend, Oregon, is located in Deschutes County, a region celebrated for its picturesque scenery and recreational opportunities. This county encompasses diverse landscapes ranging from mountains to rivers, making it a popular destination for residents and tourists alike. Understanding the county where you live can be crucial, especially when creating a Bend Oregon living trust property record, as it impacts property laws and regulations.

Bend, Oregon, is known to host a variety of famous individuals, including actor and comedian Drew Barrymore. Other notable figures have chosen to reside in this beautiful city, drawn by its stunning landscapes and outdoor lifestyle. As you explore Bend, you may also come across the homes of athletes and authors who appreciate the serene environment. The community's charm makes it appealing for those looking to establish a living trust property record.

In most cases, a certificate of trust does not require notarization, but local laws may vary. It is essential to check the specific requirements for Bend Oregon Living Trust Property Record to ensure compliance. UsLegalForms can guide you through the requirements and help you prepare the necessary documents.

Filling out a certificate of trust involves providing essential information about the trust and its trustee. You need to include the name of the trust, the date it was created, and the trustee's contact information. Using resources from UsLegalForms simplifies this process, ensuring you complete the Bend Oregon Living Trust Property Record correctly and efficiently.