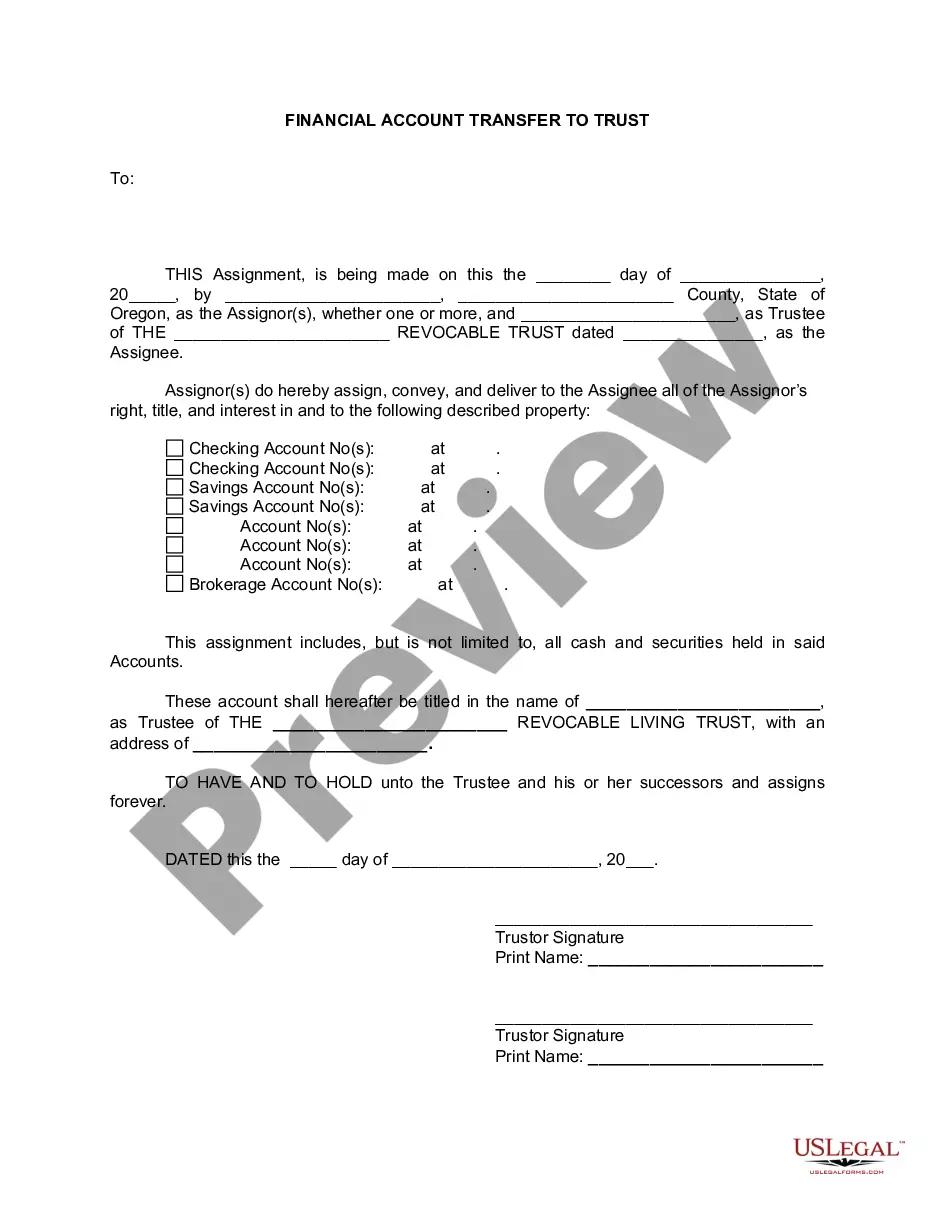

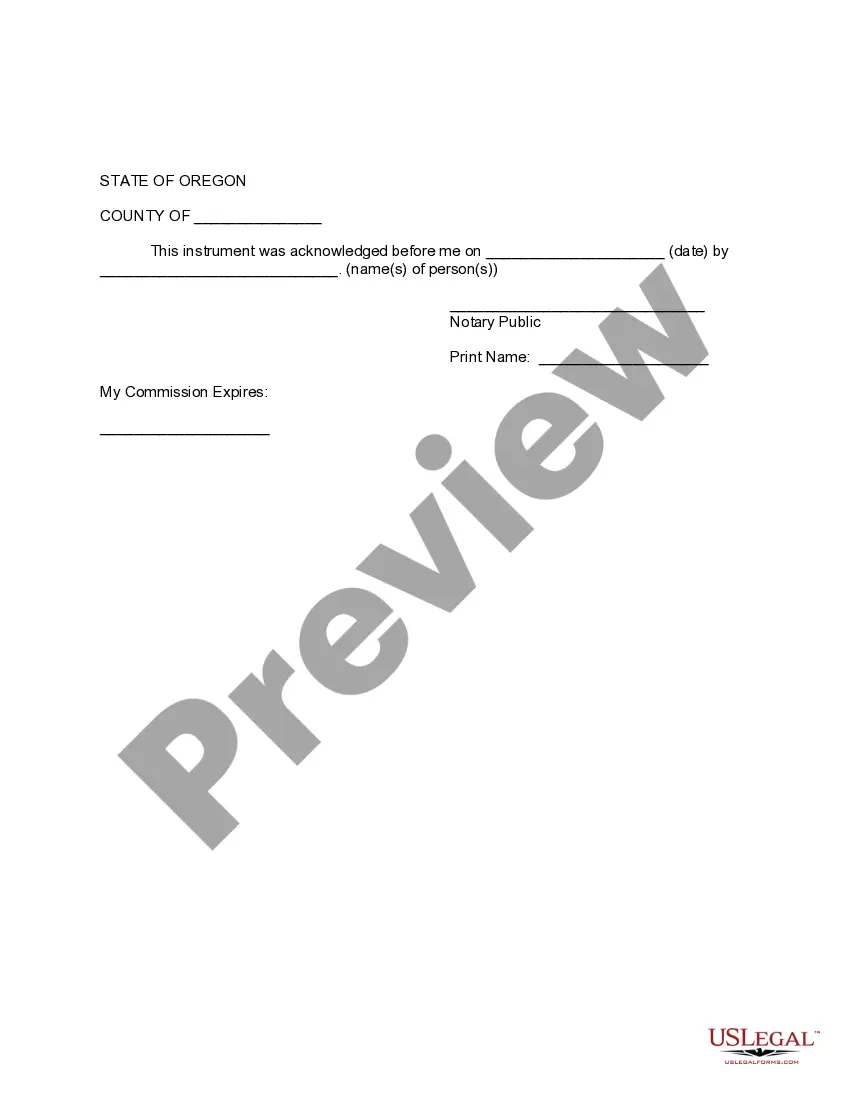

Bend Oregon Financial Account Transfer to Living Trust can be a crucial step in estate planning and asset management. This process involves transferring ownership of financial accounts from an individual's name to their living trust. By doing so, these assets are protected and can be efficiently managed while ensuring a smooth transfer of wealth to beneficiaries after the individual's passing. One type of Bend Oregon Financial Account Transfer to Living Trust is the transfer of bank accounts. Bank accounts, such as savings accounts, checking accounts, and certificates of deposit, can be transferred into a living trust. This allows the individual to retain control and access to their funds during their lifetime, while designating a successor trustee who will manage the accounts according to their wishes after their passing. Another type of financial account transfer to a living trust is the transfer of investment accounts. This includes brokerage accounts, stocks, bonds, mutual funds, and other investment instruments. Transferring these accounts into a living trust can provide continuity in managing investments and simplify the process for beneficiaries when they inherit these assets. Furthermore, Bend Oregon Financial Account Transfer to Living Trust also encompasses the transfer of retirement accounts, such as Individual Retirement Accounts (IRAs) and 401(k) plans. By designating the living trust as the primary or contingent beneficiary of these accounts, individuals can ensure that these funds are distributed according to their wishes and potentially provide tax advantages to their heirs. Lastly, real estate holdings can also be transferred to a living trust. Properties, including primary residences, vacation homes, and rental properties located in Bend, Oregon, or elsewhere, can be placed under the trust's ownership. This streamlines the transfer process, bypassing probate and allowing the appointed trustee to manage and distribute these assets without court involvement. In conclusion, Bend Oregon Financial Account Transfer to Living Trust is a comprehensive estate planning tool that covers the transfer of various financial accounts, including bank accounts, investment accounts, retirement accounts, and real estate holdings. By utilizing this strategy, individuals can ensure the efficient management of their assets, avoid probate, and provide a seamless transfer of wealth to their beneficiaries.

Bend Oregon Financial Account Transfer to Living Trust

Description

How to fill out Bend Oregon Financial Account Transfer To Living Trust?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Bend Oregon Financial Account Transfer to Living Trust gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Bend Oregon Financial Account Transfer to Living Trust takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve picked the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Bend Oregon Financial Account Transfer to Living Trust. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!