Eugene Oregon Financial Account Transfer to Living Trust

Description

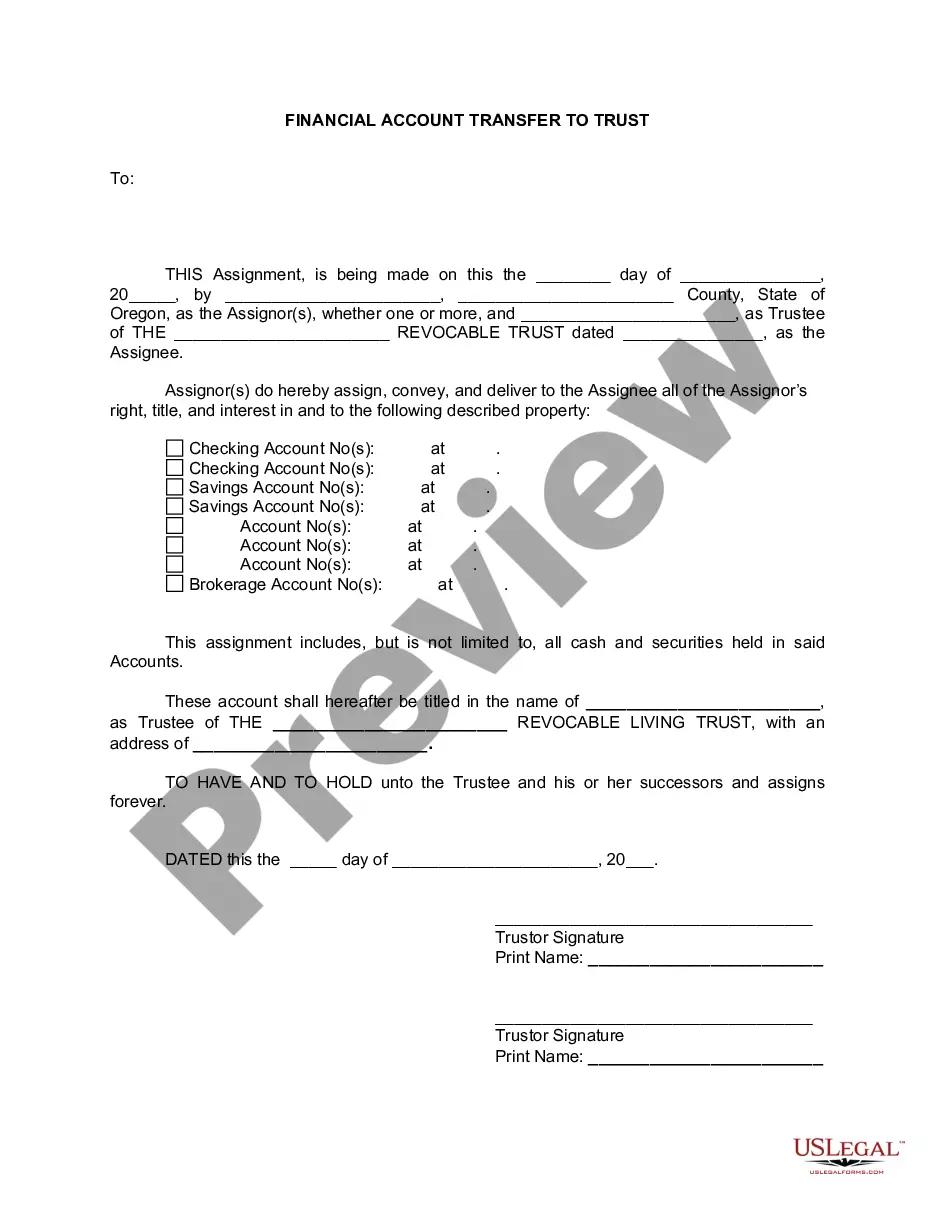

How to fill out Oregon Financial Account Transfer To Living Trust?

Take advantage of the US Legal Forms and gain immediate access to any form sample you need.

Our advantageous platform featuring thousands of templates makes it easy to locate and procure almost any document sample you need.

You can download, fill out, and validate the Eugene Oregon Financial Account Transfer to Living Trust in just a few minutes instead of browsing the internet for hours in search of a suitable template.

Utilizing our catalog is a superb way to enhance the security of your form submissions.

If you do not have a profile yet, please follow the steps outlined below.

Locate the form you seek. Confirm it is the form you want: review its title and description, and use the Preview feature if available. If not, use the Search box to find the needed one.

- Our experienced legal experts frequently examine all the documents to ensure that the templates are pertinent to a specific state and comply with updated laws and regulations.

- How can you acquire the Eugene Oregon Financial Account Transfer to Living Trust.

- If you already possess a profile, simply Log In to your account.

- The Download feature will be activated on all the documents you examine.

- Additionally, you can retrieve all the previously saved documents in the My documents section.

Form popularity

FAQ

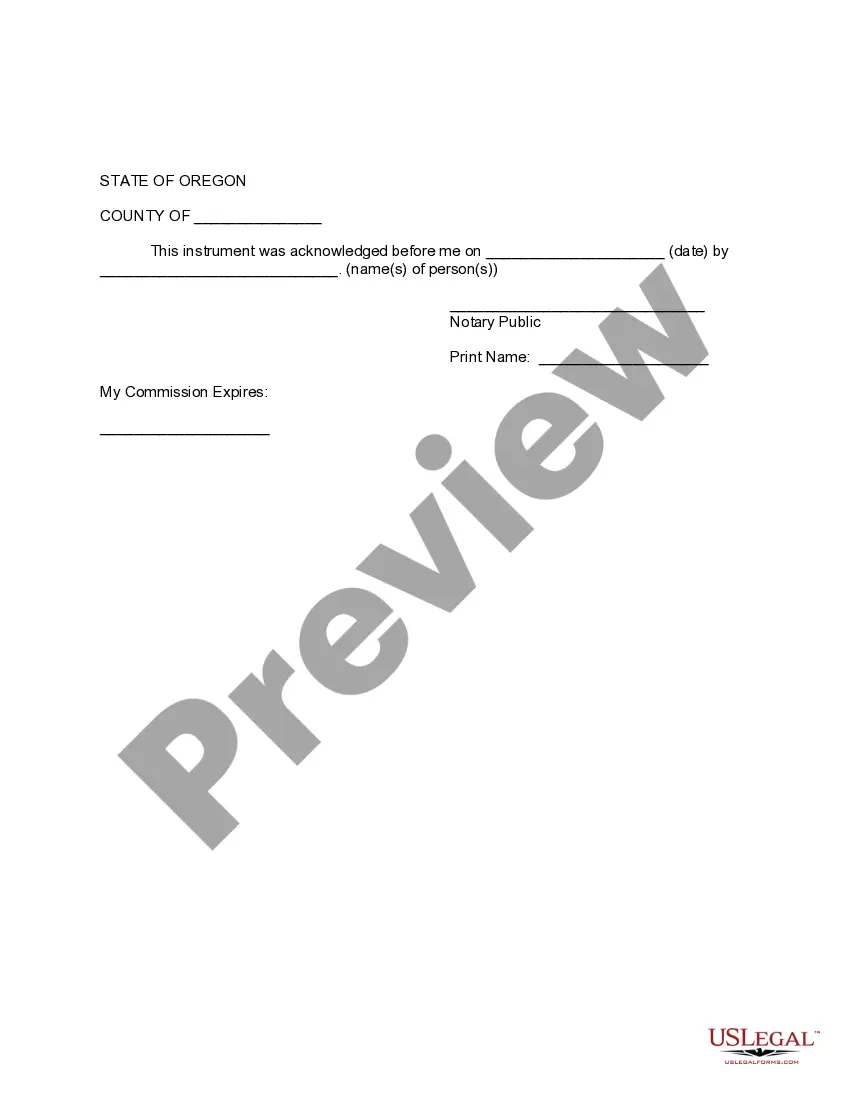

Transferring property to a trust in Oregon involves several key steps. First, you must create a trust agreement that outlines the terms and structure of your trust. After that, you will need to execute a new deed that transfers the property from your name to the trust's name. By utilizing platforms like uslegalforms, you can simplify the Eugene Oregon Financial Account Transfer to Living Trust process and ensure all legal requirements are met, providing peace of mind for you and your beneficiaries.

To transfer your checking account to a trust, you need to first establish the trust and ensure it is legally recognized. Next, contact your bank and inquire about their specific procedures for transferring an account to a living trust. Typically, you will need to provide a copy of the trust document and may need to fill out certain bank forms. By efficiently managing the Eugene Oregon Financial Account Transfer to Living Trust, you help ensure your assets are protected and passed on according to your wishes.

Assets are added to a trust through a formal process called funding. This involves changing the title or ownership documents of the assets so they fall under the trust’s control. For your Eugene Oregon Financial Account Transfer to Living Trust, you must ensure that all necessary steps are followed to prevent future legal issues. You can use uslegalforms to navigate the complexities and ensure each asset is accurately included in your living trust.

Transferring assets into a trust is a key step to ensure that your estate plan works effectively. To do this, you need to identify the assets you wish to include, then execute the appropriate transfer documents that name the trust as the new owner. When handling the Eugene Oregon Financial Account Transfer to Living Trust, you can link financial institutions or property deeds directly to the trust, making the transition seamless. Solutions like uslegalforms can assist you with the paperwork required for this transfer.

Moving items into a trust involves a process known as funding the trust. You can achieve this by transferring ownership of your financial accounts, real estate, or other assets into the trust's name. For example, when considering the Eugene Oregon Financial Account Transfer to Living Trust, make sure you gather the necessary documents and complete the required forms to properly assign these assets to the trust. Utilizing platforms like uslegalforms can simplify this process by providing the forms and guidance you need.

Transferring a checking account to your living trust is a straightforward process. First, review the trust document to ensure it is valid and ready for asset transfers. Next, contact your bank to obtain the required paperwork for the account transfer. A smooth Eugene Oregon Financial Account Transfer to Living Trust can guide you through each step to make it easier.

Although this question pertains to the UK, several lessons are universal. Parents often fail to consider tax implications when setting up a trust fund, which can complicate financial distributions. Clarity in intentions and informed planning are key to avoiding these pitfalls. For those navigating a similar scenario, the Eugene Oregon Financial Account Transfer to Living Trust offers tools to manage these aspects effectively.

While trusts offer many advantages, they can also present some negatives. Establishing a trust often requires legal and administrative costs, which may take some families by surprise. Additionally, if a trust is not properly managed, its intended benefits could be lost. To maximize the benefits of the Eugene Oregon Financial Account Transfer to Living Trust, be sure to follow best practices.

A family trust can be beneficial, yet it may have disadvantages as well. One notable concern is the potential for conflict among family members regarding decisions related to trust assets. Additionally, the initial setup and ongoing maintenance can involve time and costs. Understanding the spectrum of the Eugene Oregon Financial Account Transfer to Living Trust can help choose the right path.

One significant mistake parents make is not clearly outlining the terms of the trust. Without specific guidelines, the trust can lead to confusion among beneficiaries, resulting in disputes. It is crucial to ensure that the financial account transfer to a living trust is detailed and well-structured to prevent such misunderstandings. Consider consulting with USLegalForms for expert guidance.