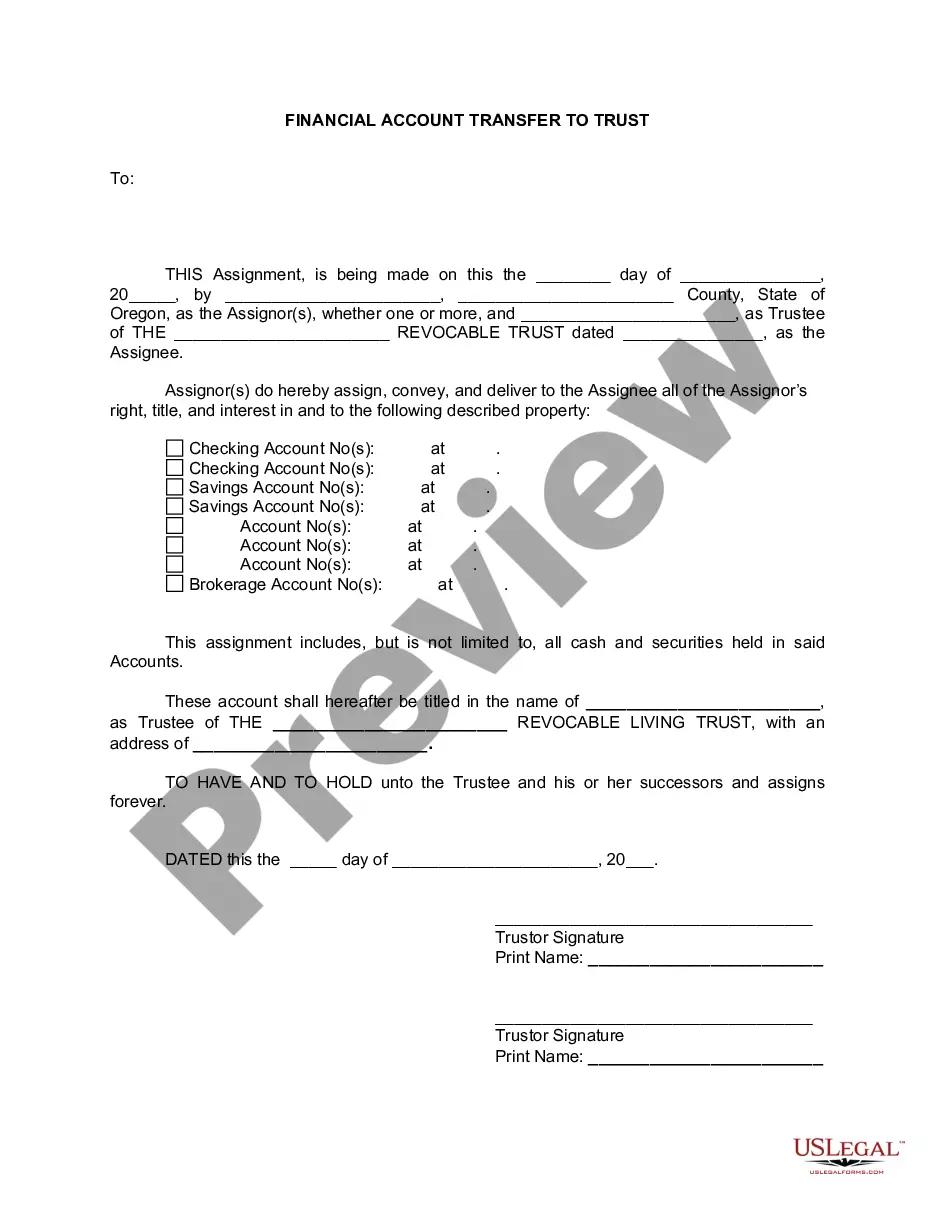

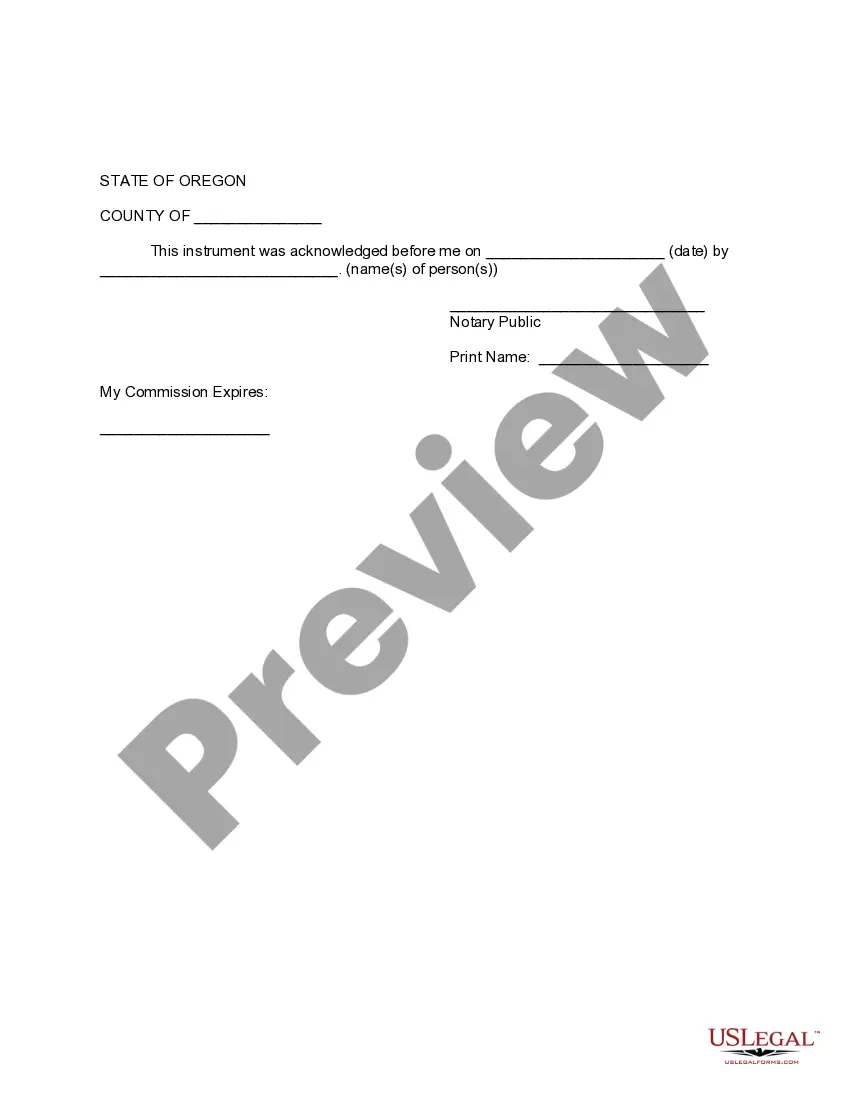

Hillsboro Oregon Financial Account Transfer to Living Trust: Understanding the Process and Benefits In Hillsboro, Oregon, individuals have the option to transfer their financial accounts to a living trust, a legally binding document that allows for the secure management and distribution of assets during and after their lifetime. This detailed description will explore the process of a financial account transfer to a living trust in Hillsboro, Oregon, as well as highlight the various types of transfers available. What is a Living Trust? A living trust, also known as a revocable trust, is a legal arrangement in which an individual, referred to as the granter, places their assets into a trust during their lifetime. The granter maintains control over these assets while designating beneficiaries and a trustee who will manage and distribute the assets according to the granter's instructions. Unlike a will, a living trust allows for the streamlined transfer of assets upon the granter's incapacity or death, avoiding the need for probate. The Process of Financial Account Transfer to Living Trust: To transfer financial accounts to a living trust in Hillsboro, Oregon, the following steps typically need to be followed: 1. Establish or revise the living trust: If an individual doesn't already have a living trust, they will need to create one. Alternatively, if they already have an existing trust, they may need to amend it to include the financial accounts they wish to transfer. 2. Review account ownership: It is essential to verify the ownership of all financial accounts that need to be transferred. This includes bank accounts, investment accounts, retirement accounts, and other assets. 3. Notify financial institutions: Contact each financial institution where the accounts are held and inform them about the desired transfer to the living trust. They may provide specific forms or procedures to complete the transfer. 4. Complete required documentation: Provide the necessary documentation required by the financial institutions, such as a copy of the living trust, account statements, and any specific transfer forms. 5. Coordinate with a professional: Seek assistance from an experienced attorney or estate planning professional who can ensure that all necessary legal requirements are met throughout the account transfer process. 6. Follow up and update accounts: After the transfer is completed, regularly review your financial accounts to ensure that they are appropriately titled in the name of the living trust. Coordinate with financial institutions as needed to make any necessary updates. Types of Financial Account Transfers to a Living Trust in Hillsboro, Oregon: Several types of financial accounts can be transferred to a living trust, including: 1. Bank accounts: This includes savings accounts, checking accounts, money market accounts, and certificates of deposit (CDs). 2. Investment accounts: Transferable investment accounts include brokerage accounts, mutual funds, stocks, bonds, and exchange-traded funds (ETFs). 3. Retirement accounts: Depending on the specific circumstances and tax implications, certain retirement accounts like IRAs (Individual Retirement Accounts) and 401(k)s can also be transferred to a living trust. 4. Life insurance policies: While life insurance policies cannot be owned directly by a trust, naming a trust as the beneficiary can facilitate the smooth transfer of the policy's proceeds to the trust after the insured's passing. By transferring these financial accounts to a living trust, individuals in Hillsboro, Oregon, can ensure the effective management and distribution of their assets, potentially minimizing taxation and avoiding probate hassles. Note: It's advisable to consult a legal professional familiar with Oregon's laws and regulations regarding living trusts and financial account transfers for personalized guidance based on individual circumstances.

Hillsboro Oregon Financial Account Transfer to Living Trust

Description

How to fill out Oregon Financial Account Transfer To Living Trust?

Regardless of social or professional position, finalizing legal documents is a regrettable requirement in today’s workplace.

Frequently, it’s nearly impossible for someone without any legal training to draft this type of paperwork from the ground up, primarily due to the complex language and legal nuances they entail.

This is where US Legal Forms proves to be beneficial.

Ensure that the form you have selected is applicable to your region since the regulations of one state or locality do not apply to another.

Preview the document and review a brief overview (if available) of scenarios for which the document can be utilized.

- Our service offers an extensive library with over 85,000 ready-to-use state-specific documents suitable for nearly any legal scenario.

- US Legal Forms also acts as a valuable resource for associates or legal advisors who wish to save time by utilizing our DIY forms.

- No matter if you need the Hillsboro Oregon Financial Account Transfer to Living Trust or any other document that is valid in your locality, with US Legal Forms, everything is accessible.

- Here’s how you can quickly acquire the Hillsboro Oregon Financial Account Transfer to Living Trust using our trustworthy service.

- If you are currently a subscriber, you can proceed to Log In to your account and download the relevant form.

- However, if you are new to our platform, make sure you follow these steps before obtaining the Hillsboro Oregon Financial Account Transfer to Living Trust.

Form popularity

FAQ

Transferring stock to a revocable trust generally does not trigger any immediate tax consequences. The assets remain under your control, and any income generated will continue to be reported on your personal tax return. It's important to consider how the transfer aligns with your overall estate planning goals within the context of Hillsboro Oregon Financial Account Transfer to Living Trust. For clarity and tailored advice, you may want to consult with a tax professional for your specific situation.

Yes, you can transfer a brokerage account to a trust, including a revocable trust. This process involves contacting your brokerage firm and providing them with the trust documents. Once the transfer is complete, the assets in the account will be held in the trust's name, ensuring they are managed according to your wishes. This method aligns with the goals of Hillsboro Oregon Financial Account Transfer to Living Trust, providing a smooth transition of your financial assets.

One downside of placing assets in a trust is the potential loss of control over those assets. Once you transfer ownership to the trust, the trust’s terms dictate how the assets are managed and distributed, which may not align with changing personal circumstances. Additionally, some types of assets might not be easily transferrable, leading to complications. If you are considering a financial account transfer to a living trust, weigh these factors carefully to make an informed decision.

A family trust can present several disadvantages, primarily related to the management of the trust and ongoing costs. Trusts require careful administration and may involve legal fees, which can accumulate over time, especially during any necessary modifications. Furthermore, if the trust is not properly funded, it may fail to provide the intended benefits for your heirs. Addressing these issues as part of your planning in Hillsboro, Oregon, can help you maximize the benefits of a living trust.

Transferring your brokerage account to a living trust involves a few key steps that require careful attention. First, contact your brokerage firm and inquire about their specific process for trust transfers. Typically, you will need to complete a transfer form and provide documentation of the trust. This is an important part of your Hillsboro, Oregon financial account transfer to a living trust, and following the firm’s instructions can ensure a smooth transition.

Deciding whether your parents should place their assets in a trust depends on their specific circumstances and goals. A trust can provide control over asset distribution and potentially reduce estate taxes, making it a valuable tool for families in Hillsboro, Oregon. If they are considering a financial account transfer to a living trust, it may be wise to consult with a legal expert who can guide them through this process. This step can help them safeguard their assets while ensuring their wishes are honored.

Transferring your bank account to your living trust involves contacting your bank and providing the necessary trust documents. They will guide you through their specific requirements to complete the transfer. This action is an important step in effective estate planning, particularly in a Hillsboro Oregon Financial Account Transfer to Living Trust, ensuring your assets are handled per your intentions.

To transfer property to a trust in Oregon, you must execute a new deed that transfers ownership from you to the trust. This deed should be recorded with the county clerk to formalize the transfer. Utilizing a Hillsboro Oregon Financial Account Transfer to Living Trust can enhance your estate plan by ensuring that real estate assets are seamlessly passed on.

Yes, it is often advisable to place your checking account in a trust. This move helps manage the account more effectively and ensures funds are distributed according to your wishes after your passing. In a Hillsboro Oregon Financial Account Transfer to Living Trust scenario, this strategy can provide peace of mind and ease for your beneficiaries.

To transfer your checking account to your living trust, contact your bank to request the necessary forms for transferring ownership. You will typically need to provide the trust documents and identification. This process is crucial in a Hillsboro Oregon Financial Account Transfer to Living Trust, as it ensures your assets are managed according to your wishes.