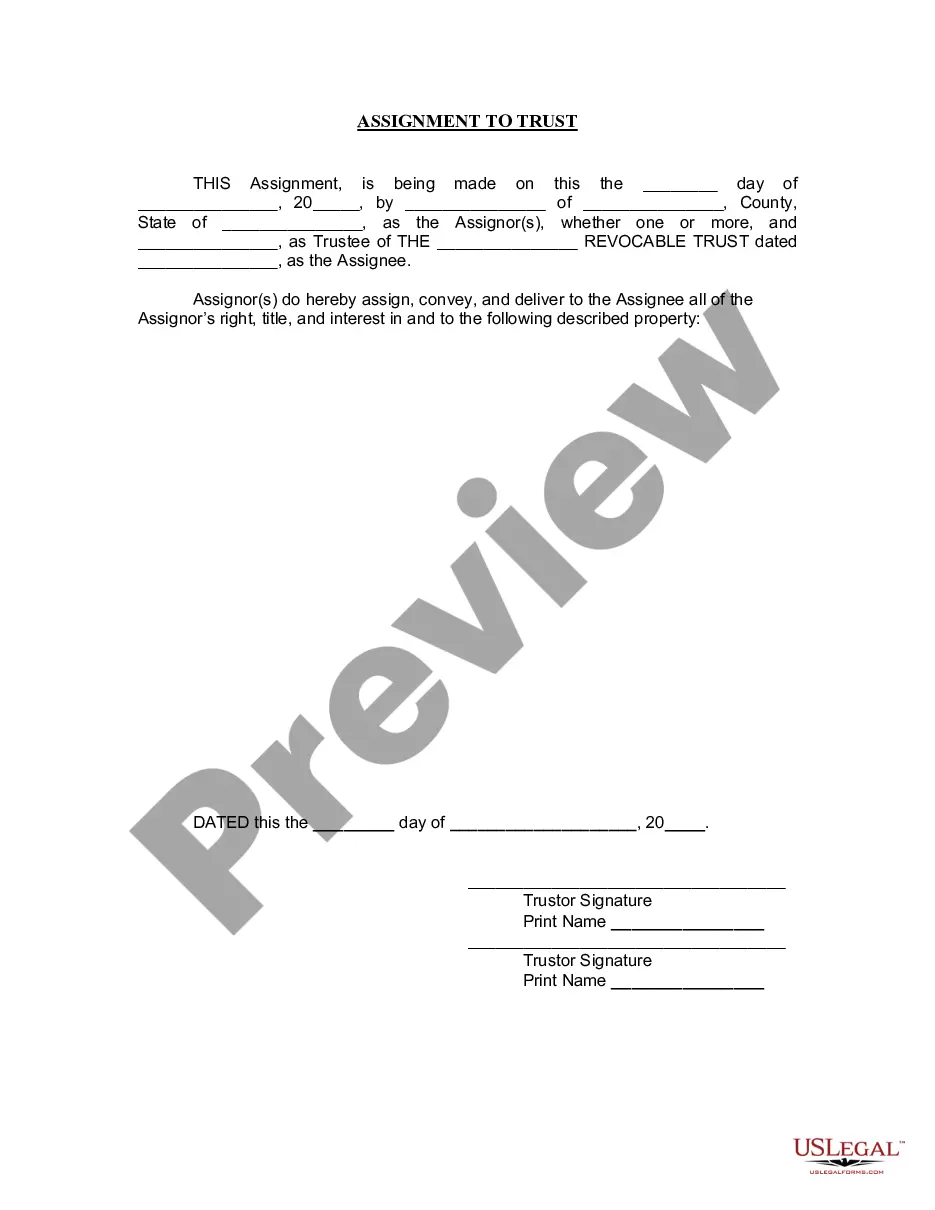

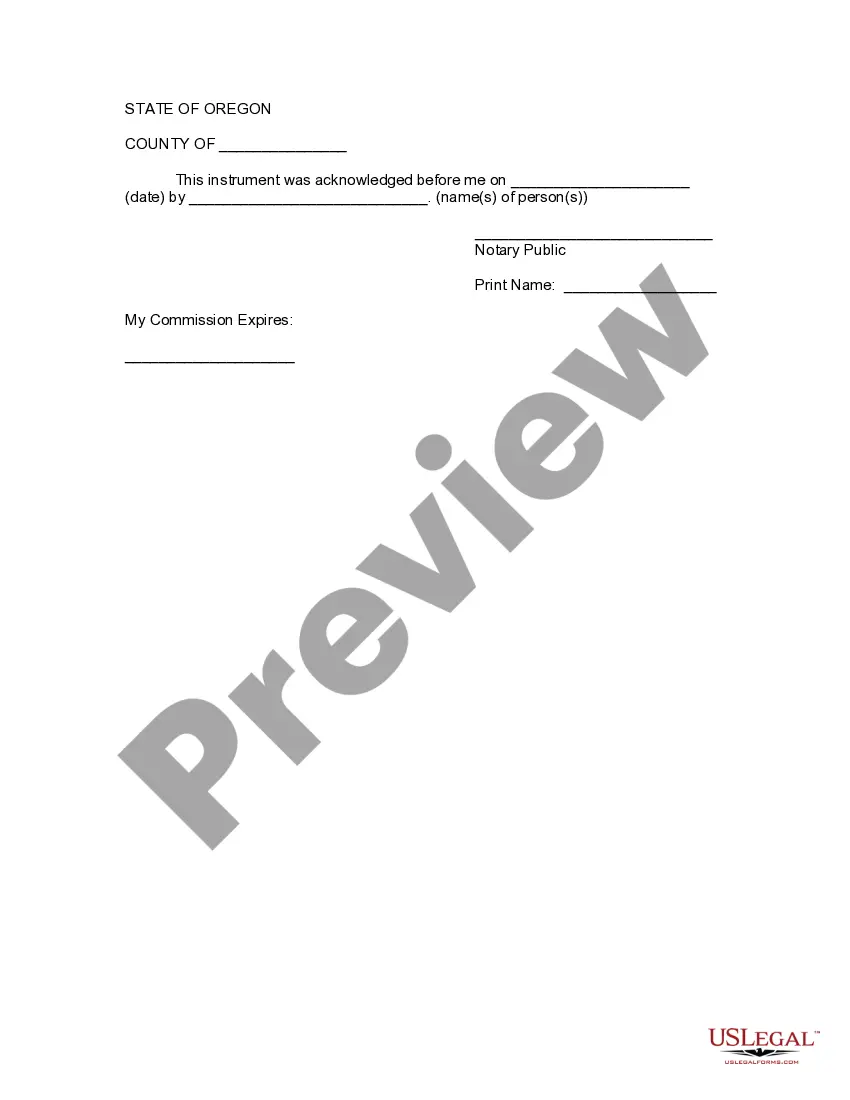

The Bend Oregon Assignment to Living Trust is a legal and financial arrangement that allows individuals in Bend, Oregon, to transfer ownership of their assets into a trust during their lifetime. This comprehensive estate planning tool helps individuals maintain control and manage their assets efficiently while providing for their loved ones and beneficiaries after their passing. When establishing a living trust in Bend, Oregon, the settler (the person creating the trust) designates a trustee who will be responsible for managing the assets held within the trust. This trustee can be the settler themselves, a family member, a trusted friend, or a professional fiduciary. The trust document outlines the terms and conditions on how the assets are to be managed, distributed, and utilized during the settler's lifetime and after their demise. There are several types of Bend Oregon Assignments to Living Trusts that individuals can consider depending on their unique circumstances and goals: 1. Revocable Living Trust: This is the most common type of living trust, allowing the settler to modify, revoke, or amend the trust during their lifetime. The assets transferred into a revocable living trust avoid probate after the settler's death, providing privacy and potential cost savings for the beneficiaries. 2. Irrevocable Living Trust: In contrast to a revocable living trust, an irrevocable living trust cannot be changed or revoked by the settler without the consent of the beneficiaries. This type of trust offers additional asset protection benefits and may help with estate tax planning. 3. Testamentary Living Trust: Unlike revocable and irrevocable living trusts, a testamentary living trust is created through the settler's will and only goes into effect upon their death. This type of trust allows the settler to maintain full control over their assets during their lifetime while providing a seamless transfer of assets to beneficiaries upon their demise. By assigning assets to a living trust, individuals in Bend, Oregon, can avoid the complex and often costly probate process, ensure efficient asset management, maintain privacy, and potentially reduce estate taxes. Consulting with an experienced estate planning attorney in Bend is highly recommended when considering an assignment to a living trust to ensure compliance with state laws and individual needs.

Bend Oregon Assignment to Living Trust

Description

How to fill out Bend Oregon Assignment To Living Trust?

We always strive to minimize or prevent legal damage when dealing with nuanced law-related or financial matters. To do so, we sign up for attorney services that, usually, are extremely expensive. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of a lawyer. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Bend Oregon Assignment to Living Trust or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is just as easy if you’re new to the website! You can create your account within minutes.

- Make sure to check if the Bend Oregon Assignment to Living Trust complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Bend Oregon Assignment to Living Trust is proper for you, you can choose the subscription plan and make a payment.

- Then you can download the form in any available file format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!