Gresham Oregon Revocation of Living Trust

Description

How to fill out Oregon Revocation Of Living Trust?

If you have previously used our service, Log In to your account and retrieve the Gresham Oregon Revocation of Living Trust onto your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it according to your billing plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You possess indefinite access to every document you have purchased: you can locate it in your profile within the My documents section whenever you wish to access it again. Utilize the US Legal Forms service to effortlessly find and store any template for your personal or business requirements!

- Ensure you’ve identified the correct document. Browse the description and utilize the Preview option, if available, to confirm if it fulfills your requirements. If it doesn’t meet your expectations, use the Search tab above to find the suitable one.

- Purchase the document. Hit the Buy Now button and select a monthly or yearly subscription option.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Gresham Oregon Revocation of Living Trust. Select the file format for your document and save it to your device.

- Complete your form. Print it out or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

A trust may become null and void for several reasons, such as the absence of essential elements during its creation, like lack of capacity or consent. Additionally, specific actions, like failing to fund the trust or violating state laws, can invalidate it. In Gresham, Oregon, proper adherence to legal requirements is crucial for the validity of your living trust. If you have concerns about the validity of a trust, our resources at USLegalForms can help clarify and resolve these issues effectively.

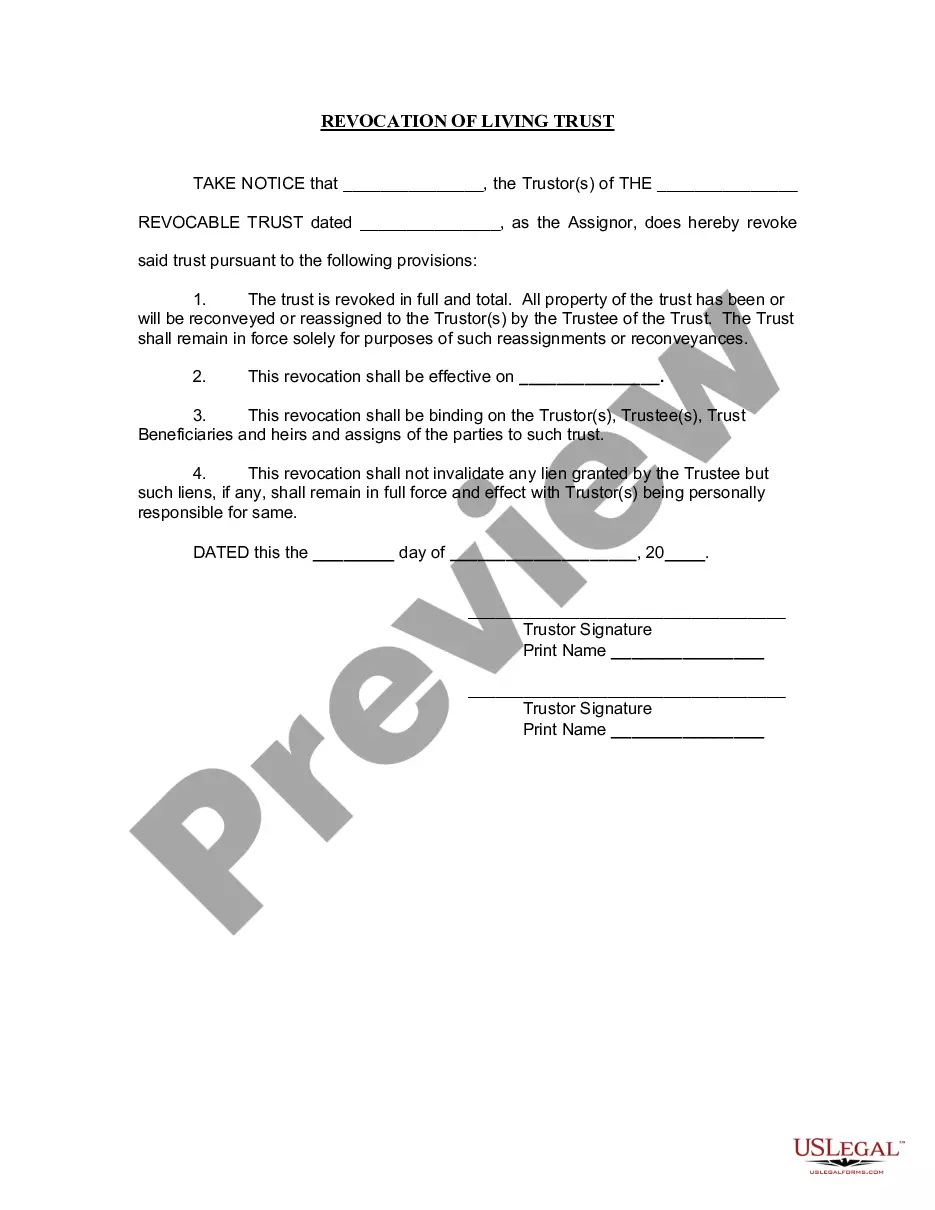

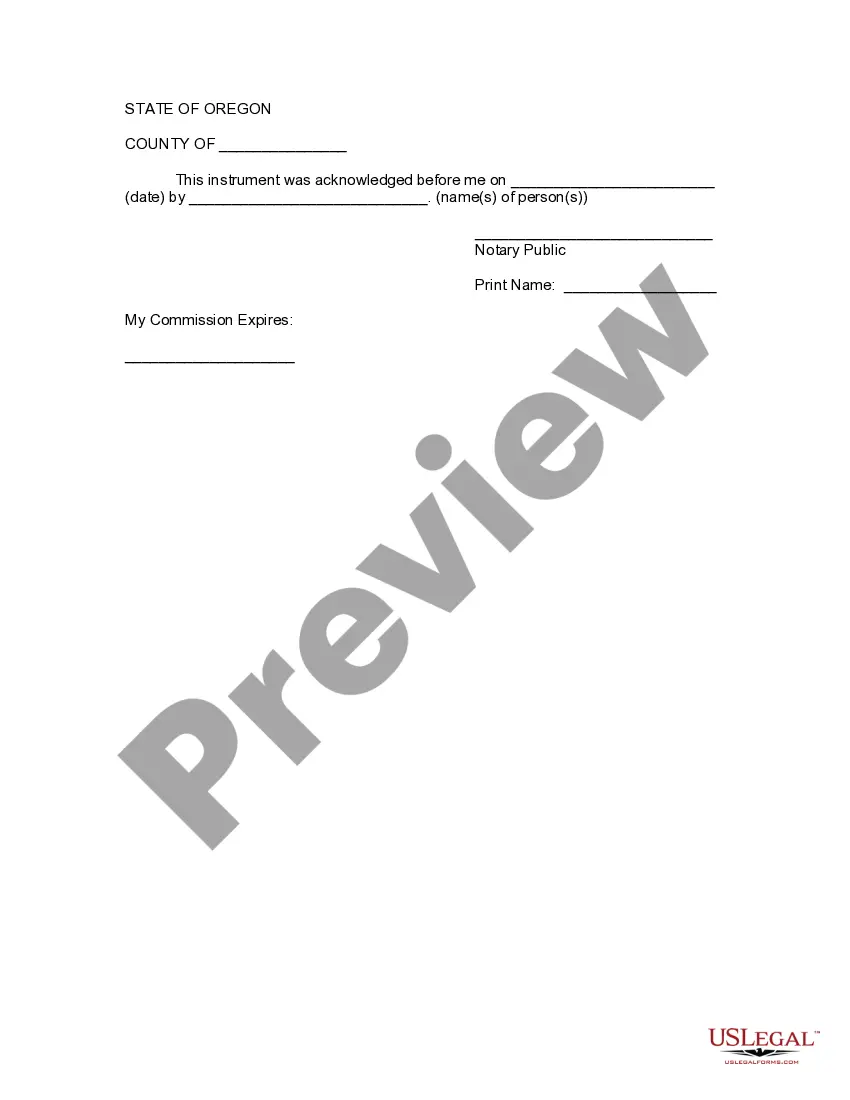

To revoke a revocable living trust, you typically need to create a formal document stating your intention to revoke it. This document should be signed and dated according to your state's requirements. In Gresham, Oregon, you can also notify the trustee and beneficiaries about the revocation to ensure clarity. For guidance on the Gresham Oregon Revocation of Living Trust process, consider using our platform, USLegalForms, to access customizable revocation templates.

Revoking a revocable trust can be straightforward, especially if you follow the required legal steps. In Gresham, Oregon, creating a revocation document is a key step in making the process effective. While it is generally easy to revoke, consultation with a legal expert can ensure all procedures are correctly followed.

A revocable trust provides a level of security but does not protect assets from creditors during the grantor's life. However, it allows for seamless asset transfer upon death, avoiding probate, which is a significant advantage in Gresham, Oregon. While it may not prevent seizure from creditors, it offers peace of mind for asset management.

The 5-year rule for trusts generally refers to the period during which certain transactions involving trusts may be scrutinized for tax purposes. In Gresham, Oregon, this means that if you created a trust and made significant changes or distributions, the IRS may review those changes within five years of establishing the trust for tax liabilities. Being informed about this rule can help you manage your trust effectively.

A trust revocation declaration is a document that officially states your decision to revoke an existing trust. It typically includes details like the trust name, date of creation, and a clear statement of revocation. For those in Gresham, Oregon, utilizing resources from US Legal Forms can help you craft a legally compliant declaration.

Yes, you can amend a revocable trust without an attorney, but it is important to follow legal requirements to ensure validity. In Gresham, Oregon, amending usually involves drafting a formal amendment document and having it signed. However, consulting an attorney can provide clarity and peace of mind as you make changes.

Filling out a revocable living trust requires you to provide information about the trust's assets and designate beneficiaries. You must also name a trustee who will manage the trust. For assistance in creating a legally sound trust in Gresham, Oregon, consider using platforms like US Legal Forms, which provide templates and guidance.

To revoke a revocable trust, you typically need to create a formal revocation document, which clearly states your intention to revoke the trust. In Gresham, Oregon, this document should be signed and dated in accordance with your state's laws. It is also advised to share the revocation with involved parties, such as your trustee and beneficiaries, to prevent confusion.

A revocable trust becomes irrevocable when the grantor, or person who made the trust, passes away or explicitly decides to change its status. After the grantor's death, the trust's terms cannot be altered. This is crucial for those in Gresham, Oregon, as it impacts how your assets are handled after your passing.