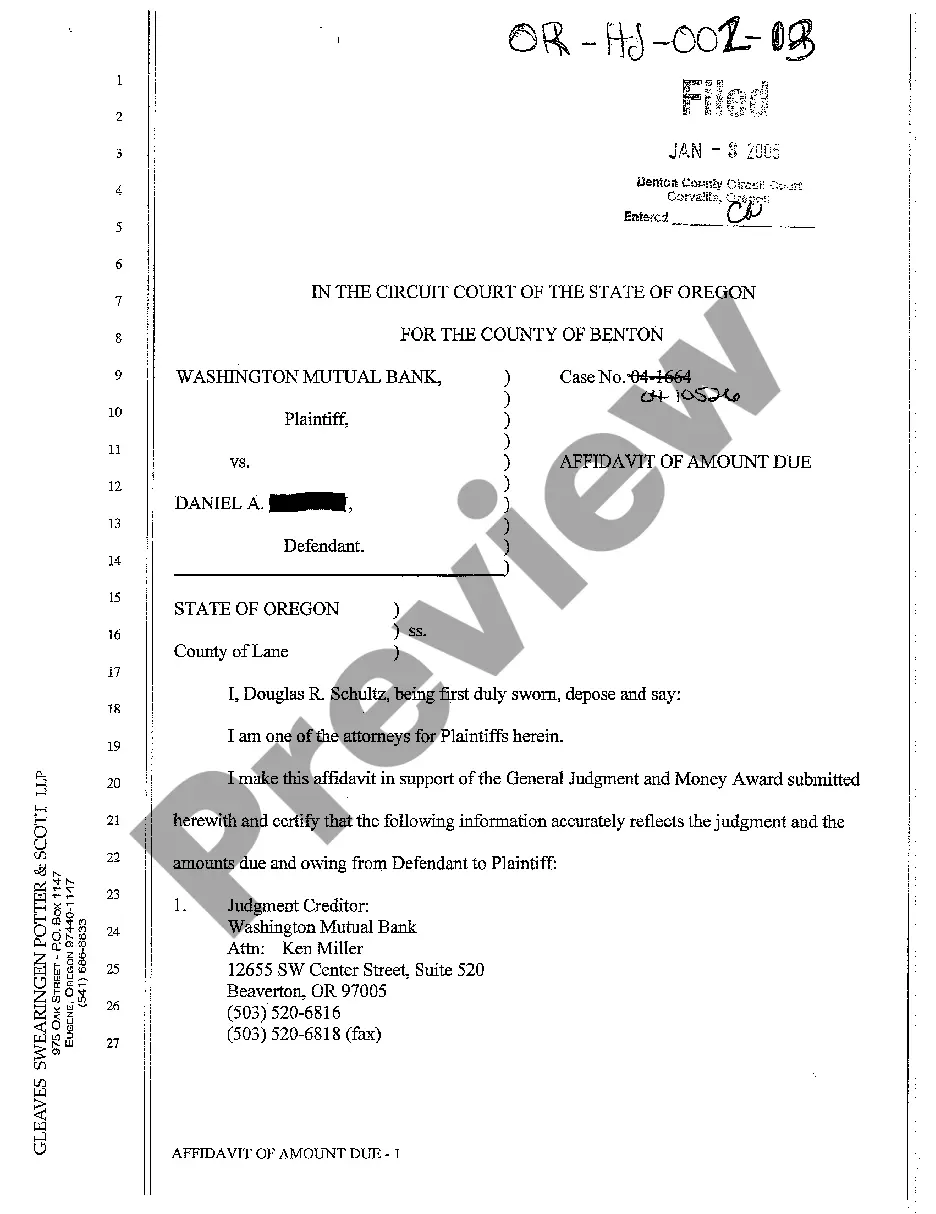

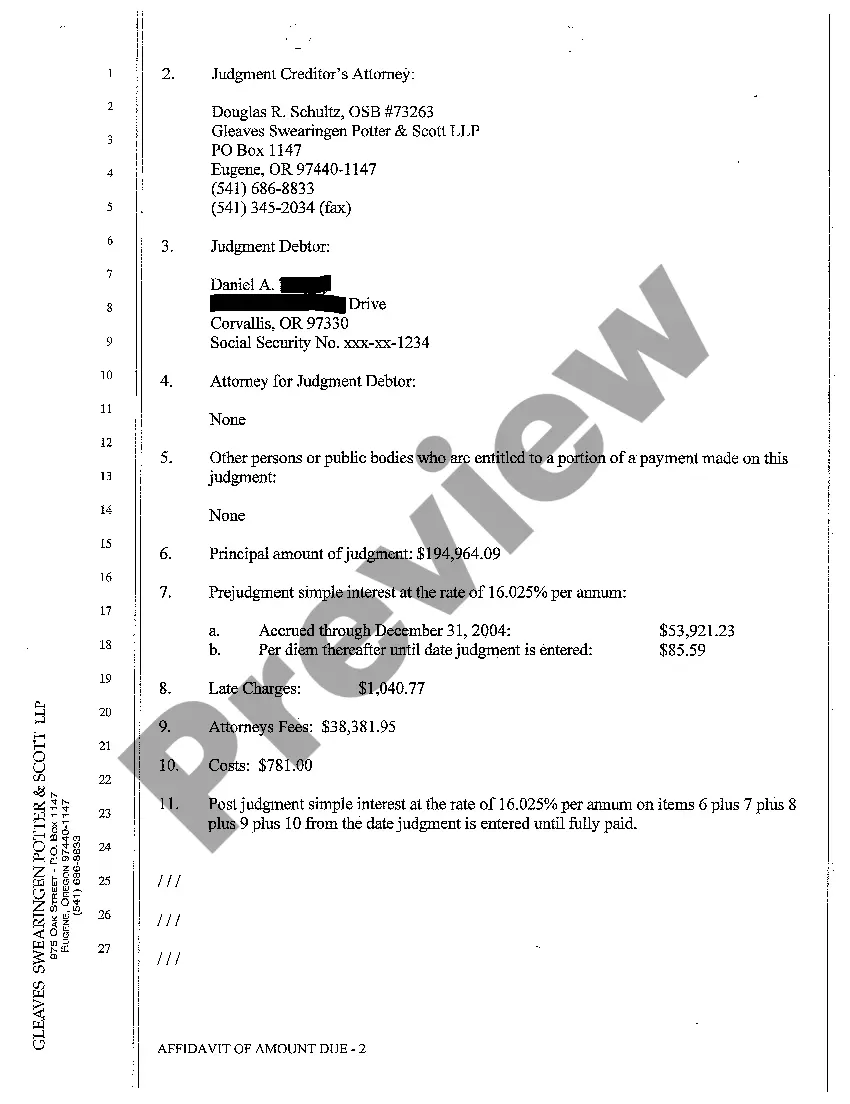

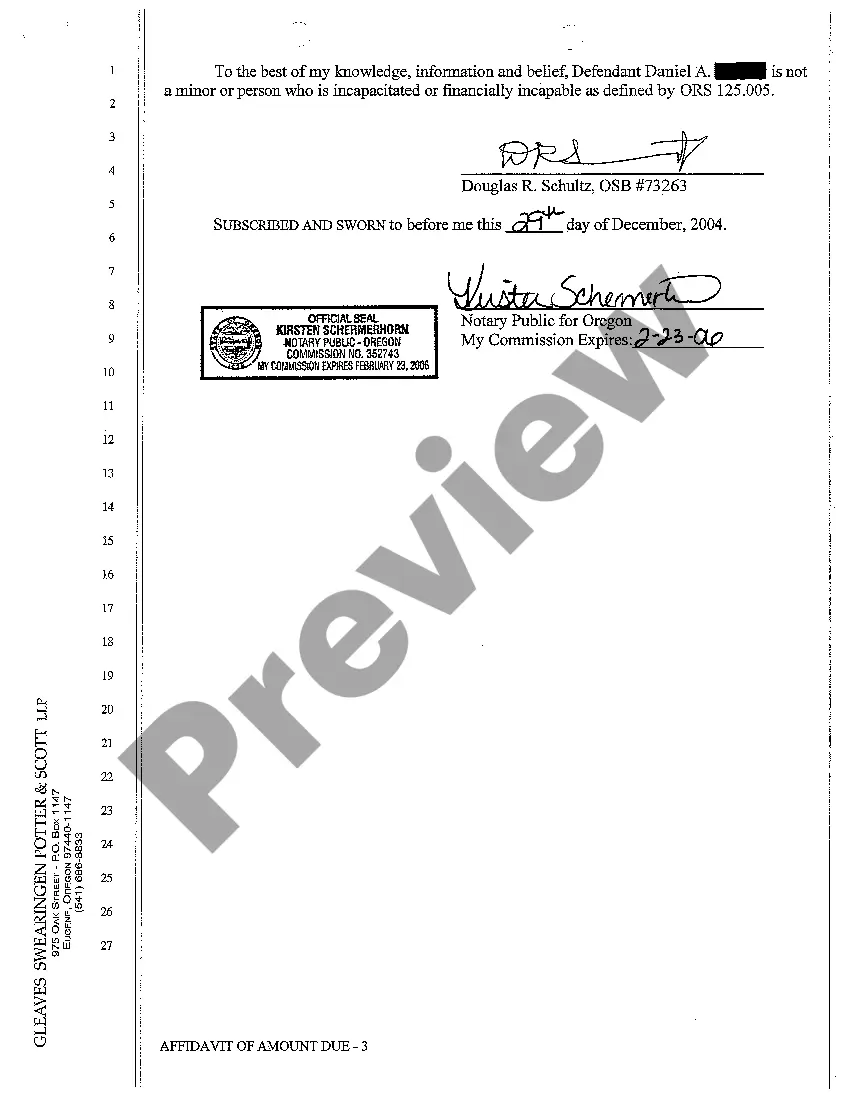

Eugene Oregon Affidavit of Amount Due is a legal document that outlines the outstanding debt owed by an individual or entity in Eugene, Oregon. This affidavit serves as a formal statement provided by a creditor or a financial institution, declaring the specific amount of money that is still due and payable. The Eugene Oregon Affidavit of Amount Due is an essential tool that helps creditors to establish a legally binding claim against a debtor. It provides proof of the outstanding balance and can be utilized in legal proceedings to demand repayment or to initiate collection actions. This document can be used in various scenarios, including but not limited to: 1. Personal loans: When an individual borrows money from a friend, family member, or private lender, and fails to repay the agreed-upon amount, the lender may file an Affidavit of Amount Due to pursue legal actions for recovery. 2. Business debts: In the case of unpaid invoices, outstanding payments, or breaches of contracts between businesses, the creditor can opt to submit an Affidavit of Amount Due to formalize the outstanding debt and seek legal remedies. 3. Credit card debts: If an individual fails to repay their credit card balance within the specified timeframe, the credit card company may file an Affidavit of Amount Due to establish their claim for the remaining balance. 4. Mortgage and real estate: When borrowers default on their mortgage payments or fail to fulfill their financial obligations related to real estate transactions, lenders can resort to filing an Affidavit of Amount Due to enforce their rights. 5. Student loans: In the case of unpaid student loans, lenders or educational institutions may use the Affidavit of Amount Due to document the outstanding debt and initiate collection actions. Different types of Eugene Oregon Affidavit of Amount Due may include variations based on the type of debt or the specific creditor involved. These types may include: 1. Personal loan Affidavit of Amount Due. 2. Business loan Affidavit of Amount Due. 3. Credit card debt Affidavit of Amount Due. 4. Mortgage Affidavit of Amount Due. 5. Student loan Affidavit of Amount Due. These different types address specific situations and allow the creditor to communicate the amount owed accurately, helping them take appropriate action for debt recovery. It is important to note that the Eugene Oregon Affidavit of Amount Due must comply with relevant state laws and regulations. Therefore, seeking legal advice or assistance is recommended when preparing or responding to such affidavits.

Eugene Oregon Affidavit of Amount Due

State:

Oregon

City:

Eugene

Control #:

OR-HJ-002-03

Format:

PDF

Instant download

This form is available by subscription

Description

A09 Affidavit of Amount Due

Eugene Oregon Affidavit of Amount Due is a legal document that outlines the outstanding debt owed by an individual or entity in Eugene, Oregon. This affidavit serves as a formal statement provided by a creditor or a financial institution, declaring the specific amount of money that is still due and payable. The Eugene Oregon Affidavit of Amount Due is an essential tool that helps creditors to establish a legally binding claim against a debtor. It provides proof of the outstanding balance and can be utilized in legal proceedings to demand repayment or to initiate collection actions. This document can be used in various scenarios, including but not limited to: 1. Personal loans: When an individual borrows money from a friend, family member, or private lender, and fails to repay the agreed-upon amount, the lender may file an Affidavit of Amount Due to pursue legal actions for recovery. 2. Business debts: In the case of unpaid invoices, outstanding payments, or breaches of contracts between businesses, the creditor can opt to submit an Affidavit of Amount Due to formalize the outstanding debt and seek legal remedies. 3. Credit card debts: If an individual fails to repay their credit card balance within the specified timeframe, the credit card company may file an Affidavit of Amount Due to establish their claim for the remaining balance. 4. Mortgage and real estate: When borrowers default on their mortgage payments or fail to fulfill their financial obligations related to real estate transactions, lenders can resort to filing an Affidavit of Amount Due to enforce their rights. 5. Student loans: In the case of unpaid student loans, lenders or educational institutions may use the Affidavit of Amount Due to document the outstanding debt and initiate collection actions. Different types of Eugene Oregon Affidavit of Amount Due may include variations based on the type of debt or the specific creditor involved. These types may include: 1. Personal loan Affidavit of Amount Due. 2. Business loan Affidavit of Amount Due. 3. Credit card debt Affidavit of Amount Due. 4. Mortgage Affidavit of Amount Due. 5. Student loan Affidavit of Amount Due. These different types address specific situations and allow the creditor to communicate the amount owed accurately, helping them take appropriate action for debt recovery. It is important to note that the Eugene Oregon Affidavit of Amount Due must comply with relevant state laws and regulations. Therefore, seeking legal advice or assistance is recommended when preparing or responding to such affidavits.

Free preview

How to fill out Eugene Oregon Affidavit Of Amount Due?

If you’ve already utilized our service before, log in to your account and download the Eugene Oregon Affidavit of Amount Due on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Make sure you’ve found a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Eugene Oregon Affidavit of Amount Due. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!