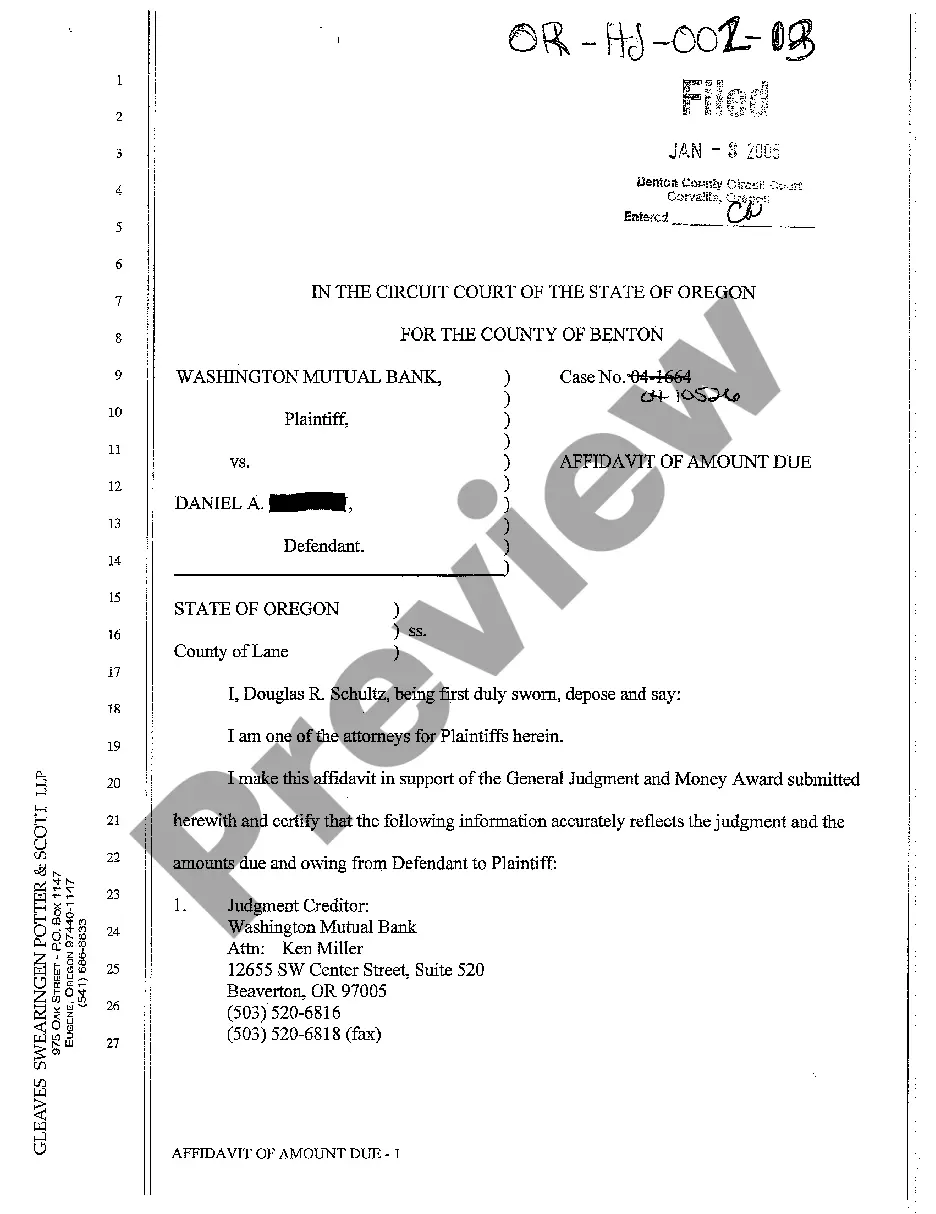

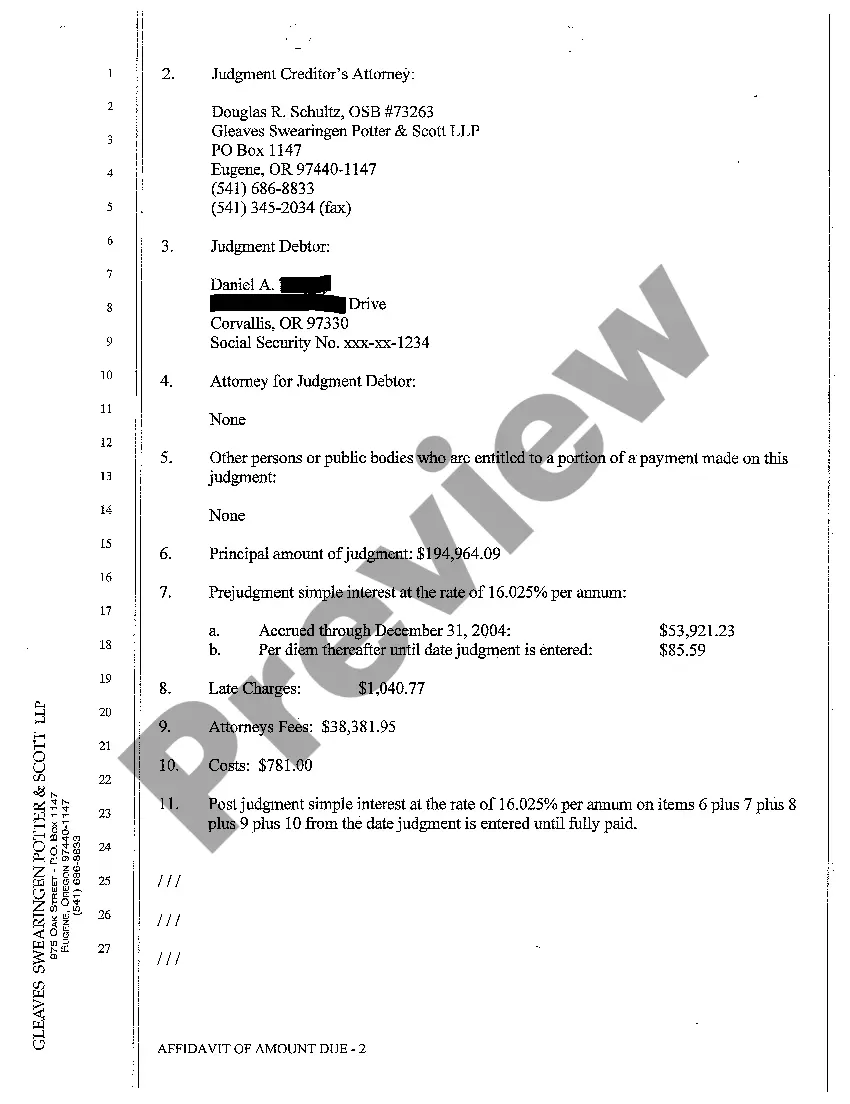

The Portland Oregon Affidavit of Amount Due is a legal document that outlines the details and calculations of an outstanding debt or payment owed within the city of Portland, Oregon. This affidavit is commonly used in various legal proceedings, such as foreclosure processes, landlord-tenant disputes, or debt collection cases. The purpose of the Portland Oregon Affidavit of Amount Due is to provide an accurate account of the amount owed by an individual or entity, serving as evidence in legal proceedings. It requires precise and detailed information to clearly state the outstanding debt, including the principal amount, any accrued interest, late fees, penalties, and other charges associated with the debt. Some relevant keywords associated with the Portland Oregon Affidavit of Amount Due include: — Debt documentation: This affidavit acts as official documentation of the outstanding debt, ensuring transparency and accountability in legal disputes. — Legal proceedings: The affidavit is commonly utilized in legal proceedings, such as foreclosure processes, tenant evictions, small claims court cases, or debt collection lawsuits. — Calculation of debt: The affidavit provides a detailed breakdown of the debt owed, including the principal amount, interest rates, late fees, penalties, and any other charges incurred. — Foreclosure proceedings: In the case of mortgage defaults, the Portland Oregon Affidavit of Amount Due is often used as part of the foreclosure process, detailing the exact amount owed by the delinquent borrower. — Tenant-landlord disputes: If a tenant has unpaid rent or has violated lease terms, the affidavit may be used in legal proceedings to determine the amount owed to the landlord. — Debt collection cases: The affidavit is crucial in debt collection cases, where creditors rely on this document to demonstrate the total outstanding debt and the basis for legal action. Different types of Portland Oregon Affidavit of Amount Due may vary depending on the specific legal situation. For instance: — Mortgage Affidavit of Amount Due: Used in foreclosure proceedings, this affidavit specifically details the outstanding amount owed by a borrower who has defaulted on their mortgage payments. — Rental Affidavit of Amount Due: In tenant-landlord disputes, this type of affidavit outlines the total debt owed by a tenant, encompassing unpaid rent, late fees, damages, and other breaches of the lease agreement. — Debt Collection Affidavit of Amount Due: Used by creditors or debt collection agencies, this affidavit supports legal actions taken to recover delinquent debts, itemizing the exact amount owed by the debtor. In conclusion, the Portland Oregon Affidavit of Amount Due is an essential legal document that accurately determines the outstanding debt owed by an individual or entity. It plays a crucial role in legal proceedings such as foreclosure cases, landlord-tenant disputes, and debt collection matters. By providing a detailed breakdown of the debt, it serves as a key piece of evidence to support legal action and ensure transparency in financial transactions.

Portland Oregon Affidavit of Amount Due

Description

How to fill out Portland Oregon Affidavit Of Amount Due?

Regardless of social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone without any law background to draft this sort of paperwork from scratch, mostly due to the convoluted jargon and legal subtleties they entail. This is where US Legal Forms comes to the rescue. Our service offers a massive collection with over 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time using our DYI forms.

No matter if you require the Portland Oregon Affidavit of Amount Due or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Portland Oregon Affidavit of Amount Due quickly using our trustworthy service. In case you are presently an existing customer, you can proceed to log in to your account to download the needed form.

Nevertheless, if you are a novice to our platform, ensure that you follow these steps before downloading the Portland Oregon Affidavit of Amount Due:

- Ensure the template you have found is good for your location since the rules of one state or area do not work for another state or area.

- Review the document and go through a brief description (if provided) of cases the paper can be used for.

- In case the one you selected doesn’t meet your requirements, you can start over and search for the necessary document.

- Click Buy now and pick the subscription option you prefer the best.

- with your credentials or register for one from scratch.

- Pick the payment gateway and proceed to download the Portland Oregon Affidavit of Amount Due once the payment is done.

You’re all set! Now you can proceed to print out the document or fill it out online. In case you have any problems locating your purchased forms, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.