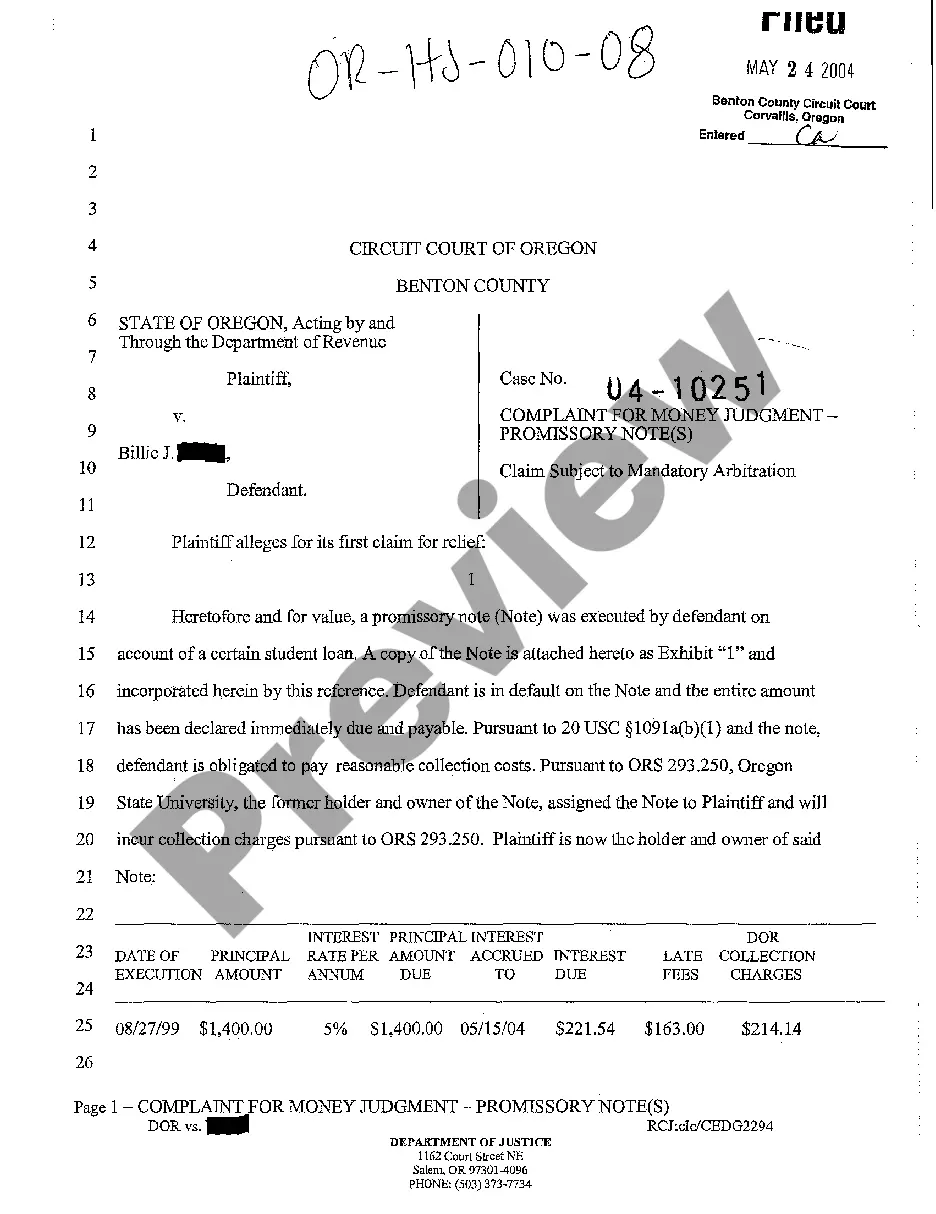

Title: Understanding the Bend Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan Introduction: When borrowers fail to meet their obligations on a student loan in Bend, Oregon, creditors have the option to pursue legal action to recover the outstanding amount. This legal proceeding is known as a "Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan." In this article, we will delve into the details of this complaint, its purpose, process, and available remedies for both borrowers and lenders. Types of Bend Oregon Complaints for Money Judgment on Promissory Note for Failure to Pay on Student Loan: 1. Bend Oregon Complaint for Money Judgment on Promissory Note: This type of complaint is filed when a lender takes legal action against a borrower who has failed to make payments on their student loan per the terms of the promissory note. The lender seeks a money judgment in order to recover the outstanding funds. 2. Bend Oregon Complaint for Money Judgment on Promissory Note with Damages: In some cases, lenders may also include a claim for damages in their complaint. This occurs when the lender has suffered additional financial losses due to the borrower's failure to pay, such as interest accrual, collection costs, or attorney fees. Key Elements of a Bend Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan: 1. Plaintiff and Defendant Identification: The complaint begins by identifying the lender (plaintiff) and the borrower (defendant) involved in the lawsuit. This includes their full legal names, contact information, and any relevant account or loan numbers. 2. Promissory Note and Breach of Agreement: The complaint outlines the terms and conditions of the promissory note, including the agreed-upon loan amount, interest rate, repayment schedule, and any applicable late fees. It establishes how the borrower has breached these terms by failing to make timely payments or fulfilling their financial obligations. 3. Amount of Outstanding Debt: The complaint specifies the exact amount of money outstanding, including principal, accrued interest, and any other costs incurred due to the debtor's non-payment. Supporting documentation, such as loan statements or payment records, may be included as evidence. 4. Request for Money Judgment: The lender will request a specific amount as a money judgment, which includes the outstanding debt, applicable interest, and other permissible costs. This reflects the total amount the borrower is legally obligated to repay. 5. Legal Remedies and Relief Sought: The complaint may outline the legal remedies the lender seeks, such as wage garnishment, bank account levies, or liens on property, to enforce the money judgment. Additionally, lenders may request immediate payment, ongoing repayment plans, or other appropriate relief. Conclusion: A Bend Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan is a legal recourse utilized by lenders when borrowers in Bend fail to meet their financial obligations on student loans. Through this complaint, lenders seek repayment of the outstanding debt, including any damages incurred. It is essential for borrowers and lenders to navigate this process diligently and seek legal advice if necessary to understand their rights and responsibilities.

Bend Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan

Description

How to fill out Bend Oregon Complaint For Money Judgment On Promissory Note For Failure To Pay On Student Loan?

If you are searching for a relevant form template, it’s impossible to find a better service than the US Legal Forms website – one of the most considerable libraries on the internet. With this library, you can get a large number of document samples for business and individual purposes by categories and states, or keywords. With our high-quality search function, discovering the most recent Bend Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan is as elementary as 1-2-3. In addition, the relevance of each record is confirmed by a team of skilled attorneys that regularly review the templates on our website and revise them based on the most recent state and county regulations.

If you already know about our system and have an account, all you need to get the Bend Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan is to log in to your user profile and click the Download button.

If you make use of US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have found the form you require. Look at its information and use the Preview function to explore its content. If it doesn’t meet your needs, utilize the Search field at the top of the screen to find the proper record.

- Affirm your decision. Choose the Buy now button. After that, select your preferred subscription plan and provide credentials to register an account.

- Process the transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Receive the template. Choose the file format and save it on your device.

- Make adjustments. Fill out, modify, print, and sign the received Bend Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan.

Each template you save in your user profile has no expiry date and is yours permanently. You can easily access them via the My Forms menu, so if you need to get an additional version for enhancing or printing, you can come back and export it again at any time.

Take advantage of the US Legal Forms extensive catalogue to gain access to the Bend Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan you were looking for and a large number of other professional and state-specific templates on a single website!