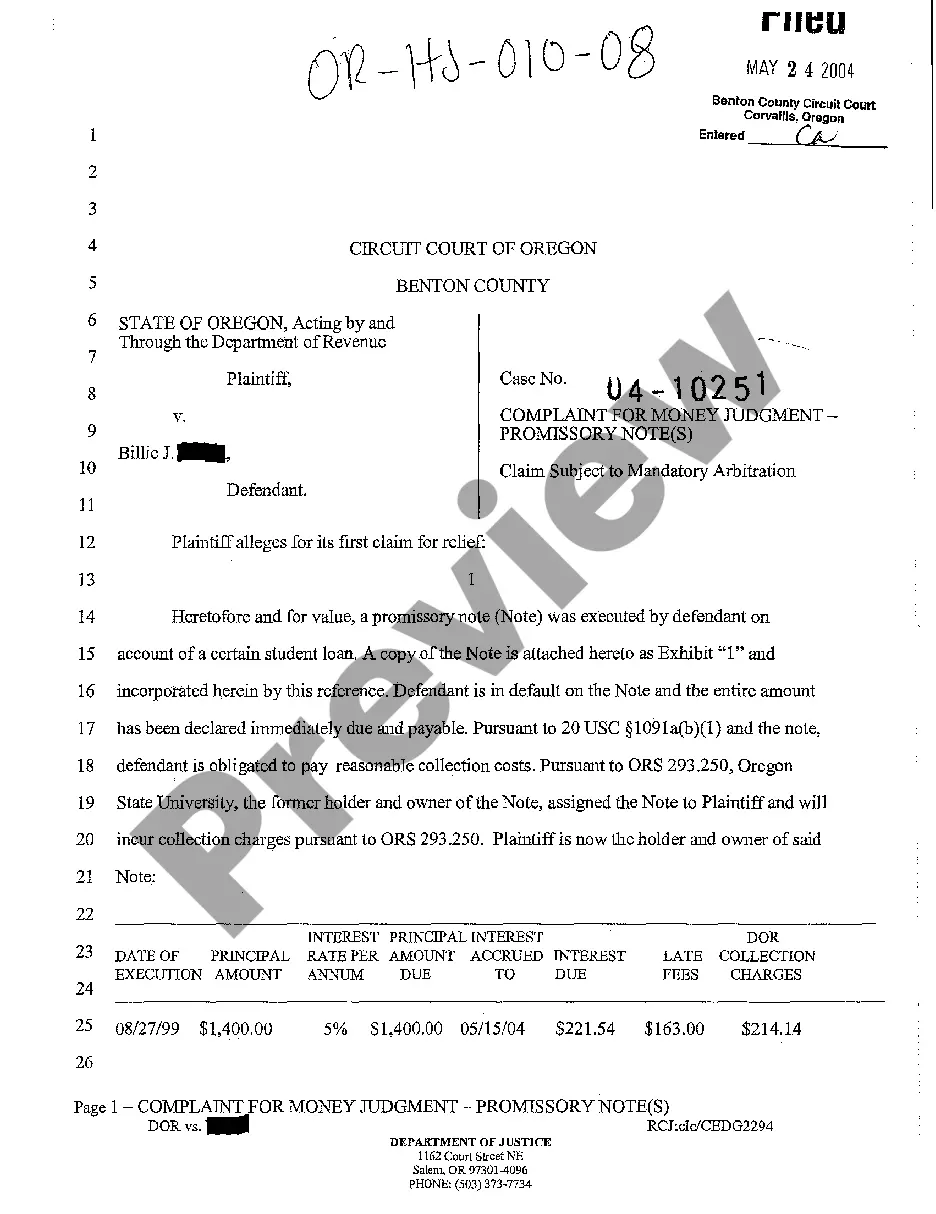

Title: Understanding Eugene Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan Introduction: When it comes to dealing with delinquent student loans, Eugene, Oregon provides a legal avenue known as the Complaint for Money Judgment on Promissory Note. This mechanism helps lenders pursue individuals who have failed to meet their student loan repayment obligations. This article will delve into the details of this legal process, including different types of Eugene Oregon Complaints for Money Judgment on Promissory Note. 1. What is a Eugene Oregon Complaint for Money Judgment on Promissory Note? A Eugene Oregon Complaint for Money Judgment on Promissory Note is a legal action taken by a lender against a borrower who has defaulted on their student loan repayment. It serves as a formal legal document initiating a lawsuit with the goal of obtaining a judgment for the amount owed. 2. Key Elements of a Complaint for Money Judgment on Promissory Note: — Plaintiff and Defendant: The lender is the plaintiff, while the borrower who failed to pay constitutes the defendant. — Promissory Note: Refers to the written agreement between the lender and borrower, outlining the terms and conditions of the loan. — Failure to Pay Allegations: The complaint must clearly state the borrower's failure to make timely payments as agreed upon in the promissory note. — Calculation of Debt: The lender needs to provide a detailed breakdown of the outstanding principal, accrued interest, and any other relevant fees. — Legal Relief: The desired outcome seeks a money judgment against the borrower, including the outstanding balance, accrued interest, and legal fees. 3. Different Types of Eugene Oregon Complaints for Money Judgment on Promissory Note: a) Standard Complaint for Money Judgment on Promissory Note: This is the most common type of complaint, wherein lenders seek a judgment for the entire outstanding balance, plus any accrued interest and additional fees specified in the promissory note. b) Complaint for Partial Default Judgment on Promissory Note: If a borrower has made partial payments or has defaulted on specific portions of the loan, the lender may file a complaint seeking a judgment for the outstanding balance on those specific portions only. c) Complaint for Acceleration of Debt: In cases where the promissory note allows for acceleration, lenders may file this complaint to demand immediate payment of the full remaining loan balance, instead of waiting for it to become due over time. Conclusion: Eugene Oregon Complaints for Money Judgment on Promissory Note provide a legal avenue for lenders to pursue individuals who default on their student loans. Understanding the various types of complaints can help both lenders and borrowers navigate the legal process effectively. If you find yourself facing such a complaint, it is crucial to seek legal counsel to ensure your rights and interests are protected throughout the proceedings.

Eugene Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan

Description

How to fill out Eugene Oregon Complaint For Money Judgment On Promissory Note For Failure To Pay On Student Loan?

If you are looking for a valid form, it’s difficult to find a more convenient platform than the US Legal Forms site – one of the most comprehensive online libraries. Here you can get thousands of document samples for business and individual purposes by categories and states, or keywords. With our advanced search option, getting the most up-to-date Eugene Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan is as easy as 1-2-3. Furthermore, the relevance of each file is verified by a group of professional attorneys that on a regular basis review the templates on our website and revise them in accordance with the most recent state and county demands.

If you already know about our system and have an account, all you need to receive the Eugene Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan is to log in to your account and click the Download option.

If you utilize US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have opened the sample you require. Look at its explanation and utilize the Preview option (if available) to see its content. If it doesn’t suit your needs, utilize the Search option at the top of the screen to discover the appropriate document.

- Affirm your selection. Select the Buy now option. After that, pick the preferred pricing plan and provide credentials to sign up for an account.

- Process the financial transaction. Use your bank card or PayPal account to finish the registration procedure.

- Obtain the form. Indicate the file format and save it on your device.

- Make changes. Fill out, edit, print, and sign the received Eugene Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan.

Every form you add to your account does not have an expiry date and is yours permanently. You can easily access them via the My Forms menu, so if you need to receive an additional duplicate for editing or printing, you can come back and export it once more whenever you want.

Make use of the US Legal Forms extensive collection to get access to the Eugene Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan you were looking for and thousands of other professional and state-specific templates on one website!