Title: A Comprehensive Overview of Gresham Oregon Complaints for Money Judgment on Promissory Notes: Addressing Failure to Repay Student Loans Introduction: Gresham, Oregon provides a legal framework for individuals and institutions facing non-repayment of student loans through a Complaint for Money Judgment on Promissory Note. This legal process enables lenders to seek redress for outstanding student loans, ensuring accountability and protecting the integrity of the student loan system. This article aims to provide a detailed description of the Gresham Oregon complaints related to money judgment on promissory notes for failure to pay student loans. Types of Gresham Oregon Complaints for Money Judgment on Promissory Note: 1. Standard Gresham Oregon Complaint for Money Judgment on Promissory Note: — If a borrower fails to repay a student loan as agreed upon in the promissory note, the lender can file a complaint for a money judgment at the Gresham, Oregon court. — This type of complaint outlines the outstanding loan amount, interest, penalties, and other relevant details, seeking financial restitution from the borrower. 2. Gresham Oregon Complaint with Request for Garnishment of Wages: — In cases where the borrower fails to respond to repayment demands and doesn't comply with a money judgment, the lender can file an additional complaint requesting wage garnishment. — This complaint seeks court intervention to deduct a portion of the borrower's wages, ensuring a consistent repayment schedule until the outstanding amount is settled. 3. Gresham Oregon Complaint for Money Judgment on Promissory Note with Request for Liens: — Lenders facing severe non-repayment may opt for a complaint seeking a lien against the borrower's property or assets. — This complaint aims to secure collateral for the outstanding amount, granting the lender legal rights to seize and liquidate assets to satisfy the loan. 4. Gresham Oregon Complaint for Money Judgment on Promissory Note with Request for Bank Account Levy: — In situations where wage garnishment alone is deemed inadequate, lenders may pursue a bank account levy complaint to access the borrower's funds directly. — This complaint seeks to freeze and seize funds from the borrower's bank account, ensuring repayment of the loan through available financial assets. Conclusion: Gresham, Oregon offers various avenues for lenders through its complaints for money judgment on promissory notes to address the failure of student loan repayment. These legal processes ensure that borrowers are held accountable for their financial obligations and help maintain the integrity of the student loan system. By utilizing appropriate legal tools such as wage garnishment, liens, or bank account levies, lenders can seek financial restitution for outstanding student loans while adhering to the applicable laws and regulations in Gresham, Oregon.

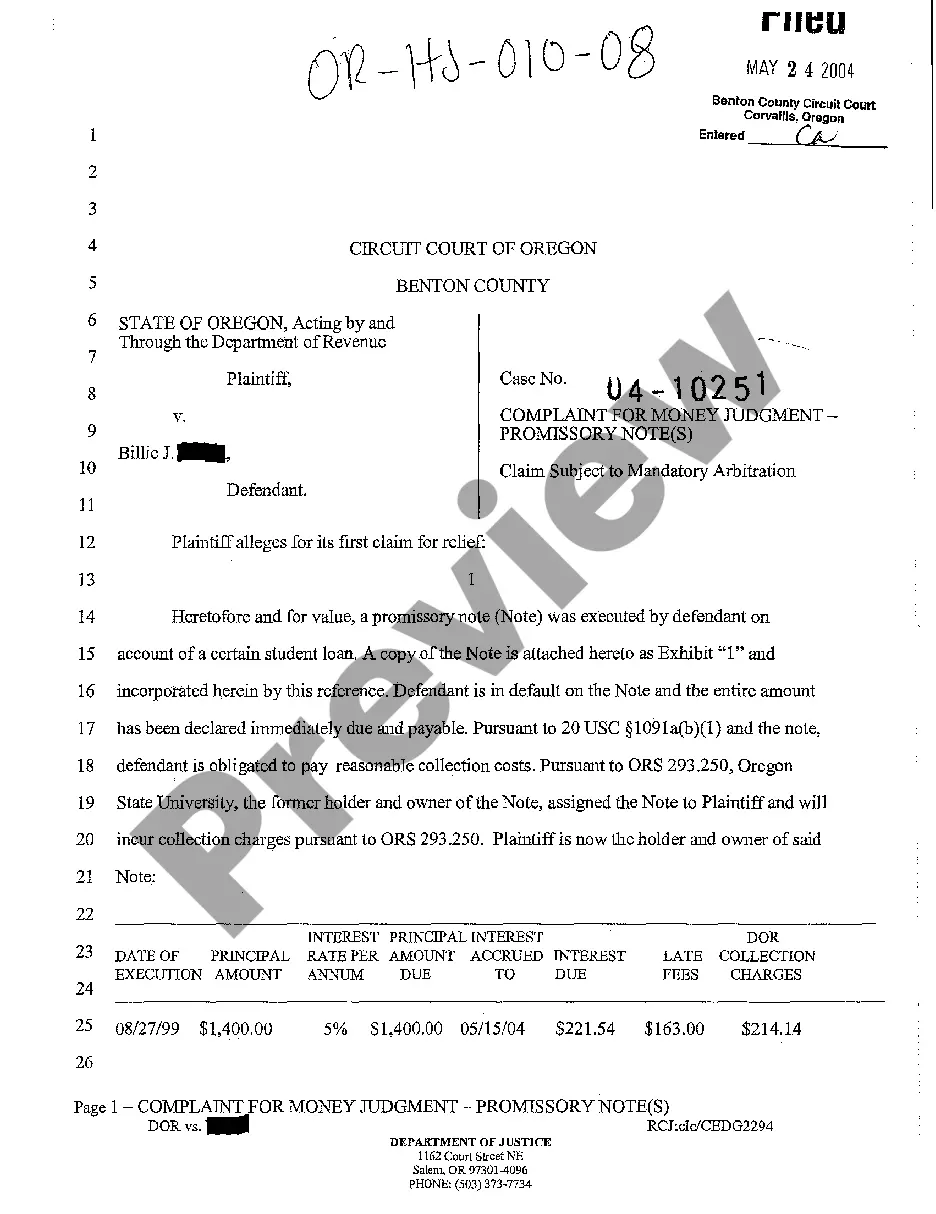

Gresham Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan

State:

Oregon

City:

Gresham

Control #:

OR-HJ-010-08

Format:

PDF

Instant download

This form is available by subscription

Description

A01 Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan

Title: A Comprehensive Overview of Gresham Oregon Complaints for Money Judgment on Promissory Notes: Addressing Failure to Repay Student Loans Introduction: Gresham, Oregon provides a legal framework for individuals and institutions facing non-repayment of student loans through a Complaint for Money Judgment on Promissory Note. This legal process enables lenders to seek redress for outstanding student loans, ensuring accountability and protecting the integrity of the student loan system. This article aims to provide a detailed description of the Gresham Oregon complaints related to money judgment on promissory notes for failure to pay student loans. Types of Gresham Oregon Complaints for Money Judgment on Promissory Note: 1. Standard Gresham Oregon Complaint for Money Judgment on Promissory Note: — If a borrower fails to repay a student loan as agreed upon in the promissory note, the lender can file a complaint for a money judgment at the Gresham, Oregon court. — This type of complaint outlines the outstanding loan amount, interest, penalties, and other relevant details, seeking financial restitution from the borrower. 2. Gresham Oregon Complaint with Request for Garnishment of Wages: — In cases where the borrower fails to respond to repayment demands and doesn't comply with a money judgment, the lender can file an additional complaint requesting wage garnishment. — This complaint seeks court intervention to deduct a portion of the borrower's wages, ensuring a consistent repayment schedule until the outstanding amount is settled. 3. Gresham Oregon Complaint for Money Judgment on Promissory Note with Request for Liens: — Lenders facing severe non-repayment may opt for a complaint seeking a lien against the borrower's property or assets. — This complaint aims to secure collateral for the outstanding amount, granting the lender legal rights to seize and liquidate assets to satisfy the loan. 4. Gresham Oregon Complaint for Money Judgment on Promissory Note with Request for Bank Account Levy: — In situations where wage garnishment alone is deemed inadequate, lenders may pursue a bank account levy complaint to access the borrower's funds directly. — This complaint seeks to freeze and seize funds from the borrower's bank account, ensuring repayment of the loan through available financial assets. Conclusion: Gresham, Oregon offers various avenues for lenders through its complaints for money judgment on promissory notes to address the failure of student loan repayment. These legal processes ensure that borrowers are held accountable for their financial obligations and help maintain the integrity of the student loan system. By utilizing appropriate legal tools such as wage garnishment, liens, or bank account levies, lenders can seek financial restitution for outstanding student loans while adhering to the applicable laws and regulations in Gresham, Oregon.

Free preview

How to fill out Gresham Oregon Complaint For Money Judgment On Promissory Note For Failure To Pay On Student Loan?

If you’ve already used our service before, log in to your account and save the Gresham Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Ensure you’ve found a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Gresham Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!