Title: Understanding Portland Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan Introduction: In Portland, Oregon, individuals who have failed to fulfill their financial obligations regarding student loans may face legal consequences. This article aims to provide a detailed description of the Portland Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan, shedding light on its purpose, process, and potential outcomes. We will also touch upon different types of complaints that may be filed in these cases. Keywords: Portland Oregon, complaint, money judgment, promissory note, failure to pay, student loan. 1. The Purpose of the Complaint: A Portland Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan is a legal document filed by a lender or their representative against a debtor who has neglected their responsibility to repay their student loan. The purpose is to seek financial compensation for the outstanding debt through a court judgment. 2. Filing the Complaint: To initiate the process, the lender must first draft the complaint, ensuring it contains all relevant information such as the borrower's name, loan details, and the amount owed. This complaint is then submitted to the appropriate court in Portland, Oregon. 3. Serving the Complaint: After filing the complaint, the lender must serve a copy to the borrower, informing them about the pending legal action. This can be done through certified mail or by hiring a process server to personally deliver the complaint. 4. Responding to the Complaint: Once served, the borrower has a limited period (typically 30 days) to respond to the complaint. They can either admit to the debt, deny the allegations, or request additional time for gathering evidence or legal advice. 5. Court Proceedings: If the borrower fails to respond within the stipulated time frame, the court may issue a default judgment in favor of the lender. However, if the borrower contests the complaint, a court hearing will be scheduled where both parties can present their arguments and evidence. 6. Possible Outcomes: Upon reviewing the evidence and hearing both parties, the court may issue a money judgment in favor of the lender. The judgment will specify the amount owed, including any interest and legal fees. The debtor may be required to repay the debt in installments or face other consequences such as wage garnishment. Types of Portland Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan: 1. Original Complaint: Filed for the first time against a borrower who has failed to repay their student loan. 2. Amended Complaint: Filed when modifications or corrections are needed in the original complaint. 3. Third-Party Complaint: Filed by a lender against a third party who may be liable for the outstanding debt, such as a co-signer. 4. Counterclaim: Filed by the borrower in response to the original complaint, alleging their own claims against the lender. Conclusion: Navigating a Portland Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan can be complex. It is essential for both lenders and borrowers to understand the process involved, respond in a timely manner, and seek legal advice if necessary. By doing so, individuals can ensure their rights are protected and work towards resolving their student loan obligations.

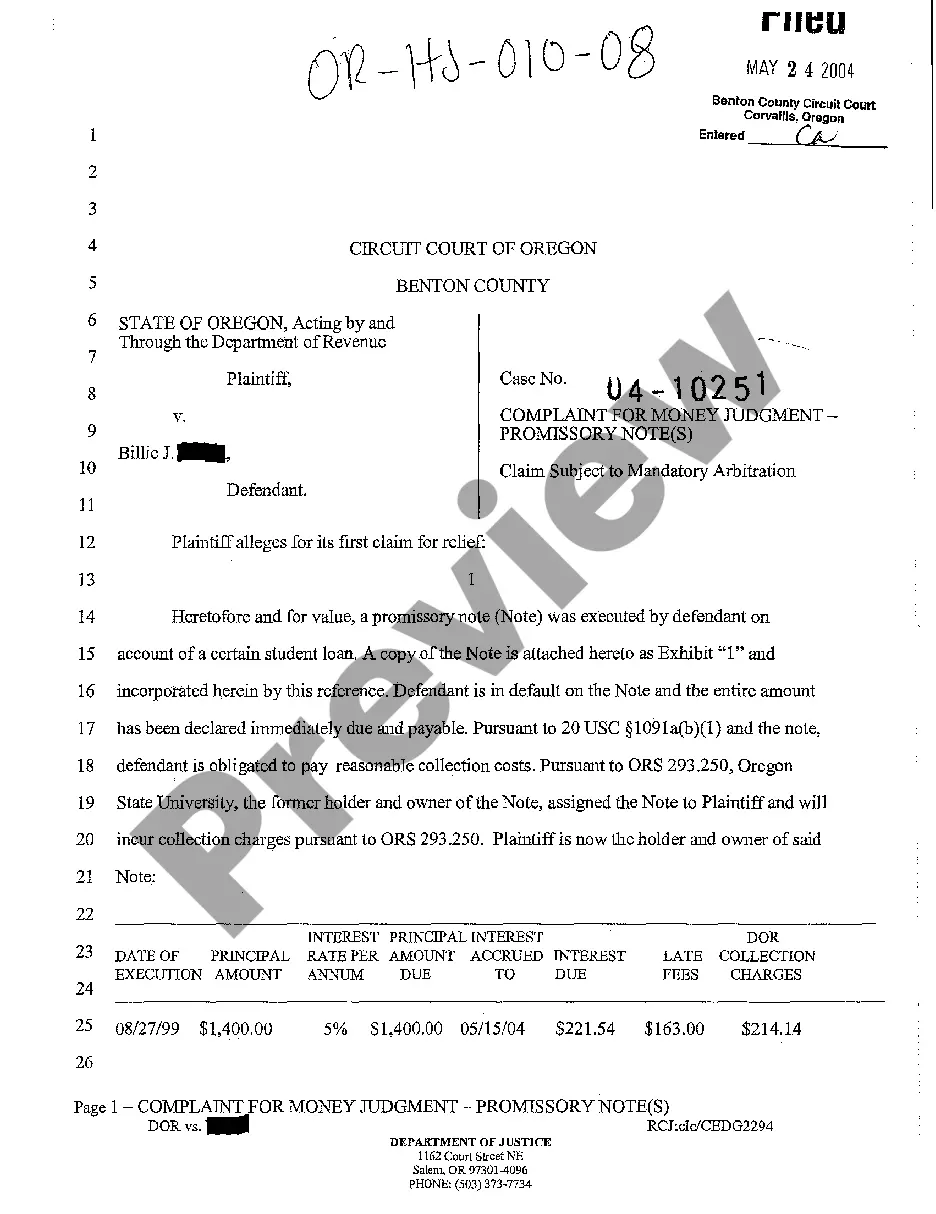

Portland Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan

Description

How to fill out Portland Oregon Complaint For Money Judgment On Promissory Note For Failure To Pay On Student Loan?

Regardless of social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for someone with no legal education to create such papers cfrom the ground up, mainly because of the convoluted jargon and legal subtleties they entail. This is where US Legal Forms can save the day. Our service offers a massive catalog with over 85,000 ready-to-use state-specific forms that work for practically any legal case. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you require the Portland Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan or any other paperwork that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Portland Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan quickly using our trusted service. If you are already a subscriber, you can proceed to log in to your account to download the needed form.

However, if you are new to our library, make sure to follow these steps before obtaining the Portland Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan:

- Ensure the template you have found is suitable for your area considering that the regulations of one state or area do not work for another state or area.

- Preview the document and go through a brief description (if provided) of cases the paper can be used for.

- If the form you chosen doesn’t meet your needs, you can start again and look for the necessary form.

- Click Buy now and pick the subscription plan you prefer the best.

- utilizing your login information or register for one from scratch.

- Choose the payment method and proceed to download the Portland Oregon Complaint for Money Judgment on Promissory Note for Failure to Pay on Student Loan once the payment is done.

You’re good to go! Now you can proceed to print out the document or fill it out online. Should you have any problems getting your purchased forms, you can quickly find them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.