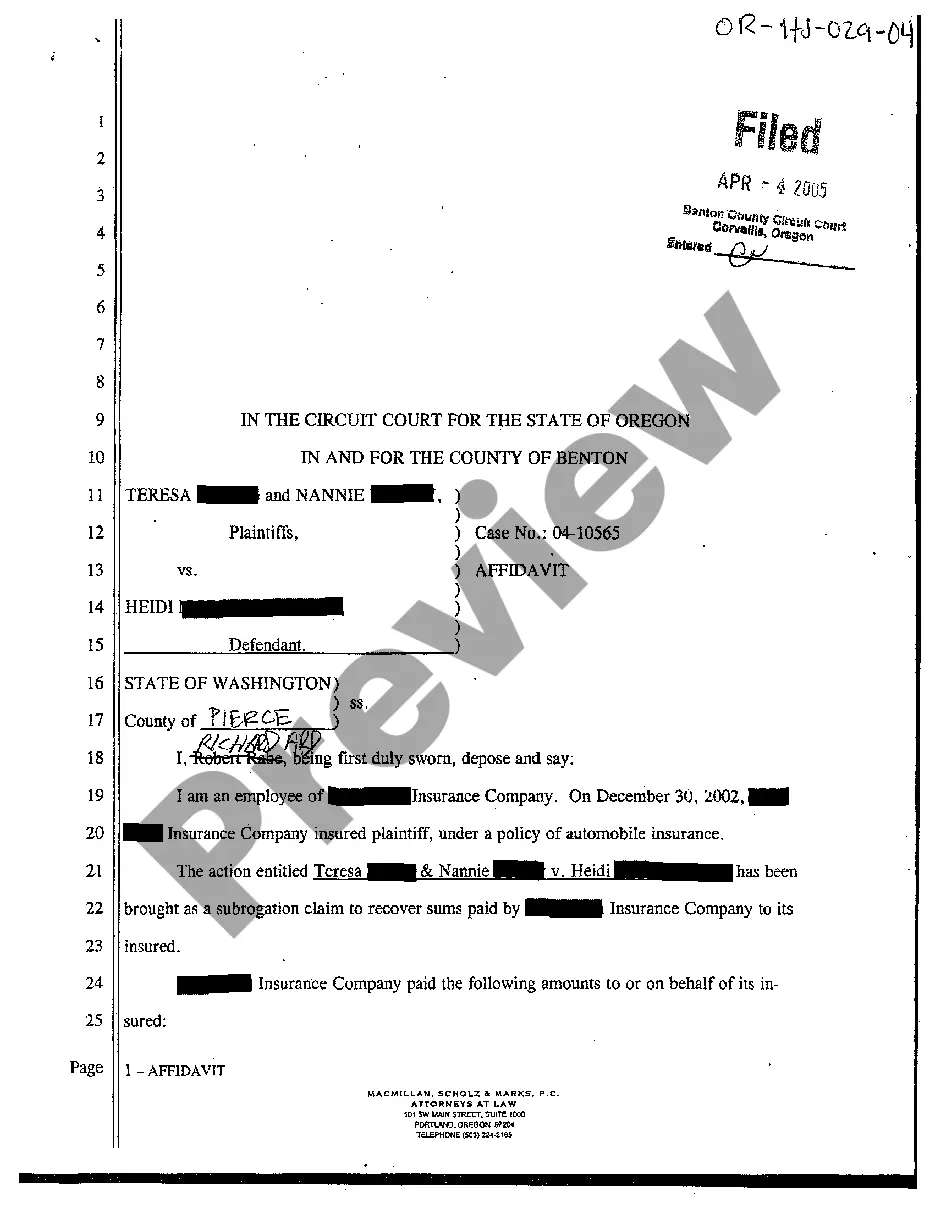

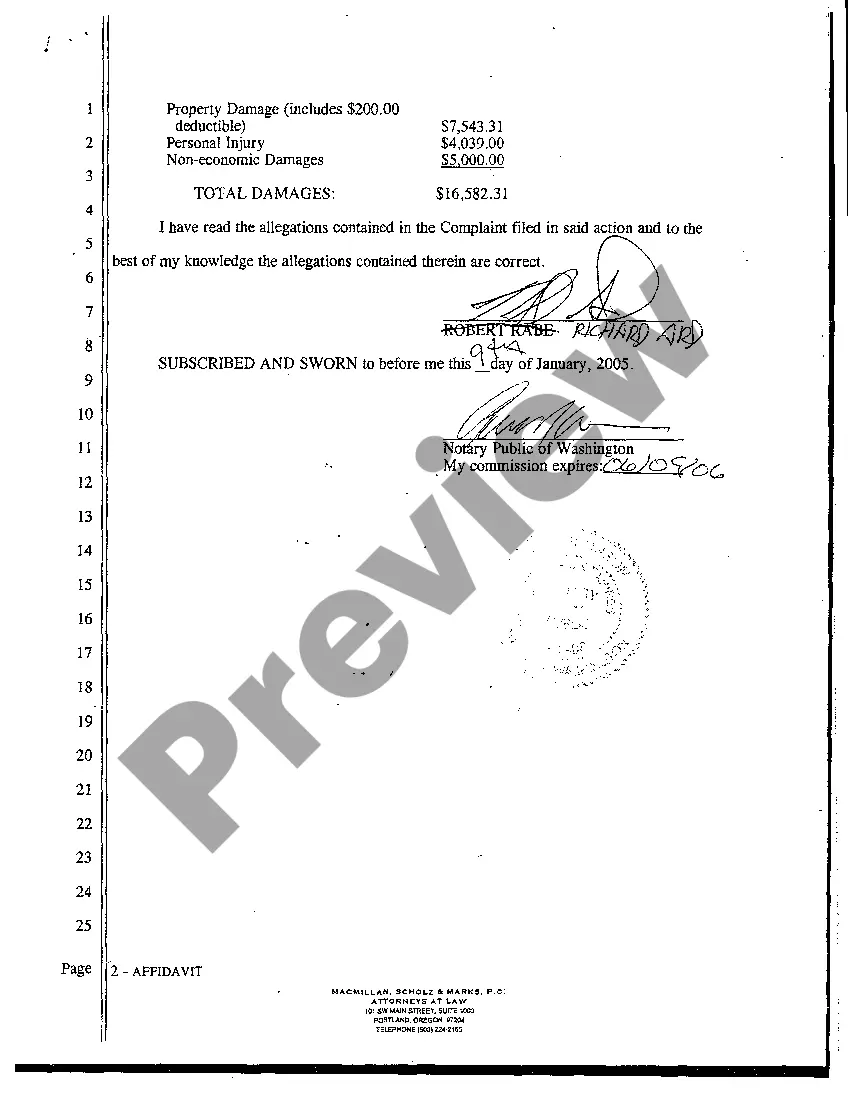

The Bend Oregon Affidavit of Insurance Employee Notifying of Subrogation Claim is a legal document that provides a detailed account of a subrogation claim initiated by an employee. This affidavit is used in Bend, Oregon, and serves as notification to the insurance company regarding the employee's intention to pursue a subrogation claim. Subrogation refers to the legal process through which an insurance company seeks reimbursement for claims paid out to an insured party. In the context of employment, this typically occurs when an employee is injured due to the negligence of a third party, such as a contractor or manufacturer. The employee's insurance company may pay out benefits for medical expenses, lost wages, or other damages, and then seek reimbursement from the responsible party. The Bend Oregon Affidavit of Insurance Employee Notifying of Subrogation Claim includes various key elements to ensure a comprehensive description of the claim. The document typically includes the following: 1. Employee Information: The affidavit begins with the employee's details, such as name, address, contact information, and policy number. This ensures that the insurance company can easily identify the involved party and policy. 2. Employer Information: Information about the employer, including the name of the company, address, and contact details, is provided to establish the relationship between the employee and the employer. 3. Incident Description: A detailed account of the incident leading to the employee's injuries is included. This section should encompass the date, time, and location of the incident. It should describe the circumstances of the incident, the injuries sustained by the employee, and any third party involved. 4. Insurance Details: The employee's insurance policy information, such as the policy number, coverage dates, and specific coverage applicable to the incident, should be clearly stated. This ensures accurate identification and verification of the policy. 5. Subrogation Claim: The affidavit explicitly states the intent of the employee to pursue a subrogation claim against the responsible third party. This includes relevant details about the responsible party, such as their name, contact information, and any known insurance details. 6. Damages Incurred: The affidavit includes a comprehensive list of the damages incurred by the employee, such as medical expenses, lost wages, property damage, pain and suffering, and any future anticipated damages. This helps the insurance company estimate the value of the claim. It is important to note that there may not be different types of Bend Oregon Affidavit of Insurance Employee Notifying of Subrogation Claim. The content described above covers the essential components of this document, regardless of specific variations that may exist.

Bend Oregon Affidavit of Insurance Employee Notifying of Subrogation Claim

Description

How to fill out Bend Oregon Affidavit Of Insurance Employee Notifying Of Subrogation Claim?

If you’ve already used our service before, log in to your account and download the Bend Oregon Affidavit of Insurance Employee Notifying of Subrogation Claim on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Make sure you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Bend Oregon Affidavit of Insurance Employee Notifying of Subrogation Claim. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!

Form popularity

FAQ

Subrogation allows your insurer to recoup costs (medical payments, repairs, etc.), including your deductible, from the at-fault driver's insurance company, if the accident wasn't your fault. A successful subrogation means a refund for you and your insurer.

Get a lawyer together to help you handle the subrogation, and keep in mind, this could be your opportunity to prove you're not actually at-fault. If you've accepted that you're at-fault, respond to the subrogation letter and try to settle the claim with the opposing insurance carrier before a trial.

You have no legal obligations to respond to a subrogation letter. You can put the letter in the garbage and ignore additional notices, but it's not in your best interest. Immediately dealing with a subrogation letter allows you to resolve a claim sooner than later.

What happens if you don't pay a subrogation claim? If you choose to not pay a subrogation, the insurer will continue to mail requests for reimbursement. Again, they may file a lawsuit against you. One way to avoid an effort to subrogate from the victim's insurance company is if there is a subrogation waiver.

Subrogation allows your insurer to recoup costs (medical payments, repairs, etc.), including your deductible, from the at-fault driver's insurance company, if the accident wasn't your fault. A successful subrogation means a refund for you and your insurer.

Defenses to defeat an insurer's subrogation rights, including asserting that the statute of limitations has run or that a valid waiver of subrogation exists or other limitations of liability. Additionally, defense counsel may contest the amount and measure of recoverable damages.

Subrogation allows your insurer to recoup costs (medical payments, repairs, etc.), including your deductible, from the at-fault driver's insurance company, if the accident wasn't your fault. A successful subrogation means a refund for you and your insurer.

If you choose to not pay a subrogation, the insurer will continue to mail requests for reimbursement. Again, they may file a lawsuit against you. One way to avoid an effort to subrogate from the victim's insurance company is if there is a subrogation waiver.

Yes, you can negotiate a subrogation claim in some circumstances, though it may not be necessary if your insurance company is handling the claim. Subrogation claims are claims filed by insurance companies against an at-fault party to recover any costs paid out for their not-at-fault policyholder's claim.