Title: Understanding the Hillsboro Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money Keywords: Hillsboro Oregon, complaint, breach, credit card agreement, recovery, money Description: In Hillsboro, Oregon, individuals and businesses who encounter a breach of credit card agreement resulting in financial loss have the option to file a complaint to seek recovery of their money. A Hillsboro Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money is a legal document that addresses such situations, providing a means to resolve disputes and seek restitution. There are several types of Hillsboro Oregon Complaints for Breach of Credit Card Agreement and Recovery of Money, depending on the specific circumstances. Some of these include: 1. Individual Consumer Complaints: — When an individual experiences a breach of credit card agreement, such as unauthorized charges or failure to provide goods or services as agreed, they can file a complaint seeking reimbursement. 2. Business Complaints: — Small businesses or enterprises that face a breach of credit card agreement, such as non-payment or fraudulent transactions, can file a complaint to recover the funds. 3. Identity Theft Complaints: — In cases of identity theft where a credit card is involved, individuals can file a complaint to reclaim stolen funds and hold the responsible party accountable. The Hillsboro Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money should include the following details: — Comprehensive information of the complainant, including their name, contact details, and any supporting identification. — Details of the credit card issuer, including the name, address, and contact information. — A thorough description of the breach of credit card agreement, highlighting specific instances, dates, and evidence (if available) to support the complaint. — The total amount of money being claimed for recovery, including any additional costs or damages incurred due to the breach. — Any communication or attempts made to resolve the issue prior to filing the complaint, including relevant correspondence or records. — Signatures of the complainant and their legal representative (if applicable), affirming the accuracy of the provided information and requesting a resolution. It is essential to consult with an attorney or legal professional familiar with Hillsboro, Oregon's specific laws and regulations concerning credit card agreements and breach complaints. This ensures that the complaint is accurately drafted, adhering to the relevant legal requirements, and increases the chances of a successful resolution leading to the recovery of funds. Remember to keep copies of all filed documents and correspondence related to the complaint for future reference and possible legal procedures. In summary, a Hillsboro Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money provides an avenue for individuals and businesses to seek redress and recuperate losses resulting from a breach of credit card agreements. Properly preparing and filing the complaint, along with seeking professional legal advice, can help in securing a resolution in favor of the complainant.

Hillsboro Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money

State:

Oregon

City:

Hillsboro

Control #:

OR-HJ-030-06

Format:

PDF

Instant download

This form is available by subscription

Description

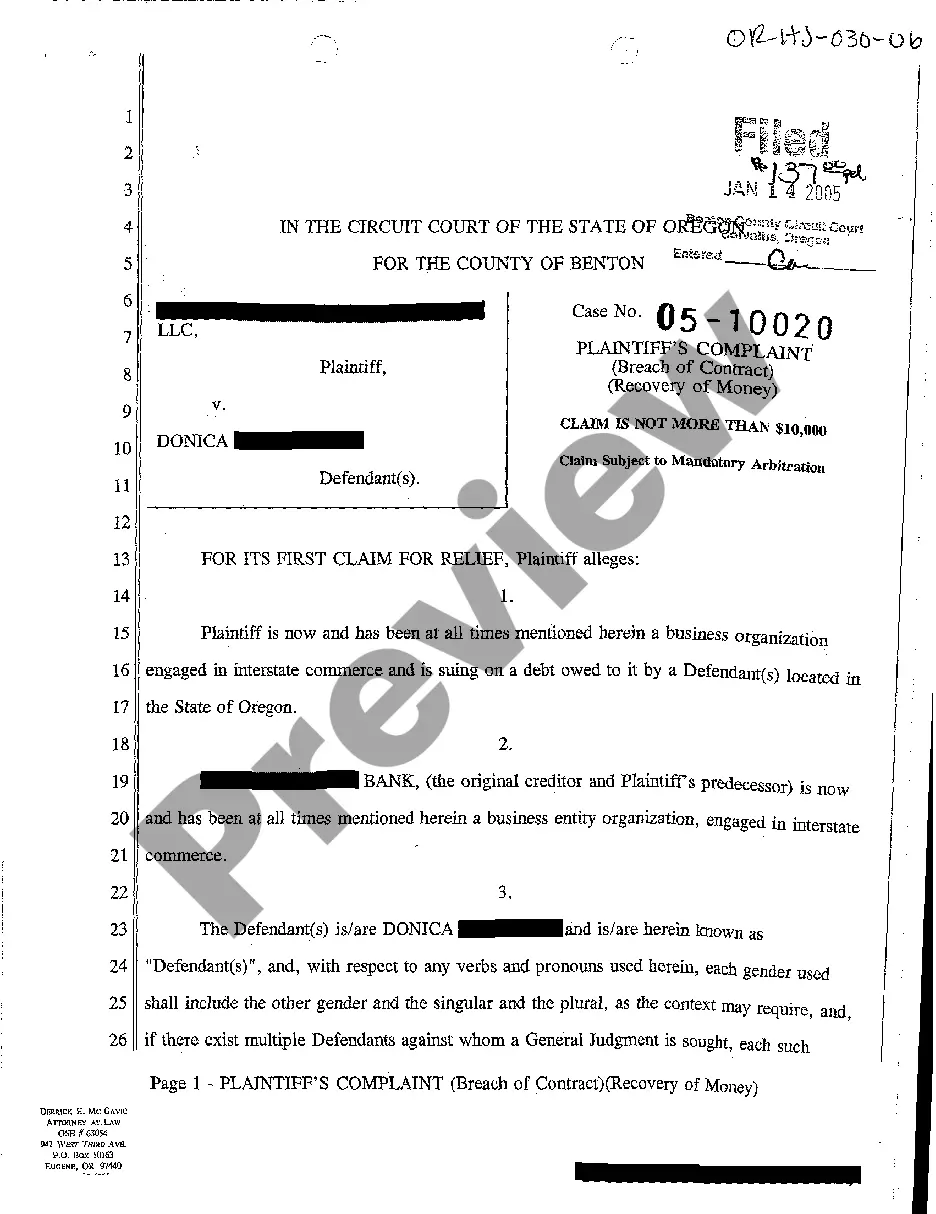

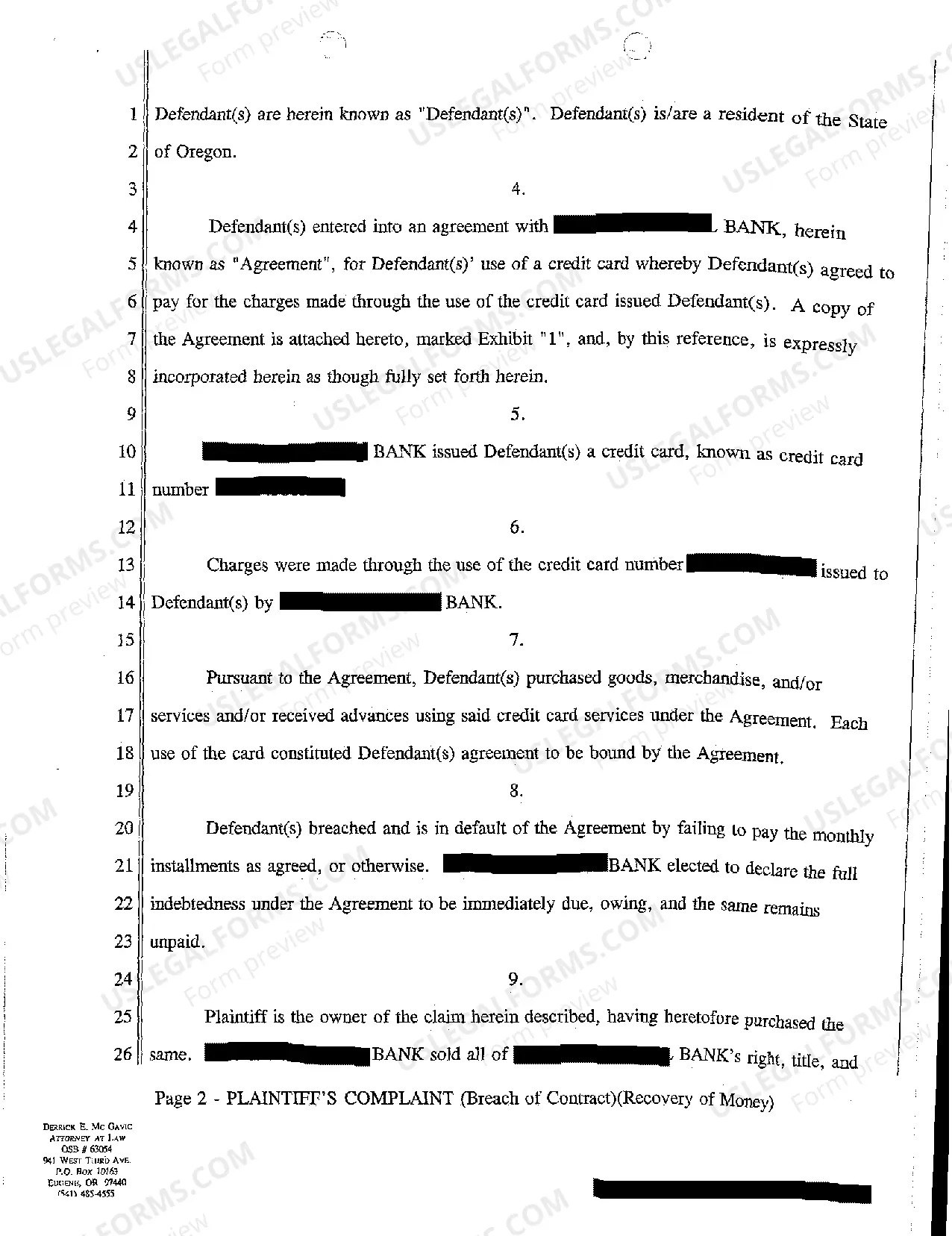

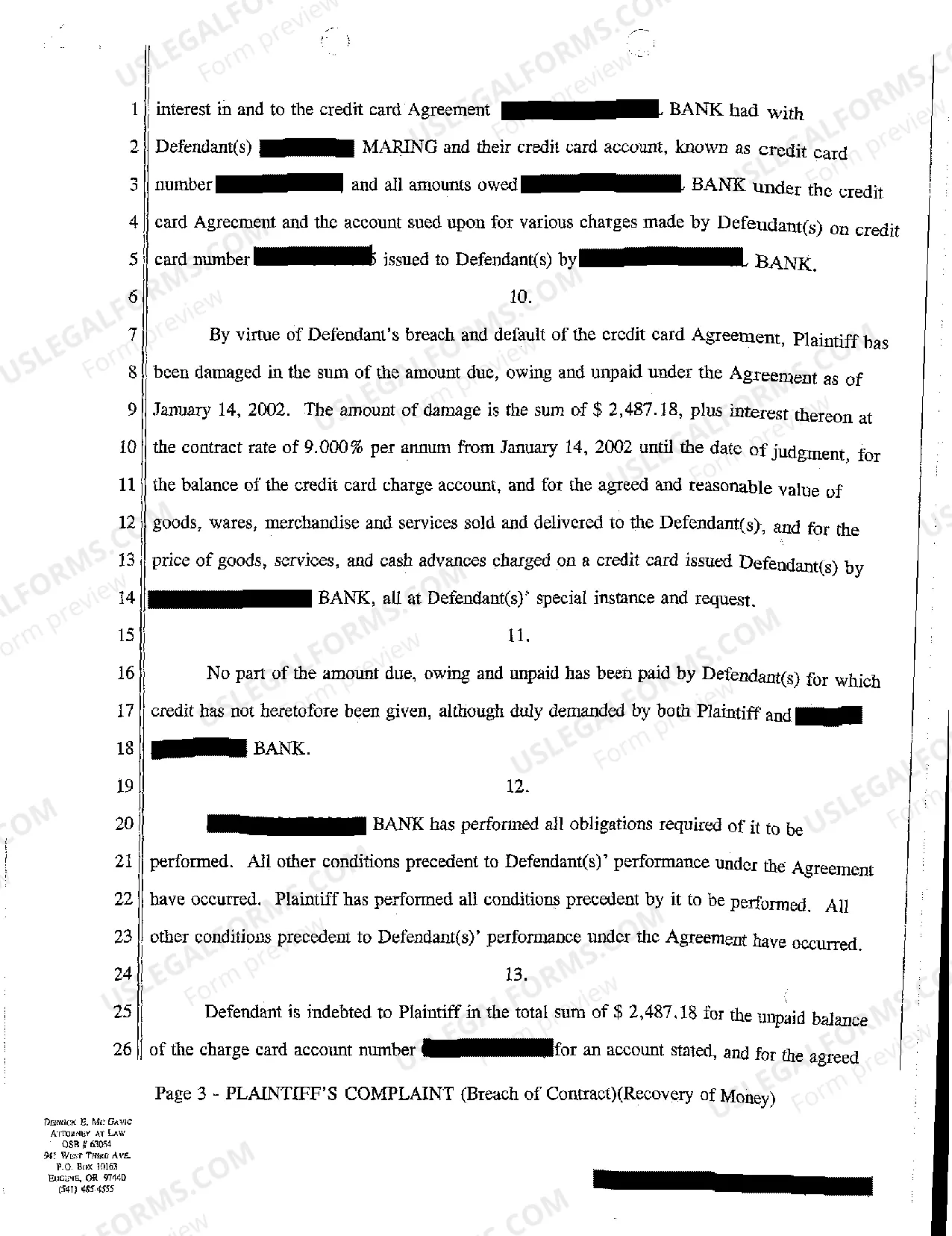

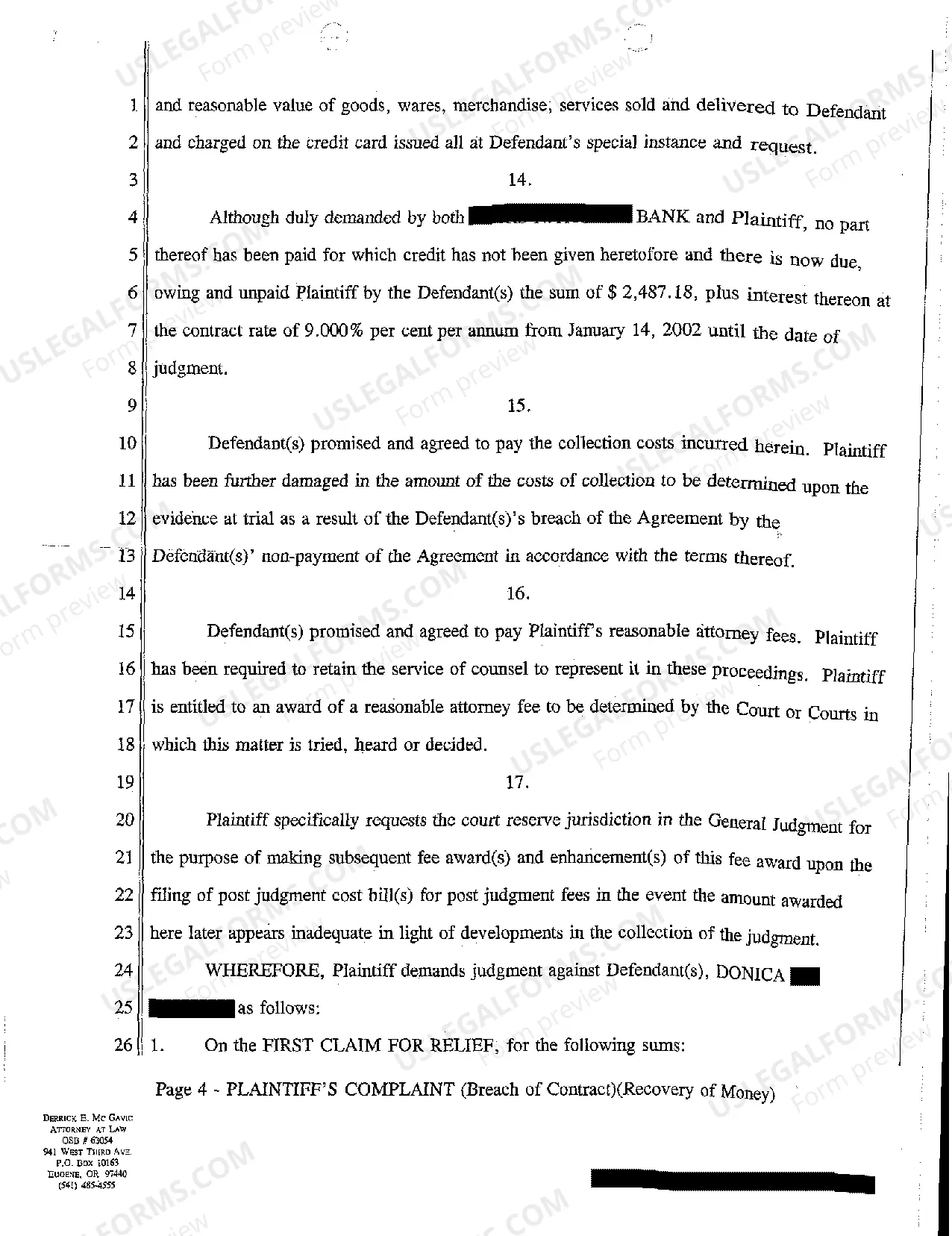

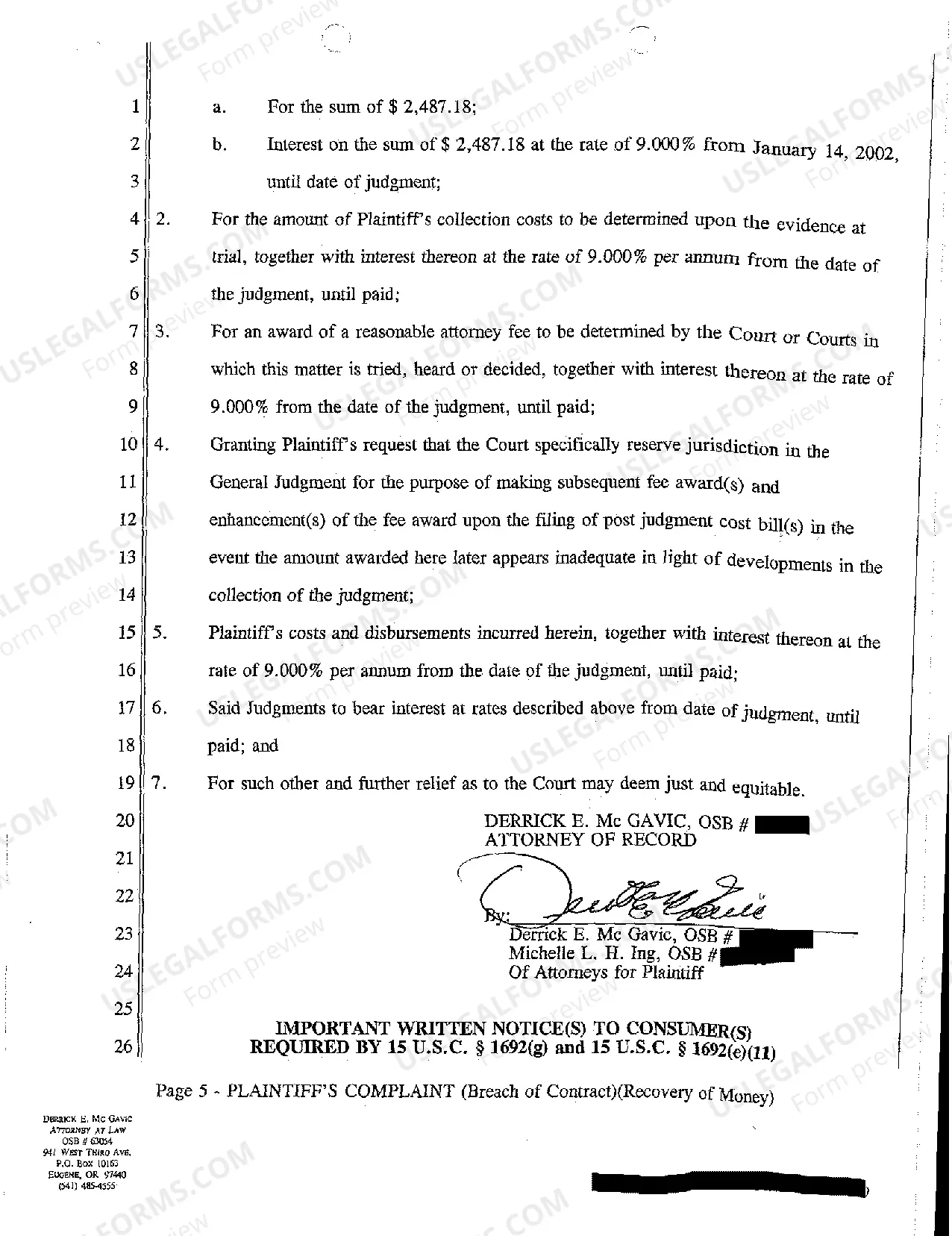

A02 Complaint for Breach of Credit Card Agreement and Recovery of Money

Title: Understanding the Hillsboro Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money Keywords: Hillsboro Oregon, complaint, breach, credit card agreement, recovery, money Description: In Hillsboro, Oregon, individuals and businesses who encounter a breach of credit card agreement resulting in financial loss have the option to file a complaint to seek recovery of their money. A Hillsboro Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money is a legal document that addresses such situations, providing a means to resolve disputes and seek restitution. There are several types of Hillsboro Oregon Complaints for Breach of Credit Card Agreement and Recovery of Money, depending on the specific circumstances. Some of these include: 1. Individual Consumer Complaints: — When an individual experiences a breach of credit card agreement, such as unauthorized charges or failure to provide goods or services as agreed, they can file a complaint seeking reimbursement. 2. Business Complaints: — Small businesses or enterprises that face a breach of credit card agreement, such as non-payment or fraudulent transactions, can file a complaint to recover the funds. 3. Identity Theft Complaints: — In cases of identity theft where a credit card is involved, individuals can file a complaint to reclaim stolen funds and hold the responsible party accountable. The Hillsboro Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money should include the following details: — Comprehensive information of the complainant, including their name, contact details, and any supporting identification. — Details of the credit card issuer, including the name, address, and contact information. — A thorough description of the breach of credit card agreement, highlighting specific instances, dates, and evidence (if available) to support the complaint. — The total amount of money being claimed for recovery, including any additional costs or damages incurred due to the breach. — Any communication or attempts made to resolve the issue prior to filing the complaint, including relevant correspondence or records. — Signatures of the complainant and their legal representative (if applicable), affirming the accuracy of the provided information and requesting a resolution. It is essential to consult with an attorney or legal professional familiar with Hillsboro, Oregon's specific laws and regulations concerning credit card agreements and breach complaints. This ensures that the complaint is accurately drafted, adhering to the relevant legal requirements, and increases the chances of a successful resolution leading to the recovery of funds. Remember to keep copies of all filed documents and correspondence related to the complaint for future reference and possible legal procedures. In summary, a Hillsboro Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money provides an avenue for individuals and businesses to seek redress and recuperate losses resulting from a breach of credit card agreements. Properly preparing and filing the complaint, along with seeking professional legal advice, can help in securing a resolution in favor of the complainant.

Free preview

How to fill out Hillsboro Oregon Complaint For Breach Of Credit Card Agreement And Recovery Of Money?

If you’ve already used our service before, log in to your account and download the Hillsboro Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make certain you’ve found a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Hillsboro Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!