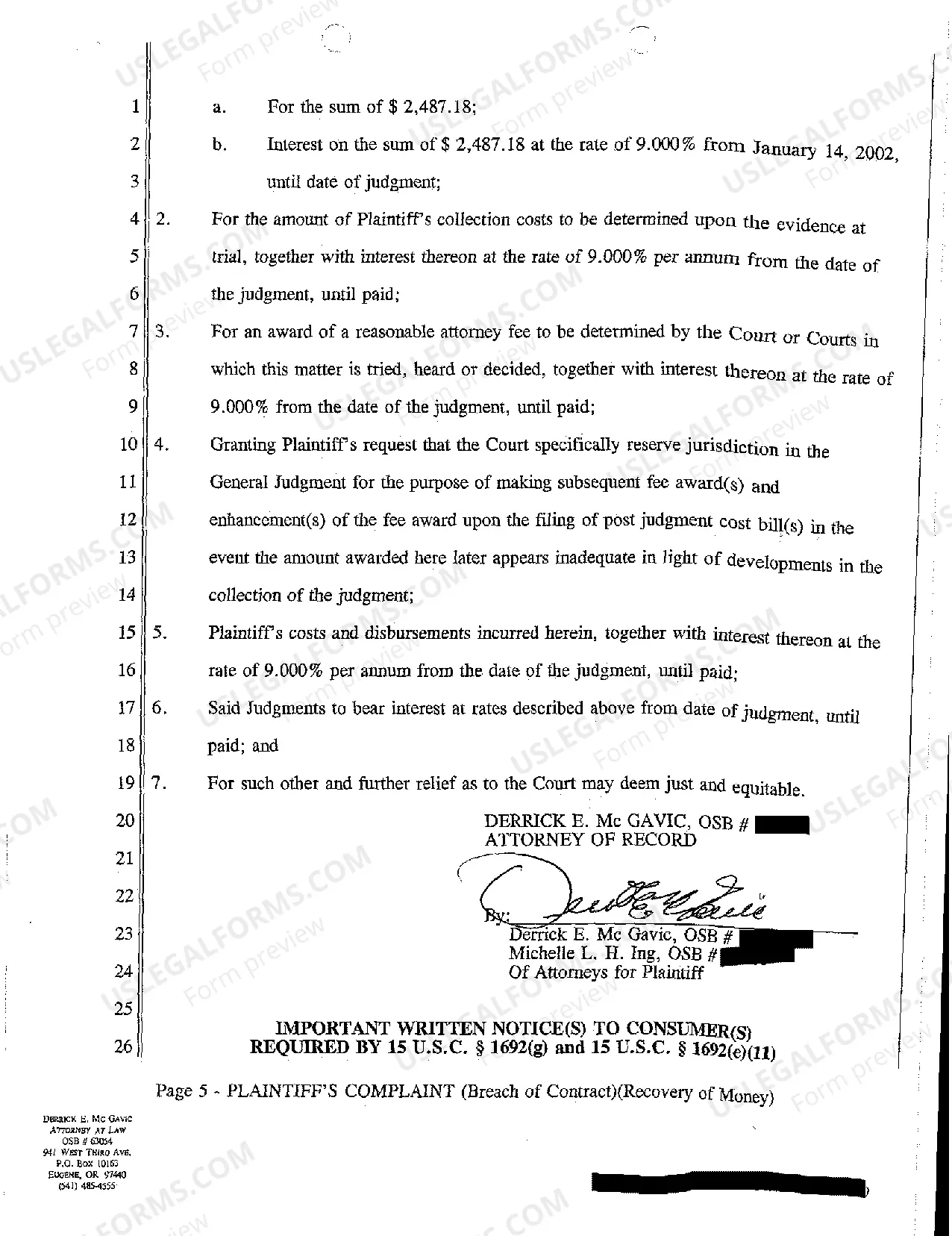

Title: Portland Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money Introduction: A complaint for breach of a credit card agreement and recovery of money is a legal action taken by an individual or organization in Portland, Oregon, seeking compensation for a breach of credit card terms and recovery of funds owed. This comprehensive description provides an overview of the process, legal actions, and relevant keywords related to different types of Portland, Oregon Complaints for Breach of Credit Card Agreement and Recovery of Money. 1. Key Terms and Definitions: — Credit Card Agreement: A contractual agreement between a creditor and the cardholder, outlining the terms, conditions, and responsibilities of both parties. — Breach of Agreement: The violation or failure to honor the terms and conditions agreed upon in the credit card agreement. — Debt Recovery: The process of attempting to collect the outstanding debt owed by the cardholder. — Complaint: A formal, legal document outlining the details and allegations of a breach of credit card agreement and the associated claim for the recovery of money. — Plaintiff: The individual or organization filing the complaint seeking compensation and debt recovery. — Defendant: The party being sued, generally the cardholder who has breached the credit card agreement. — Damages: The monetary compensation sought by the plaintiff to recover losses resulting from the breach. — Statute of Limitations: The prescribed time limit within which a plaintiff can file a complaint after the occurrence of a breach or violation. 2. Types of Portland Oregon Complaints for Breach of Credit Card Agreement and Recovery of Money: a. Individual Complaints: — Individual versus Cardholder: When an individual files a complaint against a specific cardholder for breach and recovery. — Individual versus Financial Institution: When an individual files a complaint against the credit card issuer or bank due to contractual breaches. b. Organizational Complaints: — Organization versus Cardholder: When a business or organization files a complaint against a cardholder for breach and recovery. — Organization versus Financial Institution: When a business or organization files a complaint against the credit card issuer or bank for financial losses caused by breaches. 3. Legal Process and Actions: — Filing the Complaint: The plaintiff initiates the legal process by preparing and filing a complaint in the relevant court, providing detailed information about the breach, damages claimed, and recovery sought. — Summons and Service: Once the complaint is filed, the court issues a summons, serving the defendant with a copy of the complaint and formally notifying them about the legal proceedings. — Defendant's Response: The defendant has a specific time frame to respond to the complaint, either admitting or denying the allegations made by the plaintiff. — Discovery Phase: Both parties exchange information and evidence related to the case, allowing for a fair and transparent examination of facts. — Settlement or Trial: Parties may attempt to settle the matter outside of court through negotiation or mediation. If no settlement is reached, the case proceeds to trial, where a judge or jury makes a final determination. — Judgment and Recovery: If the plaintiff successfully proves their case, the court may issue a judgment in their favor, granting compensation and outlining the recovery process. In conclusion, a Portland Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money refers to the legal action taken to address breaches of credit card agreements and reclaim money owed. Understanding the various types of complaints and the legal process involved can help individuals and organizations navigate the complexities of credit card disputes effectively.

Portland Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money

Description

How to fill out Portland Oregon Complaint For Breach Of Credit Card Agreement And Recovery Of Money?

If you are looking for a valid form template, it’s difficult to choose a better platform than the US Legal Forms website – one of the most extensive online libraries. With this library, you can find a large number of document samples for business and individual purposes by types and states, or key phrases. With the high-quality search function, getting the most up-to-date Portland Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money is as elementary as 1-2-3. Furthermore, the relevance of every record is confirmed by a group of professional attorneys that on a regular basis review the templates on our website and revise them based on the most recent state and county laws.

If you already know about our system and have an account, all you need to get the Portland Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money is to log in to your account and click the Download button.

If you make use of US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have opened the sample you require. Check its information and use the Preview feature to see its content. If it doesn’t suit your needs, utilize the Search field near the top of the screen to get the needed file.

- Confirm your choice. Select the Buy now button. Following that, choose the preferred pricing plan and provide credentials to register an account.

- Make the financial transaction. Utilize your bank card or PayPal account to finish the registration procedure.

- Receive the template. Select the file format and save it to your system.

- Make adjustments. Fill out, edit, print, and sign the acquired Portland Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money.

Each and every template you save in your account does not have an expiration date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you want to have an additional copy for editing or creating a hard copy, you may return and export it again at any time.

Make use of the US Legal Forms professional library to gain access to the Portland Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money you were looking for and a large number of other professional and state-specific templates on one platform!