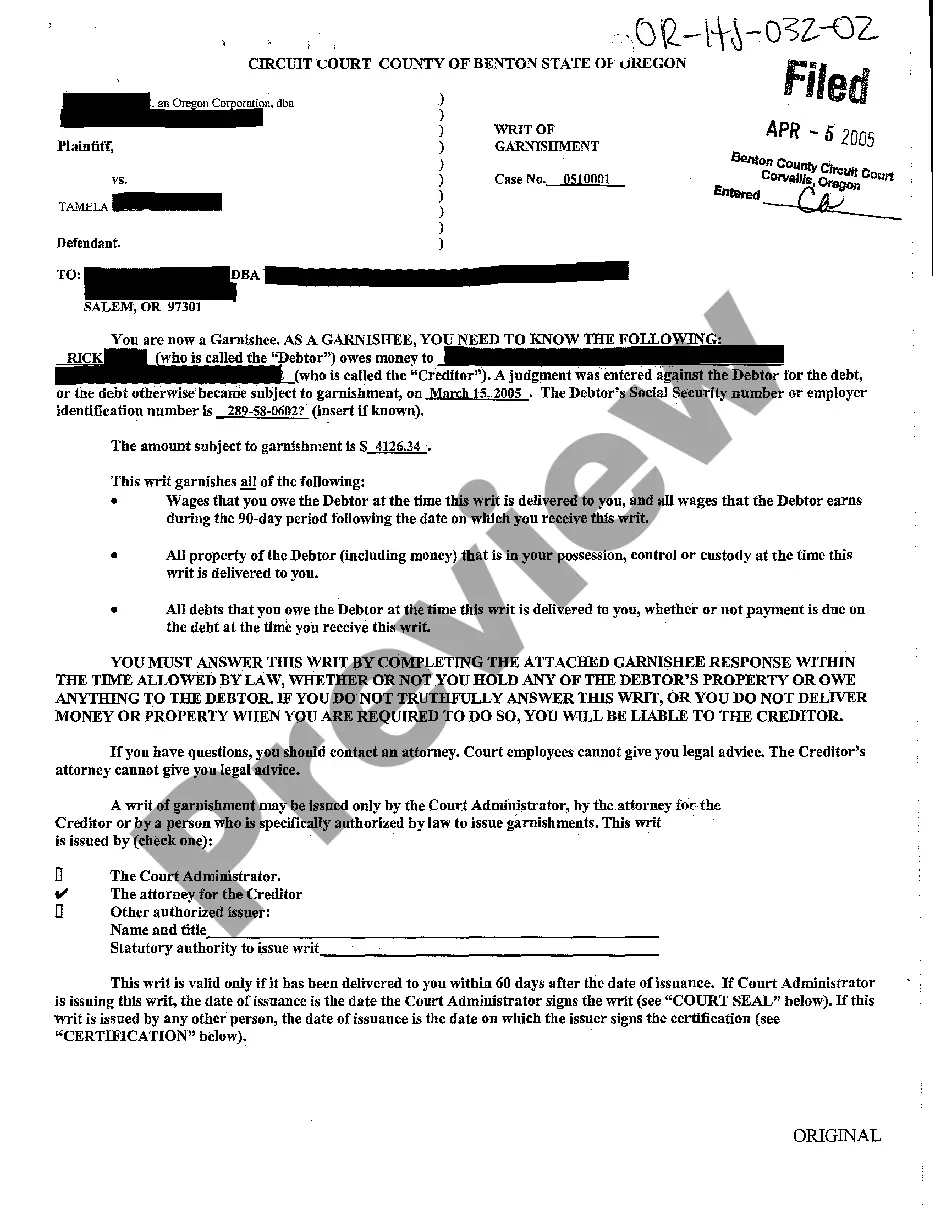

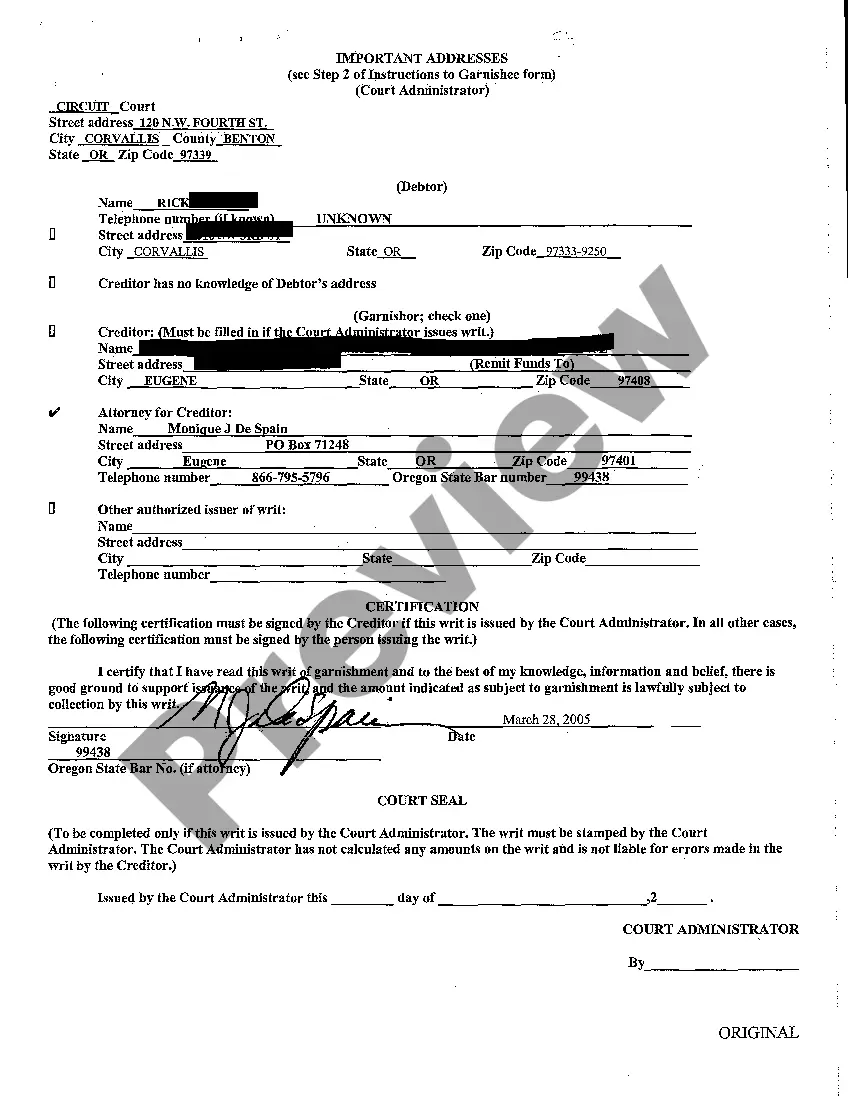

Gresham Oregon Writ of Garnishment: A Detailed Description and Types The Gresham Oregon Writ of Garnishment is a legal process used to collect unpaid debts from a person or entity who owes money to another party. It involves the court ordering the garnishment of a portion of the debtor's assets or wages in order to satisfy the debt owed. Types of Gresham Oregon Writ of Garnishment: 1. Writ of Garnishment for Wages: This type of writ allows a creditor to garnish a portion of the debtor's wages or salary until the debt is fully paid. The amount that can be garnished is determined by Oregon law and may vary depending on the debtor's income and other factors. The employer is typically responsible for deducting and remitting the garnished amount to the creditor. 2. Writ of Garnishment for Bank Accounts: With this type of writ, the creditor can garnish funds held in the debtor's bank accounts to satisfy the debt owed. The court may order the creditor to notify the debtor's bank, which will then freeze the account and release the funds necessary to cover the debt. 3. Writ of Garnishment for Property: This writ allows the creditor to seize and sell the debtor's property to recover the debt owed. The property can include vehicles, real estate, or other valuable assets that can be liquidated. The proceeds from the sale are used to satisfy the outstanding debt, with any surplus returned to the debtor if applicable. 4. Writ of Garnishment for Personal Property: Similar to the previous type, this writ allows the creditor to seize and sell certain personal property of value to apply towards the debt. Examples include jewelry, electronics, or artwork. It is important to note that the process of obtaining a Gresham Oregon Writ of Garnishment requires following strict legal procedures and obtaining court approval. A creditor must first initiate a lawsuit against the debtor, obtain a judgment in their favor, and then apply for the appropriate writ to enforce the debt repayment. The Gresham Oregon Writ of Garnishment allows creditors to seek legal recourse for recovering unpaid debts, providing a means to compel debtors into satisfying their financial obligations. It is a crucial tool in ensuring fair debt collection practices and protecting the rights of creditors.

Gresham Oregon Writ of Garnishment

State:

Oregon

City:

Gresham

Control #:

OR-HJ-032-02

Format:

PDF

Instant download

This form is available by subscription

Description

A11 Writ of Garnishment

Gresham Oregon Writ of Garnishment: A Detailed Description and Types The Gresham Oregon Writ of Garnishment is a legal process used to collect unpaid debts from a person or entity who owes money to another party. It involves the court ordering the garnishment of a portion of the debtor's assets or wages in order to satisfy the debt owed. Types of Gresham Oregon Writ of Garnishment: 1. Writ of Garnishment for Wages: This type of writ allows a creditor to garnish a portion of the debtor's wages or salary until the debt is fully paid. The amount that can be garnished is determined by Oregon law and may vary depending on the debtor's income and other factors. The employer is typically responsible for deducting and remitting the garnished amount to the creditor. 2. Writ of Garnishment for Bank Accounts: With this type of writ, the creditor can garnish funds held in the debtor's bank accounts to satisfy the debt owed. The court may order the creditor to notify the debtor's bank, which will then freeze the account and release the funds necessary to cover the debt. 3. Writ of Garnishment for Property: This writ allows the creditor to seize and sell the debtor's property to recover the debt owed. The property can include vehicles, real estate, or other valuable assets that can be liquidated. The proceeds from the sale are used to satisfy the outstanding debt, with any surplus returned to the debtor if applicable. 4. Writ of Garnishment for Personal Property: Similar to the previous type, this writ allows the creditor to seize and sell certain personal property of value to apply towards the debt. Examples include jewelry, electronics, or artwork. It is important to note that the process of obtaining a Gresham Oregon Writ of Garnishment requires following strict legal procedures and obtaining court approval. A creditor must first initiate a lawsuit against the debtor, obtain a judgment in their favor, and then apply for the appropriate writ to enforce the debt repayment. The Gresham Oregon Writ of Garnishment allows creditors to seek legal recourse for recovering unpaid debts, providing a means to compel debtors into satisfying their financial obligations. It is a crucial tool in ensuring fair debt collection practices and protecting the rights of creditors.

Free preview

How to fill out Gresham Oregon Writ Of Garnishment?

If you’ve already utilized our service before, log in to your account and download the Gresham Oregon Writ of Garnishment on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make certain you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Gresham Oregon Writ of Garnishment. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!