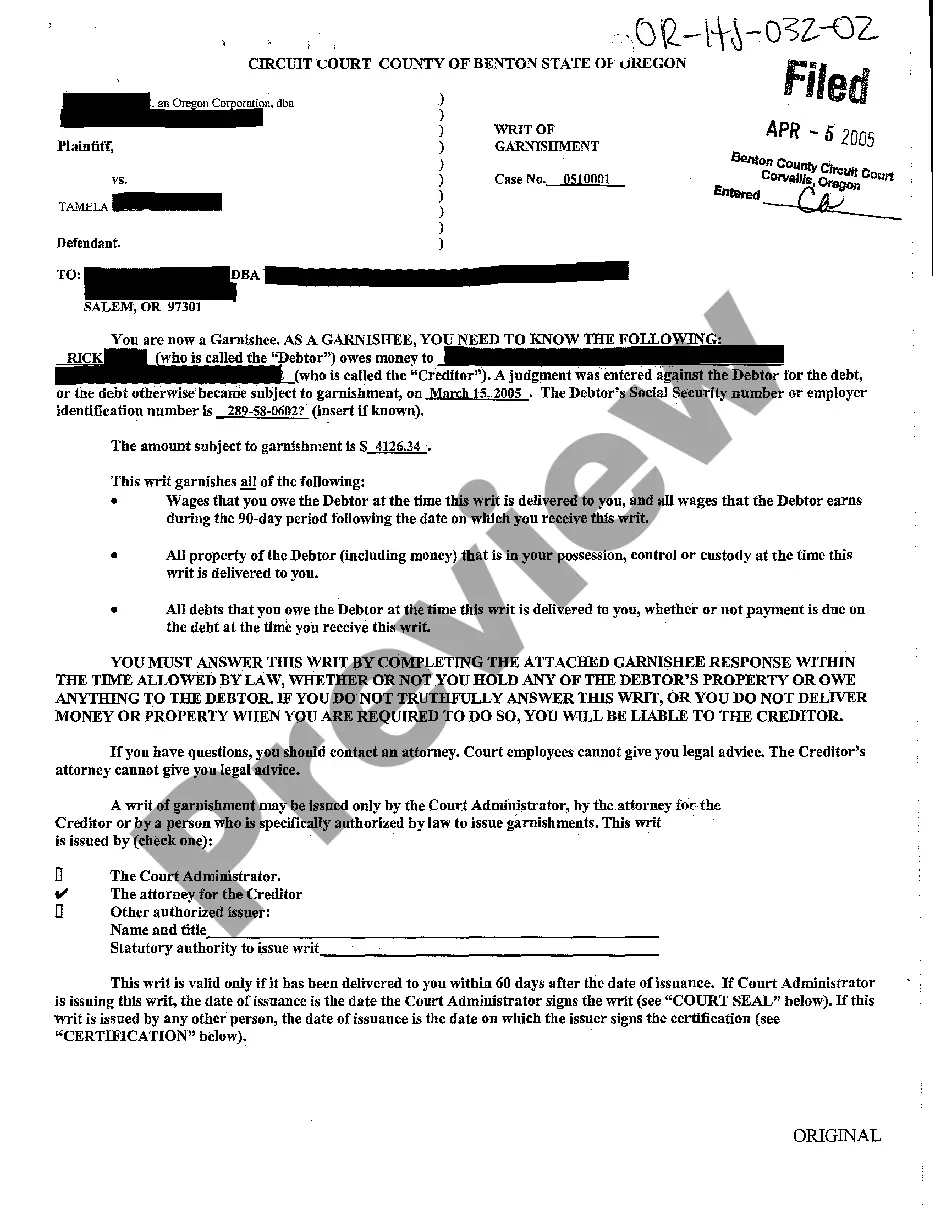

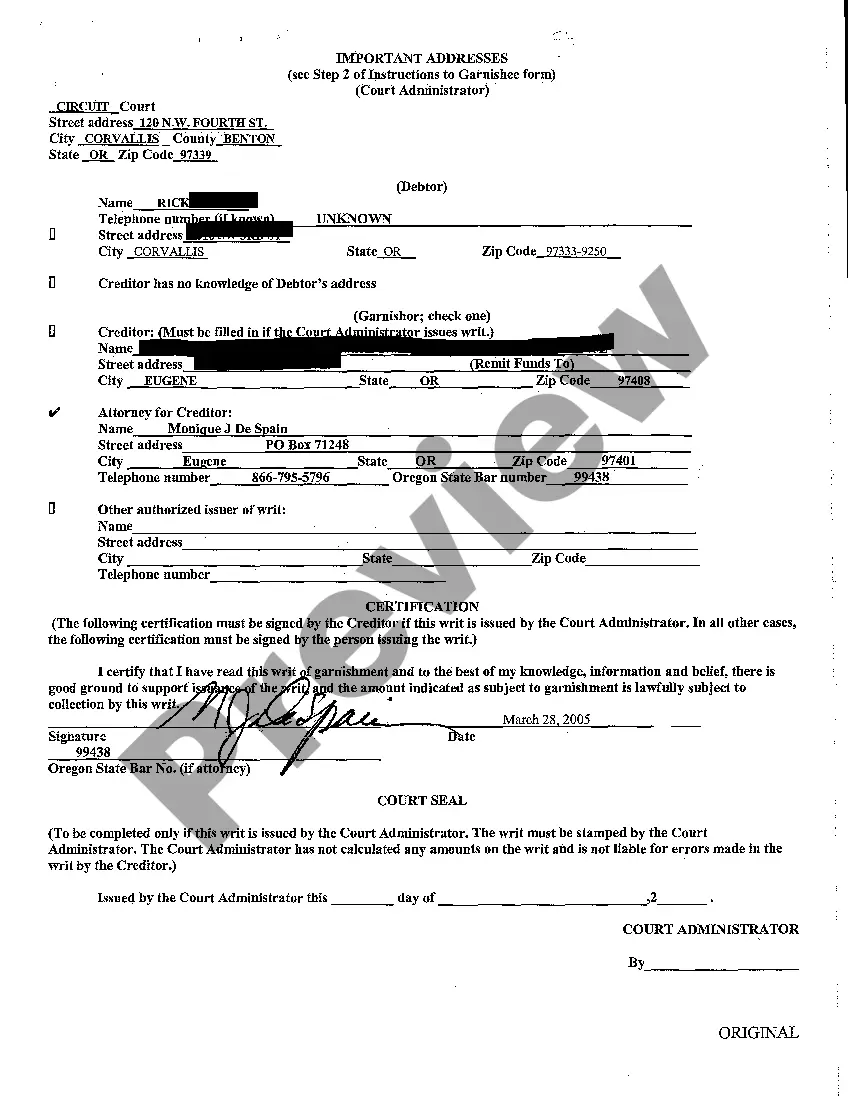

The Hillsboro Oregon Writ of Garnishment refers to a legal process used to collect on a debt by seizing a portion of a person's wages or assets. This court-ordered document authorizes the creditor to garnish a debtor's income or bank accounts to satisfy an outstanding judgment. In Hillsboro, Oregon, there are different types of Writs of Garnishment that can be utilized depending on the specific circumstances of the debt. The most common types include: 1. Wage Garnishment: This form of garnishment allows a creditor to deduct a portion of a debtor's wages directly from their employer. The employer receives a notice of garnishment and is legally bound to withhold the specified amount from the debtor's paycheck until the debt is satisfied. 2. Bank Account Garnishment: With this type of garnishment, a creditor can freeze and seize funds from a debtor's bank account(s) to satisfy the outstanding judgment. The financial institution is served with a Writ of Garnishment, and the debtor's funds are held until the debt is paid off. 3. Property or Asset Garnishment: In certain circumstances, the court may authorize garnishment of a debtor's property or assets. This includes the seizure and sale of valuable possessions such as vehicles, real estate, or other assets to apply towards the debt owed to the creditor. It's important to note that the process for obtaining a Writ of Garnishment in Hillsboro, Oregon follows specific legal requirements and procedures. Creditors must first obtain a judgment against the debtor through a lawsuit before pursuing garnishment actions. The debtor also has rights and protections under state and federal law, such as limits on the percentage of wages that can be garnished and exemptions for certain types of income. In conclusion, the Hillsboro Oregon Writ of Garnishment is a legal tool utilized by creditors to collect on outstanding debts. It includes various types such as wage garnishment, bank account garnishment, and property or asset garnishment. Understanding the specifics of each type and the legal procedures involved is essential for both creditors and debtors involved in the garnishment process.

Hillsboro Oregon Writ of Garnishment

Description

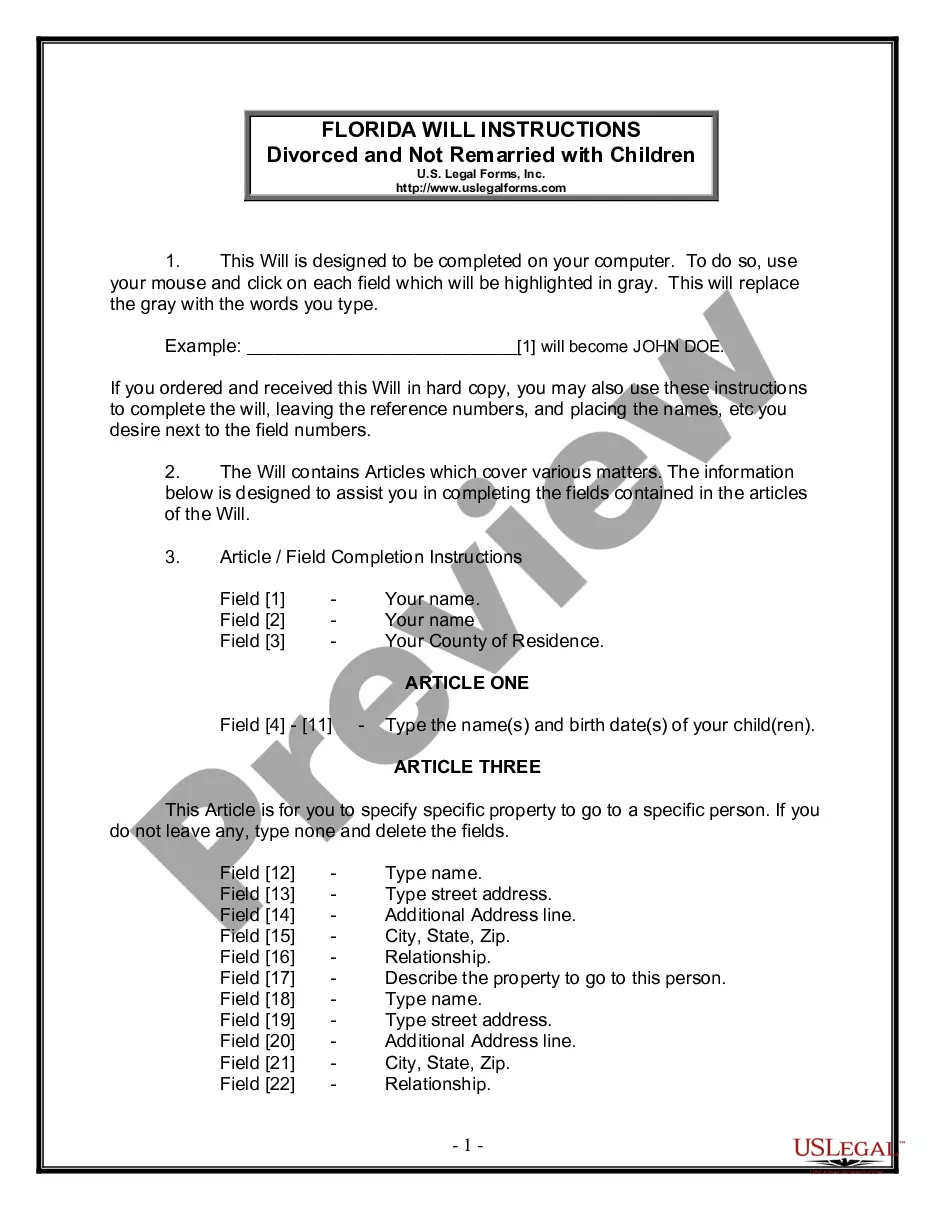

How to fill out Hillsboro Oregon Writ Of Garnishment?

If you are searching for a relevant form template, it’s extremely hard to find a better place than the US Legal Forms site – probably the most extensive online libraries. Here you can get a large number of form samples for company and individual purposes by categories and states, or key phrases. Using our advanced search function, getting the latest Hillsboro Oregon Writ of Garnishment is as elementary as 1-2-3. Additionally, the relevance of each document is confirmed by a group of skilled attorneys that regularly review the templates on our platform and update them based on the newest state and county regulations.

If you already know about our platform and have a registered account, all you should do to receive the Hillsboro Oregon Writ of Garnishment is to log in to your account and click the Download button.

If you use US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have opened the form you want. Read its description and make use of the Preview feature to see its content. If it doesn’t meet your needs, utilize the Search field at the top of the screen to find the proper file.

- Confirm your choice. Click the Buy now button. After that, pick the preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Utilize your credit card or PayPal account to complete the registration procedure.

- Obtain the form. Choose the format and download it to your system.

- Make modifications. Fill out, modify, print, and sign the received Hillsboro Oregon Writ of Garnishment.

Each form you add to your account has no expiration date and is yours permanently. It is possible to gain access to them using the My Forms menu, so if you need to have an extra copy for editing or creating a hard copy, you may come back and download it once more anytime.

Make use of the US Legal Forms professional collection to gain access to the Hillsboro Oregon Writ of Garnishment you were seeking and a large number of other professional and state-specific samples on one platform!