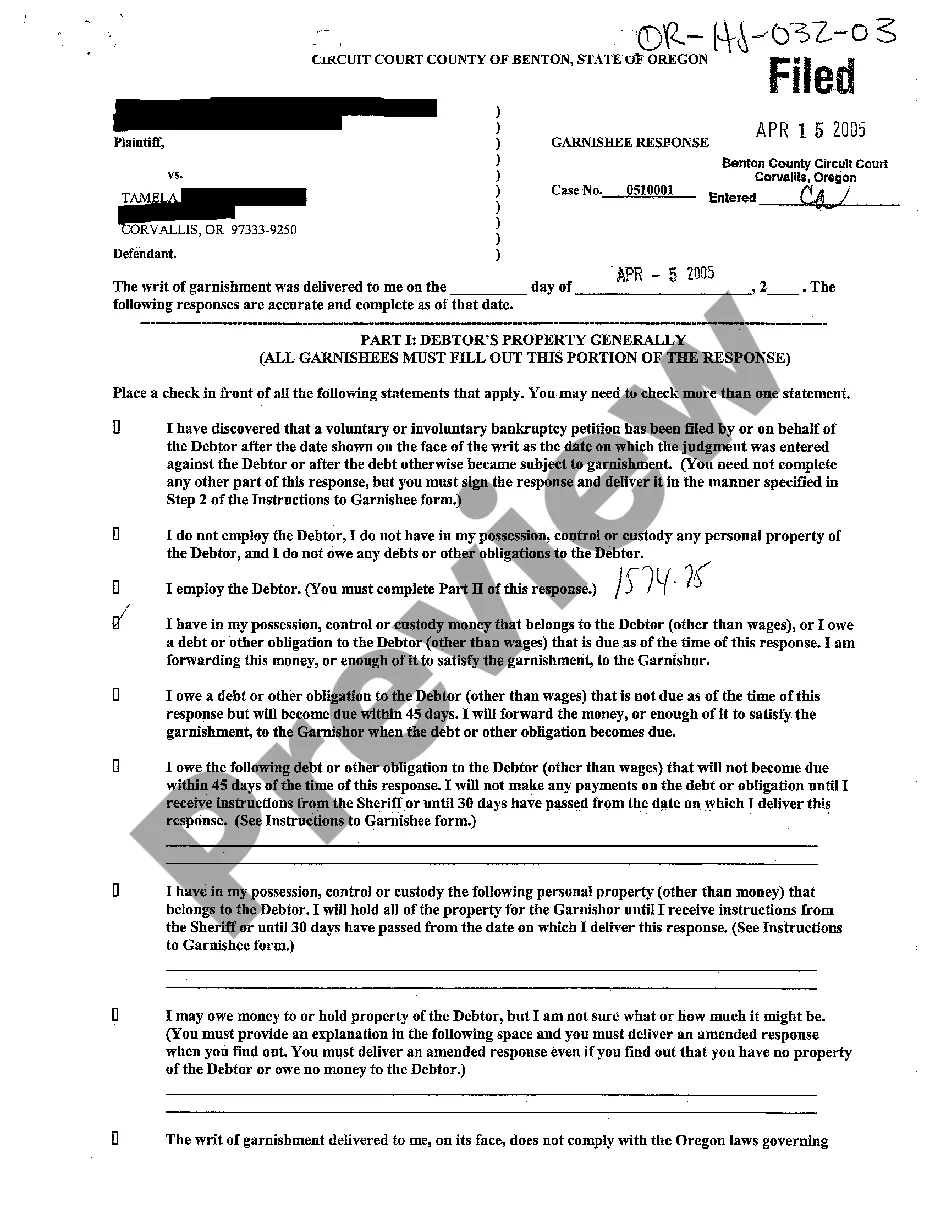

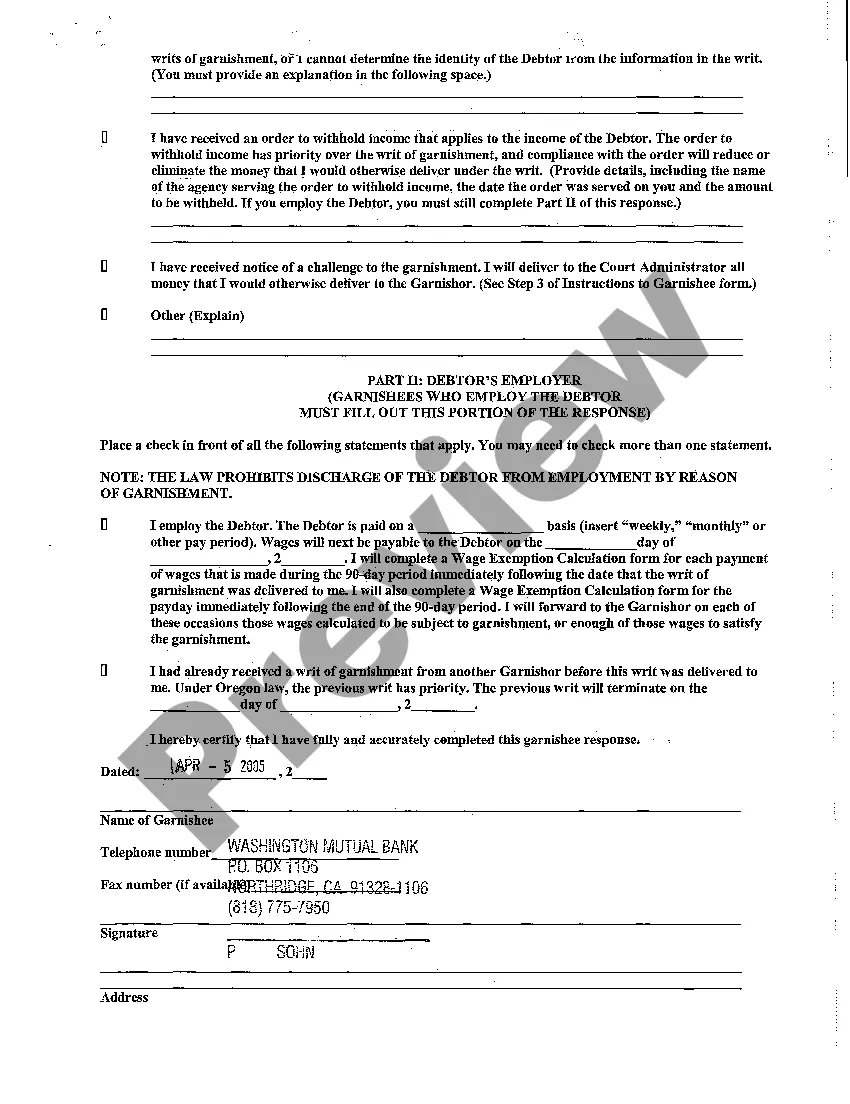

Portland, Oregon Garnishee Response Debtor's Property Generally refers to the set of rules and procedures followed when a debtor's property is being garnished in the city of Portland, Oregon. In this process, a garnishee (usually an employer or third-party entity holding the debtor's property) is required to disclose the debtor's property held in their possession and subsequently respond to the court. There are different types of Portland Oregon Garnishee Response Debtor's Property Generally, namely: 1. Wage Garnishment: This type of garnishment involves the debtor's employer as the garnishee. The employer is legally obligated to withhold a portion of the debtor's wages and submit them to the creditor in order to satisfy the debt. 2. Bank Garnishment: Here, the garnishee is usually a bank or financial institution where the debtor has an account. The bank is required to freeze the debtor's funds up to the amount owed and hand it over to the creditor. 3. Property Garnishment: In this scenario, the garnishee might be any third-party entity holding the debtor's property, such as tenants or clients who owe the debtor money. The garnishee must pay the amount owed directly to the creditor instead of the debtor. The Portland Oregon Garnishee Response Debtor's Property Generally process involves several steps. Initially, the creditor obtains a judgment against the debtor and applies for a writ of garnishment. The writ is then served to the garnishee, who must respond within a specific timeframe. Upon receipt of the writ, the garnishee is required to complete a garnishee response form, providing detailed information about the debtor's property held by them. This may include information about bank accounts, investments, real estate, vehicles, and other assets that can potentially be used to satisfy the debt. The garnishee must also indicate any property exemptions the debtor may claim under Oregon law. Common exemptions include primary residences, certain personal property, and specific funds like unemployment benefits or child support. Once the garnishee's response is submitted, it is reviewed by the court to determine the availability and value of the debtor's property. If the response is incomplete or the garnishee fails to respond, they may face legal consequences. In conclusion, Portland Oregon Garnishee Response Debtor's Property Generally outlines the process by which a debtor's property is garnished in Portland, Oregon. It encompasses various types of garnishments such as wage, bank, and property garnishments, and involves the garnishee's obligation to disclose and respond to the court regarding the debtor's property held by them.

Portland Oregon Garnishee Response Debtor's Property Generally

Description

How to fill out Portland Oregon Garnishee Response Debtor's Property Generally?

No matter what social or professional status, completing law-related forms is an unfortunate necessity in today’s world. Very often, it’s practically impossible for a person with no law background to draft such papers cfrom the ground up, mostly because of the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our service offers a huge catalog with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also is an excellent asset for associates or legal counsels who want to save time using our DYI tpapers.

No matter if you want the Portland Oregon Garnishee Response Debtor's Property Generally or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Portland Oregon Garnishee Response Debtor's Property Generally in minutes employing our reliable service. If you are already a subscriber, you can proceed to log in to your account to get the appropriate form.

Nevertheless, if you are unfamiliar with our library, make sure to follow these steps prior to obtaining the Portland Oregon Garnishee Response Debtor's Property Generally:

- Be sure the form you have chosen is good for your location considering that the regulations of one state or county do not work for another state or county.

- Preview the form and go through a quick description (if provided) of scenarios the paper can be used for.

- If the one you picked doesn’t meet your requirements, you can start again and look for the needed document.

- Click Buy now and choose the subscription option you prefer the best.

- utilizing your credentials or create one from scratch.

- Pick the payment method and proceed to download the Portland Oregon Garnishee Response Debtor's Property Generally once the payment is done.

You’re good to go! Now you can proceed to print out the form or fill it out online. Should you have any issues locating your purchased forms, you can easily access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.