Title: Understanding the Bend Oregon Affidavit in Support of Motion to Stay Proceedings Due to Filing of Chapter 7 Bankruptcy Petition Keywords: Bend Oregon, affidavit, motion to stay proceedings, Chapter 7 bankruptcy petition, detailed description Introduction: The Bend Oregon Affidavit in Support of Motion to Stay Proceedings Due to Filing of Chapter 7 Bankruptcy Petition is a crucial legal document filed by individuals or businesses seeking protection from creditors. When facing financial turmoil, bankruptcy under Chapter 7 offers debtors the opportunity to eliminate most of their debts through liquidation. This affidavit plays a significant role in requesting a temporary halt in ongoing legal actions or proceedings to allow the bankruptcy process to take place. Let's delve into the key aspects of Bend Oregon's affidavit concerning motion to stay proceedings due to the filing of a Chapter 7 bankruptcy petition. Types of Bend Oregon Affidavit in Support of Motion to Stay Proceedings Due to Filing of Chapter 7 Bankruptcy Petition: 1. Individual Debtor Affidavit: When a person files for Chapter 7 bankruptcy individually, they must submit an individual debtor affidavit. This affidavit highlights the individual's personal financial information, assets, liabilities, income, expenses, and any pending litigation or lawsuits. 2. Business Debtor Affidavit: In the case of a business entity filing for Chapter 7 bankruptcy, a business debtor affidavit is required. This affidavit outlines the details of the company's financial status, including assets, liabilities, income, expenses, pending legal matters, and any other relevant information. 3. Creditor's Affidavit: A creditor’s affidavit may be filed when the creditor seeks to prevent the automatic stay from being imposed or contest its application, necessitating additional information and supporting evidence not typically found in a debtor's affidavit. 4. Trustee's Affidavit: The Chapter 7 Trustee, appointed by the court, might submit a trustee's affidavit to support the motion to stay proceedings as per the debtor's request under Chapter 7 bankruptcy. This affidavit ensures that the trustee concurs with the debtor's assessment of the case's specifics and the necessity for a stay of proceedings. 5. Co-Debtor's Affidavit: In situations where a debtor has a co-debtor, they may be required to submit a co-debtor's affidavit, providing information relevant to the co-debtor's financial situation and reasons why the motion to stay proceedings should be granted. Conclusion: The Bend Oregon Affidavit in Support of Motion to Stay Proceedings Due to Filing of Chapter 7 Bankruptcy Petition serves as a pivotal document in bankruptcy cases. Debtors, when filing for Chapter 7 bankruptcy, must provide an accurate and detailed affidavit to request a temporary suspension of ongoing litigation. Whether you are an individual or a business debtor, ensuring that the relevant affidavit is properly filled out and filed can help protect your assets and provide you with the opportunity for financial restoration.

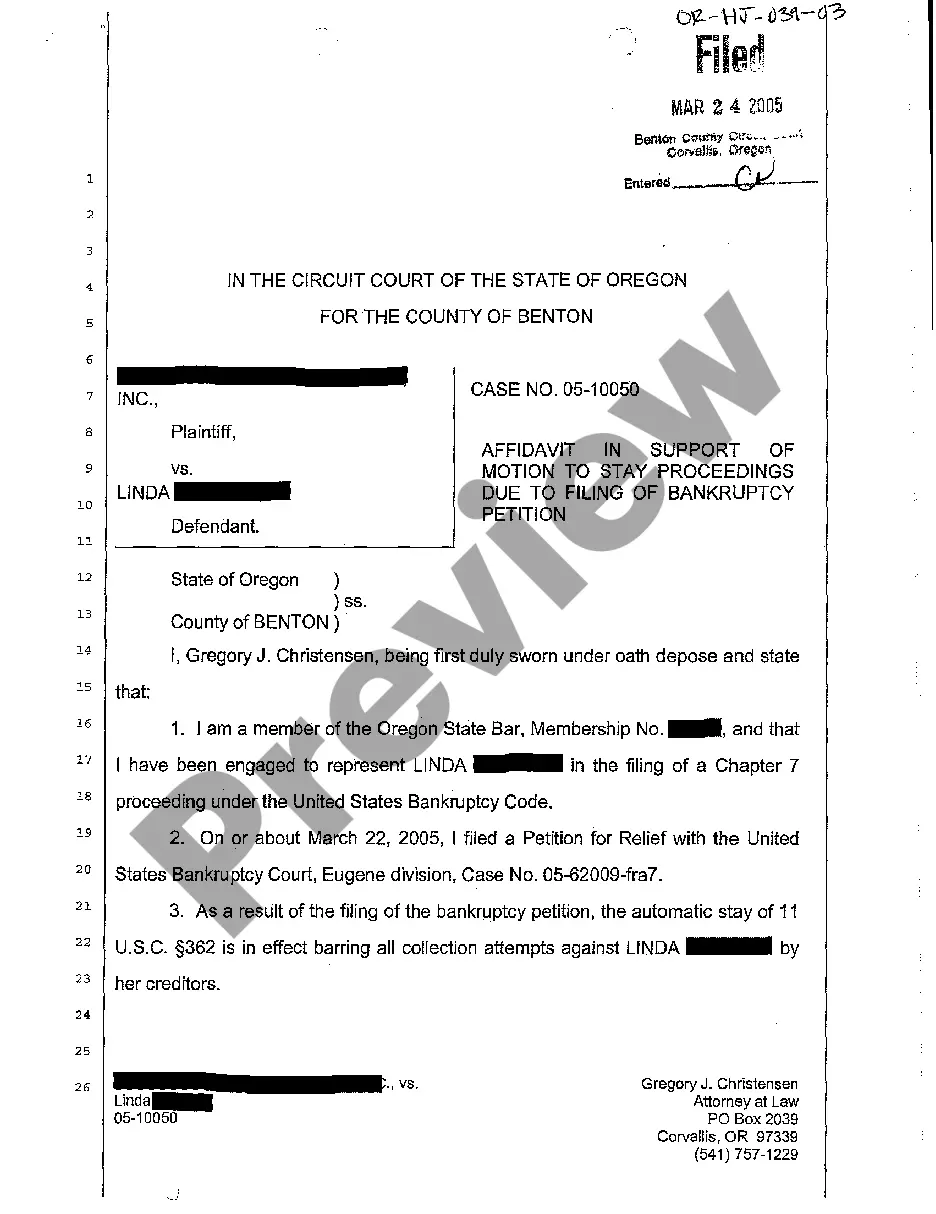

Bend Oregon Affidavit in Support of Motion to Stay Proceedings Due to Filing of Chapter 7 Bankruptcy Petition

Description

How to fill out Bend Oregon Affidavit In Support Of Motion To Stay Proceedings Due To Filing Of Chapter 7 Bankruptcy Petition?

Regardless of social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Too often, it’s practically impossible for a person with no legal education to create such papers cfrom the ground up, mostly because of the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes in handy. Our service offers a huge catalog with over 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you require the Bend Oregon Affidavit in Support of Motion to Stay Proceedings Due to Filing of Chapter 7 Bankruptcy Petition or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Bend Oregon Affidavit in Support of Motion to Stay Proceedings Due to Filing of Chapter 7 Bankruptcy Petition in minutes employing our trustworthy service. If you are presently an existing customer, you can proceed to log in to your account to download the appropriate form.

Nevertheless, in case you are a novice to our platform, ensure that you follow these steps prior to obtaining the Bend Oregon Affidavit in Support of Motion to Stay Proceedings Due to Filing of Chapter 7 Bankruptcy Petition:

- Ensure the template you have found is specific to your location since the regulations of one state or county do not work for another state or county.

- Review the form and go through a short outline (if provided) of scenarios the paper can be used for.

- If the one you selected doesn’t meet your needs, you can start over and search for the necessary form.

- Click Buy now and choose the subscription option you prefer the best.

- utilizing your login information or create one from scratch.

- Select the payment method and proceed to download the Bend Oregon Affidavit in Support of Motion to Stay Proceedings Due to Filing of Chapter 7 Bankruptcy Petition once the payment is completed.

You’re good to go! Now you can proceed to print out the form or fill it out online. Should you have any problems getting your purchased documents, you can easily access them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.