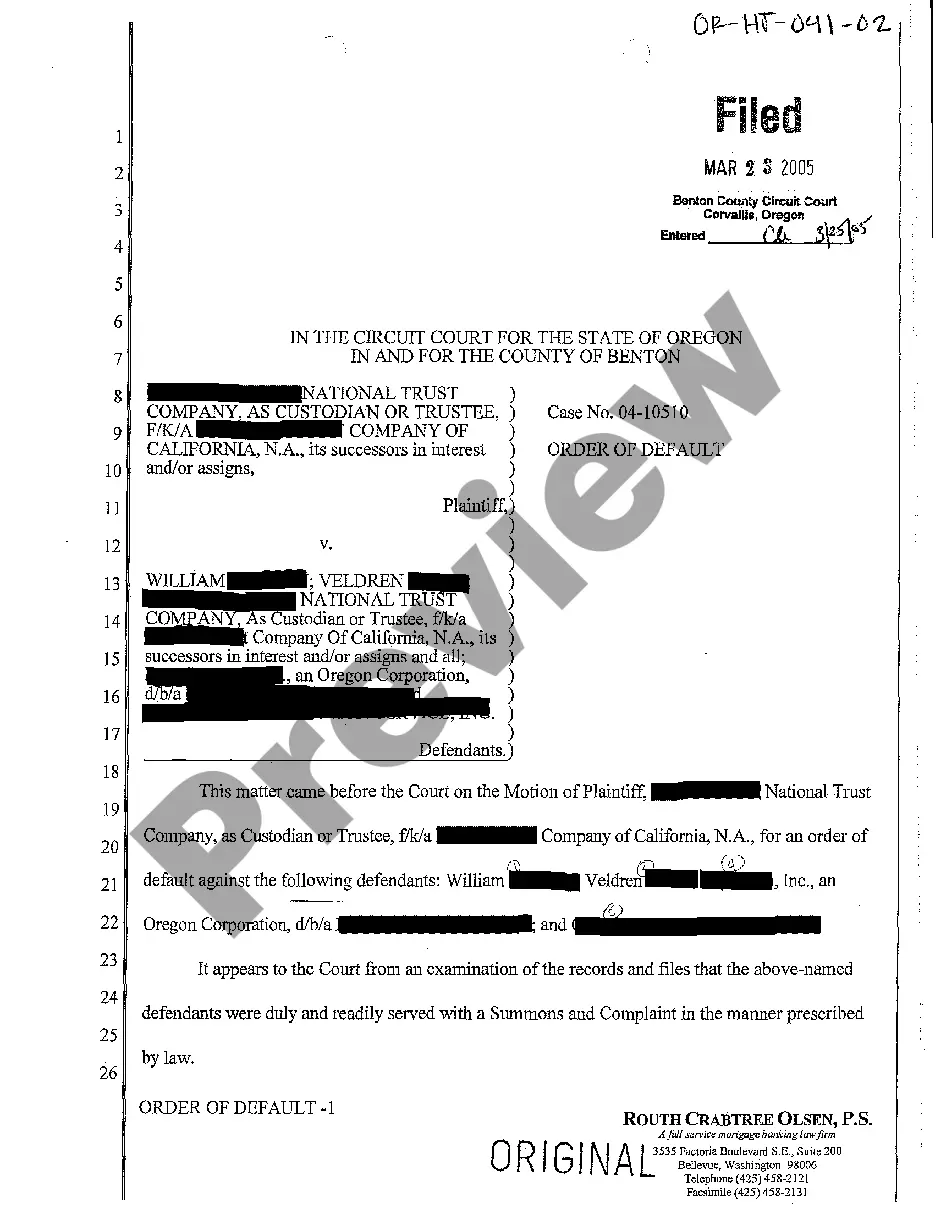

Title: Understanding the Bend Oregon Order of Default: Types and Detailed Overview Introduction: In Bend, Oregon, the Order of Default is a legal procedure implemented when a borrower fails to meet their financial obligations under a loan or mortgage agreement. This article aims to provide a comprehensive understanding of the Bend Oregon Order of Default, exploring its definition, process, and potential consequences. Additionally, we will touch upon the various types of Order of Default applicable in Bend, Oregon, shedding light on their distinct characteristics. Keywords: Bend Oregon Order of Default, legal procedure, borrower, financial obligations, loan, mortgage agreement, process, consequences, types 1. Definition of Bend Oregon Order of Default: The Bend Oregon Order of Default refers to a legal ruling issued by a court to establish that a borrower has failed to comply with the terms and conditions of their loan or mortgage agreement in Bend, Oregon. This order initiates a series of subsequent steps aimed at protecting the rights of the lender and seeking resolution for the defaulted loan. 2. Process of the Bend Oregon Order of Default: a. Notice of Default: The lender sends a notice of default to the borrower, typically through certified mail, detailing the default and allowing a specific period for remedying the situation (often known as the grace period). b. Grace Period: The grace period provides the borrower with an opportunity to cure the default by rectifying the missed payment(s) or resolving the outstanding issue that led to the default. c. Notice of Acceleration: If the borrower fails to remedy the default within the grace period, the lender sends a notice of acceleration, demanding immediate payment of the entire loan amount in full. d. Foreclosure Proceedings: Failure to fulfill the terms of the notice of acceleration may trigger a foreclosure process, where the lender initiates legal actions to reclaim the property securing the loan. 3. Consequences of Bend Oregon Order of Default: Upon the issuance of a Bend Oregon Order of Default, a series of potential consequences may arise, including but not limited to: — Collection efforts, such as wage garnishment or bank account levies, to recover the outstanding loan balance. — Foreclosure proceedings, leading to the sale of the property securing the loan to satisfy the outstanding debt. — Adverse impact on the borrower's credit score, making future borrowing more challenging. — Legal costs and fees incurred throughout the default resolution process. Types of Bend Oregon Order of Default: 1. Residential Mortgage Default: Relating specifically to defaulted mortgages secured by residential properties, this type focuses on loan defaults related to homes, condominiums, townhouses, or other residential structures. 2. Commercial Loan Default: This category encompasses defaults related to commercial properties, such as office buildings, retail centers, industrial facilities, or any non-residential real estate serving commercial purposes. 3. Personal Loan Default: Addressing unsecured personal loans, this type of default typically involves small-scale loans, credit cards, or personal lines of credit where no collateral is involved. Conclusion: Understanding the Bend Oregon Order of Default is crucial for borrowers and lenders alike. This comprehensive overview has provided insights into the definition, process, potential consequences, and types of Order of Default relevant to Bend, Oregon. It is essential for borrowers to seek professional advice and take timely action to mitigate the impact of default, while lenders should adhere to the legal requirements when initiating default proceedings.

Bend Oregon Order of Default

Description

How to fill out Bend Oregon Order Of Default?

Benefit from the US Legal Forms and get instant access to any form sample you require. Our useful website with a huge number of templates simplifies the way to find and obtain virtually any document sample you require. You are able to export, fill, and certify the Bend Oregon Order of Default in a few minutes instead of browsing the web for several hours looking for an appropriate template.

Using our collection is a superb way to improve the safety of your record submissions. Our experienced attorneys on a regular basis check all the records to make certain that the templates are relevant for a particular state and compliant with new laws and polices.

How do you obtain the Bend Oregon Order of Default? If you have a subscription, just log in to the account. The Download button will be enabled on all the samples you view. Moreover, you can find all the earlier saved documents in the My Forms menu.

If you haven’t registered a profile yet, follow the instruction listed below:

- Find the form you require. Make sure that it is the form you were seeking: verify its title and description, and take take advantage of the Preview feature if it is available. Otherwise, utilize the Search field to look for the needed one.

- Start the saving procedure. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Download the file. Choose the format to obtain the Bend Oregon Order of Default and revise and fill, or sign it for your needs.

US Legal Forms is one of the most considerable and trustworthy form libraries on the internet. We are always ready to assist you in virtually any legal case, even if it is just downloading the Bend Oregon Order of Default.

Feel free to benefit from our platform and make your document experience as convenient as possible!