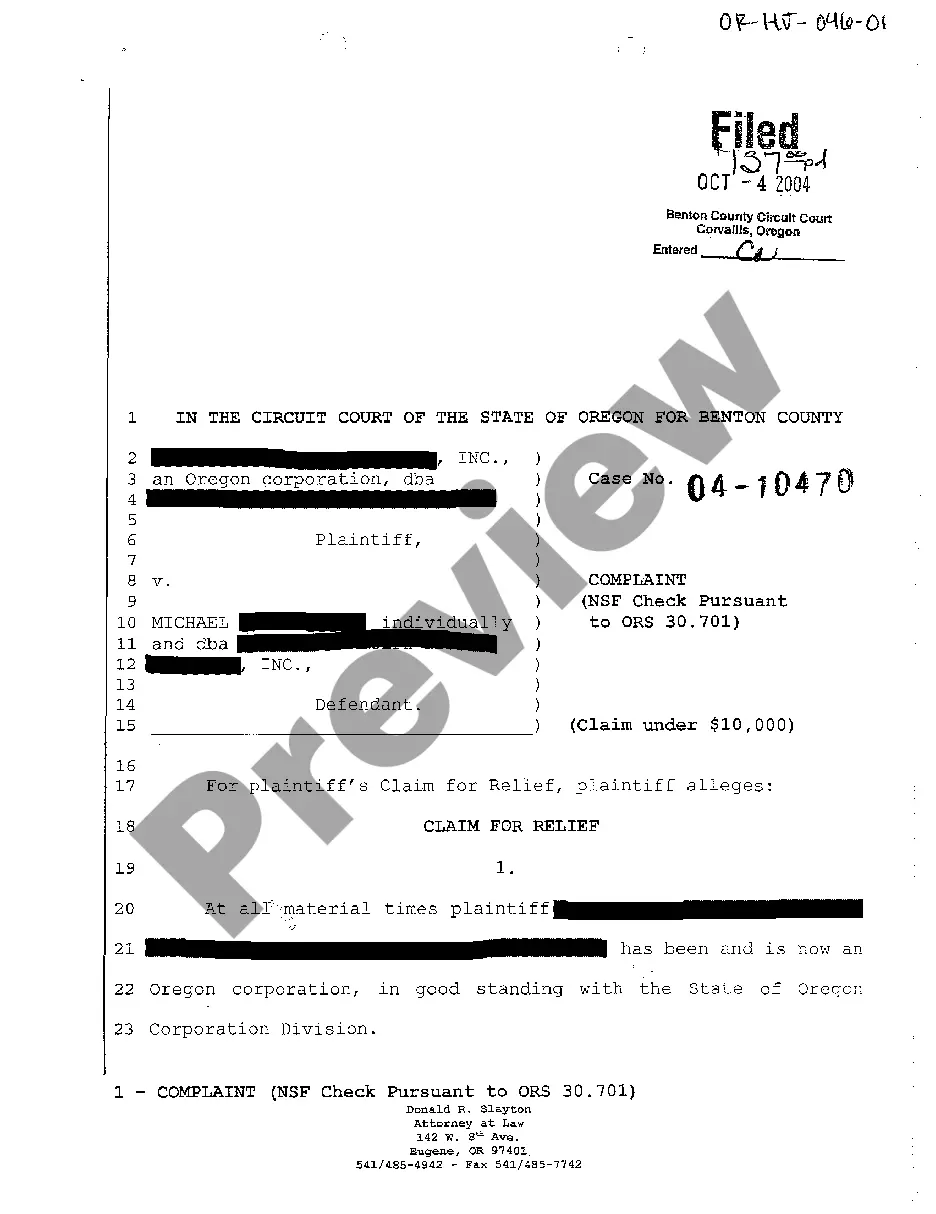

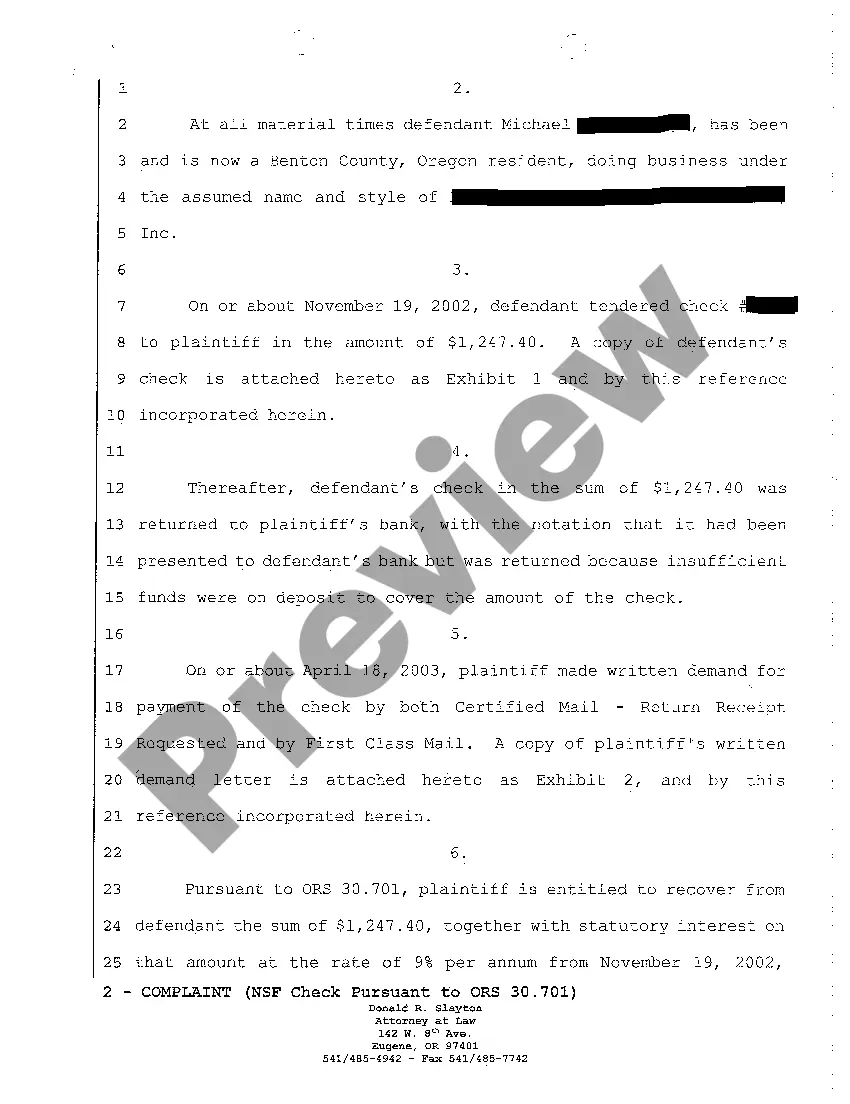

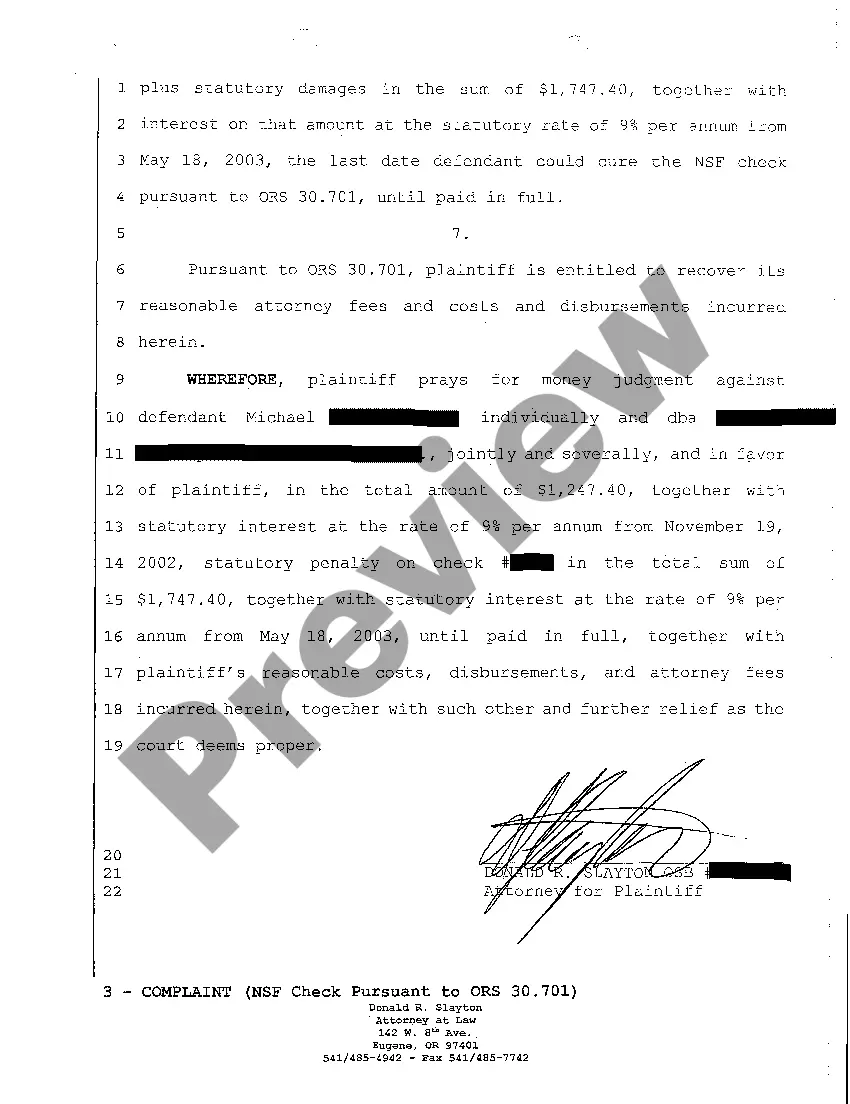

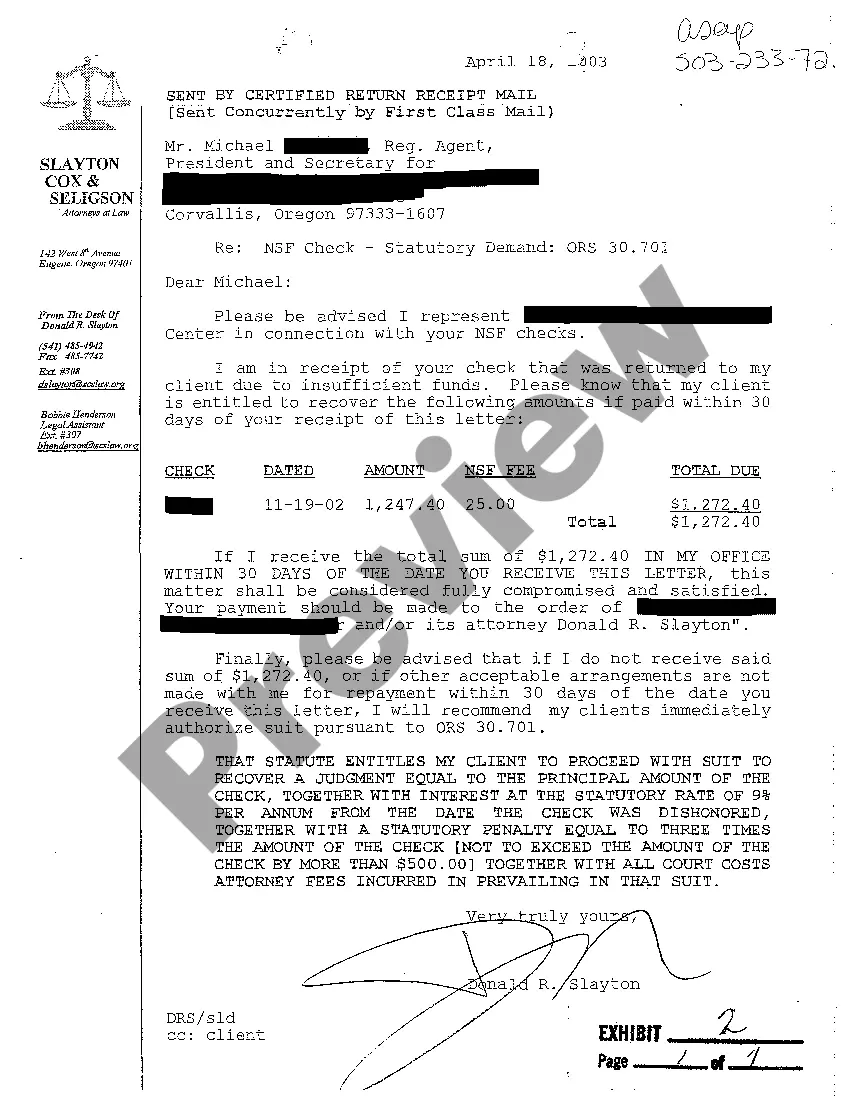

Portland Oregon Complaint for Dishonored Check is a legal document filed against an individual or business entity in Portland, Oregon, for issuing a check that has been returned or dishonored by the bank due to insufficient funds or other reasons. When an individual or business receives a dishonored check, they have the option to file a complaint in court to seek restitution for the amount owed. This complaint outlines the details of the dishonored check incident and seeks legal resolution. Keywords related to a Portland Oregon Complaint for Dishonored Check may include: 1. Dishonored check: A written instrument, typically a personal or business check, that has been returned unpaid by the bank due to insufficient funds, closed account, or other reasons. 2. Complaint: A legal document filed with a court that initiates a lawsuit against the individual or business responsible for issuing the dishonored check. 3. Portland, Oregon: Refers to the specific location where the complaint is filed, indicating the jurisdiction under which the lawsuit will be conducted. 4. Insufficient funds: Indicates that the bank account of the person or business issuing the check did not have enough money to cover the check amount when it was presented for payment. 5. Restitution: The amount of money being sought by the complainant to compensate for the dishonored check, including the face value of the check plus any applicable fees or damages incurred. 6. Bank fees: Additional charges or penalties imposed by the bank due to the dishonored check, which may be included in the restitution sought in the complaint. 7. Legal resolution: Refers to the desired outcome of the complaint, typically seeking a court order requiring the responsible party to pay the restitution amount or face additional legal consequences. Types of Portland Oregon Complaint for Dishonored Check could include: 1. Individual complaint: Filed by an individual who received a dishonored check from another individual or business. 2. Business complaint: Filed by a business entity that received a dishonored check from an individual or another business. 3. Small claims complaint: Filed in small claims court for dishonored checks of lower value, typically below a certain monetary threshold. 4. Civil complaint: Filed in civil court for dishonored checks of higher value, typically above the small claims court threshold. In summary, a Portland Oregon Complaint for Dishonored Check is a legal document filed in Portland, Oregon, to seek restitution for a dishonored check. This complaint details the incident, including keywords like dishonored check, insufficient funds, restitution, and legal resolution. Different types of complaints may include individual, business, small claims, or civil complaints, depending on the nature and value of the dishonored check.

Portland Oregon Complaint for Dishonored Check

Description

How to fill out Portland Oregon Complaint For Dishonored Check?

Benefit from the US Legal Forms and obtain immediate access to any form sample you require. Our helpful website with a large number of templates allows you to find and get virtually any document sample you require. You can export, complete, and sign the Portland Oregon Complaint for Dishonored Check in a couple of minutes instead of browsing the web for many hours seeking a proper template.

Using our catalog is a wonderful way to increase the safety of your form submissions. Our professional legal professionals regularly review all the documents to make certain that the forms are relevant for a particular state and compliant with new laws and regulations.

How can you get the Portland Oregon Complaint for Dishonored Check? If you have a profile, just log in to the account. The Download button will appear on all the samples you view. Moreover, you can get all the previously saved records in the My Forms menu.

If you haven’t registered an account yet, stick to the instruction below:

- Find the template you need. Make certain that it is the form you were seeking: examine its headline and description, and utilize the Preview function when it is available. Otherwise, make use of the Search field to look for the needed one.

- Launch the saving procedure. Click Buy Now and choose the pricing plan you like. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Export the document. Indicate the format to obtain the Portland Oregon Complaint for Dishonored Check and change and complete, or sign it according to your requirements.

US Legal Forms is probably the most extensive and reliable document libraries on the internet. Our company is always happy to help you in virtually any legal process, even if it is just downloading the Portland Oregon Complaint for Dishonored Check.

Feel free to make the most of our platform and make your document experience as convenient as possible!