Title: Understanding the Portland Oregon Writ of Execution to Satisfy Debt: Types and Detailed Explanation Introduction: The Portland Oregon Writ of Execution to Satisfy Debt is a legal mechanism employed by creditors to collect outstanding debts owed by a debtor. This article will provide a comprehensive overview of what a writ of execution entails, its purpose, and the potential types of writs used in debt recovery proceedings in Portland, Oregon. What is a Writ of Execution? A writ of execution is a court order issued by a judge that authorizes the enforcement of a judgment in favor of a creditor against a debtor. It allows the creditor to collect the amount owed by the debtor through various means, including seizing and selling the debtor's property. Types of Portland Oregon Writ of Executions to Satisfy Debt: 1. General Writ of Execution: A general writ of execution allows creditors to collect the debt owed by seizing and selling the debtor's non-exempt property, such as vehicles, bank accounts, or other valuable assets. The proceeds from the sale are then used to satisfy the debt. 2. Real Property Writ of Execution: This type of writ focuses specifically on the debtor's real estate property, such as houses, land, or commercial buildings. If the debtor fails to pay the outstanding debt, the creditor can request a real property writ of execution to obtain a court order for the sale of the property. The proceeds from the sale are then applied towards the debt. 3. Personal Property Writ of Execution: A personal property writ of execution is used when the debtor possesses valuable personal belongings, excluding real estate. Examples of personal property that may be seized and sold to satisfy the debt include vehicles, jewelry, artwork, or other valuable possessions. 4. Bank Levy Writ of Execution: In cases where the debtor has funds in a bank account, creditors may apply for a bank levy writ of execution. This writ allows the creditor to freeze the debtor's bank account and seize the funds to satisfy the outstanding debt. 5. Wage Garnishment Writ of Execution: If the debtor is employed, a creditor can request a wage garnishment writ of execution. This allows the creditor to legally instruct the debtor's employer to deduct a portion of their wages directly to repay the debt. Conclusion: Understanding the different types of Portland Oregon Writ of Execution to Satisfy Debt is crucial for both creditors and debtors. Creditors can utilize these legal remedies to recover outstanding debts, while debtors should be aware of the potential consequences and act proactively to address their financial obligations. Seeking professional legal advice is always recommended in debt recovery situations to ensure compliance with the relevant laws and regulations.

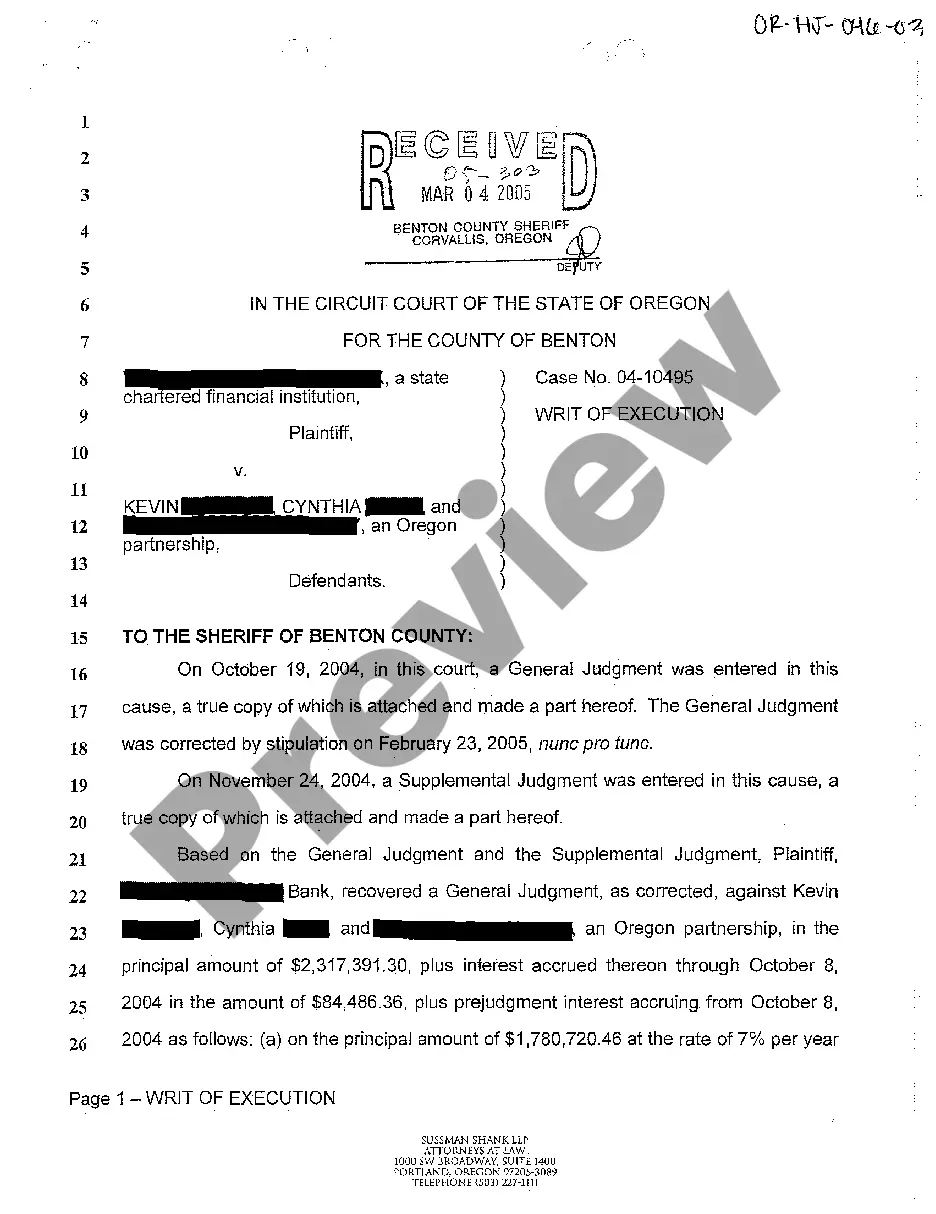

Portland Oregon Writ of Execution to Satisfy Debt

State:

Oregon

City:

Portland

Control #:

OR-HJ-046-03

Format:

PDF

Instant download

This form is available by subscription

Description

A03 Writ of Execution to Satisfy Debt

Title: Understanding the Portland Oregon Writ of Execution to Satisfy Debt: Types and Detailed Explanation Introduction: The Portland Oregon Writ of Execution to Satisfy Debt is a legal mechanism employed by creditors to collect outstanding debts owed by a debtor. This article will provide a comprehensive overview of what a writ of execution entails, its purpose, and the potential types of writs used in debt recovery proceedings in Portland, Oregon. What is a Writ of Execution? A writ of execution is a court order issued by a judge that authorizes the enforcement of a judgment in favor of a creditor against a debtor. It allows the creditor to collect the amount owed by the debtor through various means, including seizing and selling the debtor's property. Types of Portland Oregon Writ of Executions to Satisfy Debt: 1. General Writ of Execution: A general writ of execution allows creditors to collect the debt owed by seizing and selling the debtor's non-exempt property, such as vehicles, bank accounts, or other valuable assets. The proceeds from the sale are then used to satisfy the debt. 2. Real Property Writ of Execution: This type of writ focuses specifically on the debtor's real estate property, such as houses, land, or commercial buildings. If the debtor fails to pay the outstanding debt, the creditor can request a real property writ of execution to obtain a court order for the sale of the property. The proceeds from the sale are then applied towards the debt. 3. Personal Property Writ of Execution: A personal property writ of execution is used when the debtor possesses valuable personal belongings, excluding real estate. Examples of personal property that may be seized and sold to satisfy the debt include vehicles, jewelry, artwork, or other valuable possessions. 4. Bank Levy Writ of Execution: In cases where the debtor has funds in a bank account, creditors may apply for a bank levy writ of execution. This writ allows the creditor to freeze the debtor's bank account and seize the funds to satisfy the outstanding debt. 5. Wage Garnishment Writ of Execution: If the debtor is employed, a creditor can request a wage garnishment writ of execution. This allows the creditor to legally instruct the debtor's employer to deduct a portion of their wages directly to repay the debt. Conclusion: Understanding the different types of Portland Oregon Writ of Execution to Satisfy Debt is crucial for both creditors and debtors. Creditors can utilize these legal remedies to recover outstanding debts, while debtors should be aware of the potential consequences and act proactively to address their financial obligations. Seeking professional legal advice is always recommended in debt recovery situations to ensure compliance with the relevant laws and regulations.

Free preview

How to fill out Portland Oregon Writ Of Execution To Satisfy Debt?

If you’ve already used our service before, log in to your account and save the Portland Oregon Writ of Execution to Satisfy Debt on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Make sure you’ve located a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Portland Oregon Writ of Execution to Satisfy Debt. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!