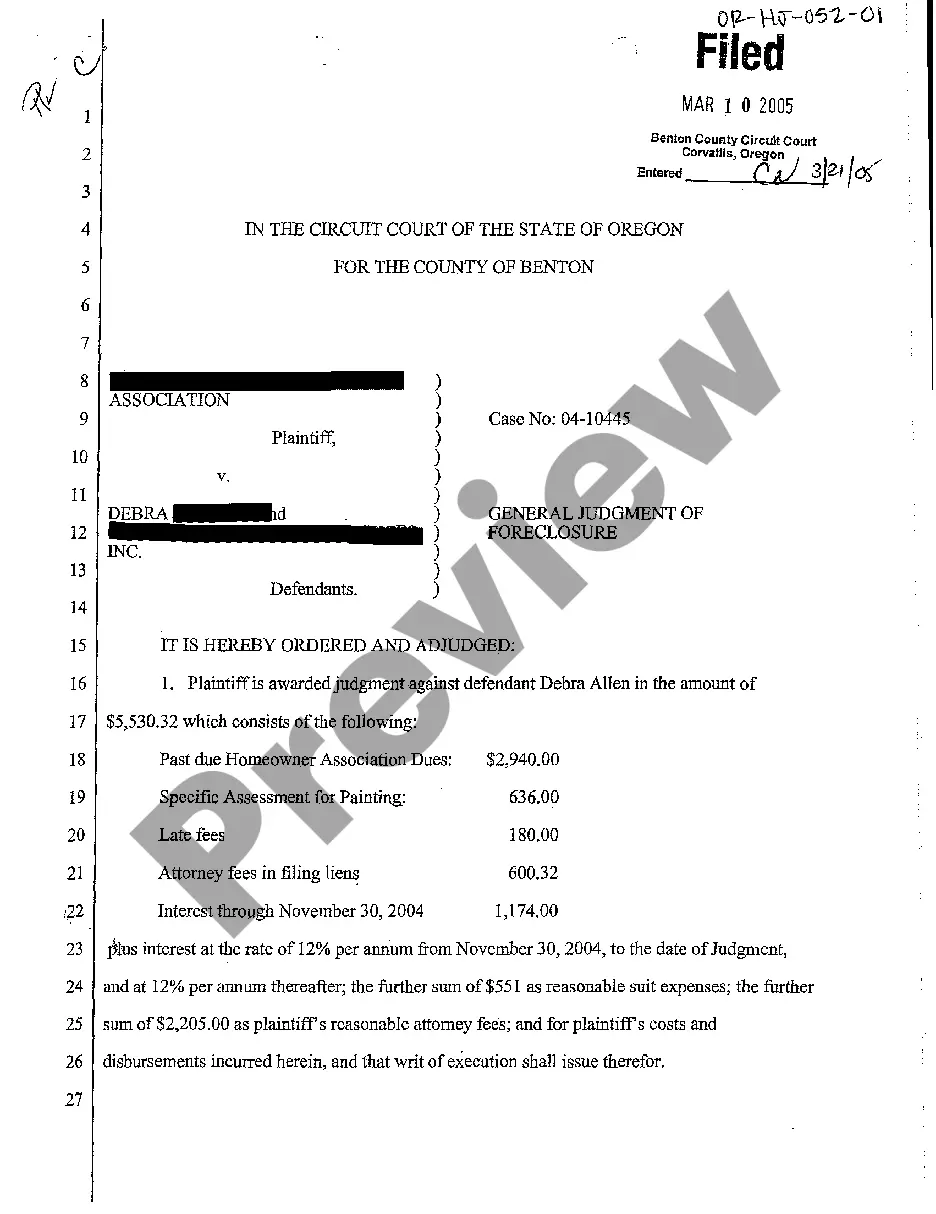

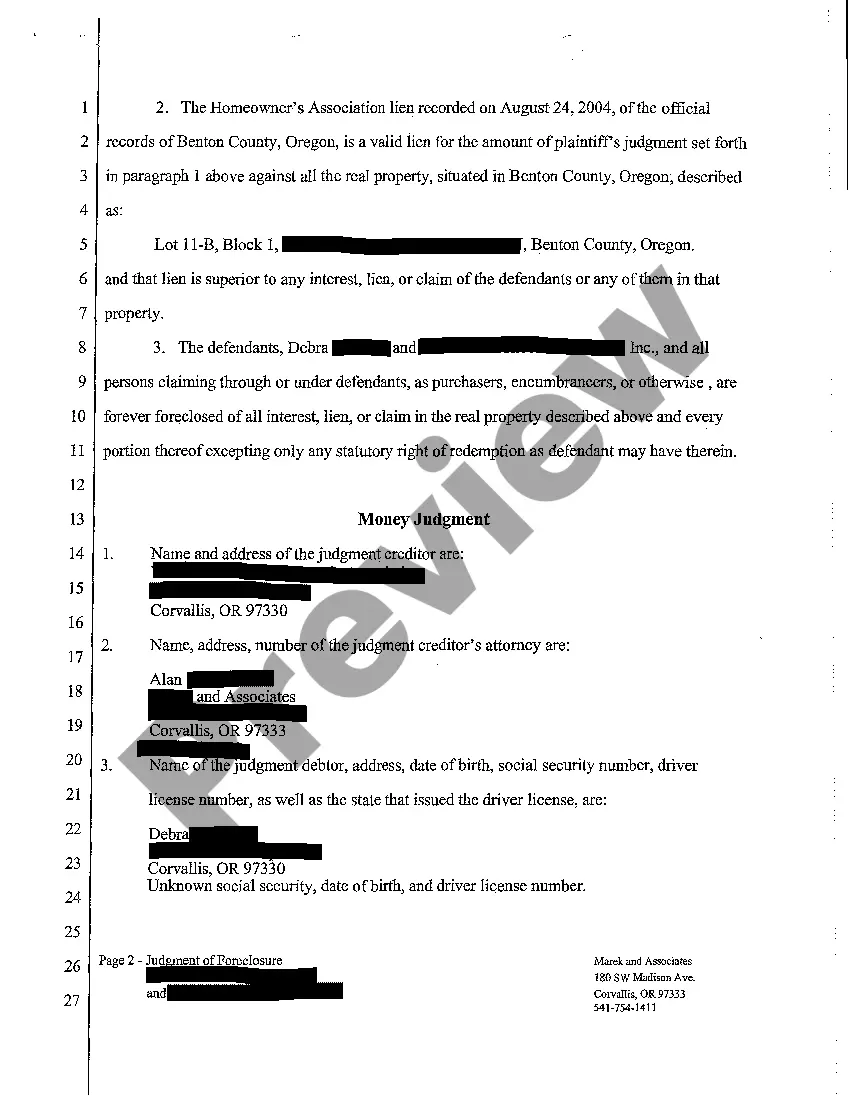

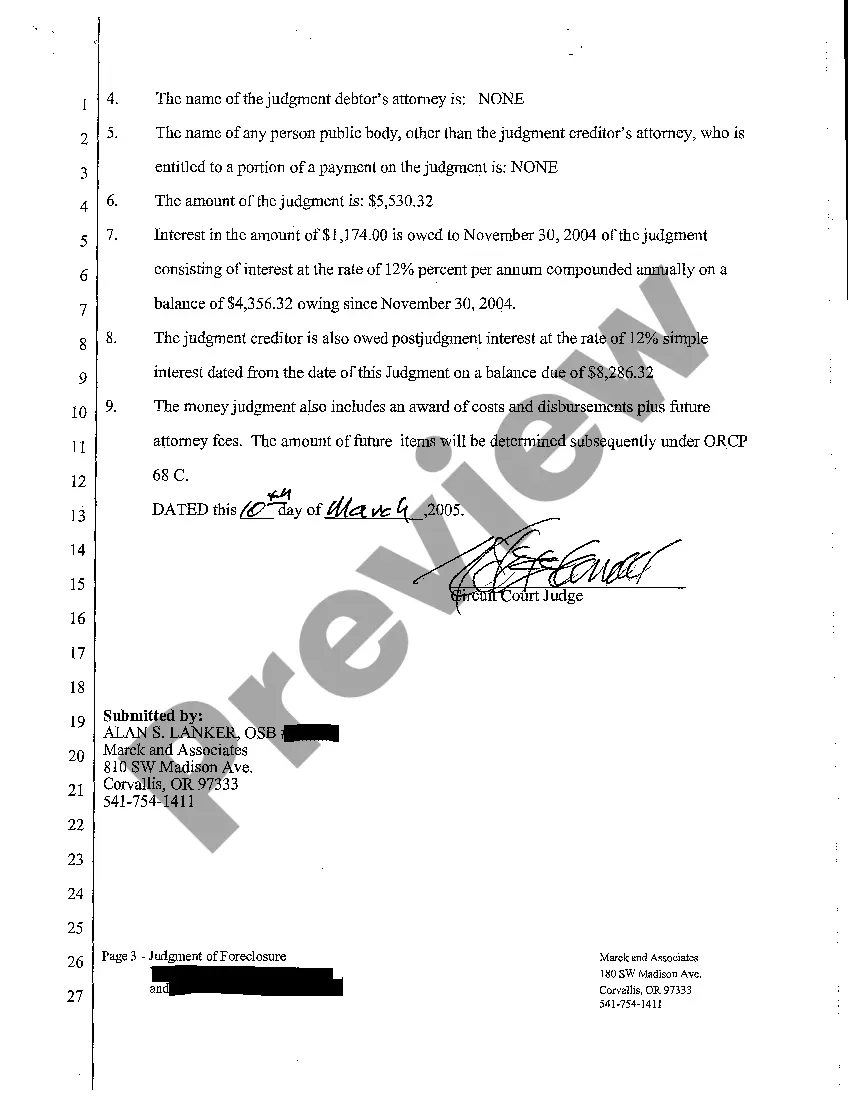

Portland Oregon General Judgment of Foreclosure and Money Award refers to a legal process that occurs when a property owner in Portland, Oregon fails to make mortgage payments as per the agreed terms. In such cases, the mortgage lender initiates a foreclosure action to recover the outstanding debt. A General Judgment of Foreclosure and Money Award is a court ruling that grants the lender ownership of the property and provides a monetary judgment against the borrower for the unpaid balance of the mortgage. This judgment allows the lender to sell the property to recover the owed funds. There are different types of Portland Oregon General Judgment of Foreclosure and Money Awards, including strict foreclosure and judicial foreclosure. In a strict foreclosure, the court awards the property to the lender without requiring a public auction. This type of foreclosure is less common and usually occurs when the property value is greater than the mortgage debt. On the other hand, a judicial foreclosure involves a public auction of the property. The court sets a date for the auction, where bidders have the opportunity to purchase the property. The winning bidder must pay the full amount in cash, and the proceeds are used to repay the lender's debt. Any surplus amount is returned to the borrower. During the foreclosure process, the court determines the fair market value of the property, the outstanding mortgage balance, and any additional fees or charges owed by the borrower. It also considers any defenses raised by the borrower, such as improper loan servicing or predatory lending practices. Portland Oregon General Judgment of Foreclosure and Money Awards provide a legal framework to ensure that the rights of both the borrower and the lender are protected. The court's involvement ensures a fair and transparent process that allows for the resolution of mortgage default cases. In summary, a Portland Oregon General Judgment of Foreclosure and Money Award is a court ruling that grants ownership of a property to a lender and provides a monetary judgment against the borrower for the unpaid mortgage balance. It aims to resolve foreclosure cases in a fair and transparent manner, ensuring the rights of both parties are upheld. Strict foreclosure and judicial foreclosure are the two main types of foreclosure processes in Portland, Oregon.

Portland Oregon General Judgment of Foreclosure and Money Award

Description

How to fill out Portland Oregon General Judgment Of Foreclosure And Money Award?

If you are searching for a pertinent form, it’s challenging to discover a more user-friendly service than the US Legal Forms site – likely the largest online repositories.

With this repository, you can locate a vast array of form examples for business and personal use by categories and states, or by keywords.

Utilizing our enhanced search feature, locating the most current Portland Oregon General Judgment of Foreclosure and Money Award is as simple as 1-2-3.

Complete the financial transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose the format and save it to your device.

- Furthermore, the accuracy of each document is validated by a team of qualified attorneys who routinely review the templates on our platform and refresh them in accordance with the latest state and county regulations.

- If you are already familiar with our system and have an established account, all you need to do to obtain the Portland Oregon General Judgment of Foreclosure and Money Award is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just adhere to the instructions below.

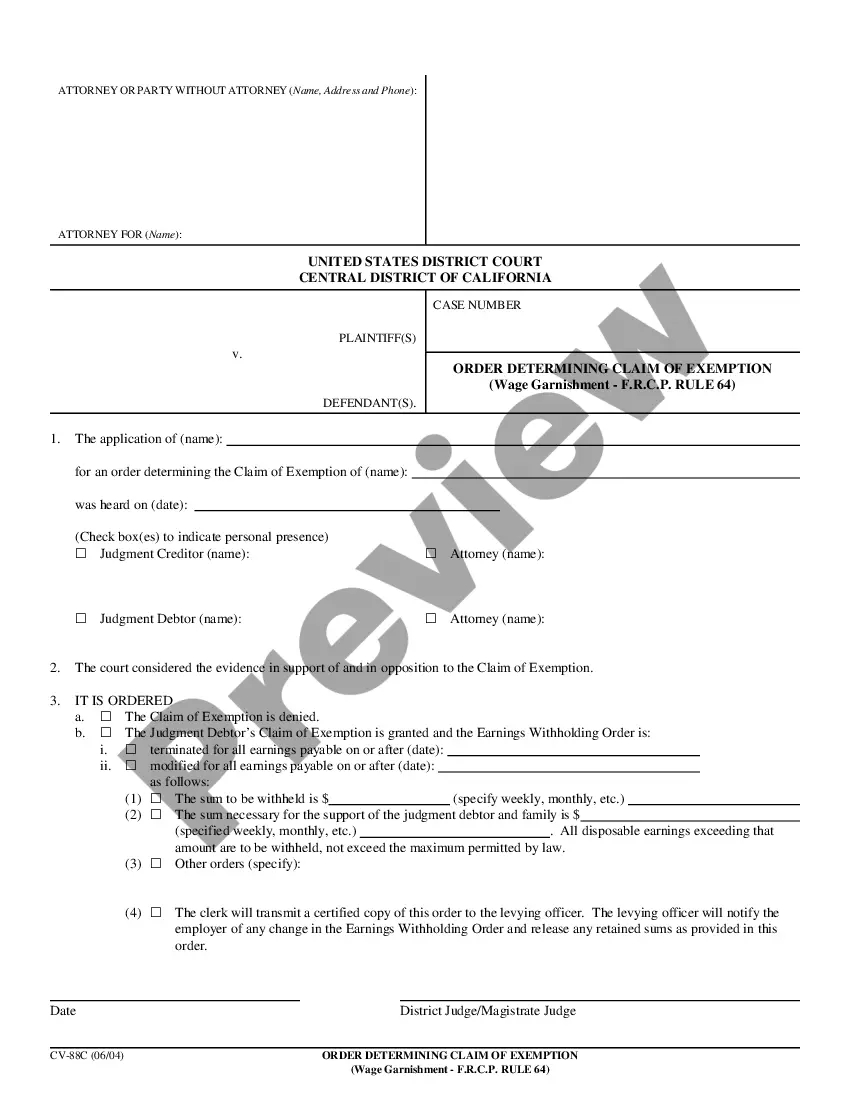

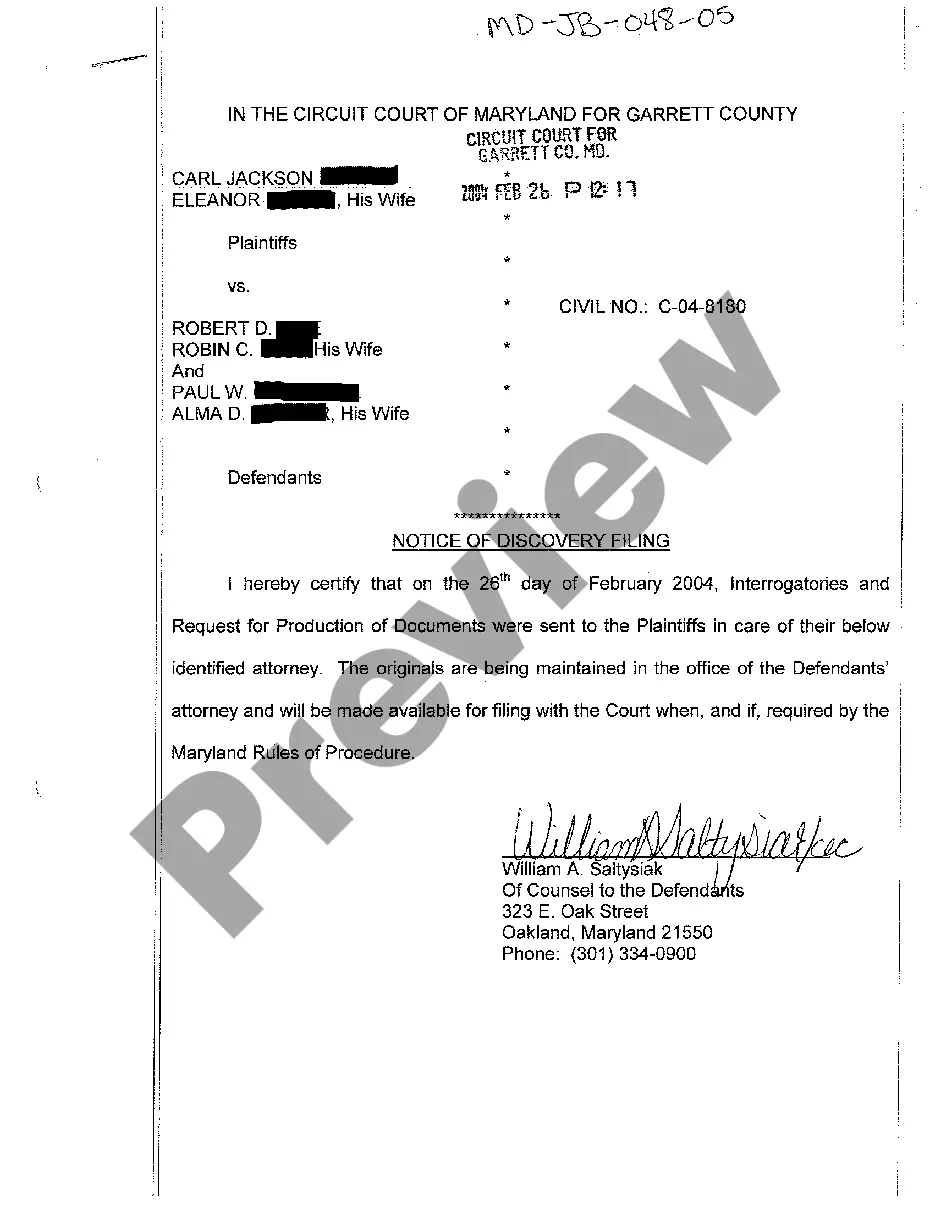

- Ensure you have accessed the form you desire. Review its description and utilize the Preview option to inspect its details. If it doesn’t fulfill your requirements, employ the Search feature at the top of the page to find the suitable document.

- Validate your selection. Click the Buy now button. Then, choose your preferred pricing option and input details to register an account.

Form popularity

FAQ

Renew the judgment Money judgments automatically expire (run out) after 10 years. To prevent this from happening, the creditor must file a request for renewal of the judgment with the court BEFORE the 10 years run out.

The judgment remedies for a judgment that are extended under the provisions of this section expire 10 years after the certificate of extension is filed. Judgment remedies for a judgment may be extended only once under the provisions of this section.

You can try and get your money (called 'enforcing your judgment') by asking the court for: a warrant of control. an attachment of earnings order. a third-party debt order. a charging order.

Way too long to ignore. For non-governmental judgments, they last for 10 (yep, ten) years. And, so long as the creditor files a renewal prior to the expiration of that ten-year term, it is renewed for another 10 years.

It is up to you to find out where the defendant has assets (property) that can be seized to pay your judgment. If you have received a judgment and the defendant refuses to pay it, you may be able to have his or her wages or bank account garnished. The court does not provide garnishment forms.

Except as provided in this subsection, judgment remedies for a judgment in a criminal action expire 20 years after the entry of the judgment. Judgment remedies for a judgment in a criminal action that includes a money award for restitution expire 50 years after the entry of the judgment.

How long does a judgment lien last in Oregon? A judgment lien in Oregon will remain attached to the debtor's property (even if the property changes hands) for ten years.

In Oregon, the statute of limitations for debt is six years. This means a creditor has up to six years to file a lawsuit to collect on the debt. The six-year statute of limitations applies to medical debt, credit card debt, and auto loan debt.