Title: Understanding the Gresham Oregon Complaint for Foreclosure of Security Interest: Types, Process, and Key Considerations Introduction: The Gresham Oregon Complaint for Foreclosure of Security Interest is a legal procedure initiated by a lender to recover unpaid debts from a borrower by foreclosing on the collateral pledged as security interest. This comprehensive guide explores the different types of complaints for foreclosure of security interest in Gresham, Oregon, delving into the process, key components, and relevant keywords associated with this legal proceeding. Types of Gresham Oregon Complaints for Foreclosure of Security Interest: 1. Judicial Foreclosure Complaint: — Pre-foreclosure proceeding— - Formal lawsuit filed by the lender against the borrower — Court involvement in the foreclosure process — Litigation and trial-based foreclosure 2. Non-Judicial Foreclosure Complaint: — Recognized under Oregon's non-judicial foreclosure law (ORS 86.735 — ORS 86.755— - Administrative process without court involvement (unless contested) — Usually completeoutsideof the courtroom Process of a Gresham Oregon Complaint for Foreclosure of Security Interest: 1. Default and Notice: — Borrower fails to meet the terms of the loan agreement (missed payments). — Lender sends a Notice of Default to the borrower, demanding payment and notifying them of the intention to initiate foreclosure proceedings. 2. Pre-foreclosure Negotiations: — Lender may attempt to negotiate a solution with the borrower, such as modifying the loan terms or establishing a repayment plan. 3. Judicial Foreclosure Complaint Process: a. Complaint Filing: — Lender files a complaint in court, initiating the foreclosure lawsuit. — Complaint should include details of the loan, default, and important documentary evidence. b. Summons and Response: — Borrower receives a copy of the complaint (summons) and responds within a specified timeframe, either admitting or denying the allegations. c. Litigation and Trial: — Parties engage in discovery, presenting evidence and engaging in litigation. — Trial determines whether to proceed with foreclosure or offer an alternative remedy. d. Judgment and Auction: — If judgment favors the lender, the court orders foreclosure and may schedule a public auction to sell the property. 4. Non-Judicial Foreclosure Complaint Process: a. Notice of Sale: — Lender issues a Notice of Sale, outlining the foreclosure sale details and notifying the borrower of their right to cure the default. b. Redemption Period: — Following the notice, the borrower enters a redemption period, during which they can repay the outstanding debt, including applicable fees and costs. c. Trustee's Sale: — If the borrower fails to cure the default, the property is then scheduled for a trustee's sale (public auction) to recover the outstanding debt. Key Considerations during the Gresham Oregon Complaint for Foreclosure of Security Interest: 1. Timelines and Deadlines: — Complying with strict timelines set by Oregon law is crucial for both lenders and borrowers involved in foreclosure proceedings. 2. Appropriate Legal Representation: — Seeking legal counsel is strongly advised to ensure compliance with foreclosure laws, protect rights, and navigate the complex legal processes involved. 3. Preservation of Property Rights: — Understanding the options available to borrowers, such as redemption periods or alternatives to foreclosure, can help them protect their property rights. In conclusion, the Gresham Oregon Complaint for Foreclosure of Security Interest encompasses various types of complaints and legal procedures involved in recovering unpaid debts through collateral foreclosure. To handle this process effectively, borrowers and lenders must be knowledgeable about their respective rights, engage in open communication, and understand the intricacies of Oregon's foreclosure laws.

Gresham Oregon Complaint for Foreclosure of Security Interest

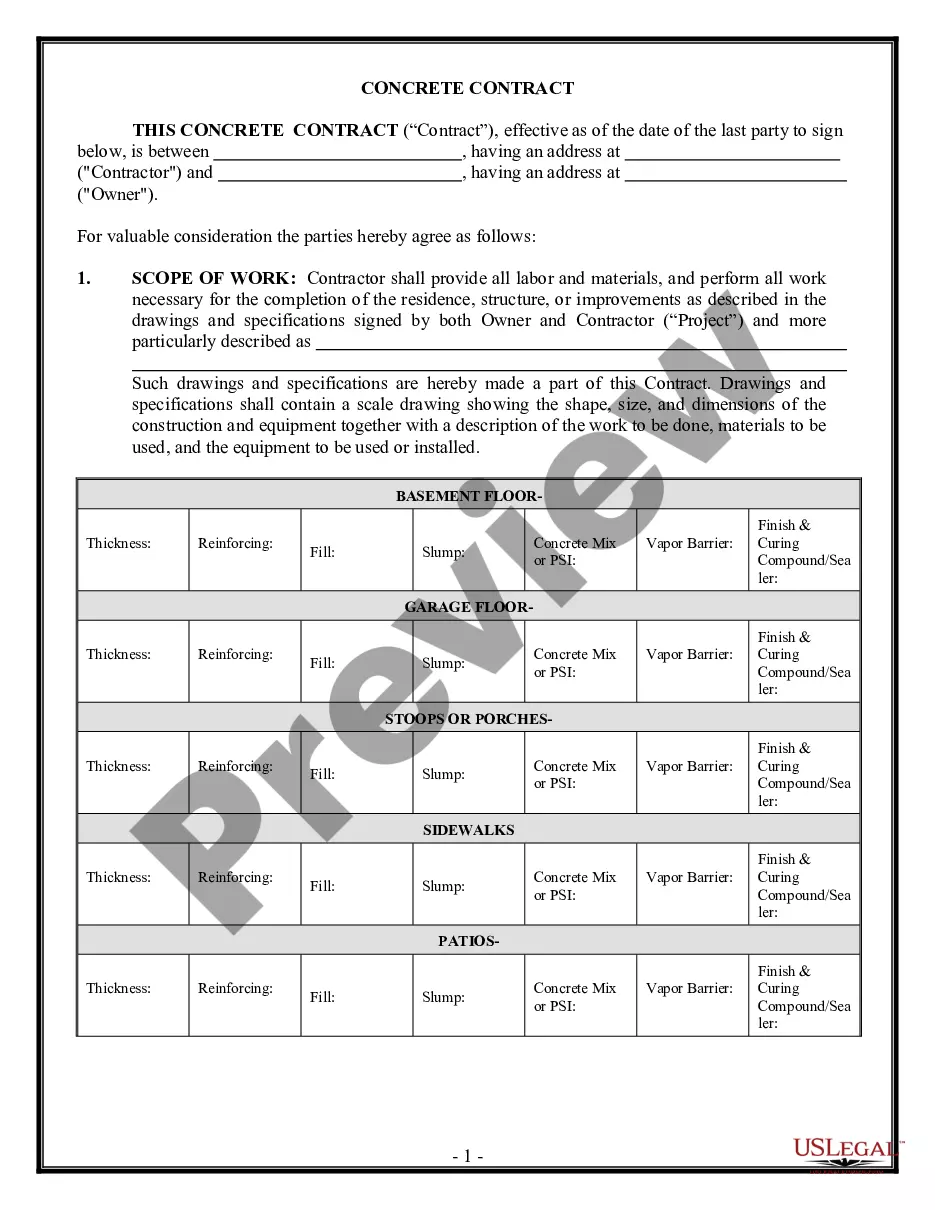

Description

How to fill out Gresham Oregon Complaint For Foreclosure Of Security Interest?

Are you looking for a trustworthy and inexpensive legal forms provider to get the Gresham Oregon Complaint for Foreclosure of Security Interest? US Legal Forms is your go-to solution.

Whether you require a simple arrangement to set rules for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and framed in accordance with the requirements of separate state and county.

To download the form, you need to log in account, locate the required form, and click the Download button next to it. Please take into account that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Gresham Oregon Complaint for Foreclosure of Security Interest conforms to the regulations of your state and local area.

- Read the form’s description (if provided) to find out who and what the form is good for.

- Restart the search if the form isn’t suitable for your legal scenario.

Now you can register your account. Then pick the subscription option and proceed to payment. Once the payment is completed, download the Gresham Oregon Complaint for Foreclosure of Security Interest in any provided file format. You can return to the website when you need and redownload the form free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about spending hours researching legal paperwork online once and for all.