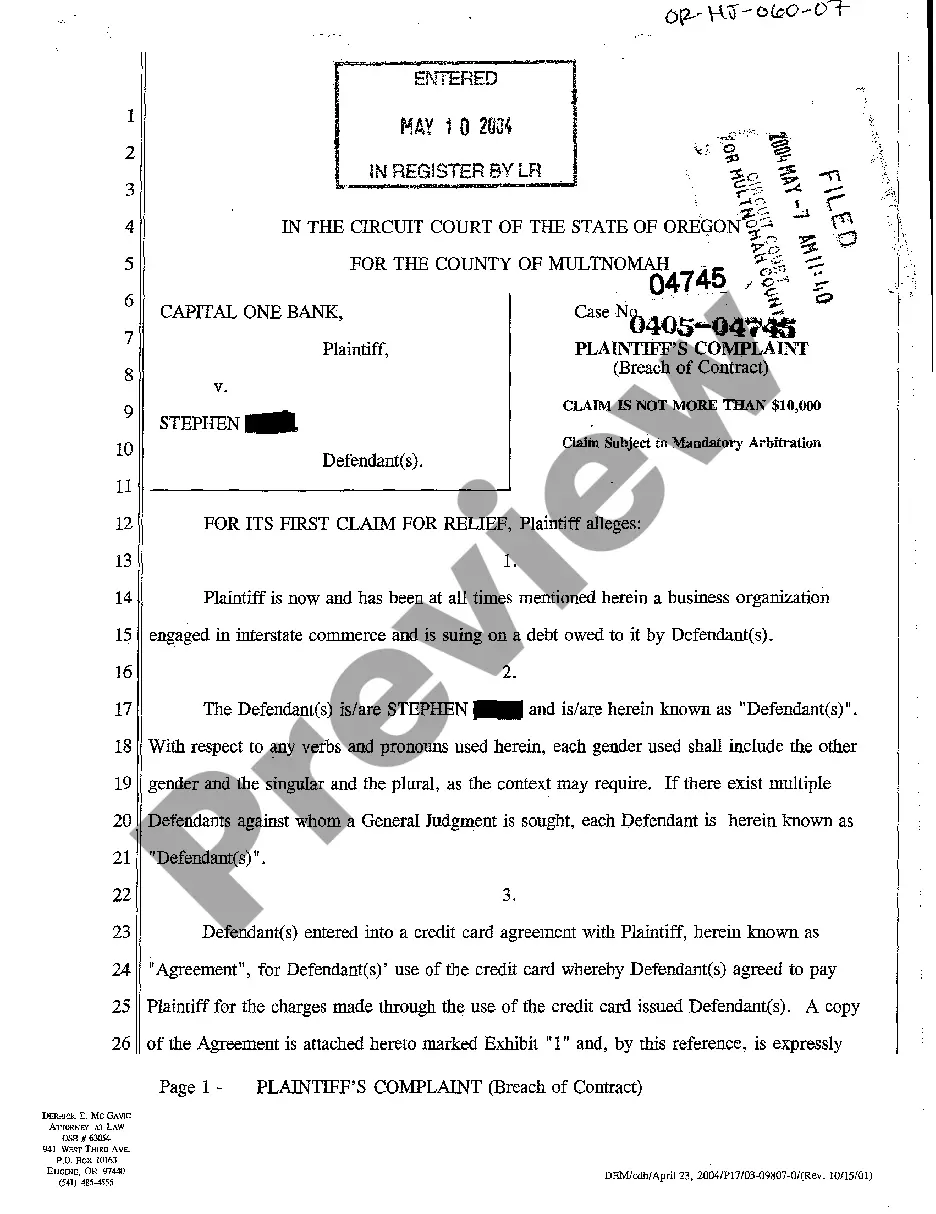

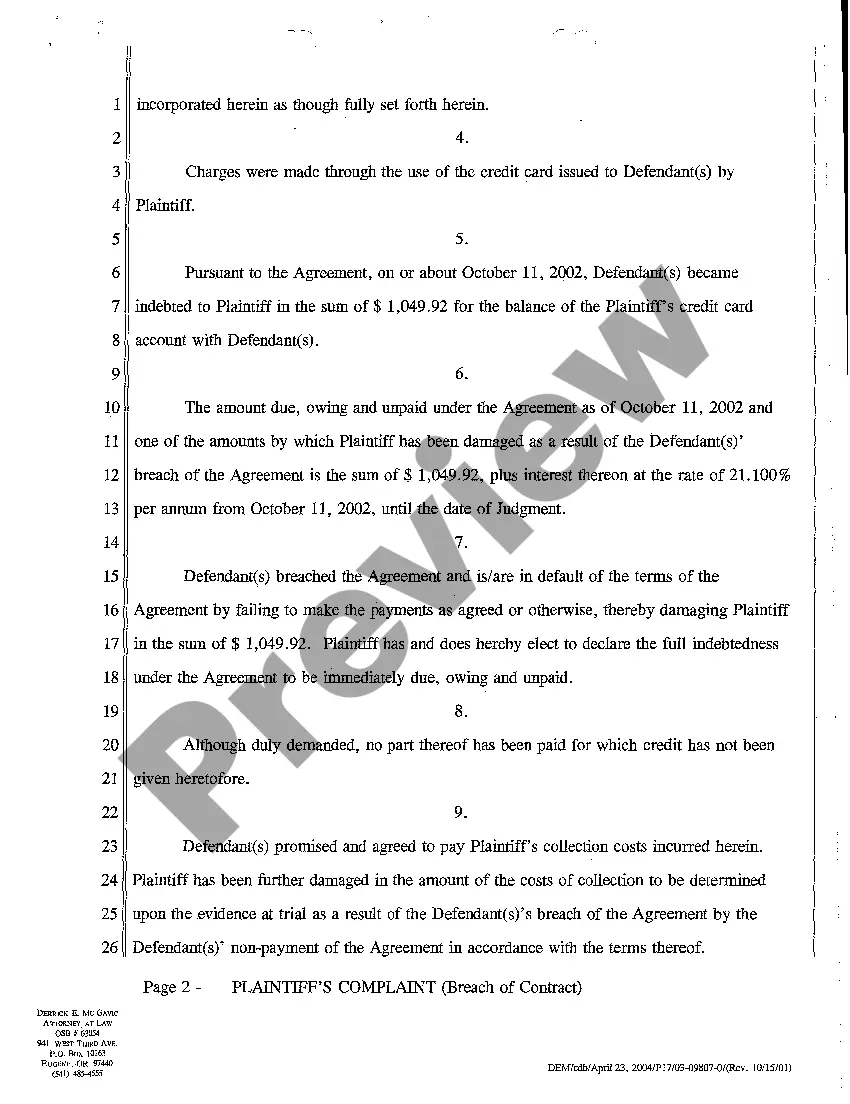

Title: Understanding Eugene Oregon Plaintiff's Complaint for Breach of Credit Card Agreement Keywords: Eugene Oregon Plaintiff's Complaint, Breach of Credit Card Agreement, legal action, credit card issuer, contractual obligations, damages, compensatory damages, punitive damages, breach notification, legal remedies Introduction: In Eugene, Oregon, a Plaintiff's Complaint for Breach of Credit Card Agreement is a legal action filed by an individual or entity against a credit card issuer for failing to honor the terms of a credit card agreement. This comprehensive description will delve into the key components and potential variations of this complaint, including available legal remedies. Types of Eugene Oregon Plaintiff's Complaint for Breach of Credit Card Agreement: 1. Alleged Failure to Provide Promised Credit Services: A Plaintiff's Complaint may arise when a credit card issuer fails to provide the credit services explicitly outlined in the agreement, such as credit limit changes, balance transfers, or accessibility to specific account features. These lawsuits often seek compensatory damages for any loss suffered by the plaintiff as a result of the breach. 2. Unauthorized Charges and Disputes: Another common type of Plaintiff's Complaint involves unauthorized charges on the credit card account. If the plaintiff identifies discrepancies in their credit card statements and suspects fraudulent activity, they can file a complaint seeking relief for any related expenses, such as legal fees or financial losses. Additionally, the complaint may outline the issuer's negligence in promptly addressing the plaintiff's dispute. 3. Improper Interest Rate or Fee Implementations: A Plaintiff's Complaint may also focus on the improper implementation of interest rates or fees as established in the credit card agreement. If the plaintiff believes that the issuer acted in violation of the agreed-upon terms by incorrectly applying rates or fees, they can file a complaint to seek financial compensation for resulting damages. 4. Breach of Privacy or Data Security: In cases where the credit card issuer fails to provide adequate data security measures or protect the plaintiff's personal information, a Plaintiff's Complaint can be filed to address the breach. Apart from compensation, the complaint may also demand remedial actions to safeguard personal data and to notify affected individuals of the breach. Legal Remedies: To address a Eugene Oregon Plaintiff's Complaint for Breach of Credit Card Agreement, various legal remedies are available, such as: 1. Compensatory Damages: Plaintiffs typically seek compensatory damages, aiming to recover the actual losses suffered as a direct consequence of the breach. These may include financial losses, additional interest expenses, legal costs, or any other relevant expenses incurred due to the credit card issuer's breach. 2. Punitive Damages: In some cases, the Plaintiff may request punitive damages if they can provide evidence that the credit card issuer acted recklessly or intentionally in breaching the agreement, causing significant harm to the plaintiff. These damages serve as a deterrent and punishment for the defendant. Conclusion: A Plaintiff's Complaint for Breach of Credit Card Agreement in Eugene, Oregon, can encompass various scenarios, such as failure to provide promised services, unauthorized charges, improper interest rates or fees, or breach of privacy. The complaint aims to seek appropriate remedies, such as compensatory and punitive damages, to rectify the harm caused by the credit card issuer's breach of contractual obligations. Prompt legal action is crucial to protect the plaintiff's rights and hold the issuer accountable for any breach.

Title: Understanding Eugene Oregon Plaintiff's Complaint for Breach of Credit Card Agreement Keywords: Eugene Oregon Plaintiff's Complaint, Breach of Credit Card Agreement, legal action, credit card issuer, contractual obligations, damages, compensatory damages, punitive damages, breach notification, legal remedies Introduction: In Eugene, Oregon, a Plaintiff's Complaint for Breach of Credit Card Agreement is a legal action filed by an individual or entity against a credit card issuer for failing to honor the terms of a credit card agreement. This comprehensive description will delve into the key components and potential variations of this complaint, including available legal remedies. Types of Eugene Oregon Plaintiff's Complaint for Breach of Credit Card Agreement: 1. Alleged Failure to Provide Promised Credit Services: A Plaintiff's Complaint may arise when a credit card issuer fails to provide the credit services explicitly outlined in the agreement, such as credit limit changes, balance transfers, or accessibility to specific account features. These lawsuits often seek compensatory damages for any loss suffered by the plaintiff as a result of the breach. 2. Unauthorized Charges and Disputes: Another common type of Plaintiff's Complaint involves unauthorized charges on the credit card account. If the plaintiff identifies discrepancies in their credit card statements and suspects fraudulent activity, they can file a complaint seeking relief for any related expenses, such as legal fees or financial losses. Additionally, the complaint may outline the issuer's negligence in promptly addressing the plaintiff's dispute. 3. Improper Interest Rate or Fee Implementations: A Plaintiff's Complaint may also focus on the improper implementation of interest rates or fees as established in the credit card agreement. If the plaintiff believes that the issuer acted in violation of the agreed-upon terms by incorrectly applying rates or fees, they can file a complaint to seek financial compensation for resulting damages. 4. Breach of Privacy or Data Security: In cases where the credit card issuer fails to provide adequate data security measures or protect the plaintiff's personal information, a Plaintiff's Complaint can be filed to address the breach. Apart from compensation, the complaint may also demand remedial actions to safeguard personal data and to notify affected individuals of the breach. Legal Remedies: To address a Eugene Oregon Plaintiff's Complaint for Breach of Credit Card Agreement, various legal remedies are available, such as: 1. Compensatory Damages: Plaintiffs typically seek compensatory damages, aiming to recover the actual losses suffered as a direct consequence of the breach. These may include financial losses, additional interest expenses, legal costs, or any other relevant expenses incurred due to the credit card issuer's breach. 2. Punitive Damages: In some cases, the Plaintiff may request punitive damages if they can provide evidence that the credit card issuer acted recklessly or intentionally in breaching the agreement, causing significant harm to the plaintiff. These damages serve as a deterrent and punishment for the defendant. Conclusion: A Plaintiff's Complaint for Breach of Credit Card Agreement in Eugene, Oregon, can encompass various scenarios, such as failure to provide promised services, unauthorized charges, improper interest rates or fees, or breach of privacy. The complaint aims to seek appropriate remedies, such as compensatory and punitive damages, to rectify the harm caused by the credit card issuer's breach of contractual obligations. Prompt legal action is crucial to protect the plaintiff's rights and hold the issuer accountable for any breach.